Life insurance is a legally binding contract that promises a death benefit to the policy owner when the insured person dies. It provides vital financial protection for your loved ones, but selecting the right policy can sometimes feel overwhelming. There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance is designed to provide coverage for a specific time, usually between 10 and 40 years, and is a more affordable and straightforward option. Permanent life insurance offers lifetime coverage and cash value accumulation but is more expensive. When choosing a life insurance policy, it's important to consider your financial situation, family circumstances, and future goals to ensure your loved ones are financially secure in the event of your death.

| Characteristics | Values |

|---|---|

| Types | Term life insurance, Permanent life insurance |

| Coverage amount | Depends on personal finances and goals, e.g. income, family situation, mortgage and debts, future expenses, funeral wishes |

| Term length | 10-40 years depending on age |

| Cost | Depends on age, medical history, nicotine use, lifestyle, type of policy |

What You'll Learn

Choosing the right type of life insurance for you: term or permanent

Life insurance is an important financial tool to protect your loved ones in the event of your death. It can also be used as a savings tool to build wealth. When choosing a life insurance policy, you will need to decide between term life insurance and permanent life insurance. Here are some things to consider when making your decision:

Length of Coverage

Term life insurance provides coverage for a specific period, typically between 10 and 30 years, or until a particular age. Permanent life insurance, on the other hand, provides coverage for your entire life as long as you continue to pay the premiums.

Cost

Term life insurance is generally more affordable than permanent life insurance, especially when purchased at a younger age. The premiums for term life insurance are locked in for the selected coverage period but will increase with each renewal. Permanent life insurance, such as whole life insurance, usually has higher premiums but they remain stable over time.

Benefits

Term life insurance offers short-term death benefit protection, with beneficiaries receiving a lump-sum payout if the insured person passes away during the coverage term. Permanent life insurance offers long-term death benefit protection and also includes a cash value component that can be accessed during the policyholder's lifetime for expenses such as college or retirement.

Flexibility

Term life insurance provides flexibility as it can be renewed or converted to permanent life insurance at the end of the term. Permanent life insurance is less flexible as it is designed to provide lifelong coverage, and any withdrawals from the cash value may reduce the death benefit.

Suitability

Term life insurance is suitable for those who need short-term coverage, are on a budget, or prefer flexibility. Permanent life insurance is ideal for those who require long-term financial protection, want to create an inheritance for heirs, or desire a tax-advantaged way to save for future expenses.

In conclusion, when choosing between term and permanent life insurance, consider your financial situation, the needs of your loved ones, and your budget. Term life insurance offers affordability and flexibility, while permanent life insurance provides lifelong coverage and additional benefits such as the accumulation of cash value.

Variable Life Insurance: Invest and Insure

You may want to see also

Determining your coverage amount

When determining your coverage amount, it's important to consider your financial goals and needs. Here are some factors to help you decide on the right coverage amount:

Financial Obligations and Income Replacement:

- Consider your annual income and the number of years you want to replace that income for your beneficiaries. This is especially important if you are the primary income earner or have financial dependents.

- Calculate your long-term financial obligations, such as mortgage payments, rent, or college fees. Ensure your coverage amount is sufficient to cover these expenses.

- If you have a stay-at-home parent, calculate the cost of replacing their services, such as childcare.

- Add up your debts, including credit card debt, student loans, car loans, or any other personal loans. Your coverage amount should help pay off these debts.

- Consider any future financial obligations, such as your children's education. You may want to add an additional amount to your coverage for each child's college expenses.

Funeral Costs and Final Expenses:

Calculate the costs of funeral services, burial, or cremation. Ensure your coverage amount includes these final expenses.

Number of Dependents and Their Age:

Generally, the more dependents you have and the younger they are, the higher the coverage amount you may need.

Existing Assets and Life Insurance:

Assess your current assets, such as savings, investments, or existing life insurance policies. If you have significant assets, you may not need as much additional coverage.

Inflation and Interest:

Consider adding a buffer to your coverage amount to hedge against inflation and interest rates, especially if your coverage is meant to replace your income.

Online Calculators and Professionals:

- Utilize online life insurance calculators to get a more accurate estimate of your coverage needs. These calculators take into account various factors and provide a detailed assessment.

- Consult a financial professional or a certified financial planner. They can help you assess your unique situation and determine the appropriate coverage level.

Remember, the coverage amount should give you peace of mind and ensure your loved ones are financially secure in your absence.

Cigna Life Insurance: Depression History and Rejection Risk

You may want to see also

Choosing your term length

When choosing the length of your term life insurance, you should consider your unique circumstances. Here are some factors to help you decide:

10-Year Term

This option is ideal for parents who want to financially secure their children's college years or for those nearing retirement and seeking security for their partner. If you have children approaching college age or are planning for retirement, a 10-year term can provide coverage during this crucial period.

20-Year Term

A 20-year term is suitable for young families who want to protect their children until they become independent or couples wanting to guard against long-term personal or business debts. If you have young children or anticipate taking on significant debts, this option can give you peace of mind for two decades.

30-Year Term

A 30-year term is recommended for individuals planning to have children or those with new mortgages. If you're starting a family or have recently purchased a home, this option ensures coverage for a substantial period, giving you financial security.

40-Year Term

A 40-year term is useful for young individuals seeking coverage until retirement, those considering permanent life insurance but finding it too expensive, or people with long-term debts they don't want to leave to their families. This option provides an extended safety net for those who want coverage throughout their working lives or are dealing with long-term financial obligations.

When deciding on the term length, consider your age, family situation, financial goals, and the specific needs of your dependents. Additionally, you can use online tools and calculators to explore how different term lengths and coverage amounts can influence the price of your policy.

How to Cancel Life Insurance After a Month?

You may want to see also

Preparing your application

- Understand the Different Types of Life Insurance: There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance is typically more affordable and provides coverage for a specific period, usually between 10 and 40 years. On the other hand, permanent life insurance offers lifetime coverage and accumulates cash value but is more expensive.

- Determine Your Coverage Amount: This is one of the most important steps as it decides the amount of money your beneficiaries will receive upon your death. Consider factors such as your income, family situation, mortgage and debts, future expenses, and funeral costs when deciding on the coverage amount.

- Choose Your Term Length: If you opt for term life insurance, you need to determine the term length, which can range from 10 to 40 years. The premiums for this term length are fixed and predictable. Consider your unique circumstances, such as age, family situation, and financial goals when choosing the term length.

- Gather Personal Information: Life insurance applications require personal and family medical history, beneficiary information, and standard identification documents such as your Social Security card, driver's license, or passport. Be prepared to disclose any pre-existing medical conditions, moving violations, DUIs, and dangerous hobbies or occupations.

- Medical Exam and Health History: Most life insurance providers will require a medical exam to assess your health. This may include screening for heart disease, diabetes, cancer, and other medical conditions. It is important to be honest and disclose any pre-existing conditions or health issues.

- Driving Record: Your driving record can impact the cost of life insurance premiums. A history of moving violations or drunk driving can result in higher premiums.

- Compare Policy Quotes: Once you have gathered all the necessary information, compare quotes from different providers to find the best combination of policy, company rating, and premium cost. Prices can vary significantly between companies, so it is essential to find the most suitable option for your needs.

Primerica's Term Life Insurance: Loan Options Explored

You may want to see also

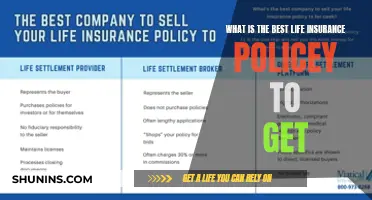

Comparing policy quotes

Comparing quotes from different life insurance providers is an important step in the process of buying life insurance. Here are some key things to keep in mind when comparing policy quotes:

- Shop around: Compare quotes from multiple insurers to get the best price. It is recommended to get quotes from at least 3 or 4 companies.

- Compare coverage: Ensure you are comparing policies with the same level of coverage. For example, select policies with a similar coverage amount, such as $250,000, to get an accurate comparison.

- Consider extras: Look at the features and add-ons offered by each policy. Some policies may include free life insurance riders, while others may not. If customisation is important to you, take this into account when comparing quotes.

- Choose the right policy type: There are two main types of life insurance: term and permanent. Term life insurance covers you for a specific period, such as 10 or 20 years, and is usually more affordable. Permanent life insurance is designed to last your entire life and often includes additional features like cash value accumulation, but it tends to be more expensive.

- Research different carriers: Look into the reputation and financial strength of the insurance companies you are considering. Check ratings from agencies like AM Best, S&P, and Moody's to assess their financial stability. Also, consider the level of customer service and the range of policy options offered by each carrier.

- Understand the quote: A life insurance quote is an estimate based on the basic information you provide. The final price may change after you submit your application and complete any necessary health requirements, such as a medical exam.

- Use comparison tools: Utilise online comparison tools or work with a broker to efficiently gather quotes from multiple companies. Keep in mind that brokers and comparison tools may not cover all insurers, so ensure the companies you are interested in are included.

- Compare similar policy details: When comparing quotes, make sure you are looking at policies with similar terms, coverage amounts, and riders to get an accurate comparison.

- Assess your needs: Consider your financial goals, income, family situation, debts, and future expenses to determine the amount of coverage you need. Tools like the DIME formula or an online coverage calculator can help you estimate the appropriate coverage amount.

Life Insurance and Social Security: What's the Connection?

You may want to see also

Frequently asked questions

Term life insurance is designed to last a certain number of years, then end. You can choose the term when you take out the policy, with common terms being 10, 20, or 30 years. Permanent life insurance is more expensive but stays in force throughout the insured's entire life unless the policyholder stops paying the premiums or surrenders the policy.

The amount of life insurance you need depends on your personal finances and goals. Consider factors such as income, family situation, mortgage and debts, future expenses, and funeral wishes.

Once you've determined how much coverage you need and what type of policy would best fit your needs, you can contact a local insurance agent or broker, look for online marketplaces, or contact the insurance company directly to obtain coverage.

Life insurance rates depend on several factors, including age, medical history, nicotine use, lifestyle, and the type of policy chosen. In general, the healthier and younger you are, the lower your policy premiums will be.