Whether claiming medical payment on auto insurance will cause a rate increase depends on a number of factors. In most cases, filing a claim will lead to an increase in insurance rates because insurance companies calculate costs based on risk, and drivers who file claims are considered a risk. The number of claims filed is directly linked to the likelihood of a rate hike. Filing an at-fault claim is very likely to lead to an increase in car insurance rates, with one major insurance company reporting an average increase of 28% after an at-fault claim. However, even not-at-fault claims can result in higher rates. The decision to file a claim can have a major impact on insurance rates, even if the accident was minor.

What You'll Learn

At-fault claims

When you file an at-fault claim, your property damage liability insurance will cover the damages to the other driver's vehicle, and your bodily liability coverage will pay for their medical bills. If you have comprehensive and collision coverage, your vehicle should also be covered after you pay your deductible.

The costliest insurance claims are bodily injury claims, and the average bodily injury claim cost $22,734 in 2021. The second most expensive type of claim is property damage, which cost an average of $5,314 in the same year.

After an at-fault accident, your insurance rates will likely increase for three to five years, depending on your state and company. During this time, your insurance company may also deny your policy renewal.

To lower your car insurance rates after an at-fault accident, you can try improving your credit score, increasing your deductible, looking for discounts, or shopping around for a new insurance provider.

Auto Insurance Premiums: Tax Write-Off?

You may want to see also

Not-at-fault claims

If you're involved in a car accident that wasn't your fault, you might wonder if your insurance rates will increase. The short answer is that they might, but the increase will likely be less than if you were at fault. The impact of a not-at-fault accident on your insurance rates depends on various factors, including state laws, insurer policies, and the specifics of the accident. Let's take a closer look at how not-at-fault claims can affect your insurance rates.

The Role of State Laws

State laws play a significant role in determining insurance rates after a not-at-fault accident. Some states, like Oklahoma and California, have regulations prohibiting insurance companies from increasing rates if the driver was not at fault. On the other hand, some states operate under comparative negligence laws, where the level of fault assigned to each party in an accident can influence insurance rates. For example, in California, your damage award is reduced by your percentage of fault, while in Arkansas, no damage award is permitted if you are found to be more than 50% at fault. Therefore, the location of the accident can significantly impact your insurance rates following a not-at-fault claim.

Insurer Policies

Different insurance companies have different policies regarding rate increases after not-at-fault accidents. Some companies, like USAA, typically do not increase rates if the policyholder is not at fault. However, this is not a universal practice, and other insurers may choose to raise rates in such situations. The increase is generally less than if the policyholder was at fault, but it's essential to understand your insurer's specific policies. Additionally, some insurers may refrain from raising rates if the insured party is innocent and the claim is supported by a police report.

Accident Forgiveness

Accident forgiveness is a feature offered by some insurance companies that can shield you from rate increases following a not-at-fault accident. It is designed to prevent rate increases after your first accident, but it may not entirely prevent them, especially if you previously had a safe driver or claim-free discount. The rules vary among insurers, and some may only forgive one accident every few years. Accident forgiveness may be offered at an additional cost or provided for free to policyholders with a clean driving record for a certain period, typically around five years.

Factors Affecting Insurance Rates

Several factors can influence your insurance rates after a not-at-fault claim, including your previous driving record, history of multiple claims, and the severity of the accident. A driving record laden with traffic violations or accidents may result in higher insurance rates, as insurers perceive such drivers as high-risk. Additionally, filing multiple claims, regardless of fault, can lead to higher rates, as insurers may consider you a higher risk. The severity of the accident also plays a significant role, with more severe accidents resulting in higher rate increases.

In summary, while not-at-fault accidents generally have a smaller impact on insurance rates compared to at-fault accidents, they can still lead to increases in certain situations. Understanding the nuances of your insurance policy, state laws, and the factors influencing your rates is crucial to managing your insurance costs effectively.

State Farm Auto Insurance: Can You Cancel?

You may want to see also

Accident forgiveness

- Liberty Mutual: Liberty Mutual's accident forgiveness policy is straightforward. If you have been accident-free for five years with any company, Liberty Mutual will forgive your first accident and not raise your rates. This policy applies to all drivers in the household, including teenagers. Liberty Mutual only forgives one claim per household, not per driver. This coverage is not available in California.

- Nationwide: Nationwide's accident forgiveness program is available at an added cost. They forgive your first at-fault auto accident on the policy and offer a safe driving discount of 10% if you remain accident-free for five years.

- GEICO: GEICO will forgive your first auto accident, regardless of who is at fault. To earn accident forgiveness, you need to be over 21 and have an accident-free driving history for five years. This coverage is not available in California, Connecticut, or Massachusetts.

- Progressive: Progressive's accident forgiveness program is a tiered loyalty program. To qualify, you must be insured with an accident-free driving record for a certain period. Tiers are assigned based on how long you have been accident-free and how major an incident the company is willing to forgive.

- Allstate: To qualify for accident forgiveness with Allstate, you must pay using the company's Gold or Platinum coverage plan, also known as the YourChoice Auto plan. For the gold plan, it takes three years without an accident to be eligible for accident forgiveness. With the platinum plan, your accident forgiveness begins immediately. This coverage is not available in California.

- Erie: Erie offers two options for accident forgiveness coverage. The first option is the standard coverage, which forgives the first accident if you've been a customer for three years. The second option is a loyalty program that forgives all at-fault auto accidents if you are with Erie for 15 years.

- Travelers: Travelers offers auto accident and minor violation forgiveness for a fee, forgiving one accident or violation every three years.

Insuring Your New Ride

You may want to see also

Risk and insurance rates

Insurance companies calculate costs based on risk. The more claims a customer files, the riskier they are to insure, and the higher their insurance rates will be. This is true for both auto and home insurance.

Auto insurance

When it comes to auto insurance, filing a claim will very likely cause your insurance rates to increase. This is especially true if you are at fault in an accident, but your rates may also increase if you are not at fault. The number of claims you file, and the types of claims, will impact your insurance rates. For example, an at-fault claim for bodily injury could increase your insurance rates by 32%, while a not-at-fault claim could increase your rates by 10% or more.

Your driving history will also be taken into account when insurance companies calculate your rates. If you have a history of accidents or traffic violations, your rates are more likely to increase.

Home insurance

Some types of home insurance claims are more likely to affect your insurance rates than others. For example, dog bites, theft, water damage, slip-and-fall incidents, and fire are all likely to cause a significant rate increase.

Mitigating insurance rate increases

There are a few ways to mitigate insurance rate increases after filing a claim. For example, you can raise your deductible, use discounts, increase security, or, in the case of auto insurance, drive safely and avoid accidents and traffic violations.

GAP Insurance: Protecting Your Assets

You may want to see also

Mitigating circumstances

- Number of Previous Claims: The number of claims you have filed in the past can impact your rates, even if the latest claim is not your fault. Each claim increases the perception of risk associated with insuring you, potentially leading to higher premiums.

- Driving Record: Your driving history, including speeding tickets, traffic violations, and accidents, is a crucial factor. A clean driving record may result in lower rates, while multiple violations or accidents could significantly increase your premiums.

- Frequency of Natural Disasters: Living in an area prone to natural disasters, such as earthquakes, hurricanes, or floods, can contribute to higher insurance rates. Insurers consider the likelihood of damage or injury resulting from these events when calculating premiums.

- Credit Score: A low credit rating can be a mitigating factor that leads to increased insurance rates. Insurers may view individuals with low credit scores as higher-risk customers and adjust rates accordingly.

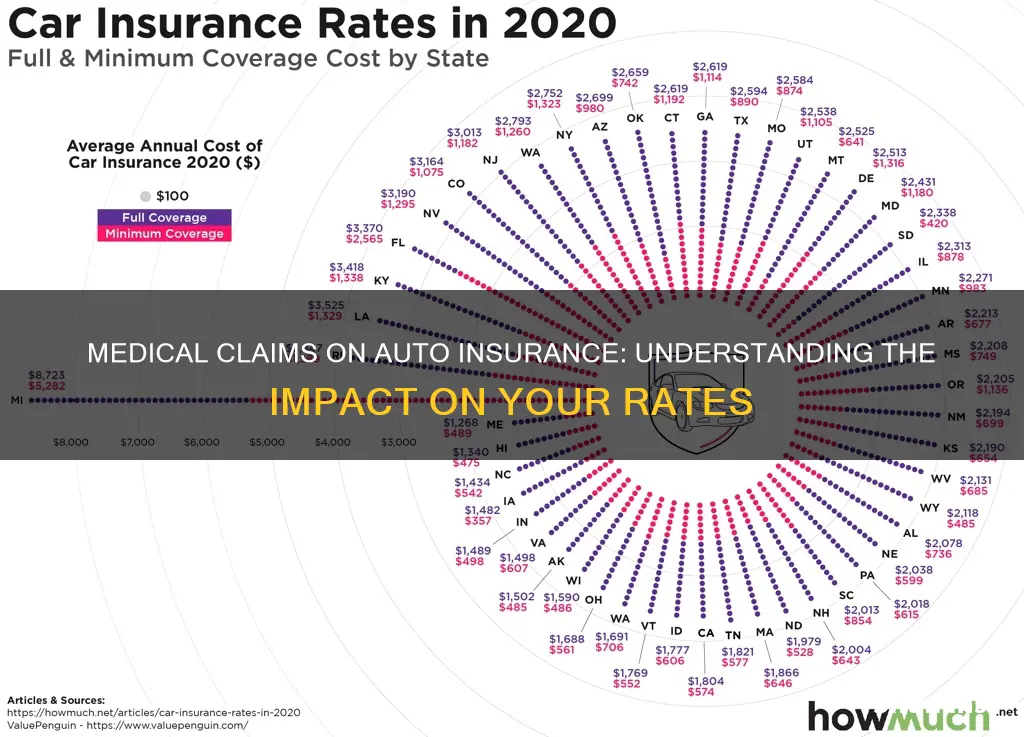

- State of Residence: Insurance rates can vary depending on the state you live in. Each state has its own regulations, and factors such as the cost of repairs, inflation, and market trends within your state can influence insurance rates.

- Vehicle Type: Driving a newer car with advanced safety technologies can impact your rates. While these features make your vehicle safer, the cost of repairing these technologies is often higher, which is reflected in your insurance premiums.

- Additional Drivers: Adding young or inexperienced drivers to your policy can increase your rates. Their lack of driving experience is considered a higher risk, but as they gain experience, your premium may start to decrease again.

- Time Since Last Claim: Insurance companies typically consider your driving record over the past three to five years when calculating premiums. If your last claim was outside this timeframe, it may no longer affect your rates.

While these mitigating circumstances can influence your insurance rates, it's important to note that filing a claim, especially an at-fault claim, is very likely to lead to an increase in your auto insurance rates. The exact increase is difficult to predict and depends on various factors, including the severity of the accident and your specific insurance provider's policies.

Bundling Home and Auto Insurance: Is It Worth It?

You may want to see also

Frequently asked questions

In most cases, yes. Insurance companies calculate costs based on risk, and drivers who file claims are considered a risk.

Mitigating circumstances, such as the number of previous claims you have filed, the number of speeding tickets you have received, the frequency of natural disasters in your area, and even a low credit rating can all cause your rates to go up.

Dog bites, slip-and-fall personal injury claims, water damage, and mold are red flag items for insurers.

Surprisingly, the much-dreaded speeding ticket may not cause a rate hike at all. Many companies forgive the first ticket. The same goes for a minor automobile accident or a small claim against your homeowners' insurance policy.

An accident can stay on your record and raise your rates for between three to five years, depending on the severity of the accident and your car insurance company.