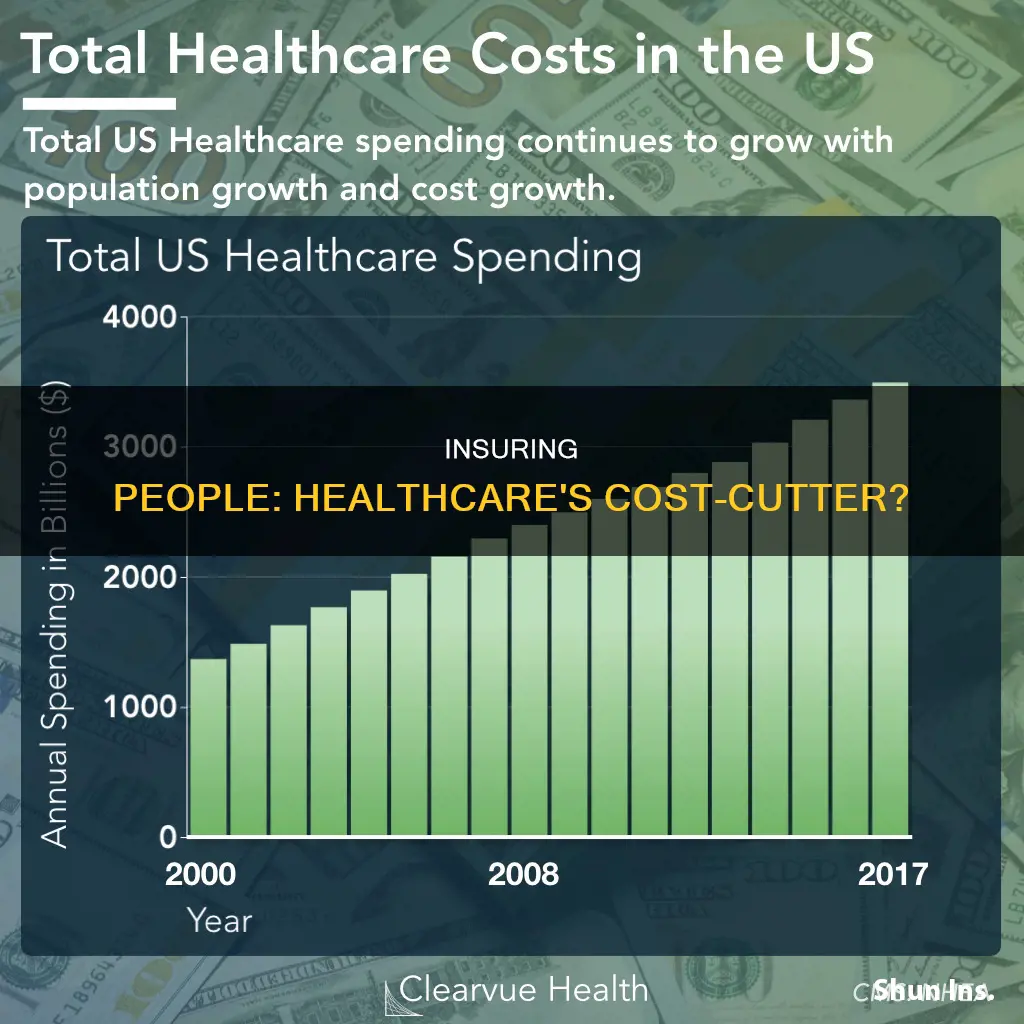

Providing health insurance to people can reduce healthcare costs by improving the likelihood of appropriate care and better health outcomes. Health insurance achieves these positive effects by facilitating ongoing care with a regular healthcare provider and reducing financial barriers to obtaining services.

People without health insurance are exposed to high medical costs, which can lead to deep debt or bankruptcy. Fixing a broken leg can cost up to $7,500, the average cost of a 3-day hospital stay is around $30,000, and comprehensive cancer care can cost hundreds of thousands of dollars.

Health insurance plans protect people from high medical expenses in three ways: reduced costs after meeting deductibles, coinsurance, and out-of-pocket maximums. People with insurance are more likely to receive preventive and screening services, and are less likely to put off or postpone needed care due to cost.

| Characteristics | Values | |

|---|---|---|

| Health insurance status | Insured | Uninsured |

| Health outcomes | Better | Poorer |

| Health services | More appropriate use | Less appropriate use |

| Health spending | Higher | Lower |

| Health insurance costs | Rising faster than inflation and wages | N/A |

What You'll Learn

- Insuring people can reduce healthcare costs by lowering administrative costs

- Insuring people can reduce healthcare costs by focusing on preventive care

- Insuring people can reduce healthcare costs by eliminating unnecessary tests and procedures

- Insuring people can reduce healthcare costs by controlling the costs of prescription drugs

- Insuring people can reduce healthcare costs by reducing the cost of health insurance

Insuring people can reduce healthcare costs by lowering administrative costs

Insuring more people can help reduce healthcare costs by lowering administrative costs. Administrative costs account for a significant portion of total healthcare spending in the United States, often amounting to one-quarter to one-third of the total expenditure. These costs include billing, insurance-related activities, and other overhead expenses. By insuring more people, we can streamline the billing and insurance process, reducing the complexity and administrative burden on healthcare providers.

One way to reduce administrative costs is by standardizing and simplifying billing procedures. Currently, healthcare providers in the US have to deal with multiple insurance companies, each with their own unique billing requirements and processes. This complexity increases administrative costs and creates inefficiencies in the system. By standardizing billing procedures and reducing the number of different payer contracts, providers can save time and resources, leading to lower administrative costs.

Another approach to lowering administrative costs is to implement a single-payer system, such as "Medicare for All." In a single-payer system, there is only one payer (usually the government) that reimburses healthcare providers. This eliminates the need for providers to negotiate and manage multiple contracts, reducing architectural complexity. Additionally, single-payer systems often have simpler billing procedures and less stringent regulatory requirements, further reducing the administrative burden on providers.

According to some estimates, moving towards a single-payer system or implementing reforms to standardize billing procedures could reduce administrative costs by 30-60%. This would result in significant savings for healthcare providers, insurers, and patients, ultimately contributing to lower healthcare costs overall.

In addition to reducing administrative costs, insuring more people can also lead to better health outcomes and improved access to healthcare services. When more people are insured, they are more likely to seek preventive care and regular check-ups, reducing the need for costly emergency room visits and hospitalizations. This shift towards preventive care can help identify health issues early on and improve overall health outcomes, reducing the demand for expensive treatments and procedures.

Furthermore, expanding insurance coverage can help reduce the financial burden on individuals and families. When more people are insured, the risk of catastrophic medical expenses is reduced, and individuals are less likely to delay or avoid seeking medical care due to financial concerns. This can lead to better management of chronic conditions and improved health outcomes over the long term.

Updating Insurance Information: A Step-by-Step Guide for BYUI Students

You may want to see also

Insuring people can reduce healthcare costs by focusing on preventive care

Preventative care is particularly important for chronic diseases, which are the leading cause of poor health, long-term disability, and death in the United States. These include heart disease, cancer, chronic lung disease, stroke, Alzheimer's disease, diabetes, osteoarthritis, and chronic kidney disease. Chronic diseases can profoundly reduce quality of life for patients and their families, affecting enjoyment of life, family relationships, and finances. They are also the leading drivers of healthcare costs in the United States, with total direct costs for treatment exceeding $1 trillion in 2016. If lost economic productivity is considered, the total cost of chronic diseases in the US increases to $3.7 trillion, close to one-fifth of the entire US economy.

Primary prevention, which involves controlling modifiable risk factors to avert the occurrence of disease, can help to reduce the incidence of chronic diseases and their associated costs. For example, intensive lifestyle changes can reduce new cases of diabetes by more than 50%, and early detection of certain cancers and other chronic diseases through screening can reduce mortality from these conditions by 15-20%. Preventative care can also help to reduce the costs associated with colon cancer, which has an average treatment cost of $60,321. Similarly, out-of-pocket costs for managing heart disease average nearly $5,000 a year, but this can be reduced through preventative lifestyle modifications and screenings.

In addition to clinical preventive services, community-based prevention programs can also play a crucial role in reducing healthcare costs. These include worksite wellness programs, school policies, information technology and self-care resources, nutrient labeling, media and advertising campaigns, changes to the built environment to facilitate exercise, legislation such as indoor smoking bans, and counseling services. By addressing the root causes of chronic diseases and promoting healthier lifestyles, these programs can help to reduce the incidence of chronic diseases and their associated costs.

Overall, investing in prevention and early detection can lead to significant cost savings for both patients and the healthcare system. By focusing on preventive care, insurance companies can help to reduce healthcare costs while also improving health outcomes and quality of life for their members.

Colonoscopy Conundrum: Unraveling the Insurance Billing Diagnostic Dilemma

You may want to see also

Insuring people can reduce healthcare costs by eliminating unnecessary tests and procedures

Insuring people can be an effective strategy to reduce healthcare costs by eliminating unnecessary tests and procedures. While uninsured individuals tend to incur lower healthcare costs due to reduced service utilization, they often face higher out-of-pocket expenses relative to their income. Insuring people can help address this disparity and reduce overall healthcare costs by streamlining services and eliminating redundant or unnecessary procedures.

Unnecessary medical tests and treatments are a significant contributor to rising healthcare costs. It is estimated that the US healthcare system wastes around $200 billion annually on excessive testing and treatment, with an additional $210 billion attributed to unnecessary or needlessly expensive care. This excessive treatment can also lead to patient harm, resulting in mistakes and injuries that cause approximately 30,000 deaths each year.

One of the primary drivers of unnecessary testing and procedures is the fee-for-service payment model, where providers are reimbursed based on the volume of services rendered. This creates a financial incentive to perform more tests and procedures, regardless of their medical necessity. Additionally, defensive medicine, driven by the fear of malpractice litigation, also contributes to the problem.

By insuring people, particularly through a single-payer system, the payment model can be restructured to emphasize value-based care rather than volume-based care. This shift can help eliminate unnecessary tests and procedures by incentivizing providers to focus on delivering the most appropriate and cost-effective treatments.

Furthermore, insurance coverage can help reduce the financial burden on individuals, who often lack the necessary knowledge and leverage to question or refuse unnecessary tests and procedures. Insured individuals are more likely to have access to primary care providers and preventive care, reducing the need for costly emergency care and reducing the overall cost of healthcare.

In conclusion, insuring people can be a powerful strategy to reduce healthcare costs by eliminating unnecessary tests and procedures. It addresses the financial incentives that drive excessive treatment and empowers individuals to make more informed decisions about their healthcare. By streamlining services and focusing on value-based care, the cost of healthcare can be significantly reduced while improving patient outcomes.

Insurance Switch: When to Change?

You may want to see also

Insuring people can reduce healthcare costs by controlling the costs of prescription drugs

There are several reasons for the high cost of prescription drugs. Firstly, monopolies allow pharmaceutical companies to charge high prices, as there are often no alternative drugs. This is particularly true for drugs used to treat serious illnesses like cancer, where patients will need access to every effective drug at some point during their treatment. Furthermore, the high cost of drug development, estimated at around $3 billion for a new drug, and the lobbying power of pharmaceutical companies, which spent around $220 billion on lobbying in 2018, contribute to high prescription drug prices.

There are several potential solutions to reduce the cost of prescription drugs. Firstly, governments can play a more active role in negotiating drug prices and ending pharmaceutical practices that block competition. Additionally, patent reforms can help prevent patent abuse and "pay-for-delay" schemes, where generic competitors are paid to delay market entry. Streamlining the approval process for generic and biosimilar drugs can also increase competition and drive down prices. Empowering consumers to shop around for the best prices and eliminating intermediaries can also help reduce drug prices. Finally, governments should remove incentives for more expensive therapies and encourage the development of cost-effective practice patterns among physicians to avoid unnecessary tests and procedures.

FQHCs: Insurance-Covered Facilities?

You may want to see also

Insuring people can reduce healthcare costs by reducing the cost of health insurance

Health insurance is one of the main benefits employees seek when considering a company's compensation package. In 2020, 163 million non-elderly Americans, or 60% of the non-elderly population, were covered by employer-sponsored insurance (ESI). While the majority of employees (63%) report being extremely or very satisfied with their coverage, many people with private coverage say that costs have prevented them from seeking medical care.

Over the past decade, ESI premiums have risen faster than wages, and the rising price of healthcare is responsible for approximately two-thirds of per-person medical and pharmacy claims spending growth between 2015 and 2019. The rising cost of healthcare has resulted in higher insurance costs, with premiums and deductibles for ESI rising at firms of all sizes. As a result, the cost of health insurance is growing as a share of total compensation, cutting into employees' take-home pay.

Health insurance provides important financial protection in the event of a serious accident or illness. Without health coverage, people are exposed to high medical costs, which can lead to deep debt or even bankruptcy. Fixing a broken leg can cost up to $7,500, the average cost of a 3-day hospital stay is around $30,000, and comprehensive cancer care can cost hundreds of thousands of dollars.

Health insurance plans protect individuals from high medical expenses in three ways: reduced costs after meeting deductibles, coinsurance, and out-of-pocket maximums. Once an individual meets their deductible, the insurance plan covers a portion of their medical expenses. Additionally, there is a limit to how much an individual will have to pay out of pocket in a plan year, providing peace of mind and protection from very high medical costs.

Furthermore, health insurance improves access to preventive and screening services, outpatient prescription drugs, and specialty mental health care, all of which contribute to better health outcomes. Uninsured adults are less likely to receive preventive and screening services and are more likely to be diagnosed with cancer at a later stage, leading to poorer clinical outcomes and higher mortality rates. They are also less likely to receive appropriate care for chronic conditions such as diabetes, hypertension, and mental illness, resulting in worse health outcomes.

In summary, insuring people can reduce healthcare costs by lowering health insurance premiums and out-of-pocket expenses. It achieves this by providing financial protection, improving access to necessary healthcare services, and contributing to better health outcomes.

Citations: Multiple Items, One Fine?

You may want to see also

Frequently asked questions

Insuring more people can reduce healthcare costs by reducing administrative costs, focusing on preventive care, eliminating unnecessary tests and procedures, and controlling the costs of prescription drugs.

A single-payer system, instead of hundreds of insurers with thousands of different plans, would save 15% of healthcare costs.

Encouraging more physicians to be adult generalists and providing them with new skills can help shift the focus from disease management to prevention and health promotion.

Ensuring that all physicians (specialists and generalists) practice cost-effective medicine and that all citizens adopt living wills can help eliminate unnecessary tests and procedures.

Controlling the prices of prescription drugs, as is done in nearly every other nation, can help reduce healthcare costs.