Nevada requires drivers to have auto insurance and to carry proof of insurance in their vehicles. The state accepts digital proof of insurance, allowing drivers to present their insurance documents electronically on their mobile devices when stopped by traffic enforcement officers. This law provides convenience for drivers and ensures that they can easily provide the necessary documentation during traffic stops.

| Characteristics | Values |

|---|---|

| Digital proof of insurance accepted? | Yes |

| Digital proof of insurance accepted on mobile devices? | Yes |

| Digital proof of insurance accepted on paper? | No |

| Digital proof of insurance accepted on tablets? | Yes |

| Digital proof of insurance accepted on smartphones? | Yes |

What You'll Learn

- Nevada motorists can use their smartphones to provide proof of insurance

- Assembly Bill 143 permits drivers to use their mobile devices to produce a copy of their insurance documents

- Officers cannot view anything else on the device

- Nevada requires that automobile liability insurance policies carry a minimum coverage of $25,000 for bodily injury or death of one person in any one accident

- The Nevada Department of Motor Vehicles can verify motor vehicle liability insurance coverage through the NV LIVE program

Nevada motorists can use their smartphones to provide proof of insurance

Nevada motorists can now use their smartphones to provide proof of insurance when stopped by traffic enforcement officers. Assembly Bill 143 permits drivers to use their mobile devices—smartphones, tablets, and other gadgets—to produce a copy of their insurance documents. This bill also makes it unlawful for officers to view anything else on the device.

The bill addresses the safety concerns of officers when a driver reaches into their pocket to retrieve their phone, which is similar to the action of reaching into a pocket for a wallet or glove box for a paper insurance card or driver's license. Before handing over their phones, motorists should first communicate with the officer in charge.

In addition to Assembly Bill 143, Nevada law also allows for digital proof of insurance. The Nevada Department of Motor Vehicles (DMV) specifies that motorists must carry Nevada Evidence of Liability Insurance in the vehicle or on a mobile device. This can be presented on a printed card or in an electronic format displayed on a mobile electronic device.

It is important to note that insurers are not required to provide electronic evidence, but they must always provide a printed card upon request. When presenting a mobile device as proof of insurance, the device owner assumes all liability for any damage, and peace officers may only view the evidence of insurance without accessing other content on the device. The evidence of insurance must be provided by the insurer and contain the same information as a printed card.

Navy Federal: Auto Insurance Options

You may want to see also

Assembly Bill 143 permits drivers to use their mobile devices to produce a copy of their insurance documents

Assembly Bill 143 (AB143) permits drivers in Nevada to use their mobile devices to produce a copy of their insurance documents. This bill allows drivers to provide digital proof of insurance when stopped by traffic enforcement officers. It applies to smartphones, tablets, and similar gadgets. The bill also makes it illegal for officers to view anything else on the device.

AB143 was introduced in the Nevada Assembly on February 11, 2015, and was approved by the Governor on May 25, 2015, with an effective date of October 1, 2015. The bill authorises electronic verification of motor vehicle insurance, allowing drivers to use a digital copy of their insurance policy, which must be provided by their insurer. This digital copy must contain the same information as a printed insurance card.

The bill addresses safety concerns for officers, as motorists reaching into their pockets for a phone, wallet, or glove box can pose risks. Lieutenant Scott Dugan of the Reno Police Traffic Division emphasises the importance of motorists first communicating with the officer before handing over their phones.

Insurers are not mandated to provide electronic evidence, but they must supply a printed card upon request. Drivers presenting digital proof of insurance on their devices assume all liability for any damage to their device. Additionally, Nevada law stipulates that peace officers can only view the insurance information and may not intentionally access any other content on the device.

Nevada requires that automobile liability insurance policies carry minimum coverage of $25,000 for bodily injury or death of one person in any one accident, $50,000 for two or more people, and $20,000 for property damage. This coverage must be electronically validated by an insurance company authorised to operate in Nevada.

Weekend Auto Insurance: Can I Get Covered?

You may want to see also

Officers cannot view anything else on the device

Nevada motorists can now use digital means to provide proof of insurance when stopped by traffic enforcement officers. Assembly Bill 143 permits drivers to use their mobile devices to produce a copy of their insurance documents. This includes smartphones, tablets, and other similar gadgets. This bill also makes it unlawful for officers to view anything else on the device besides the insurance documents.

When presenting digital proof of insurance, the driver assumes all liability for any damage to the device. It is important to communicate with the officer in charge before handing over the device. This is to ensure the officer's safety, as people immediately reaching into their pockets to retrieve their phones can pose a risk.

The digital proof of insurance must be provided by the insurer and contain all the same information as a printed insurance card. Insurers are not required to provide digital proof of insurance, but they must provide a printed card upon request.

Nevada law requires motorists to carry Evidence of Liability Insurance in the vehicle or on a mobile device. This can be presented on a printed card or in an electronic format displayed on a mobile device.

Vehicle Insurance Status: Check and Verify

You may want to see also

Nevada requires that automobile liability insurance policies carry a minimum coverage of $25,000 for bodily injury or death of one person in any one accident

In the state of Nevada, it is mandatory for all drivers to purchase auto insurance. The minimum liability insurance coverage required by law is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage, often referred to as the "25/50/20" rule. This means that the insurance policy must include a minimum of $25,000 to cover bodily injury or death for one person involved in a single accident.

The minimum coverage requirements in Nevada are designed to protect at-fault motorists from claims made against them by other drivers, passengers in other vehicles or their own vehicle, and pedestrians or bystanders. Bodily injury liability coverage includes a range of expenses related to an accident, such as medical and ambulance bills, short- or long-term medical treatment, lost wages, and loss of consortium.

It is important to note that if the damages from a car accident exceed the state's minimum insurance coverage limits, the driver may be held personally liable for the remaining balance. Therefore, it is advisable to purchase higher policy limits if possible, especially if there are assets that need protection in the event of a lawsuit arising from a car accident.

In addition to the minimum liability insurance coverage, Nevada drivers have the option to purchase additional types of coverage to protect themselves and their vehicles. These include collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

Nevada also allows drivers to provide digital proof of insurance when stopped by traffic enforcement officers. Assembly Bill 143 permits drivers to use mobile devices, such as smartphones and tablets, to present a digital copy of their insurance documents. This law also prohibits officers from viewing any content on the device other than the proof of insurance.

Auto Insurance: Engine Repairs and Coverage

You may want to see also

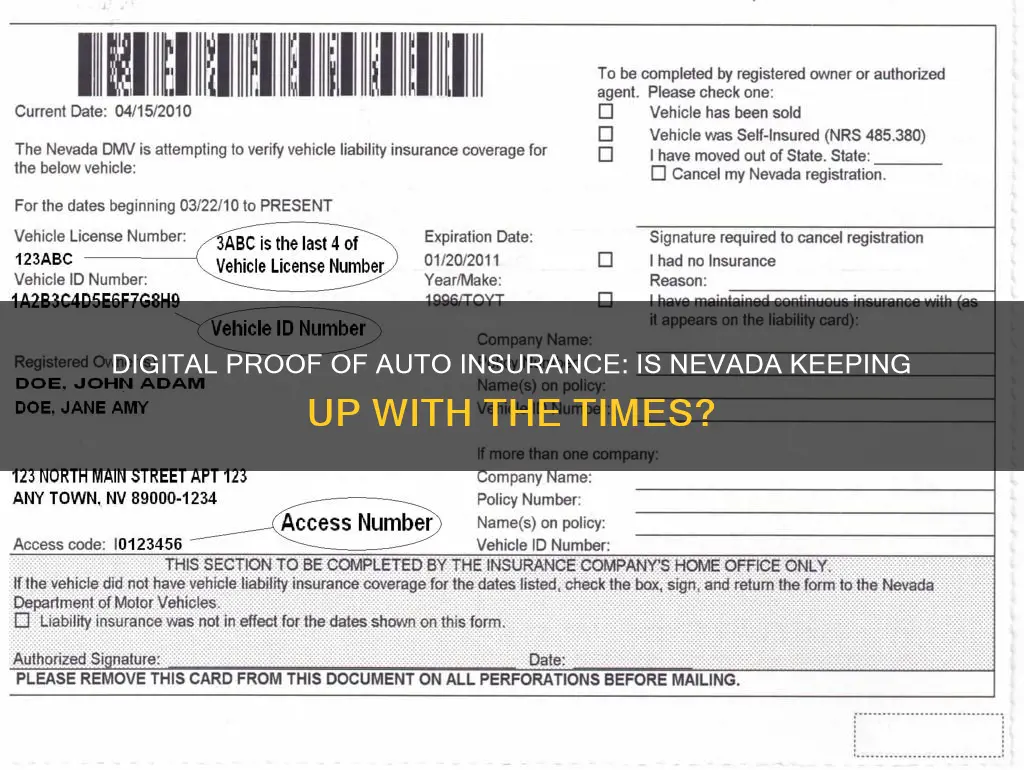

The Nevada Department of Motor Vehicles can verify motor vehicle liability insurance coverage through the NV LIVE program

The Nevada Department of Motor Vehicles (DMV) can verify motor vehicle liability insurance coverage through the NV LIVE (Nevada Liability Insurance Verification Electronically) program. This program allows the DMV to periodically verify insurance coverage for registered vehicles in Nevada. The insurance company and the DMV exchange policy information over a secure internet connection.

Nevada law requires all registered vehicles in the state to have liability insurance. This insurance must be provided by a company licensed to do business in Nevada and must meet the minimum coverage requirements. The minimum coverage limits are $25,000 for bodily injury or death of one person, $50,000 for two or more people, and $20,000 for property damage.

Drivers in Nevada are allowed to provide digital proof of insurance when stopped by traffic enforcement officers. This means that drivers can use their mobile devices, such as smartphones or tablets, to show a copy of their insurance documents. However, it is important to note that insurers are not required to provide electronic evidence, and they must provide a printed card upon request.

When providing digital proof of insurance, drivers assume all liability for any damage to their device. Additionally, peace officers are only allowed to view the evidence of insurance and cannot intentionally view any other content on the device. The digital proof of insurance must be provided by the insurer and contain the same information as a printed card.

Auto Insurance: Are Your Teens Covered?

You may want to see also

Frequently asked questions

Yes, Nevada does accept digital proof of insurance for automobiles. Assembly Bill 143 permits drivers to use their mobile devices to provide a copy of their insurance documents.

Digital proof of insurance is more convenient than carrying a physical copy and can be accessed easily on a mobile device. It also eliminates the need to search through your glove box for an insurance card.

Failure to provide proof of insurance in Nevada can result in a fine or suspension of your driver's license and vehicle registration. However, driving without insurance is a more serious offense and can lead to more severe penalties.

In Nevada, registered vehicles are required to have liability insurance. The minimum coverage requirements are $25,000 for bodily injury or death of one person, $50,000 for two or more persons, and $20,000 for property damage. These requirements must be met by a policy issued by an insurance company licensed in the state.