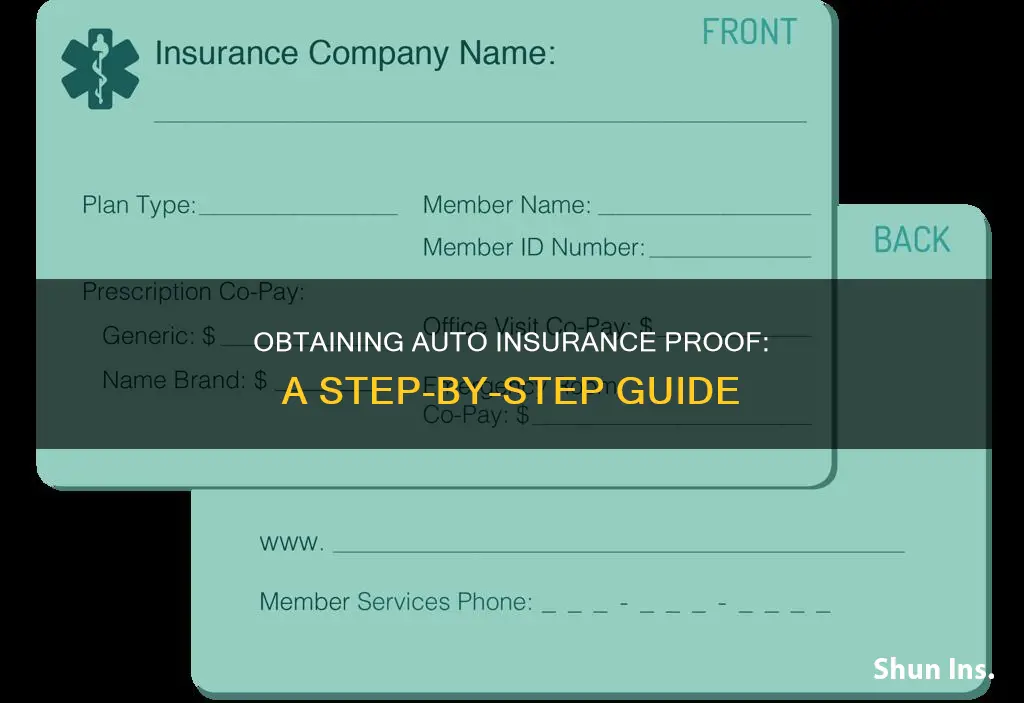

Proof of auto insurance is a vital document for all motorists. It is a document or ID card containing information about you and your policy. It usually includes your name, insurer’s name, policy number and effective dates. You may need to show proof of insurance in order to register a vehicle, and you’ll also need it if you’re in an accident or if you get pulled over.

Most states allow you to use electronic forms of proof of insurance. However, the only state in which a digital proof of car insurance isn’t explicitly accepted is New Mexico.

| Characteristics | Values |

|---|---|

| When is proof of insurance needed? | Registering a vehicle, during traffic stops, accidents, leasing or financing a car |

| What does proof of insurance verify? | An active car insurance policy, compliance with state legal requirements, financial responsibility |

| What information does proof of insurance include? | Policyholder's name, insurance company's name and contact information, effective dates of coverage, description of the insured vehicle, policy number, types of coverage and policy limits |

| How to get proof of car insurance? | Insurer typically provides a physical or electronic copy of the insurance card |

| Is digital proof of insurance accepted? | Yes, except in New Mexico |

What You'll Learn

What to do if you can't show proof of insurance

If you can't show proof of insurance, you could face fines or even jail time, depending on the state. However, if you do have insurance, you can usually contest a ticket by mailing a copy of your proof of insurance or by attending the court hearing with proof that you were insured on the date in question. While the charges could be dismissed, you may have to pay a fine or court fees.

If you receive a ticket for not providing proof of insurance, make sure you respond to all correspondence. If you fail to do so, some states may revoke or suspend your license and registrations if you can't prove you're insured.

In most states, you can show a digital insurance card as proof of insurance. However, New Mexico is the lone state where police are not required to accept electronic proof of insurance. It's a good idea to have a physical card as a backup.

If you lose your insurance card and need to get proof of insurance, you can:

- Download the insurance company's app. Many insurance companies have apps that allow you to access digital copies of your insurance cards.

- Access your account online. If your insurance company doesn't have an app, you may be able to download and print out a card by logging into your account on its website.

- Contact your agent. Call your insurance agent and ask them to send you an updated copy of your insurance card.

GEICO Auto Insurance: Is a VIN Number Necessary?

You may want to see also

What to do if you lose your insurance card

If you lose your insurance card, you'll need to get a new one as soon as possible. Here are the steps you can take:

- Contact your insurance provider: Get in touch with your insurance agent or company and ask them to send you an updated copy of your insurance card. They may be able to mail you a new physical card or provide a digital copy that you can access through their website or mobile app.

- Use your insurance company's mobile app: Many insurance companies offer mobile apps that allow you to access digital copies of your insurance cards. Downloading the app can be a quick way to retrieve your proof of insurance.

- Access your account online: If your insurance company doesn't have a mobile app, you may still be able to log into your account on their website and download or print a new card.

- Keep a photocopy or photo of your card: It's always a good idea to keep a separate copy of your insurance card in a safe place, such as your home. That way, if you lose the original, you can refer to the copy while waiting for a replacement.

Remember, driving without proof of insurance can result in tickets and fines. Most states require you to carry proof of insurance in your vehicle at all times. So, it's important to take the necessary steps to obtain a new insurance card as soon as possible if you lose the original.

Collectibles: Cheaper Insurance?

You may want to see also

What happens if you use a fake insurance card

Proof of insurance is a requirement in most U.S. states, and drivers are usually mandated to have bodily injury and property damage liability insurance. This proof is often in the form of an ID card, provided by the insurer, and must be carried by the driver at all times.

Now, what happens if you use a fake insurance card? Well, it's a crime and can lead to serious consequences. Here are some of the potential outcomes:

Legal Consequences

Using a fake insurance card is considered insurance fraud, and it is treated as a serious offence. In some states, you could face hefty fines of up to $2,000 or more for presenting a fake insurance card. For example, in California, you might have to pay up to $50,000. Additionally, you could be jailed for up to six months or more, depending on the state and the specifics of the case.

Driving Privileges Impacted

If found guilty of using a fake insurance card, your driver's license may be suspended or revoked. This suspension will show up on your driving record, making it challenging to obtain car insurance in the future. The authorities may also revoke your vehicle registration, essentially preventing you from driving legally.

Financial Liability

Without valid insurance, you are financially responsible for any injuries or damages you cause to others in an accident, as well as the damage to your own vehicle and your passengers' injuries. These costs can be substantial and will have to be paid out of pocket.

Difficulty in Obtaining Future Insurance

Insurance companies may consider you a high-risk driver if they discover you have used a fake insurance card in the past. This could make it challenging to obtain car insurance in the future, and you may have to pay higher premiums or be classified as a high-risk driver, requiring an SR-22 form.

Cumulative Fines

Some states impose cumulative fines for each day you are uninsured. This means that for every day you drive without valid insurance, your fines will increase, potentially resulting in a significant financial burden.

Online Databases and Verification

It is relatively easy for law enforcement officers to verify the authenticity of your insurance card. They can use your license plate number to check real-time insurance data and quickly discover if your insurance is valid or not. Additionally, insurance companies are required to notify the DMV about policy lapses, making it challenging to get away with using a fake insurance card.

Enterprise Auto Insurance: Understanding the Requirements

You may want to see also

How to get proof of insurance from your insurer

Getting proof of insurance from your insurer is a relatively straightforward process. Once you've purchased an auto insurance policy, your insurance company will provide you with proof of insurance. This may be sent to you in the mail, or you may be able to access it online or through a mobile app.

- Digital Documents by Mail: Your insurance company will typically send you a physical insurance ID card in the mail. Keep this card with you in your vehicle at all times, as you may need to show it during a traffic stop or if you're in an accident.

- Digital Documents by Email: If you manage your insurance policy online, you may be able to request that your insurance company emails you a digital copy of your insurance card.

- Digital Documents by Website or App: Many insurance companies offer online portals or mobile apps where you can access your insurance information, including your proof of insurance. In some cases, you may be able to download a digital copy of your insurance card to your phone.

It's important to note that, in most states, you are required to have proof of insurance with you when driving. Failure to provide proof of insurance when requested by law enforcement may result in penalties, such as fines or even jail time, depending on the state.

Vintage Cars: Insurance Costs Explained

You may want to see also

What to do if you need proof of insurance in a hurry

If you need proof of auto insurance in a hurry, there are several options available to you. Firstly, it is important to understand what proof of insurance is and when you might need it. Proof of insurance is a document that demonstrates you have a current and valid auto insurance policy. It is typically required when registering a new vehicle, renewing your license, or if you are involved in a car accident or pulled over by the police.

- Contact your insurance company: After purchasing an auto insurance policy, your insurance company should provide you with proof of insurance. If you have not received it, reach out to your insurance provider and request the appropriate documentation. They may be able to send it to you via fax or email immediately upon request.

- Use your insurance company's mobile app: Many insurance companies offer mobile apps that allow you to access digital copies of your insurance cards. Downloading the app can provide you with quick access to your proof of insurance.

- Access your account online: If your insurance company does not have a mobile app, you may be able to log in to your account on their website and download or print a temporary insurance card.

- Contact your insurance agent: If you are unable to access your proof of insurance through the app or website, calling your insurance agent directly and requesting an updated copy of your insurance card can be a quick solution.

- Keep a photocopy or photograph of your insurance card: It is always a good idea to keep a photocopy or photograph of your latest insurance card in a safe place, separate from your vehicle. This way, if you lose your original card or need to access it in a hurry, you have a backup readily available.

- Know your state's requirements: Each state has its own laws regarding proof of insurance. While most states allow digital proof of insurance, some, like New Mexico, may require a physical copy. Be sure to familiarise yourself with the requirements of your specific state.

Remember, driving without proof of insurance can result in tickets, fines, and other penalties. It is always best to be prepared and have your proof of insurance readily available.

Auto Insurance: Exploring the Role of Banks in the Equation

You may want to see also

Frequently asked questions

When you buy an auto insurance policy, your insurance company will send you a physical or digital copy of your insurance card. You can also access your proof of insurance through your insurer's mobile app or website.

Your auto insurance card will include your insurance company's name and address, the policy effective and expiration dates, the policyholder's name, and the insured vehicle's make, model, and vehicle identification number (VIN).

An SR-22 form is a certificate of financial responsibility that your insurance company files with the state. It is used as proof of insurance in cases where your license has been suspended. While an SR-22 form can be used as proof of insurance, it is not a substitute for an auto insurance card, which you should carry with you at all times.

Most states allow you to show digital proof of insurance, which you can access through your insurer's mobile app. However, New Mexico does not accept digital proof of insurance during traffic stops, so it is recommended to keep a physical copy of your insurance card in your vehicle as well.