GEICO aims to make the car insurance claims process as streamlined and stress-free as possible. Customers can file their claim online, via the GEICO Mobile app, or by calling their customer service line. Once a claim is reported, GEICO assigns a liability examiner to investigate the accident and contact those involved. The examiner reviews the insurance policy, gathers information, and determines the cause of the accident. If the car is safe to drive, GEICO schedules an appointment for the customer to bring it in, usually within 24 hours. If not, an auto damage adjuster is sent to the vehicle's location. Customers can choose their own repair shop or use GEICO's Auto Repair Xpress program for fast repairs. GEICO provides a written lifetime guarantee for repairs as long as the customer owns the vehicle. The company also assists with rental car arrangements if the customer has rental reimbursement coverage. GEICO typically sends payment after the accident investigation is complete, covering the cost of repairs minus any deductible amount.

| Characteristics | Values |

|---|---|

| Claim reporting methods | Online, GEICO Mobile app, phone call |

| Claim reporting number | (800) 841-3000 |

| Commercial vehicle insurance claims number | (866) 509-9444 |

| Claim investigation process | Liability investigation |

| Inspection process | Damage inspection, usually within 30 minutes |

| Repair process | Repairs can be done anywhere, GEICO Auto Repair Xpress® is available |

| Rental car | Available if eligible and if you have rental reimbursement coverage |

| Payment | Sent as soon as possible after the accident investigation is complete |

What You'll Learn

GEICO's liability investigation process

When an accident is reported to GEICO, the company assigns a liability examiner to investigate the incident thoroughly. This process, known as the liability investigation, aims to ensure that all claims are handled properly. Here is a detailed overview of GEICO's liability investigation process:

Review Your Coverage

The liability examiner's first step is to review the insurance policy and the coverage in effect for the loss. They determine what types of damage or injuries are covered under the policy. This step helps the examiner understand the scope of the investigation and identify the relevant facts and information needed to process the claim.

Contact Parties Involved

The liability examiner then attempts to contact everyone involved in the accident, including drivers, passengers, and witnesses. They collect statements and accounts from all parties to gain a comprehensive understanding of the incident. This step is crucial in gathering firsthand information and different perspectives about the accident.

Take Statements and Gather Information

When there are conflicting versions of the accident, the liability examiner conducts in-depth interviews with each person involved. These interviews help resolve disputes and clarify the facts. The examiner also gathers and reviews additional relevant information, such as police reports, applicable traffic laws, and photos of the scene and vehicles involved.

Analyse the Information and Determine Cause

After collecting all the facts, the liability examiner carefully considers the information gathered. They analyse the evidence, determine the cause of the accident, and make a decision regarding the claim. The examiner's decision is based on the findings of the investigation and the information provided by all parties involved.

Re-examination and Settlement

GEICO is always willing to re-examine its decision if new information about the accident becomes available. The company prioritises a fair and thorough investigation process. Once the investigation is complete, GEICO provides payment digitally or by mail, covering the repairs minus any deductible amount.

It is important to note that GEICO's liability investigation process may vary slightly depending on the specific circumstances of each case and the state in which the accident occurred.

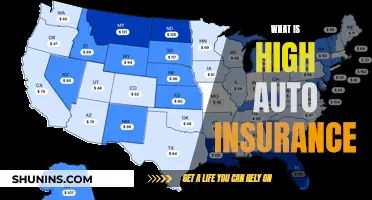

Choosing the Right Auto Insurance: Navigating Coverage and Costs

You may want to see also

How to file a claim

Filing an auto insurance claim with GEICO can be done in a few simple steps. Firstly, ensure you are safe and have called for any necessary medical assistance. If your car is safe to drive, move it to a secure location, but do not leave the scene of the accident. It is important to not admit fault or reveal your policy limits at this stage. Contact the police and request an officer to attend the scene if necessary. Exchange information with all other parties involved, including names, contact details, and insurance information. It is also a good idea to take photos of the scene and all vehicles involved. If your car is not drivable, you can request roadside assistance from GEICO.

You can file a claim with GEICO online, using the GEICO Mobile app, or by calling (800) 841-3000. It is important to report your claim as soon as possible so a thorough investigation can take place while the details are fresh. Once you have reported your claim, you can schedule a damage inspection, which will usually take around 30 minutes. If your car is not safe to drive, a GEICO adjuster will come to the vehicle's location. You can choose any repair shop for your vehicle, or you can use GEICO's Auto Repair Xpress® program for fast, hassle-free repairs. GEICO provides a written lifetime guarantee for repairs for as long as you own the vehicle.

If you have rental reimbursement coverage, GEICO will help set you up with a rental car while your vehicle is being repaired. After the inspection, you can choose where to have your vehicle repaired. You will receive regular updates on the repair progress. GEICO will send you payment after the accident investigation is complete, which will cover the repairs to your car, minus any deductible amount. This payment can be made digitally or by mail.

Texas Auto Insurance: Unaffordable?

You may want to see also

Claim settlement process

GEICO's auto insurance claim settlement process is designed to be streamlined and stress-free for its customers. The process is straightforward and can be initiated by submitting a claim online or by calling their customer service line. Here is a detailed overview of the claim settlement process:

Initiating the Claim:

The first step is to report the claim to GEICO as soon as possible after the accident. This can be done either through their website, the GEICO Mobile app, or by calling their customer service line at (800) 841-3000. Reporting the claim promptly allows for a more detailed investigation while the details are fresh.

Inspection and Repair:

Once the claim is reported, GEICO will schedule a damage inspection, which usually takes around 30 minutes. If the vehicle is not safe to drive, a GEICO adjuster will be sent to the vehicle's location to assess the damage. Customers have the option to meet with the adjuster if they wish. After the inspection, customers can choose any repair shop for their vehicle's repairs. GEICO also offers its Auto Repair Xpress® program, which provides fast and hassle-free repairs with a written lifetime guarantee.

Rental Vehicle Assistance:

During the repair process, GEICO can assist customers with rental car arrangements if they have rental reimbursement coverage. This ensures that customers have a temporary vehicle while their own car is being repaired.

Liability Investigation:

A liability examiner from GEICO will be assigned to investigate the accident thoroughly. This process involves reviewing the insurance policy, contacting all parties involved (drivers, passengers, witnesses), gathering information (police reports, photos, etc.), and determining the cause of the accident. The examiner's role is to handle the claim fairly based on the findings of this investigation.

Payment and Settlement:

GEICO aims to provide payment as soon as possible after the accident investigation is complete. Payments are typically sent digitally or by mail and cover the repairs to the vehicle, minus any deductible amount. If the claim involves determining fault, the settlement process may take longer. GEICO provides legal support in such cases and will arrange for an attorney to defend and advise the customer if necessary.

Overall, GEICO strives to make the claim settlement process efficient and stress-free for its customers, offering support and guidance every step of the way.

Auto Insurance and Death: Uncovering the Hidden Benefits

You may want to see also

Claim investigation process

When someone reports an accident to GEICO, a liability examiner is assigned to investigate the accident to ensure that everyone's claim is handled properly. This process is called the liability investigation. Here is a step-by-step guide to the claim investigation process:

Review Your Coverage:

The liability examiner reviews the insurance policy and the coverage in effect for the loss. They determine what types of damage or injuries are covered under the policy.

Contact Parties Involved:

The examiner attempts to contact everyone involved in the accident, including drivers, passengers, and witnesses, to gather their accounts of the incident.

Take Statements and Gather Information:

When there are conflicting versions of events, the examiner conducts in-depth interviews with each person involved. These interviews help to resolve disputes over the facts of the accident. The examiner also collects and reviews relevant information such as police reports, applicable traffic laws, and photos of the scene and vehicles involved.

Determine Cause and Handle Claim:

After considering all the facts, the liability examiner determines the cause of the accident and handles the claim accordingly. GEICO is willing to re-examine its decision if new information about the accident becomes available.

It is important to note that GEICO handles claims against its customers when someone claims that the insured party was at fault and seeks compensation for bodily injury or property damage. In such cases, GEICO investigates and evaluates the claims, and settlement may take longer as determining fault can be complex.

Does Health Insurance Cover Auto Accident Injuries in New Jersey?

You may want to see also

Claim payment recovery

When it comes to claim payment recovery, GEICO is committed to helping you through the process and making it as stress-free as possible. After an accident, you can file your claim online, on the GEICO mobile app, or by calling (800) 841-3000. GEICO claims representatives are available anytime to assist you with filing your claim and answering any questions.

Once you've reported your claim, GEICO will conduct a liability investigation to ensure that everyone's claim is handled properly. This includes reviewing your coverage, contacting all parties involved, gathering information, and determining the cause of the accident.

If your vehicle is not safe to drive, GEICO will send an auto damage adjuster to its location. You can choose any repair shop for your repairs, or you can use GEICO's Auto Repair Xpress® program for fast and hassle-free repairs. GEICO provides a written lifetime guarantee for repairs done through this program as long as you own the vehicle.

GEICO will typically send payment for repairs to your vehicle as soon as possible after the accident investigation is complete, minus any deductible amount. Payment can be made digitally or by mail. Keep in mind that if the claim is against you, the settlement may take longer as GEICO will need to investigate and determine fault.

Digital Auto Insurance: The Future of Driving?

You may want to see also

Frequently asked questions

You can file a claim with GEICO by using the GEICO Mobile app, online at geico.com/claims, or by calling (800) 841-3000.

After filing a claim, a liability examiner will be assigned to investigate the accident. They will review your coverage, contact the parties involved, take statements, and gather information.

GEICO aims to make the claims process as hassle-free as possible, and your claim may be settled in as little as 48 hours.

If your car is not safe to drive, GEICO will send an auto damage adjuster to the vehicle's location. You can then choose any repair shop for your repair work or consider using GEICO's Auto Repair Xpress® program for fast, hassle-free repairs.

It's important to keep a vehicle safety kit in your car and store important information in your glovebox, such as ID cards, vehicle registration, emergency contacts, and health insurance cards. Downloading the GEICO mobile app can also help you collect information, file and track your claim, and sometimes get an estimate for damages.