Life insurance is a financial safety net for your loved ones after you're gone. It's a way to ensure your family is supported and can maintain their standard of living when you die. In the UK, life insurance is typically paid out as a lump sum to beneficiaries upon the policyholder's death, but most policies can also be claimed if the policyholder is diagnosed with a terminal illness. The process is simple: notify the insurer, who will assess the claim and then issue the payout if it's valid. While the average life insurance payout rate is around 98%, it's important to be aware that claims can be declined if, for example, the policyholder hasn't maintained their premiums or the cause of death is excluded by the policy terms.

| Characteristics | Values |

|---|---|

| Definition | Cover that pays out a lump sum if you pass away during the policy term or if you’re diagnosed with a terminal illness and not expected to live longer than a year |

| Purpose | Provide financial support for loved ones after you’re gone, e.g. helping pay off the mortgage or maintaining their standard of living |

| Types | Term life insurance, whole-of-life insurance |

| Who gets the payout? | Trustee, executor, next-of-kin, beneficiary, or the deceased's estate |

| Payout rate | Around 98% |

| Payout time | No set timeframe |

| Payout amount | Depends on the amount of cover the plan holder asks for and the type of cover they get |

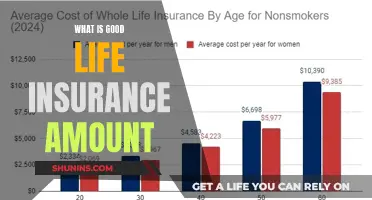

| Cost | Depends on age, occupation, lifestyle, health, and the type of policy |

What You'll Learn

Life insurance payouts to beneficiaries

Life insurance payouts are typically paid out as a lump sum to beneficiaries upon the death of the policyholder. However, most insurers will also pay out if the policyholder is diagnosed with a terminal illness. This money can help the beneficiaries meet household bills, cover funeral costs, or pay off any debts.

The process for making a payout claim is straightforward. First, notify the insurer of the policyholder's death. They will then assess the claim, which may involve providing documents such as a death certificate. Finally, if the claim is valid, the insurer will issue the payout. While there is no time limit for making a claim, providing it within the notification period specified in the policy can help expedite the process.

There are two main types of private life insurance policies: term life insurance and whole-of-life insurance. Term life insurance policies run for a fixed amount of time and only pay out if the policyholder dies during the policy term. In contrast, whole-of-life insurance policies pay out whenever the policyholder dies.

The person who receives the life insurance payout depends on how the policy was set up. If the policy was arranged with a trust, the beneficiaries are clearly outlined. If there is no trust, the payout will go to the policyholder's estate and be distributed according to their will or the rules of intestacy if they did not leave a will.

In most cases, the person who receives the life insurance payout will be the trustee (if the plan is in trust), the executor (if the plan was not in trust but the deceased had a will), or the deceased's next of kin. However, if the policyholder has named a beneficiary to receive the payout, and that person is not the personal representative, they can also receive the payout.

The average life insurance payout rate is around 98%, indicating that the vast majority of policies result in successful claims. The amount of the payout depends on the level of cover the policyholder chose and the type of cover they have. Generally, the more the policyholder pays in premiums, the larger the payout will be.

Understanding Life Insurance Cash Value and Net Worth

You may want to see also

Claiming on a private life insurance policy

There is no time limit for claiming on a life insurance policy. When you are ready, you can contact the insurance company to start a claim. You can do this by phone, post, or online.

Before you make a claim, you will need to obtain a copy of the death certificate. When you contact the insurer, they will ask for the name of the deceased, the cause of death (which can be found on the death certificate), and their policy number. You will also need to state your relationship to the deceased.

You may not know which insurance company the policy is with, or the company may have changed its name. The Association of British Insurers can help with this.

You will need to send the insurer some documents, including a copy of the person's death certificate. If the policy was 'written in trust', the insurance company will pay the money to whoever was named as the beneficiary. A beneficiary is someone who receives the money. There will not be any inheritance tax to pay on this money. If the policy was not written in trust, the money will be considered part of the person's estate, which includes all the money, assets, and possessions the person owned when they died. This means getting the money can take longer and it may be subject to inheritance tax.

Documents you will need to claim on a life insurance policy:

- The death certificate

- The claim form (from the insurance company or found online)

- The policy document (supplied by the insurer at the time of the policy purchase)

The insurer will assess the claim and, if it is valid, they will issue the payout.

Annuities and Whole Life Insurance: What's the Difference?

You may want to see also

Life insurance through an employer

Employee life insurance will pay out a lump sum to any employees who die while working for the company, regardless of the cause or location of death. The company pays the premiums, which are usually tax-deductible, and in return, the policy pays out a tax-free lump sum to the beneficiaries. This sum is usually a multiple of the employee's earnings, with most companies offering between two and four times the employee's salary, although payouts of up to fifteen times the salary are possible.

In addition to financial security, employee life insurance can also include additional benefits such as digital private GP appointments, physiotherapy sessions, counselling resources, and nutrition and fitness programs. These benefits can be accessed independently from any claims made.

When setting up employee life insurance, employers should seek advice to ensure they choose a cover that suits their employees' needs. It is also important to note that employee life insurance requires a trust to receive the payout and distribute it to the chosen beneficiaries, avoiding inheritance tax.

While employee life insurance is a valuable benefit, it may not be sufficient for all employees' needs. The coverage is often tied to the job, with limited portability if employees leave the company. Additionally, the coverage amounts may be capped at low amounts, and the premiums are not fixed, increasing over time.

Lying on Life Insurance: What's the Legal Risk?

You may want to see also

Life insurance payout rates

The rate of life insurance payouts is generally quite high and often much higher than most people predict. However, there are caveats to a successful payout. For example, if a person has fallen behind with payments, it is likely that their policy will have lapsed and it will have ceased to cover them.

The amount paid out depends on the level of cover the person took out. Usually, the more the policyholder pays for their premium, the bigger the life insurance payout. Older people, or people with pre-existing conditions, often have higher premiums but this can mean a bigger payout in the end.

There are two main types of life insurance: term life insurance and whole-of-life insurance. Term life insurance policies run for a fixed amount of time and only pay out if the person dies during the policy. Whole-of-life insurance policies pay out whenever the person dies.

Life Insurance Cash Value: Does It Keep Growing?

You may want to see also

Reasons life insurance won't pay out

When you take out a life insurance policy, you expect that your loved ones will receive a payout when you pass away. While life insurance companies do pay out the majority of claims, there are instances where they may refuse to pay. Here are some reasons why a life insurance policy may not pay out in the UK:

Non-Disclosure or Misrepresentation

When you apply for life insurance, you are required to disclose all relevant information about your health, lifestyle, and medical history. Failure to disclose certain information or providing misleading answers can render your policy invalid. For example, if you do not disclose that you are a smoker and die from a smoking-related illness, the insurance company may refuse to pay out. It is important to be honest and accurate when providing information to ensure your policy is valid.

Exclusions

Life insurance policies typically have a list of exclusions, which are specific situations or causes of death that are not covered by the policy. Common exclusions include death by suicide within the first 12-24 months of the policy, dangerous activities such as extreme sports, acts of war, or drug abuse. If the insured person dies under circumstances that fall under any of the listed exclusions, the insurance company may deny the claim. Make sure you carefully review the exclusions listed in your policy to avoid any surprises.

Policy Lapse

Life insurance policies remain active as long as the premiums are paid on time. However, if you stop paying the premiums, your policy may lapse and no longer be in effect. This means that if the insured person passes away while the policy is lapsed, there will be no payout. It is important to keep track of your premium payments and ensure they are up to date to maintain the validity of your policy.

Fraud or Misconduct

Insurance companies have the right to deny claims if they find evidence of fraud or misconduct by the policyholder or the beneficiaries. This could include providing false information during the application process, forging documents, or making a false claim. Insurance fraud is a serious offence and can result in legal consequences, including fines and imprisonment.

Pre-Existing Medical Conditions

Some life insurance policies may not pay out if the insured person had a pre-existing medical condition that was not disclosed during the application process. Insurance companies assess risk based on the information provided, and undisclosed pre-existing conditions can invalidate the policy. It is important to be transparent about any medical issues to ensure coverage.

In summary, while life insurance can provide financial security for your loved ones, it is important to understand the circumstances under which a policy may not pay out. Being honest and accurate during the application process, keeping your policy active by paying premiums on time, and being aware of any exclusions or limitations can help ensure that your loved ones receive the support they need when they need it most.

Life Insurance: A Necessary Safety Net?

You may want to see also

Frequently asked questions

Life insurance is a cover that pays out a lump sum if you pass away during the policy term or if you're diagnosed with a terminal illness and are not expected to live longer than a year. It provides financial support to your loved ones after you're gone.

Life insurance payouts follow a three-step process: first, notify the insurer; second, they assess the claim and may request documents such as a death certificate; and third, the insurer issues the payout if the claim is valid.

The life insurance payout is typically paid to the trustee, executor, or next of kin. If the policy is in trust, the trustee will receive the payout. If the deceased had a will but no trust, the executor will receive the payout. If there is no will, the next of kin, usually the spouse or children, will receive the payout.

Yes, there are two main types of life insurance payouts: term life insurance policies and whole-of-life insurance policies. Term life insurance policies run for a fixed amount of time and only pay out if the person dies during the policy. Whole-of-life insurance policies, on the other hand, pay out whenever the person dies.