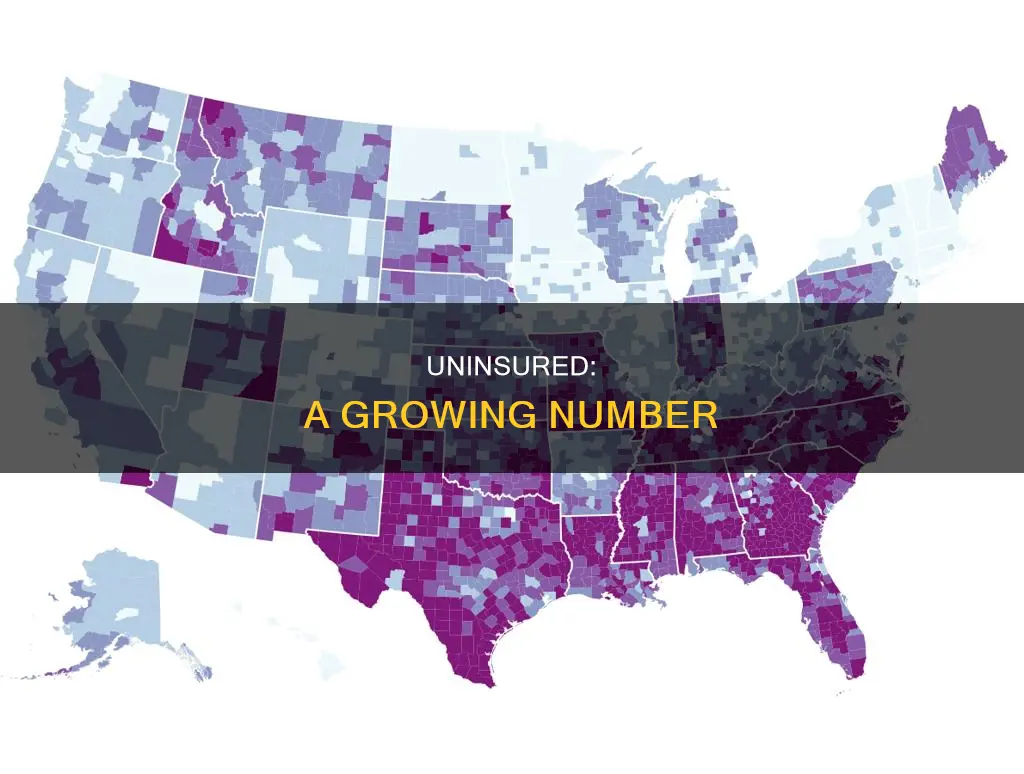

In the US, almost one in ten people don't have health insurance. In 2022, 25.6 million non-elderly individuals were uninsured, a decrease of 3.3 million from 2019. However, this number rose to 27.3 million in 2024. The percentage of uninsured people in the US has been steadily decreasing since 2010, when it was at its peak of 18.2%. The uninsured rate fell to 10.5% by 2015, largely due to the Affordable Care Act (ACA) and improvements in the economy. However, the improvement in coverage began to reverse under President Trump, with the number of uninsured people rising to 29.6 million in 2019.

What You'll Learn

The number of uninsured people in the US

The decrease in the number of uninsured people is widespread among the non-elderly population, with larger gains in coverage among American Indian and Alaska Native people, Hispanic people, individuals in low-income families, and adults. From 2019 to 2022, the uninsured rate for American Indian and Alaska Native people decreased from 21.7% to 19.1%, while the uninsured rate for Hispanic people decreased from 20.0% to 18.0%. The uninsured rate for children was 5.1% in 2022, less than half the rate for non-elderly adults (11.3%).

Despite these improvements, racial and ethnic disparities in coverage persist. The uninsured rates for non-elderly Hispanic (18.0%) and American Indian and Alaska Native people (19.1%) are more than 2.5 times higher than the rates for White people (6.6%). Additionally, non-citizens are more likely to be uninsured than citizens, with an uninsured rate of 30.3% for recent immigrants (those in the US for less than five years) and 33.1% for immigrants who have lived in the US for more than five years.

The majority of the non-elderly uninsured population are adults in working low-income families, and people of color. Most of the uninsured individuals (75.6%) are US citizens, and nearly three-quarters live in the South and West regions of the country. The high cost of insurance is the main reason cited by uninsured individuals for lacking coverage, with 64% of uninsured non-elderly adults stating that coverage is unaffordable.

The implications of not having insurance include reduced access to healthcare, as uninsured individuals are more likely to delay or forgo care due to costs. Uninsured people often face unaffordable medical bills and are more likely to be hospitalized for preventable health conditions. The financial consequences of being uninsured can be significant, with many individuals facing medical debt and struggling to afford basic living expenses.

Secondary Insurance: Who Pays After Primary?

You may want to see also

The reasons for not having insurance

Reasons for Not Having Insurance

There are several reasons why someone might not have insurance. Here are some of the key factors:

- Cost: The primary reason people go without insurance is that they cannot afford it. Insurance premiums can be expensive, and even with subsidies, some individuals may struggle to pay for coverage. This is particularly true for those with low incomes or those who are unemployed.

- Eligibility: Some people are ineligible for insurance coverage, including undocumented immigrants in some countries and adults who do not meet the eligibility criteria for certain public insurance programs.

- Access through Employment: Not all workers have access to insurance through their jobs. Many employers do not offer health benefits to their employees, leaving them without coverage.

- Complexity of Signing Up: For some, the process of enrolling in an insurance plan can be complicated and time-consuming, leading them to forgo coverage. This is especially true if they are unaware of available options or face barriers during the enrollment process.

- Perceived Need: A small proportion of people choose to go without insurance because they believe they do not need it or want it. They may feel they are healthy enough not to require insurance or that the benefits do not justify the cost.

- Chronic Conditions: Individuals with pre-existing or chronic conditions may find it more challenging to obtain affordable insurance. In some cases, insurance companies may deny coverage or charge higher premiums due to these conditions.

- Lack of Awareness: Some individuals may not be aware of their options for obtaining insurance, especially if they are new to a country or unfamiliar with the healthcare system.

- Healthcare Beliefs: Personal beliefs and values can influence an individual's decision to forgo insurance. For example, they may distrust the healthcare system or prefer alternative forms of medicine.

- Citizenship Status: In certain countries, non-citizens may face barriers to obtaining insurance, particularly if they are recent immigrants. This can contribute to higher uninsured rates among non-citizens.

These reasons highlight the complex factors contributing to individuals' decisions or circumstances that lead them to go without insurance. Addressing these issues is crucial to ensuring that more people have access to the security and benefits that insurance provides.

The Intricacies of COIs: Navigating Insurance Terminology

You may want to see also

The impact of being uninsured on health

Being uninsured has a significant impact on health outcomes. Uninsured individuals are less likely to seek medical care, often due to the high costs involved. This can lead to a downward spiral of worsening health and increased healthcare costs. Uninsured individuals are less likely to receive preventative care and treatment for major health conditions and chronic diseases. They are also more likely to be hospitalised for health conditions that could have been avoided.

Uninsured individuals often face unaffordable medical bills when they do seek care. This can quickly lead to medical debt, especially for those with low or moderate incomes and little to no savings. In the US, stable health insurance coverage is associated with improved health outcomes. A lack of insurance is associated with premature death from preventable causes.

Primary care clinicians are often in a position to witness the negative impact of being uninsured on patients' health. However, most ambulatory care clinics are not actively involved in helping patients obtain or maintain health insurance coverage.

The magnitude and complexity of the "uninsurance" problem, as well as recent federal initiatives to expand coverage options, have raised important questions about the potential role of medical homes in addressing this issue. Medical homes can play a proactive role in helping patients find and keep health insurance coverage by developing systems based on the chronic care model, increasing the expertise and skills of clinicians, educating and supporting patients, utilising a team-based approach, and making better use of registry-based information systems.

Overall, the consequences of being uninsured can lead to higher healthcare costs for everyone and put individuals at risk of not receiving timely and appropriate medical care, potentially resulting in serious health complications and even premature death.

Term Insurance: Navigating the Fine Print to Avoid Crashes

You may want to see also

The financial implications of being uninsured

Being uninsured can have serious financial implications for individuals and families. Uninsured people often face unaffordable medical bills when they seek care, and these costs can quickly lead to medical debt, especially for those with low or moderate incomes and little to no savings. In 2015, only around a quarter of uninsured adults received free or reduced-cost care. Uninsured people are often charged the full cost of care, which can be two to four times higher than what insurers or public programs pay. This can result in people delaying or forgoing necessary care due to financial concerns, leading to higher healthcare costs in the long run.

Being uninsured can also impact an individual's ability to work and their overall quality of life. Uninsured adults are more likely to worry about paying for normal healthcare and medical bills, and over two-thirds worry about paying medical bills if they get sick or have an accident. This can lead to financial strain and difficulty paying for basic monthly expenses such as rent and bills. Uninsured people may also have to use their savings or borrow money to pay for medical care, further impacting their financial stability.

Exchange-Insured: Who and How Many?

You may want to see also

Demographic trends among the uninsured

The demographic trends among the uninsured are complex and multifaceted, influenced by various socioeconomic, geographic, and cultural factors. Here are some key trends identified in the United States:

- Age: The uninsured tend to be working-age adults, with the highest proportion falling between the ages of 19 and 64. Among this group, young adults aged 18-34 have the highest uninsured rates. Children and older adults over 65 are less likely to be uninsured due to public programs like Medicaid and Medicare.

- Gender: Men are more likely to be uninsured than women. Women often have lower incomes and qualify for public insurance during pregnancy or as mothers of young children.

- Race and Ethnicity: Racial and ethnic minorities, particularly Hispanics and non-Hispanic African Americans, have higher uninsured rates than non-Hispanic whites. This is due to lower rates of employment-based coverage and higher proportions of lower-income families within these groups.

- Income: Lower-income families, earning less than 200% of the federal poverty level (FPL), have higher uninsured rates. The cost of insurance is often cited as a barrier, and lower-wage jobs are less likely to offer health benefits.

- Education: Lack of a high school diploma is associated with higher uninsured rates. Higher educational attainment, especially a college degree, increases the likelihood of having health insurance.

- Employment Status: Most uninsured individuals are members of families with at least one wage earner, but they tend to work in occupations or sectors where employers are less likely to offer health benefits. Self-employment and working for small private-sector firms also increase the likelihood of being uninsured.

- Geography: The South and West regions of the US have higher uninsured rates, partly due to the larger populations in these areas. Urban and rural residents have similar chances of being uninsured, but urban areas have higher numbers of uninsured individuals.

- Citizenship: Foreign-born residents, including naturalized citizens and noncitizens, are more likely to be uninsured than US-born residents. The longer the residency in the US, the lower the uninsured rate tends to be.

- Family Composition: Families with children are more likely to be insured due to public programs like Medicaid and CHIP. However, lower-income parents may struggle to qualify for Medicaid, resulting in partial insurance coverage for the family.

These trends highlight the complex interplay of factors that contribute to individuals being uninsured. It's important to note that these trends are not static and can change over time due to various economic, social, and policy factors.

Switching Screens: Navigating a Career Shift from Insurance to Computers

You may want to see also

Frequently asked questions

As of 2022, there are 25.6 million nonelderly uninsured individuals in the US, which is a decrease from 27.5 million in 2021.

As of 2022, 9.6% of nonelderly Americans are uninsured, which is a decrease from 10.2% in 2021.

As of 2024, there are 38 million people in the US with inadequate health insurance.

The high cost of insurance is the main reason why many Americans are uninsured. In 2022, 64% of uninsured nonelderly adults said that they lacked coverage because they couldn't afford it.