Life insurance is a contract between the policyholder and the insurance company that provides financial support to your loved ones in the event of your death. The average cost of life insurance is $26 a month, but this can vary depending on factors such as age, gender, health, and lifestyle choices. Term life insurance, which covers a fixed period, is generally more affordable than whole life insurance, which covers the policyholder's entire life. To get the best rates, it's recommended to buy life insurance as early as possible and to compare quotes from multiple insurers.

What You'll Learn

How much is life insurance for a 30-year-old?

The cost of life insurance for a 30-year-old depends on several factors, including gender, health, lifestyle, and the type of policy chosen.

Term Life Insurance

Term life insurance is typically the most affordable option as it only covers a set number of years and does not build cash value. The cost of a term life insurance policy for a 30-year-old will depend on the length of the term and the coverage amount. For example, a 30-year-old non-smoking female can expect to pay around $48 per month for a 20-year term policy with $1,000,000 of coverage, while a 30-year policy with the same coverage would cost around $96 per month.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that lasts for the entirety of the policyholder's life and includes a cash value component. The cost of whole life insurance for a 30-year-old will depend on factors such as gender, health, and smoking status. For example, a 30-year-old female non-smoker in good health can expect to pay around $408 per month for a whole life insurance policy with a $500,000 payout, while a 30-year-old male non-smoker with the same health profile can expect to pay around $472 per month for the same coverage.

Factors Affecting the Cost of Life Insurance

In addition to age, gender, and health, other factors that can influence the cost of life insurance for a 30-year-old include:

- Smoking status: Smokers typically pay higher rates for life insurance due to the increased risk of health issues associated with tobacco use.

- Family medical history: Insurers may inquire about any family history of serious health conditions, such as heart disease, cancer, or diabetes, which could impact the cost of coverage.

- Driving record: A history of DUIs, DWIs, or major traffic violations may result in higher life insurance rates.

- Occupation and lifestyle: Individuals with hazardous jobs or high-risk hobbies may be subject to higher premiums.

Choosing the Right Type of Policy

When deciding between term and whole life insurance, it is essential to consider one's financial responsibilities, future plans, and the length of coverage needed. Term life insurance is generally more affordable, but it does not build cash value and may not be suitable for those seeking lifelong coverage. On the other hand, whole life insurance provides permanent coverage and includes a cash value component but tends to be more expensive.

Whole Life vs Universal Life Insurance: Which is Better?

You may want to see also

How much is life insurance for a 40-year-old?

The cost of life insurance for a 40-year-old depends on several factors, including gender, health, lifestyle, and the type of policy chosen. According to Covr Financial Technologies, the average cost of life insurance is $26 per month, based on a 40-year-old purchasing a 20-year, $500,000 term life policy. However, rates can vary depending on individual circumstances.

For example, a 40-year-old male in good health can expect to pay an average of $334 per year for a $500,000, 20-year term life insurance policy, while a female in the same health category would pay around $264 per year for the same policy. These rates increase with age, with a 50-year-old male paying approximately $817 for the same coverage.

Term life insurance is generally the most affordable option, as it only provides coverage for a specified number of years. Permanent life insurance, on the other hand, is more expensive since it offers lifelong coverage and includes a cash value component. Whole life insurance, a type of permanent life insurance, allows you to build cash value over time and typically costs more than term life insurance.

When determining the cost of life insurance for a 40-year-old, other factors come into play, such as smoking status, family medical history, driving record, occupation, and lifestyle choices. Smokers typically pay higher rates due to the increased health risks associated with tobacco use. Additionally, risky hobbies like skydiving or racing can also result in higher premiums.

When choosing a life insurance policy, it's important to consider your long-term goals and budget. Comparing average life insurance rates by age and policy type can help you make an informed decision. Maintaining a healthy lifestyle and refraining from smoking can also help lower your premiums.

Military Life Insurance: Eligibility for Surviving Spouses

You may want to see also

How much is term life insurance?

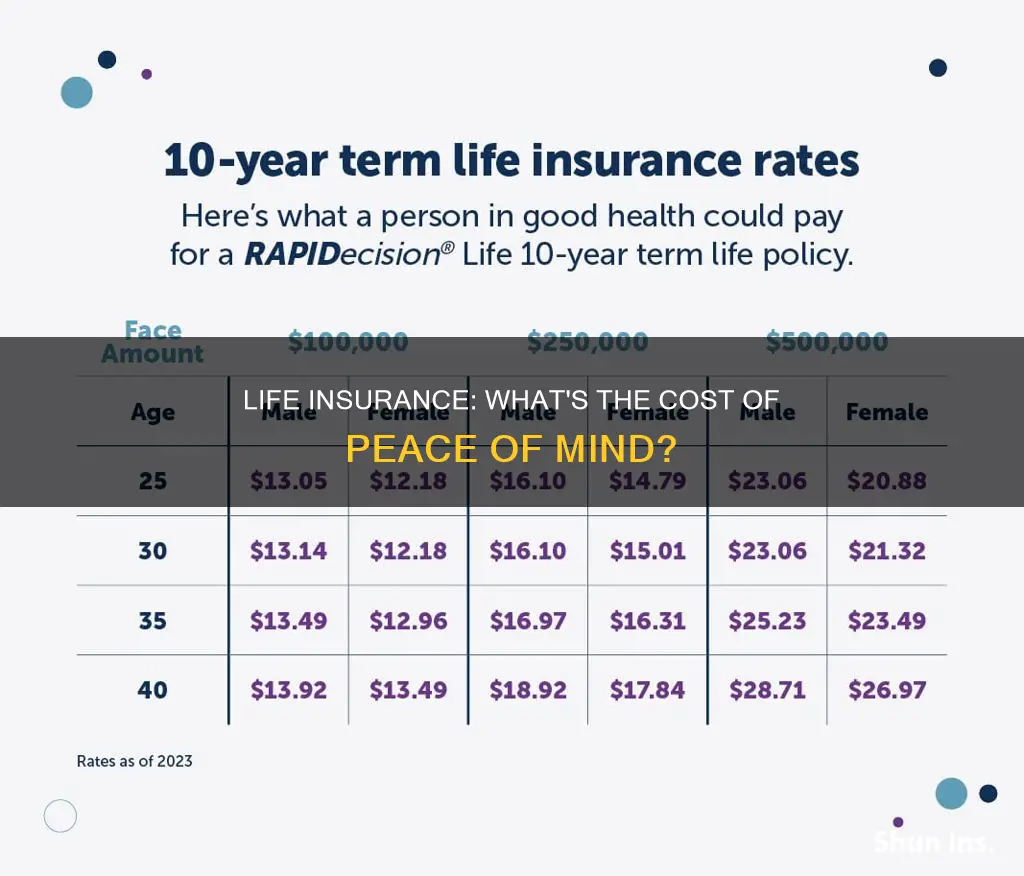

Term life insurance is a temporary policy that provides your beneficiaries with a death benefit payout if you pass away before the policy expires. It is considered a more affordable alternative to permanent life insurance as it is only in place for a set number of years. The cost of term life insurance depends on a number of factors, including age, gender, health, lifestyle, and occupation.

Age

Age is one of the biggest factors in determining the cost of term life insurance. Younger people tend to pay less than older people as they are less likely to have health problems and are expected to live longer. The likelihood of an insurer having to pay out a policy increases with age, so the cost of insurance increases too. For example, a $50,000 policy for a 25-year-old woman will cost approximately $14 a month, while the same policy for a 55-year-old woman would be around $60 a month.

Gender

Women tend to pay less for life insurance than men because women generally have longer life expectancies. For example, in the US, the average life expectancy is 79.3 years for women and 73.5 years for men.

Health

Many insurers require you to take a medical exam before taking out term life insurance. If you have health issues such as diabetes, heart disease, or high blood pressure, you may have to pay higher premiums.

Lifestyle and Occupation

If you have a hazardous job or participate in risky hobbies, you may pay more for term life insurance. Occupations that may be considered hazardous include police officers, firefighters, pilots, and construction workers. Risky hobbies include skydiving, racing, and mountain climbing.

Coverage

The amount of coverage you get will also affect the cost of term life insurance. The more coverage you get, the higher your rates will be. However, term life insurance tends to be more cost-effective than permanent life insurance, as you can get more coverage for a lower price.

Joint Term Life Insurance: What Couples Need to Know

You may want to see also

How much is whole life insurance?

The cost of whole life insurance depends on several factors, such as your age, health, gender, the policy design, and the amount of coverage. Whole life insurance is a type of permanent life insurance that doesn't expire and has a savings feature called a cash value, which can be borrowed against while the policyholder is still alive.

The average cost of whole life insurance is $440 per month for a $500,000 policy for a 30-year-old non-smoker in good health. The cost of whole life insurance increases with age, with a 35-year-old non-smoking man in good health paying between $542 and $708 per month for the same coverage. Women tend to pay slightly less than men due to their longer life expectancy.

Other factors that affect the cost of whole life insurance include health history, occupation, hobbies, and the insurance company. Whole life insurance policies are also generally more expensive than term life insurance policies due to their permanent coverage and cash value component.

It's important to note that the cost of whole life insurance can vary significantly depending on individual circumstances and the specific policy chosen. Working with a financial advisor can help tailor a policy to your specific needs and budget.

Life Insurance Rates: Understanding Term Policy Price Hikes

You may want to see also

How much is life insurance for a smoker?

Smoking is considered a health risk that can reduce your life expectancy, and life insurance companies reserve higher rates for those who are not expected to live as long. This means that if you smoke, you should expect to pay more for a life insurance policy than a non-smoker.

Types of Life Insurance for Smokers

There are several types of life insurance available to smokers, each with its own unique features and benefits. Here are some of the most common options:

- Term life insurance offers coverage for a set period, typically between 10 and 30 years. Your premiums may remain the same over the term, and your beneficiaries will receive a death benefit if you pass away during the active period.

- Whole life insurance is a permanent policy that provides coverage for your entire life. It typically includes a death benefit and a cash value component that allows you to earn money in a tax-deferred account, which you can access while alive.

- Final expense insurance is another type of permanent policy designed to cover end-of-life expenses, including medical bills, legal and accounting costs, and funeral and burial expenses.

- Guaranteed-issue life insurance is a whole life insurance policy that does not require you to answer health-related questions or undergo a medical exam. However, this policy usually comes with a waiting period before the benefits take effect.

Factors Affecting Life Insurance Rates for Smokers

Several factors influence the cost of life insurance for smokers. Here are some key considerations:

- Increased Risk: Smoking is associated with various health conditions, such as lung cancer and heart disease, leading to a higher risk assessment by insurers. This increased risk translates to higher premiums.

- Life Expectancy: Life insurance rates are closely tied to life expectancy. As smoking can reduce life expectancy, smokers often face higher premiums than non-smokers.

- Type of Smoking: Life insurance companies classify smokers based on the type of smoking they engage in. This includes cigarette smoking, vaping, tobacco chewing, and the use of nicotine patches or gum.

- Frequency of Use: The frequency of smoking also impacts insurance rates. Occasional smokers or those who smoke only a few cigars or chew a small amount of tobacco per month may be categorized as non-smokers by some insurers.

- Medical History: Pre-existing health conditions related to smoking can further increase insurance rates. If you have a smoking-related disease, an insurer may deny your request for a policy or offer higher rates.

- Marijuana Use: Marijuana usage is considered differently by various companies. Some insurers may offer the best rates to legal and/or medical marijuana users, while others may classify marijuana users as tobacco users.

Sample Costs for Smokers' Life Insurance

To provide a more concrete example of the cost difference, let's consider the following scenario:

A 30-year-old female smoker in good health purchases a 20-year term life insurance policy with a $500,000 payout. She can expect to pay around $65.75 per month for this policy. On the other hand, a 30-year-old non-smoker with the same coverage would likely pay significantly less.

For whole life insurance, the rates are even higher for smokers. Using the same example, a 30-year-old female smoker in good health can expect to pay approximately $505.20 per month for a $500,000 whole life insurance policy.

Tips for Smokers Seeking Life Insurance

When seeking life insurance as a smoker, consider the following tips:

- Be honest about your smoking habits during the application process. Lying about your tobacco usage may result in your policy being cancelled or your claim being denied.

- Compare quotes from multiple insurance companies, as some may be more lenient towards smokers and offer more competitive rates.

- Consider term life insurance, as it provides the flexibility to cancel at any time without fees. Look for carriers that offer features like "re-entering," which lets you qualify for non-smoker rates on your existing policy after quitting smoking.

- Consult an independent insurance agent who works with multiple carriers, as they can help you find insurers more favourable to smokers.

Health Insurance and Air Ambulance: What's Covered?

You may want to see also

Frequently asked questions

The average cost of life insurance is $26 a month. This is based on data provided by Covr Financial Technologies for a 40-year-old buying a 20-year, $500,000 term life policy.

Life insurance premiums are based primarily on life expectancy. The younger and healthier you are, the cheaper your premiums. Other factors that may affect the cost of life insurance include your gender, smoking status, health, family medical history, driving record, occupation, and lifestyle.

Term life insurance is usually cheaper than permanent life insurance. The cost of term life insurance depends on the length of the term, the coverage amount, and personal factors such as age, gender, and health. For example, a $50,000 policy for a healthy 25-year-old woman may cost around $14 a month, while the same policy for a 55-year-old woman may cost around $60 a month.