Life insurance is a financial product that pays out a sum of money to beneficiaries upon the policyholder's death. Before selling a policy, insurance companies conduct a risk assessment to determine the likelihood of a claim being filed. This process, known as underwriting, involves evaluating an applicant's health, lifestyle, occupation, and financial history to assign them to a risk class. The risk class determines the premium, with higher-risk groups paying more. While the specific criteria vary across insurers, the goal is to balance the risk of insuring an individual while ensuring the company can meet its financial obligations.

| Characteristics | Values |

|---|---|

| Age | The younger you are, the lower your risk class and premium will be. |

| Health | No serious health issues; no medication for chronic conditions; no history of early-onset diseases in the family. |

| Lifestyle | No smoking, drinking, skydiving, or other high-risk activities. |

| Gender | Women tend to live longer than men and hence might have lower premiums. |

| Job | Not in a dangerous occupation. |

| Education Status | Undergraduate or above. |

| Credit Score | A good credit score may not be necessary but can help. |

Health & Family Medical History

When applying for life insurance, you will be asked about your health and family medical history. This is because your probable longevity and overall health are considered when deciding on your coverage. Your family medical history is used as an indicator of your future health risks. If you have a family history of certain illnesses, you may be at higher risk of developing those conditions in the future.

During the application process, you will be asked questions about your immediate family's health history. This includes your mother, father, and siblings. You will need to know about hereditary conditions, such as:

- Cancer, including skin, breast, colon, lung, melanoma, and prostate cancer

- Alcoholism and drug dependency

- Motor neuron disease

- Musculoskeletal disorders

- Neurological/psychiatric disorders

- Cardiovascular disorders

- Respiratory disorders

- Other genetic conditions

If a family member has had one of these conditions, you may be asked to provide details about the age of diagnosis and the severity of the condition. This is because patterns of medical incidents, as opposed to single medical issues, are more likely to affect your coverage. For example, if your mother was diagnosed with breast cancer at age 40, this may be seen as a higher risk than if she had been diagnosed at age 80. Similarly, if your father died of a heart attack at age 45, this would present a higher level of risk than if he had been treated for heart disease at age 75.

If you are female and your family has a history of gender-related conditions, such as prostate cancer, this may not impact your insurance coverage. Additionally, if your family members developed medical issues late in life, after the age of 60, it may affect your coverage less compared to early diagnoses.

It is important to be honest when disclosing your family medical history. While it may result in higher premiums, lying on your application can lead to your coverage being canceled or your premium being increased.

VA Life Insurance: Is It Really Free?

You may want to see also

Lifestyle & Habits

When applying for life insurance, you will be asked detailed questions about your lifestyle and habits. This is because insurers need to determine how likely you are to die during the term of the policy. The healthier you are, the less risky you are to the insurer.

Smoking is a significant factor in determining your risk class. Smokers pay higher premiums than non-smokers, and this is usually the case even if you only smoke a few cigarettes a day. This is because regular smoking leads to numerous health problems later in life.

Other lifestyle choices that are considered risky include:

- Horseback riding

- Motorcycle riding

- Aviation-related activities, such as flying an aeroplane, ultra-light flying, hang gliding, or skydiving

- Mountain climbing

- Racing cars

- Scuba diving

- Rock climbing

Engaging in these activities may result in higher insurance premiums.

Your occupation can also affect your risk class. If you work in a job that is considered dangerous, such as being a police officer or a miner, your premium rate might be higher than average.

Other factors that might affect your risk assessment include:

- Gender: Women tend to live longer than men and hence might have lower premiums.

- Previous insurance history: If you have pre-existing insurance policies, your subsequent life cover amount will be reduced.

- Education status: Those who are undergraduates or above are more likely to get beneficial premium rates.

- Credit score: Insurers take your credit score into account during the risk assessment process, and it may affect your coverage amount.

Bankruptcy's Impact on Life Insurance: What You Need to Know

You may want to see also

Age

Life insurance policies are less expensive for younger people, who have longer life expectancies and are less likely to get ill. In some cases, you may not even qualify for life insurance if you are over a certain age. Typically, the cost of a life insurance premium increases from 8% to 10% on average for every year of age. The longer you wait to buy life insurance, the more you will have to pay for premiums. With term life insurance, your premium remains the same every year. However, after your term life insurance expires, your premium will likely be higher because you are older and your health status may have changed.

The best time to purchase life insurance is when you are younger. This is because younger people are less likely to develop serious health problems and are, therefore, more likely to reach the end of the policy term. This is why the premium for younger people is generally lower, especially for term insurance plans. You can get high life cover for a reasonable premium in your 20s, but the same life cover amount may be costlier if you try to purchase insurance in your 30s.

Blue Cross Blue Shield: Life Insurance Options Explored

You may want to see also

Occupation

When it comes to life insurance, insurance companies determine an individual's risk class based on factors such as age, health, lifestyle, and family medical history. This risk class then informs the premium they will have to pay, with higher-risk individuals paying more.

- Fishing and hunting workers

- Loggers

- Aircraft pilots and flight engineers

- Roofers

- Construction workers

- Refuse and recyclable material collectors

- Drivers and truck drivers

- Structural iron and steel workers

- Farmers, ranchers, and agricultural managers

- Grounds maintenance workers

- Active-duty military personnel

- CEOs or CFOs conducting international business

- Commercial pilots

- Delivery drivers of hazardous materials

- Dentists who travel for work or are medical missionaries

- Scuba divers

- Doctors who travel for work or are medical missionaries

- Firefighters and first responders

- Lawyers who travel for work

- Marijuana industry workers

- Oil refinery workers

- Municipal police officers, especially those with specialties like undercover work or SWAT teams

- Private pilots

- Professional athletes

- Ranchers and farm workers

- Veterinarians who travel for work

The above-listed occupations are considered high-risk by most life insurance companies due to the potential dangers associated with them. As a result, individuals in these professions may face higher premiums or limited coverage options.

It is important to note that not all insurance companies approach high-risk applicants in the same way. Some companies may allow low-risk factors in other areas of an individual's life to balance out a high-risk occupation, offering different premium options to offset the risk.

Additionally, individuals can take steps to improve their overall risk class, such as improving their health and lifestyle choices, which may result in lower premiums over time.

Farm Bureau Life Insurance: Accelerated Payment Options Explained

You may want to see also

Financial Health

Income plays a significant role in determining an individual's financial health. Life insurance companies calculate the "Human Life Value" (HLV) of an individual based on their current income. By extrapolating this income to the point of retirement, insurers can predict the individual's potential net worth. A higher HLV generally leads to a higher life cover amount, as the family will require a greater sum to maintain their standard of living.

Outstanding debts and investments are also taken into account during the risk assessment process. An individual with significant debts may be considered a higher financial risk, as their ability to pay premiums could be impacted. On the other hand, a stable financial record with consistent bill payments and a stable income can improve an individual's financial stability rating.

Additionally, credit score is another factor considered by insurers. While a good credit score is not necessary to purchase life insurance, it can impact the coverage amount offered. A higher credit score may indicate financial responsibility and stability, which could lead to more favourable terms.

It is important to note that financial health is just one aspect of the overall risk assessment for life insurance. Other factors, such as health, family medical history, lifestyle, and age, also play a significant role in determining an individual's risk class and premium costs.

Whole Life Insurance: Do Payouts Decrease as We Age?

You may want to see also

Frequently asked questions

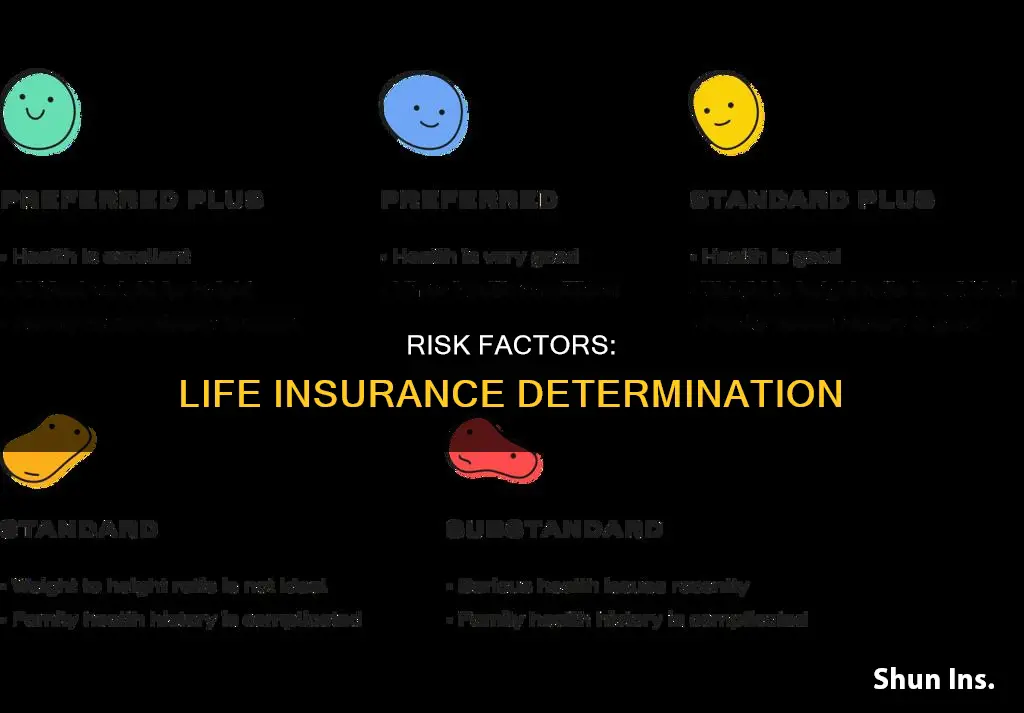

A risk class is a group of individuals with similar characteristics that help insurers determine the risk associated with providing coverage and the premium to be charged. There are typically four main risk classes: Preferred Plus, Preferred, Standard Plus, and Standard.

Factors such as age, health, lifestyle, and family medical history are considered when determining your risk class. Lifestyle factors include smoking, drinking, high-risk activities, and your current job.

Your risk class directly impacts your life insurance premiums. Individuals in the Preferred Plus risk class, who are considered the lowest risk, will generally pay lower premiums. Those in higher-risk classes may have to pay more for life insurance.

Yes, you can take steps to improve your risk class and potentially reduce your premiums. This includes maintaining a healthy lifestyle, getting regular health check-ups, avoiding high-risk activities, and improving your financial stability.