Climate change, inflation, and global instability have put the spotlight on reinsurance companies, a little-known slice of the financial industry that provides insurance to insurers. Reinsurers have raised prices, causing insurance companies to pull back from offering coverage in certain areas or cut the kinds of damage they will pay to repair. This has resulted in a new sense of uncertainty for the future of the insurance industry.

The math behind insurance is based on the Law of Large Numbers and weighted probability. The Law of Large Numbers states that the more you do something, the closer the average result will be to the actual probability. Weighted probability is a concept that calculates the average amount of money gained or lost in a situation by multiplying each probability by the money gained or lost and adding the results.

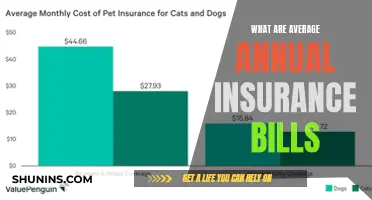

Insurance companies use these concepts to calculate the premiums they charge their customers. By collecting lots of small payments, companies know that probability will protect them from the occasional loss.

What You'll Learn

- Climate change, inflation, and global instability have caused reinsurance companies to increase their prices

- Reinsurance companies provide insurance to insurance companies

- Reinsurance companies have helped drive changes in the insurance industry

- Insurance companies have pulled back from offering coverage in certain areas or cut the kinds of damage they will pay to repair

- Reinsurance companies have lost money over the last four or five years as they competed to offer the best terms to customers

Climate change, inflation, and global instability have caused reinsurance companies to increase their prices

Climate change is a significant factor in the increasing prices of reinsurance. The physical effects of climate change are contributing to more frequent and extreme weather events, which directly impacts the reinsurance industry. If reinsurers do not properly account for the impact of climate change in their modelling and pricing, it could lead to significant unexpected volatility in their earnings and capital. This could result in pricing corrections that increase the cost of reinsurance for primary writers, affecting their profitability and risk profiles.

Inflation is another factor contributing to rising reinsurance prices. Central banks respond to high inflation by raising interest rates, which can cause financial instability and a more severe economic slowdown than intended if done too quickly. This can lead to economic uncertainty and increased costs for businesses, including reinsurers.

Global instability, such as the impact of the COVID-19 pandemic and the war in Ukraine, has also played a role in the increasing prices of reinsurance. These events have disrupted global supply chains and increased economic uncertainty, affecting the ability of reinsurers to accurately predict and manage risk.

The combination of these factors has led to a "crisis of confidence" in the insurance industry, as climate change makes weather events more unpredictable and increases the potential for damage. As a result, reinsurance companies have been withdrawing from high-risk areas, and insurance companies have been forced to raise premiums and pull out of markets, leaving homeowners with fewer choices and more financial distress.

Unraveling the Mystery of Retroactive Dates in Insurance Policies

You may want to see also

Reinsurance companies provide insurance to insurance companies

Reinsurance companies, or reinsurers, provide insurance to insurance companies. Reinsurance is often referred to as "insurance for insurance companies". It is a form of risk transfer and risk-sharing between insurance companies.

Reinsurance companies allow insurance companies to transfer risk, reduce capital requirements, and lower claimant payouts. They enable insurance companies to issue policies with higher limits, as the risk is offset to the reinsurer. Reinsurance also makes income more predictable for insurance companies by transferring highly risky insurance liabilities to reinsurers, who can absorb potentially large losses.

Reinsurance is particularly useful in the case of natural disasters, such as earthquakes and hurricanes, which can cause abnormally high claims. By shifting part of the insurance liabilities to reinsurers, insurance companies can avoid bankruptcy and remain solvent.

Reinsurance companies generate revenue by identifying and accepting policies that they deem to be less risky, and by reinvesting the insurance premiums they receive. They also generate revenue by investing the insurance premiums they receive and only liquidating their securities if they need to pay out losses.

Reinsurance transactions can be complex and involve a variety of factors, such as the financial strength of the reinsurer. Reinsurance is less regulated than insurance for individual consumers because the purchasers of reinsurance are considered sophisticated buyers.

Unraveling the Mystery of Calculating HLV for Term Insurance: A Comprehensive Guide

You may want to see also

Reinsurance companies have helped drive changes in the insurance industry

Reinsurance companies have been pivotal in driving changes in the insurance industry. They have supported the solvency and capital efficiency of insurance risk transfer, playing a critical role for over 150 years. Reinsurance is essentially "insuring the insurers", and this has helped the insurance industry in several ways.

Firstly, reinsurance companies enable insurance companies to reduce their liability for claims by transferring a part of the liability to another insurer. This, in turn, reduces the amount of capital the insurance company must maintain to satisfy regulators and allows them to take on more or larger insurance policies.

Secondly, reinsurance companies provide financial protection to insurance companies, especially in the case of catastrophic risks such as hurricanes, wildfires, and other natural disasters. By purchasing reinsurance, insurance companies can limit their liability on specific risks, stabilize loss experience, and increase their capacity.

Thirdly, reinsurance companies help insurance companies manage their capital more efficiently. By transferring risk to reinsurers, insurance companies can free up additional capital, avoid the need to raise additional capital, and improve their solvency.

Moreover, reinsurance companies provide expertise to insurance companies, helping them obtain higher ratings and premiums. Reinsurance companies also enable insurance companies to diversify their portfolios and increase their global presence, particularly in emerging markets such as Asia and Latin America.

Finally, reinsurance companies have helped drive innovation in the insurance industry. They have invested in digital distribution, data analytics, and technology, supporting the development of new products and services. For example, reinsurance companies have played a role in the securitization of insurance risk, with the emergence of catastrophe bonds and other alternative risk-financing tools.

In conclusion, reinsurance companies have had a significant impact on the insurance industry by reducing liability, providing financial protection, improving capital management, offering expertise, enabling diversification and global expansion, and driving innovation. These changes have helped insurance companies become more resilient and better able to meet the evolving needs of their customers.

Supplemental Insurance: Understanding the Added Layer of Protection

You may want to see also

Insurance companies have pulled back from offering coverage in certain areas or cut the kinds of damage they will pay to repair

As disasters like the wildfires that devastated the Hawaiian town of Lahaina and the storms that tore apart roofs from Alabama to Massachusetts, insurance companies have pulled back from offering coverage in certain areas or cut the kinds of damage they will pay to repair.

Insurance companies have also pulled back from offering coverage in certain areas or cut the kinds of damage they will pay to repair due to the rising severity and frequency of extreme weather events. For example, State Farm stopped offering new policies in California, citing "rapidly growing catastrophe exposure", and Farmers Insurance pulled many of its policies in Florida for the same reason.

CVS Flu Shot Services: Understanding Insurance Billing

You may want to see also

Reinsurance companies have lost money over the last four or five years as they competed to offer the best terms to customers

Reinsurance is a form of insurance for insurance companies, allowing them to manage their risks and remain solvent by recovering some or all amounts paid out to claimants. Reinsurance companies assume the risk that insurance companies cannot handle alone, especially in the case of catastrophic events like hurricanes, floods, or earthquakes. Reinsurance is essential for insurance companies to manage their risks and the amount of capital they must hold.

Reinsurance companies have lost money over the last four to five years due to competition to offer the best terms to customers. Reinsurance is a competitive market, with companies vying to offer the most attractive terms to insurance companies. This competition has driven down prices and may have led to reinsurance companies taking on more risk than they can handle.

Reinsurance companies employ risk managers and modelers to price their contracts, and they work with a different customer base than standard insurance companies. They operate in the background of the financial world, targeting a niche market with a few large competitors.

By offering more favourable terms, reinsurance companies may have been able to secure more business. However, if the terms are too generous, it could lead to financial losses for the reinsurer, especially if a major disaster occurs. Reinsurance companies must balance offering competitive terms with ensuring they can cover their liabilities.

The competition in the reinsurance market has likely contributed to the financial losses of reinsurance companies over the last four to five years. To remain profitable, reinsurance companies need to carefully manage their risks and ensure they have sufficient capital to cover potential claims.

Unraveling the Complexities of Retroactive Rx Insurance Billing

You may want to see also

Frequently asked questions

People buy insurance to protect themselves from the financial consequences of unlikely but expensive events.

Insurance companies make money by charging their customers more in premiums than they pay out in claims. They employ actuaries to calculate the premiums based on the likelihood of certain events occurring.

The Law of Large Numbers is a statistical concept that states that as the number of trials of an experiment increases, the results get closer to the expected probability. In the context of insurance, this means that as the number of people insured increases, the likelihood of the insurance company paying out claims gets closer to the expected probability.