Changing hospitals on your insurance I.D. can be a tricky process. In the U.S., there are a variety of insurance plans, including the Affordable Care Act (ACA), Medicare, and Medicaid, and each has different rules and regulations. Typically, you can only change your insurance plan during the yearly Open Enrollment period (November 1 – January 15), unless you qualify for a Special Enrollment Period due to a significant life event, such as losing health coverage, moving, getting married, having a baby, or adopting a child. If you do qualify for a Special Enrollment Period, you usually have 60 days from the life event to enroll in a new plan, but it's recommended to report your change as soon as possible.

What You'll Learn

Understanding the process of changing your health insurance plan

In the United States, there are specific periods when you can change your health insurance plan. One of these is the yearly period, from November 1 to January 15, known as the Open Enrollment period, when people can enroll in a Marketplace health insurance plan. Outside of this Open Enrollment period, changing your health insurance plan is typically only possible under certain circumstances.

You may be able to change your health insurance plan outside of the Open Enrollment period if you experience certain qualifying life events. These life events include losing health coverage, moving to a new location, getting married, having a baby, adopting a child, or if your household income falls below a certain level. It's important to note that you usually have a window of 60 days from the life event to enroll in a new plan, but it's recommended to report the change as soon as possible.

To initiate the process of changing your health insurance plan during a Special Enrollment Period, you need to first report the change by updating your application. After that, you can review your Eligibility Results. If you are indeed eligible for a Special Enrollment Period, you can then proceed to shop for new plans and enroll in one that better meets your needs and circumstances.

It's worth noting that the ability to change plans may vary depending on the specific health insurance provider and your plan type. Be sure to carefully review the terms and conditions of your current plan, and don't hesitate to reach out to your insurance provider for clarification on your options for making changes.

Navigating the LabCorp Billing Process: Understanding Insurance Claims

You may want to see also

Special Enrollment Periods and qualifying life events

Special Enrollment Periods are times outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for a Special Enrollment Period if you've experienced certain life events, including:

- Losing health coverage

- Moving

- Getting married

- Having a baby

- Adopting a child

- Your household income is below a certain amount

- Gaining or losing a dependent

- Death of the person through whom you were covered

- Loss of coverage under the Access for Infants and Mother's Program and Medicaid share of cost program

- Loss of HMO coverage benefits as you no longer live or work in the HMO service area

- Becoming a permanent resident of California during a month outside of the open enrollment period

- Returning from active military duty

- Being released from incarceration

- Gaining citizenship or lawful presence

- Experiencing a natural or human-caused disaster

- Gaining access to an individual coverage HRA or a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA)

- Misconduct or misinformation during your enrollment

- Gaining membership in a federally recognized tribe or status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- Becoming a U.S. citizen

- AmeriCorps members starting or ending their service

Most special enrollment periods last 60 days from the date of the qualifying life event. Depending on your Special Enrollment Period type, you may have 60 days before or after the event to enroll in a plan. You can enroll in Medicaid or the Children's Health Insurance Program (CHIP) at any time. Job-based plans must provide a Special Enrollment Period of at least 30 days.

Choosing the Right Term Insurance Horizon: Navigating the Optimal Tenure for Peace of Mind

You may want to see also

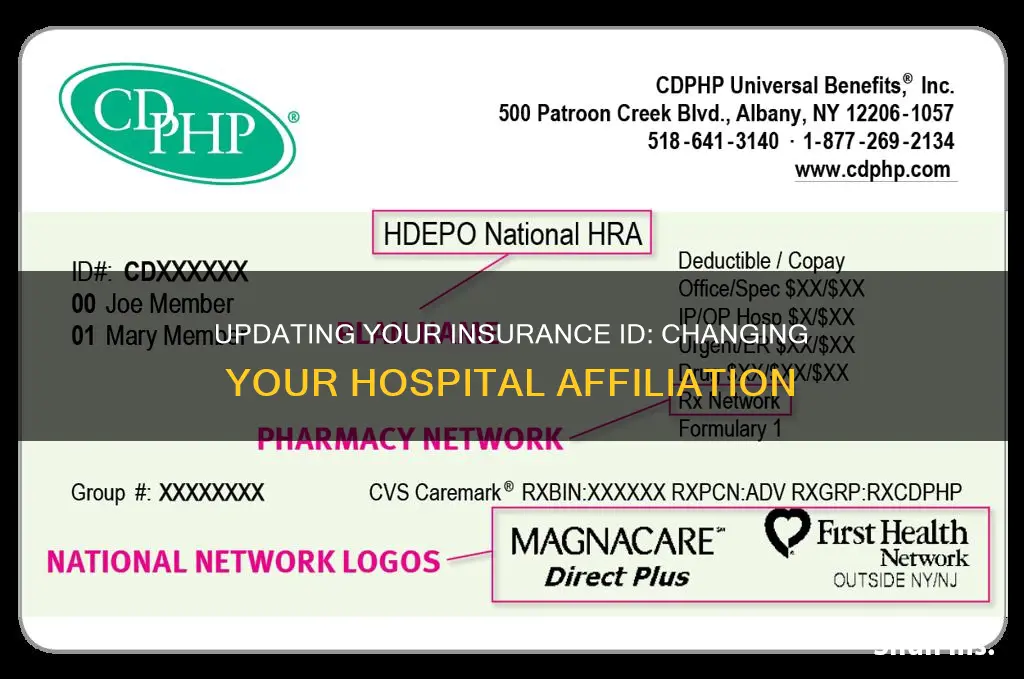

Finding in-network providers and hospitals

Understand Your Insurance Plan:

Before searching for in-network providers, familiarize yourself with the specifics of your insurance plan. Different types of plans have varying levels of coverage for in-network and out-of-network providers. Common types include HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), EPO (Exclusive Provider Organization), and POS (Point of Service) plans. Knowing the type of plan you have will help you understand your coverage options.

Utilize Online Resources:

Most insurance companies provide online tools to help you find in-network providers. You can start by visiting your insurance company's website and searching for a "Provider Search" or "Find a Doctor" tool. These tools allow you to input your location and plan details to find a list of in-network providers near you. Additionally, you can check the websites of specific hospitals or doctors to see if they list the insurance networks they are part of.

Contact Your Insurance Company:

If you're unable to find the information you need online, don't hesitate to call your insurance company's customer service line. Have your insurance card ready, as you may need your plan name, member ID, and other details. Their representatives can help you confirm whether a specific provider is in-network and can guide you in understanding your coverage options.

Reach Out to the Provider's Office:

Another option is to contact the provider's office directly. Ask them if they accept your specific insurance plan. Keep in mind that not all doctors within a practice may accept the same insurance, so be sure to have the name of your specific doctor and your insurance plan when calling. This is especially important if you have a marketplace plan, as some providers may not accept these plans.

Understand In-Network Hospitals:

Hospitals are typically part of insurance networks, and your plan may require you to use in-network hospitals for coverage. However, be aware that even within an in-network hospital, there may be out-of-network providers. Always confirm with the hospital and your insurance company that the specific services you need will be covered.

Consider Open Enrollment and Special Enrollment:

If your current providers are not in-network and you wish to continue seeing them, you may have the option to change your insurance plan. Open Enrollment periods typically allow you to make changes to your plan. Additionally, if you experience certain life events, such as moving or having a baby, you may qualify for a Special Enrollment Period, during which you can select a new plan that better suits your needs.

Understanding Negligence: The Key to Unlocking Insurance Claims

You may want to see also

Changing plans during the Open Enrollment Period

The Open Enrollment Period is the time of year when anyone can change their health insurance plan for any reason. It typically runs from November 1 to January 15. During this period, you can accept your current plan's renewal or shop around for a better option. The plan you choose will begin on February 1, or January 1, depending on when you enroll.

- If you want to look at new plans with the same insurance provider, you can usually compare plans online or call their team.

- If you want to see options from different health insurance providers, you can either contact them directly, call your broker, or use the health insurance marketplace.

- On the health insurance marketplace, you can see plan information from many different companies all at once. You can also find out if you qualify for financial assistance.

Cancelling your plan

You can cancel your Marketplace plan at any time, but there are some important things to consider:

- Once you cancel your coverage, you might have to wait for the next Open Enrollment Period to enroll again.

- Health coverage helps you get regular care, including free preventive services, to keep you healthy.

Special Enrollment Period

Outside of the Open Enrollment Period, you can still change plans if you qualify for a Special Enrollment Period. A Special Enrollment Period is a time outside the yearly Open Enrollment Period when you can sign up for health insurance if you've had certain life events, including:

- Losing health coverage

- Moving

- Getting married

- Having a baby

- Adopting a child

- Your household income is below a certain amount

You usually have 60 days from the life event to enroll in a new plan, but you should report your change as soon as possible.

The Pelvic Region Paradox: Exploring Insurance Billing Conundrums

You may want to see also

Maintaining access to your preferred doctors and specialists

- Check your insurance plan's requirements: Different plans have different requirements for accessing specialists. Some plans require a referral from your primary care physician (PCP) or primary care doctor, while others allow you to see a specialist directly. Understanding the rules of your plan will help you navigate the process effectively.

- Choose a PCP that suits your needs: Your PCP plays a crucial role in coordinating your care and guiding you through your health journey. Select a PCP who is located near you and is part of a medical group or Independent Practice Association (IPA) that includes your preferred specialists. This will make it easier to get referrals and access the specialists you need.

- Understand the concept of in-network and out-of-network providers: In-network providers have a contract with your insurance plan and usually offer lower out-of-pocket costs. Out-of-network providers do not have a contract and may result in higher costs for you. Whenever possible, choose in-network doctors or hospitals to minimize your expenses and potentially improve the quality of your care.

- Review your insurance plan's provider directory: Your insurance plan should have a directory or network of doctors, hospitals, and other healthcare providers that they contract with. Check this directory to see if your preferred doctors and specialists are included. You can usually find the provider directory on your plan's website or by contacting your insurer.

- Communicate with your doctors: Discuss your preferences and needs with your PCP and specialists. They can help guide you in making decisions that align with your insurance plan's requirements and ensure continuity of care.

- Be proactive: If your insurance plan changes or you move to a different area, be proactive in finding new doctors and specialists who are part of your insurance plan's network. This will help you maintain access to the care you need.

- Understand the appeal process: In case your insurance company denies coverage for a visit to your doctor, know that you have the right to appeal the decision and have it reviewed by an independent third party. Understanding the appeals process will help you navigate any disputes that may arise.

Navigating Home Insurance Adjustments: A Guide to Making the Right Changes

You may want to see also