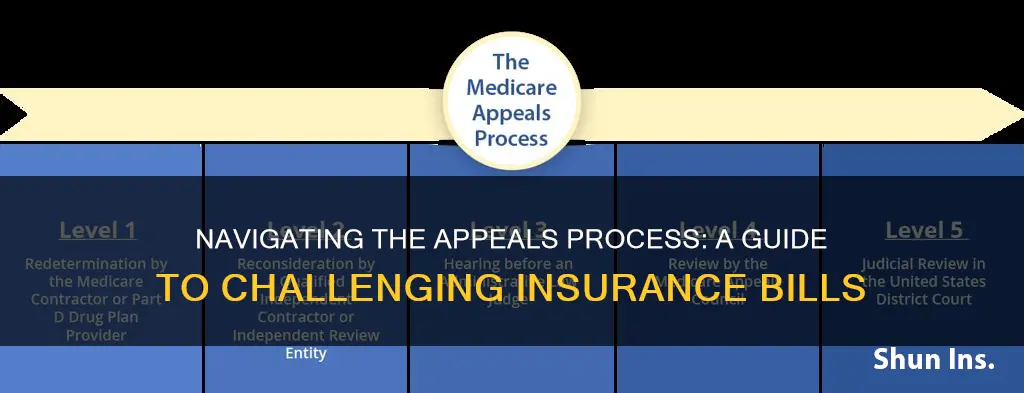

If your insurance company refuses to pay a claim or ends your coverage, you have the right to appeal the decision. There are two types of appeals: internal and external. The internal appeal involves requesting a review from your insurance company, while the external appeal involves seeking an independent third-party review. It is important to understand the specific procedures and deadlines for each type of appeal. During the appeals process, you may be faced with outstanding bills. In such cases, you can delay paying them until the outcome of your appeal is known, or set up a payment plan to avoid having the bill sent to collections.

What You'll Learn

Understanding the grounds for appeal

Appealing an insurer's decision can be overwhelming and confusing. However, it is important to know that you have the right to appeal a health plan decision and have it reviewed by a third party. There are two ways to appeal a health plan decision: internal appeal and external review.

Internal Appeal

If your claim is denied or your health insurance coverage is canceled, you have the right to an internal appeal. You may request that your insurance company conduct a full and fair review of its decision. The internal appeal process typically involves completing and submitting forms, providing additional information, and adhering to deadlines.

Common reasons for internal appeals include:

- The benefit is not offered under your health plan.

- The medical problem is pre-existing.

- The requested service or treatment is deemed "not medically necessary".

- The requested service or treatment is "experimental" or "investigative".

- You are no longer enrolled or eligible for the health plan.

External Review

If you are unsatisfied with the outcome of the internal appeal, you can proceed with an external review. This involves taking your appeal to an independent third party, typically an independent physician or organization, for a final and binding decision. The external reviewer will either agree with the insurer's decision or overturn it, which the insurer is legally required to abide by.

To initiate an external review, you must submit a written request to the insurance company within the specified timeframe, usually a few months after receiving the internal appeal decision.

The Nuance of "Bi" in Insurance: Unraveling a Multifaceted Acronym

You may want to see also

Knowing the appeal process

Step 1: Understand the Reasons for Denial

Before initiating an appeal, it's crucial to understand why your claim was denied. Review the denial letter from your insurance provider, which should outline the specific reasons for the denial. Common reasons for claim denials include missing or incomplete information, services not covered by your plan, treatments deemed medically unnecessary, or reaching the maximum coverage limit. Understanding the reason for the denial will help you formulate your appeal strategy.

Step 2: Contact Your Insurance Provider

Reach out to your insurance company to gather more details about the denial and explore your appeal options. Each insurance provider has its own specific appeals process, so it's important to understand their requirements. Ask about the necessary forms, deadlines, and any other pertinent information. Your insurance agent can guide you through their unique process.

Step 3: Communicate with Your Doctor's Office

In some cases, claims may be denied due to errors or omissions in the claim form submitted by your healthcare provider. Contact your doctor's office to discuss the denial and request their assistance. They can resubmit the claim with any necessary corrections or provide additional supporting documentation. Additionally, inform them about your intention to appeal, and request that they delay sending you bills or refrain from forwarding your account to a collection agency during the appeal process.

Step 4: Gather Relevant Paperwork

Collect all the paperwork related to your claim, the services provided, and the denial. This includes the claim denial letter, original bills, and any relevant phone call notes. Additionally, gather supporting documents, such as medical records or letters from your doctor, to strengthen your appeal. Your policy documents, including the Evidence of Coverage or Summary of Benefits, are also essential to refer to during this process.

Step 5: Initiate the Internal Appeal Process

You have the right to request an internal appeal directly from your insurance company, asking them to reconsider their decision. This typically involves completing the required forms and writing an appeal letter. In your letter, explain the service that was denied and why you believe your claim should be paid, and provide supporting evidence, such as medical records or a detailed explanation of why the service was medically necessary. Remember to remain concise and focused in your letter, expressing your case clearly and directly.

Step 6: Await the Decision

Your insurance provider is required to respond to your internal appeal within a specified timeframe. If you're seeking coverage for a treatment you haven't received yet, they must decide within 30 days. For treatments you've already received, the deadline is typically 60 days. In urgent care cases, they must provide a decision within 72 hours.

Step 7: Proceed with an External Review (If Necessary)

If your internal appeal is unsuccessful, you have the right to escalate the matter to an external review. This involves an independent third party, who is not affiliated with your insurance company, conducting a full review of your case and providing a final decision. Information about your external review options and contact details for the external reviewer can usually be found in your Explanation of Benefits (EOB).

Term Insurance Traps: Understanding the High Lapse Rates

You may want to see also

Filing an internal appeal

If your health insurance claim is denied or your coverage is cancelled, you have the right to file an internal appeal. This involves requesting that your insurance company conduct a full and fair review of its decision. Here are the steps to follow when filing an internal appeal:

Firstly, review your policy and paperwork. Look over the summary of benefits in your insurance documents, as well as any letters or forms sent to you by your insurance plan. Understand the reasons for the denial and identify the steps to initiate the appeal process.

Next, contact your insurance company to clarify any doubts and seek guidance on how to proceed with the appeal. Keep a record of your communication, including the names of the representatives you speak to, the dates, and the outcomes of the conversations.

Then, learn about the specific appeal process outlined by your insurance plan. Check your plan's website or contact their customer service team to obtain detailed instructions on how to file an appeal and complete the necessary forms. Be sure to inquire about any deadlines for submitting your appeal.

Now, it's time to gather the required documentation. Complete all the forms mandated by your health insurer, ensuring you include essential details such as your name, claim number, and health insurance ID number. Additionally, compile any supporting documentation, such as letters from your doctor or other relevant information that you want the insurer to consider.

Once you have all the necessary documentation, submit your internal appeal within the stipulated timeframe. In most cases, you must file your appeal within 180 days (6 months) of receiving the denial notice. You can submit your appeal by mail or through your insurance company's website, following their specified guidelines.

Remember to keep copies of all the forms, letters, and supporting documents you send as part of your internal appeal. It is recommended to send your correspondence via certified mail to ensure delivery confirmation and maintain a record of your interactions with the insurance company.

The internal appeal process typically has defined timelines for completion, depending on whether the appeal is for a service you have already received or one that you have not yet received. Your insurance company is required to provide you with a written decision regarding your internal appeal, after which you can proceed with further steps if necessary, such as requesting an external review.

Understanding Insurance Events: Unraveling the Meaning and Its Impact

You may want to see also

Filing an external appeal

If your health insurance claim is denied or your health insurance coverage is cancelled, you have the right to file an external appeal. This is when you take your appeal to an independent third party for review. This means that the insurance company no longer gets the final say over whether to pay a claim.

How to File an External Appeal

There are two steps in the external review process:

- You file a written request for an external review within four months of receiving a notice or final determination from your insurer that your claim has been denied.

- An external reviewer issues a final decision: the reviewer either upholds your insurer's decision or decides in your favour. Your insurer is required by law to accept the external reviewer's decision.

Types of Denials That Can Go to External Review

- Any denial that involves medical judgment where you or your provider may disagree with the health insurance plan.

- Any denial that involves a determination that a treatment is experimental or investigational.

- Cancellation of coverage based on your insurer's claim that you gave false or incomplete information when you applied for coverage.

Your Rights in an External Review

Insurance companies in all states must offer an external review process that meets federal consumer protection standards. If your state doesn't have an external review process that meets the minimum consumer protection standards, the federal government's Department of Health and Human Services (HHS) will oversee an external review process for health insurance companies in your state.

How to Request an External Appeal

Visit externalappeal.cms.gov. You’ll be able to file a request using a secure website. For claimants who are able to do so, the portal is the preferred method of submission for review requests.

You can also call toll-free: 1-888-866-6205 to request an external review request form. Then fax an external review request to: 1-888-866-6190.

Alternatively, mail an external review request form to:

MAXIMUS Federal Services

3750 Monroe Avenue, Suite 705

Pittsford, NY 14534

Or submit a request via email: is [email protected]

You may appoint a representative (like your doctor or another medical professional) who knows about your medical condition to file an external review on your behalf. An authorized representative form is available at: externalappeal.cms.gov

If your health insurance company is using the HHS-Administered Federal External Review Process, there’s no charge. If your issuer has contracted with an independent review organization, or is using a state external review process, you may be charged. If so, the charge can’t be more than $25 per external review.

Understanding Your Cigna Insurance Bill: A Breakdown of Charges and Coverage

You may want to see also

Negotiating bills during the appeal process

Understand Your Rights and the Appeal Process:

Before initiating any negotiations, it is crucial to understand your rights as a patient or policyholder. Familiarize yourself with the internal and external appeal processes offered by your insurance company. Know that you have the right to request a review or reconsideration of the decision. Additionally, your health plan cannot drop your coverage or raise your rates due to your appeal.

Review Your Policy and Paperwork:

Thoroughly examine your insurance policy documents, including the summary of benefits. Understand what is covered, as well as any limitations or exclusions. Read the letter or form sent by your insurance company explaining the denial of your claim. This correspondence should outline the reasons for the denial and provide instructions on how to initiate the appeal process.

Identify Negotiation Points:

Analyze your medical bills for any errors or discrepancies. Compare the billed items with the services you actually received. Look for duplicate charges, services that were not provided, or charges that should be covered by your insurance. Even small errors can add up, so it's important to scrutinize every detail.

Communicate with Your Medical Provider:

Contact your medical provider's billing office to discuss the outstanding bills. Express your intention to appeal the denial and work collaboratively to find a solution. Ask them to delay sending the bill to collections until the appeal process is complete. They may be willing to negotiate a payment plan or a reduced fee, especially if you demonstrate financial hardship.

Gather Supporting Documentation:

Collect all the necessary documentation to support your case, including medical bills, insurance policy documents, and relevant medical records. Keep a record of all communication, including phone calls, emails, and letters, with your medical provider and insurance company. This paper trail can strengthen your position during negotiations.

Prepare a Strong Appeal:

Write a concise and polite appeal letter, clearly stating why you believe the medical bill is incorrect or unreasonable. Provide specific details about the errors or discrepancies you have identified, and include any relevant facts or evidence to support your claims. Attach supporting documentation, such as medical records, bills, or other relevant paperwork.

Consider Seeking Professional Help:

If you find the appeal process overwhelming or complex, consider consulting a medical billing advocate. These professionals specialize in helping individuals resolve medical billing issues and can guide you through the process. They can provide expert advice, negotiate on your behalf, and potentially reduce your financial burden.

Be Persistent and Follow Up:

Stay engaged and actively follow up on your appeal. Contact your insurance company or medical provider to inquire about the status and keep the lines of communication open. Be persistent in seeking clarification and escalating concerns if necessary. Remember, you have the right to understand the status of your appeal and receive updates.

Explore Other Options:

If negotiations with your medical provider are unsuccessful, consider applying for Medicaid if you are eligible. Medicaid provides free or low-cost medical coverage for individuals with low incomes, older adults, pregnant people, and individuals with disabilities. You can also reach out to patient advocacy groups, as they often have financial assistance resources to help individuals facing financial burdens.

Remember, each situation is unique, so assess your options and decide on the best course of action for your specific circumstances.

Securing Short-Term Rental Insurance: Navigating the Path to Comprehensive Coverage

You may want to see also

Frequently asked questions

The process of appealing an insurance bill can be broken down into two categories: internal appeals and external appeals. An internal appeal involves requesting a full and fair review of the insurance company's decision. This can be done by completing the required forms or writing a letter to the insurer. The internal appeal must be filed within 180 days of receiving the denial and must be completed within 30 days if the appeal is for a service that hasn't been received yet, or 60 days if the service has already been received. If the internal appeal is unsuccessful, you can proceed to an external appeal.

There are several common reasons why insurance companies deny claims, including:

- The benefit is not offered under the health plan (e.g. cosmetic surgery, weight loss surgery, or chiropractic care).

- The medical problem is pre-existing.

- The service or treatment is deemed "not medically necessary".

- The requested service or treatment is "experimental" or "investigative".

- You are no longer enrolled or eligible for the health plan.

When filing an appeal, it is important to include the following information:

- Your name, address, and insurance ID number.

- The claim number and a description of the specific items or services being disputed.

- The dates of service and any relevant documentation, such as letters from your doctor.

- A detailed explanation of why you believe the items or services should be covered.

- Any other information that may support your case.

If you have outstanding bills during the appeals process, you can try to negotiate with your medical provider's office to delay payment or set up a payment plan until the outcome of your appeal is known. Alternatively, you can pay the bill and seek reimbursement from your health plan if your appeal is successful.