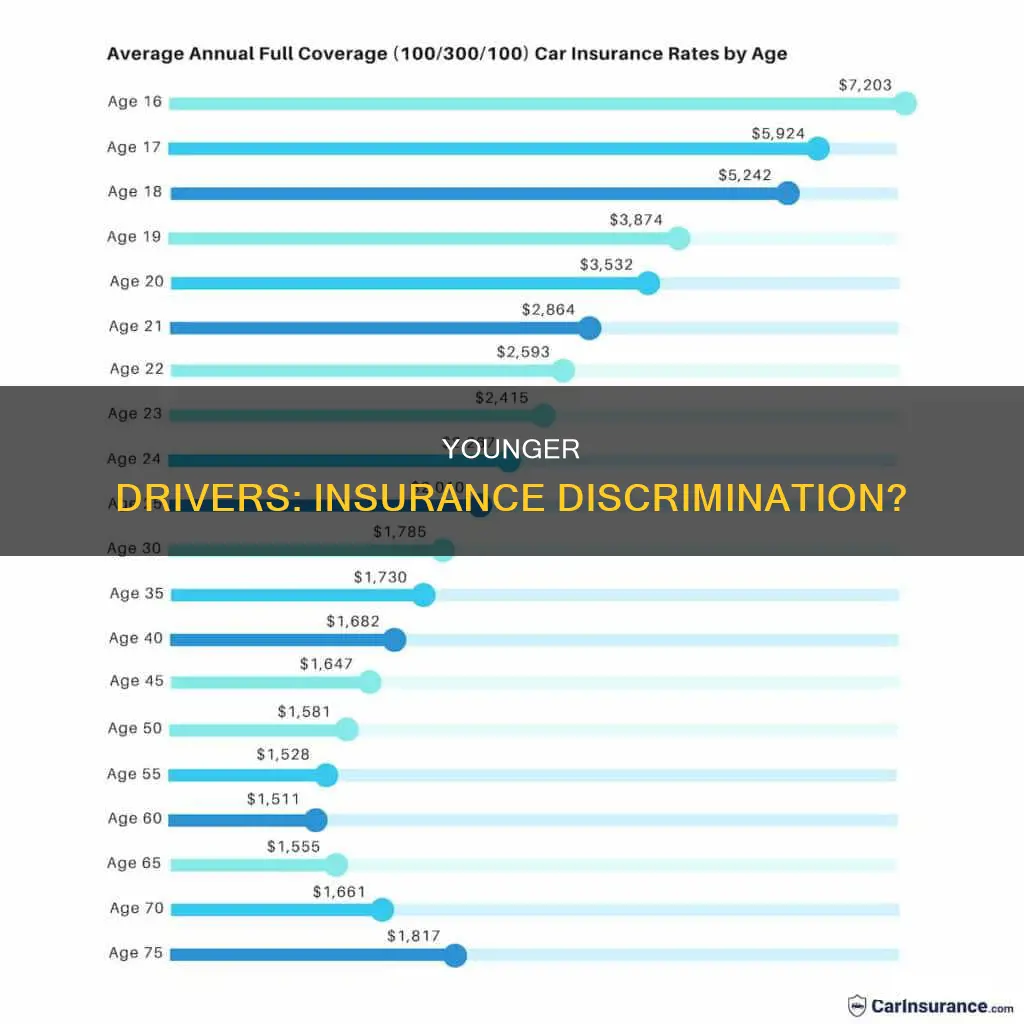

Should insurance be charged more for people under 25? This is a question that has been asked by many young people, and the answer is not always clear-cut. Several factors come into play when determining insurance rates for individuals, and age is a significant factor. Younger individuals, especially those under 25, are often considered higher-risk by insurance companies due to their lack of experience and higher likelihood of reckless and distracted driving. As a result, insurance rates for this age group tend to be higher. However, it's important to note that rates can vary depending on other factors such as gender, driving record, and the type of vehicle driven. While insurance for under-25s may be more expensive, there are ways to mitigate these costs, such as taking a defensive driving course, maintaining good grades, and choosing a safe and practical vehicle. Understanding these factors can help young people make more informed decisions about their insurance options.

| Characteristics | Values |

|---|---|

| Insurance Type | Car insurance, health insurance, life insurance |

| Insured Age | Under 25 |

| Insurance Cost | More expensive for under 25s |

| Reasons for Higher Cost | Lack of driving experience, higher risk of accidents, reckless driving, distracted driving, lower credit scores, pose a financial risk to insurance companies |

| Insurance Discounts | Good student discounts, multi-policy discounts, driving school discounts, multi-car discounts, higher deductibles |

What You'll Learn

Young drivers are more likely to be in accidents

Young drivers are more likely to be involved in accidents, and this is a key factor in insurance companies charging higher premiums for those under 25.

According to data from the National Highway Traffic Safety Administration, the rate of car accidents per mile driven is disproportionately high among young drivers, especially those under 20. This is due to a number of factors, including a lack of driving experience, and a higher tendency to engage in reckless and distracted driving.

Young drivers are less likely to safely navigate difficult driving conditions or react as effectively to unexpected hazards compared to more experienced drivers. They are also more likely to panic or overcorrect when facing an unusual circumstance on the road, increasing their risk of accidents and, consequently, insurance claims.

Distracted driving is a significant issue among young drivers, with cellphone use, eating, and multitasking while driving being common causes of accidents. According to the CDC, distracted driving is responsible for 9% of all fatal accidents involving young drivers aged 15 to 20.

As a result of these factors, insurance companies view young drivers as high-risk and charge them higher premiums to compensate for the increased likelihood of claims.

Hardship: Insurance's Fine Print

You may want to see also

Young drivers have an unproven record

Young drivers are more likely to be in accidents. In 2019, over 5,600 young people under the age of 25 died in car accidents, compared to 4,958 drivers between the ages of 45 and 54. Insurance companies consider statistics like these and decide annual rates accordingly. Accidents will raise car insurance rates at any age, but young drivers will see the highest increases. Young drivers can get cheaper auto insurance quotes by taking a defensive driving course and keeping a clean record.

Young drivers are also more likely to be reckless behind the wheel, causing them to be in more accidents and file more claims. The good news is that this risky behaviour is reduced as teens get older. As young drivers enter their twenties, they are less likely to engage in risk-taking behaviour, whether behind the wheel or not. Accordingly, insurance companies will lower rates as drivers age and maintain a clean driving record that shows they are less likely to have an accident.

Young drivers also have lower credit scores. They are less likely to open a line of credit, especially if they continue to live at home or are enrolled as full-time students. Drivers with low credit scores are considered more likely to file a claim, and insurance companies consider drivers with no credit to be just as high-risk as drivers with poor credit. Fortunately, some states are starting to make it illegal to use credit scores to determine insurance rates.

Term Insurance: Understanding the Wait for Coverage

You may want to see also

Young drivers are more likely to be distracted

Distracted driving is any activity that diverts attention from driving. This includes talking or texting on the phone, eating and drinking, talking to people in the vehicle, and fiddling with the stereo or navigation system. Texting is the most alarming distraction, as sending or reading a text takes a driver's eyes off the road for 5 seconds. At 55 mph, that's like driving the length of an entire football field with your eyes closed.

The widespread use of mobile devices among adolescents and young adults means that these devices are likely to be present in most teens' cars. Their novice driver status may also make them more susceptible to the distracting effects of mobile devices and in-vehicle technology.

Having peer passengers in the car is a well-known risk factor for serious crashes. Peers may serve as a source of distraction and negatively influence teens' decision-making when driving. In addition, teens are more likely to text, send emails, and talk on the phone while driving. According to the CDC, distracted driving is responsible for 9% of all fatal accidents involving young drivers between the ages of 15 and 20.

The influence of parents and families also plays a significant role in teen driving safety. Parenting practices that ensure the health and safety of their children are vital to raising responsible and safe drivers. Adolescents who experience involved parenting are less likely to engage in risky driving behaviors. However, if parents model unsafe driving behaviors, such as using their cell phones while driving, their children are likely to replicate these behaviors.

To address the issue of distracted driving among young drivers, legislative interventions such as Graduated Licensing Systems and restrictions on cell phone use have been introduced. While these interventions are essential, there is also a need for behavior change programs that target adolescents, parents, and friends. School-based programs, simulations, and web-delivered programs have been evaluated, but more controlled implementation and evaluation studies are needed. Technological interventions to manage phone use, such as features that lock a teen's phone while driving, may also be promising.

Lowering Car Insurance Rates: Mileage Adjustment

You may want to see also

Young drivers are more likely to be reckless

The recklessness of young drivers can be attributed to their lack of driving experience and immature judgement. Inexperience means that young drivers are less likely to safely navigate difficult driving conditions or react effectively to unexpected hazards. They are also more likely to panic or overcorrect when facing unusual circumstances on the road, increasing their risk of accidents.

Distracted driving is another major factor contributing to the recklessness of young drivers. According to the CDC, distracted driving is responsible for 9% of all fatal accidents involving young drivers aged 15 to 20. This includes texting, sending emails, talking on the phone, eating, and putting on makeup while driving.

While young drivers may be more likely to engage in reckless behaviour, the good news is that this tendency decreases as they enter their twenties and gain more driving experience. Insurance companies recognize this and will lower rates for drivers who maintain a clean driving record as they age.

Uninsured Globally: A Large Number Unprotected

You may want to see also

Young drivers have lower credit scores

Young drivers, particularly those under 25, are often charged more for auto insurance due to their lack of driving experience and the increased risk of accidents. One factor that contributes to higher insurance rates for this age group is their lower credit scores.

Young adults, especially those between the ages of 18 and 29, tend to have lower credit scores compared to older individuals. The average credit score for young people in this age bracket is 659, which is significantly lower than the overall average of 704. This can be attributed to several factors:

Difficulty in Getting Approved for a Credit Card

Young people may struggle to get approved for a credit card due to their limited credit history and income, hindering their ability to build a strong credit score.

Shorter Credit Histories

Credit scoring systems favour individuals with longer credit histories. Young drivers have shorter credit histories, which can negatively impact their overall credit score.

Higher Delinquency Rates

Young adults are more likely to make late payments, which significantly impacts their credit score. Delinquency rates on credit card payments are higher among those under 30 compared to other age groups.

Lower Credit Limits

Credit card companies often offer lower credit limits to young adults due to their limited income or credit history. This makes it challenging to maintain a low credit utilisation rate, which is a critical factor in determining credit scores.

Impact of Minority Status

Research by the Urban Institute revealed that young adults in majority Black and Hispanic communities have lower credit scores than those in majority white communities. This is attributed to historical discriminatory policies that have denied communities of colour equal access to financial services and wealth-building opportunities.

While young drivers may face challenges due to their lower credit scores, there are strategies to improve their financial situation. Young adults can consider becoming authorised users on a family member's credit card or having a relative co-sign for a credit card or loan. Building a strong credit history and making timely payments can help improve their credit scores over time. Additionally, young drivers can benefit from taking defensive driving courses, maintaining good grades, and choosing safer vehicles to reduce their insurance costs.

The Elusive Hour: Unraveling Insurance's Unique Billing Unit

You may want to see also

Frequently asked questions

Insurance companies consider young, less experienced drivers to be high-risk. This is because younger drivers are more likely to be involved in accidents and make claims.

Yes, there are a few strategies to reduce insurance costs for younger people. These include adding a young driver to a parent's existing policy, taking a defensive driving course, maintaining good grades, and choosing a safe, older vehicle.

Generally, insurance rates decrease as individuals age and gain more driving experience. However, this decrease may not be immediate and can depend on various factors, such as driving record and location.

Term life insurance is typically more affordable for younger individuals as it covers a specific set of events over a defined period and does not accumulate cash value. Permanent life insurance, on the other hand, tends to be more expensive.