The concept of billable hours is prevalent in certain industries, such as law, consulting, and freelancing. Billable hours refer to the time spent working on tasks directly related to a client's project, which can then be charged to the client at an agreed-upon hourly rate. These hours typically include activities such as project-related meetings, research, planning, and completing or revising work as requested by the client. However, it is important to distinguish billable hours from non-billable hours, which encompass tasks unrelated to the client's project, such as administrative work or pitching services to new clients.

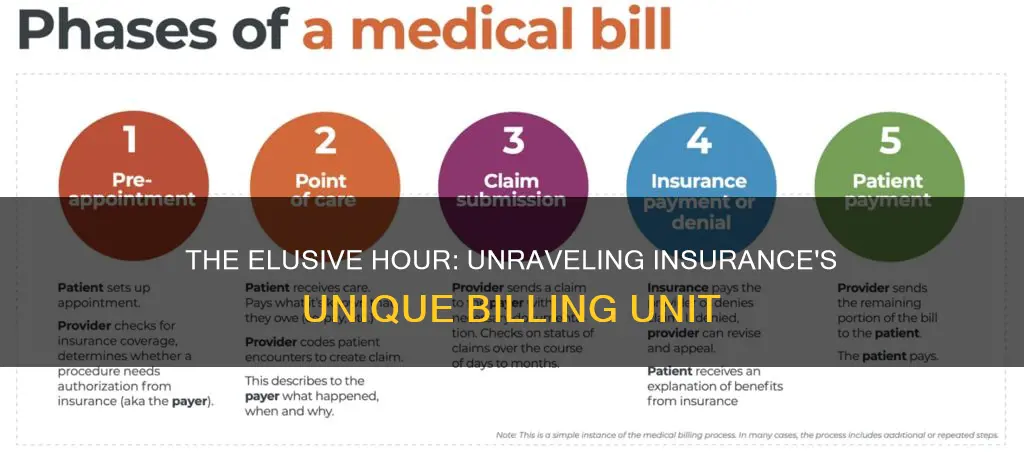

In the context of insurance, billing practices can vary depending on the specific insurance company and the type of coverage provided. For example, insurance companies may have different policies regarding preventive visits, immunizations, or elective services. Additionally, the time taken to process and pay insurance claims can vary, and there have been concerns raised about delayed payments from insurers to healthcare providers.

What You'll Learn

Deductibles, co-pays and co-insurance

When it comes to health insurance, there are a few key terms that are important to understand: deductibles, co-pays, and co-insurance. These terms all refer to the portion of medical costs that the insured person is responsible for paying out-of-pocket.

Deductibles

A deductible is a fixed amount that you must pay each year before your insurance company begins to cover the costs of your medical treatment. For example, if you have a $2,000 deductible, you will need to pay the first $2,000 of your medical expenses yourself before your insurance plan kicks in and starts contributing to your treatment costs. Deductibles help insurance companies guard against unnecessary claims and reduce premium payments.

Co-pays

A co-pay, or co-payment, is a set fee that you pay each time you visit your doctor, fill a prescription, or receive another type of medical service. The amount of the co-pay is usually printed on your health plan ID card, and it varies depending on the type of service you receive. For example, you might have a $20 co-pay for a standard doctor's visit, a $50 co-pay for a specialist, and a $10 co-pay for generic drugs. Co-pays are typically charged after you have met your deductible, but in some cases, they are applied immediately.

Co-insurance

Co-insurance is the percentage of covered medical expenses that you pay after you've met your deductible. For example, if you have an 80/20 plan, your insurance company will pay 80% of the costs, and you will pay 20%. The amount you pay in co-insurance is in addition to any deductibles or co-pays you may owe. Like co-pays, co-insurance usually doesn't apply to preventive services, which are typically covered at 100%.

It's important to understand the differences between deductibles, co-pays, and co-insurance when choosing a health insurance plan. Plans with lower monthly premiums typically have higher deductibles, co-pays, and co-insurance, while plans with higher monthly premiums have lower out-of-pocket costs. When selecting a plan, consider your expected medical needs and choose the option that makes the most financial sense for your situation.

Haven Insurance: Understanding the Fine Print

You may want to see also

Clean claims

- Identifies the health professional or facility that provided the service, including any identifying numbers

- Sufficiently identifies the patient and health plan subscriber

- Lists the date and place of service

- Is for covered services for an eligible individual

- If necessary, substantiates the medical necessity and appropriateness of the care or service provided

- If prior authorization is required for certain patient care or services, includes information sufficient to establish that prior authorization was obtained

- Identifies the service rendered using a generally accepted system of procedure or service coding

- Includes additional documentation based upon services rendered as reasonably required by the health plan

Demystifying Insurance Billing: A Step-by-Step Guide to Navigating the Claims Process

You may want to see also

In-network and out-of-network providers

In-network and out-of-network refer to a health care provider's relationship with your insurance company and the impact this has on the cost to you for their services.

An in-network provider has a contract with your insurance company to provide health care services to its plan members at a pre-negotiated rate. This means that you will pay a lower cost when you receive services from an in-network provider.

An out-of-network provider does not have a contract with your insurance company. This means that the provider has not agreed to a pre-negotiated rate and can charge you the full price for their services. This is usually much higher than the in-network discounted rate and can result in unexpected medical bills.

It is important to understand the difference between in-network and out-of-network providers to help lower your health care expenses and avoid paying full price for services. You can check whether a provider is in-network by searching on your insurance company's website or by calling the provider directly.

Understanding VA Healthcare and Insurance Billing: A Guide for Veterans

You may want to see also

Pre-authorisation

The pre-authorisation process can be time-consuming and frustrating for both doctors and patients. Doctors must fill out a lot of paperwork, make phone calls, and send faxes to get permission to use certain medications or treatments. Patients may wait days, weeks, or even months for a necessary test or medical procedure to be scheduled because physicians need to first obtain similar authorisation from an insurer.

To obtain pre-authorisation, patients should work closely with their doctor or the contact at their doctor's office to ensure they have all the necessary information. It is also important to identify who at the doctor's office handles pre-authorisations and to have a good relationship with this representative, as this may help create a smoother process for getting the request approved. Patients should also be aware that pre-authorisations are only valid for a specific amount of time and may require periodic renewal.

Billable hours

For example, a freelance web designer building a website for a client may conduct payment via billable hours. In this case, the web designer will submit an invoice to the client detailing the project-related tasks completed and the number of hours spent on them. The billable hours may include tasks related to planning and writing the website's code or designing its appearance.

It is important to note that billable hours only refer to project-related tasks. Excluded from billable hours are tasks such as administrative work, pitching services to new clients, and conducting meetings or calls unrelated to the project.

To record billable hours effectively, it is recommended to set an hourly rate, schedule invoices and payments, log the hours worked on each project separately, add up the billable hours, and create an invoice for the client.

Additionally, to increase billable hours ethically, individuals can track every billable task, use real-time tracking, be mindful of non-billable time, and utilize automation tools for administrative tasks.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

Frequently asked questions

Billable hours refer to the hours worked by an individual that they can charge to a client. The work conducted during those hours must be on behalf of the client and cannot include any hours spent doing non-project-related tasks. Typically, the individual agrees on an hourly rate with the client before starting the project.

Any tasks completed on behalf of the client count toward billable hours. These may include attending project-related meetings, completing and reviewing work, conducting project-related research, setting project plans, responding to project-related emails or phone calls, and revising submitted work when requested by the client.

Exclude any time spent conducting work unrelated to the client's project from billable hours. Non-billable hours include tasks or activities done for yourself or your business, such as attending non-project-related meetings, conducting administrative tasks, responding to non-project-related phone calls or emails, pitching your services to new clients, and creating proposals for new or potential clients.