Attracting people to buy insurance is a challenging task, especially with the rise of digital platforms and an increasingly competitive market. Here are some strategies to help attract potential customers:

- Online Presence: Building an online presence through a well-designed website and active social media profiles is crucial. Most people now use online platforms to research and purchase insurance, so having a strong digital presence is essential for reaching potential customers.

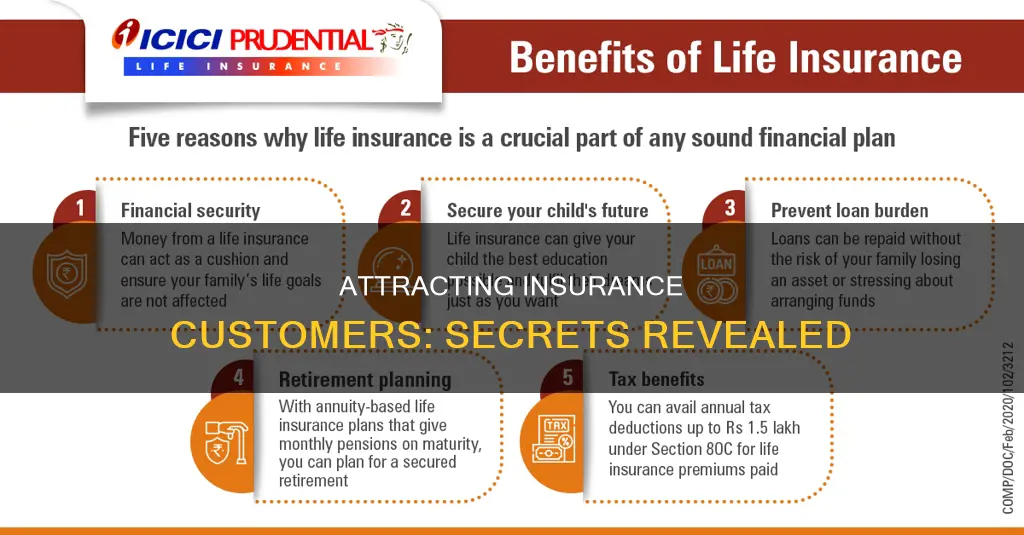

- Informational Approach: Instead of a hard sales pitch, focus on providing valuable information and educating your audience about insurance issues and topics they need to know. This establishes your expertise and builds trust.

- Niche Marketing: Concentrating your marketing efforts on a specific business class or demographic can help you develop deep knowledge about their risks and establish yourself as an expert in that field. This strategy can give you a competitive advantage and increase your standing in the industry.

- Networking and Community Involvement: Attend events and meetings outside the insurance industry to meet potential customers and build connections. Getting involved in the community strengthens your reputation and makes your business the go-to choice for insurance-related needs.

- Referrals and Partnerships: Building relationships with other professionals and creating referral programs can lead to valuable partnerships. This strategy can help expand your reach and gain new customers.

- Discount Offers and Loyalty Programs: Highlight any discount offers or loyalty programs you have in place. Millennials, in particular, tend to favour brands that offer discounts and rewards.

- Understanding Customer Needs: Take the time to understand your customer's unique needs and circumstances. This shows that you care about their specific situation and helps build trust.

- Personality and Communication: While physical appearance matters, it's more important to speak your customer's language and build a connection. Be enthusiastic, friendly, and relatable, and don't be afraid to embrace your youth.

- Targeted Marketing: Identify your target audience and create marketing messages that speak directly to their needs and interests. For example, if your target market includes millennials, focus on digital communication and social media presence.

- Availability and Accessibility: Ensure your business is easily accessible to customers. Consider extended hours or employing a call centre to answer queries outside of regular business hours.

- Highlighting Your Company's Story: Share your company's story, mission, and values through your online content. This helps potential customers connect with your brand and builds trust.

These strategies can help you attract people to your insurance business and establish long-lasting customer relationships.

What You'll Learn

Offer discounts and loyalty schemes

Offering discounts and loyalty schemes is a great way to attract new customers and retain existing ones. Here are some strategies to consider when it comes to offering discounts and loyalty schemes in the insurance industry:

Incentivize Loyalty

Rewarding loyal customers can be an effective way to show your appreciation and encourage them to continue doing business with you. Incentives can come in various forms, such as discounts, better coverage, or loyalty programs. For example, some insurance providers offer discounts of up to 10% for customers who constantly renew their policies early. Additionally, you can offer forgiveness benefits for minor claims by not raising rates or increasing rewards for customers with longer tenures. These incentives can reduce customers' motivation to shop around and assure them that their loyalty is valued.

Personalize Quotes and Policies

Personalization is key to retaining customers and keeping them loyal. By collecting and analyzing customer data, you can provide customized quotes and policies that meet their unique needs. This could include using telematics devices, smartphone sensors, or smart home devices to gather information on driving behavior, daily activities, property conditions, and more. With this data, you can predict accidents, health issues, and offer timely notifications or lifestyle recommendations. Customers who follow the rules and maintain a healthy lifestyle can be rewarded with lower premiums.

Implement Digital Tools and Platforms

The insurance industry is rapidly digitizing, and using digital tools can significantly improve customer communication, education, and service. Digital platforms allow for more frequent interactions with clients, data collection, and personalized services. For example, chatbots and speech analytics tools can assist call center representatives in providing timely and accurate information to customers. Additionally, digital tools can make it easier for insurance agents to answer customer questions and build relationships.

Proactive Retention

While acquiring new customers is essential, focusing on retaining existing customers is also crucial. Proactive retention strategies aim to boost customer loyalty before they consider looking elsewhere. This can include gathering customer feedback, addressing their pricing concerns, and implementing formal or informal retention and loyalty programs. By showing your commitment to meeting their needs and providing value, you can strengthen customer loyalty.

Partner with Non-Insurance Services

Consider partnering with non-insurance services that relate to your customers' property and casualty needs. Customers view these ecosystems as partnerships that help them achieve a higher quality of life. Leveraging these partnerships effectively can also build loyalty between insurance customers and your company. By offering a range of services beyond insurance, you provide added value and convenience to your customers.

Navigating the Billing Process for L&I Self-Insured Claims

You may want to see also

Be available outside of typical working hours

Being available outside of typical working hours is a great way to attract clients and stand out from the competition. Here are some tips to make the most of non-traditional work hours:

Identify your target market

First, identify your target demographic. If you're available during the daytime, your target market may be seniors. In this case, consider specializing in products like Medicare or final expense life insurance. On the other hand, if you're free during evenings and weekends, your target demographic is likely working adults who don't have time to discuss insurance options during regular business hours. In this case, being available after hours gives you a competitive advantage.

Create a schedule and stick to it

Consistency is key. Commit to a set schedule and production goals each week to ensure you're putting in the necessary work to generate leads and meet clients. Working evenings and weekends might not be ideal, but the payoff can be significant. Remember, this is your time to shine and establish yourself as a part-time agent.

Manage client expectations

Whether you work part-time or full-time, excellent client service is essential. Set clear expectations with your clients from the beginning, and let them know the best times to reach you. Return their calls promptly, and make an effort to be available whenever possible. Going the extra mile to communicate and provide quality service will make a lasting impression.

Utilize digital marketing

To reach potential clients outside of typical working hours, leverage digital marketing strategies. Optimize your website for search engines by incorporating relevant keywords, ensuring easy navigation, and making it mobile-friendly. Establish yourself as an authority in the industry by creating valuable content and building a strong social media presence. This way, when potential clients search for insurance options during non-traditional hours, your name will be at the top of their list.

Embrace flexibility

Selling insurance part-time requires a flexible work environment. Consider adopting flexible work hours, reduced mandated hours, and telecommuting opportunities to accommodate the needs of your clients and yourself. Remember, it's about finding a balance that works for you and your clients.

By implementing these strategies, you can successfully attract clients and build a thriving part-time insurance business, all while maintaining the flexibility to work outside of typical working hours.

Insurable Hours: What Counts?

You may want to see also

Create an online presence

In today's world, having an online presence is crucial for any business, including insurance agencies. Here are some strategies to establish and enhance your online presence:

Website and Social Media:

Create a well-designed website that serves as a central hub for your business. Include essential information such as what your business does, contact details, business hours, and your credentials. A website is often the first touchpoint for potential customers, so ensure it leaves a positive impression.

Build a strong social media presence on platforms such as Facebook, Instagram, YouTube, and LinkedIn. These platforms are widely used by insurance shoppers, and your presence will help you connect with your target audience. Share informative content that educates your audience about insurance topics and establishes your expertise.

Content Creation:

Focus on creating valuable content that addresses the needs and pain points of your target audience. This can include blog posts, articles, videos, and social media posts. For example, you can write about life insurance, annuities, health insurance, and other relevant topics. Share personal stories and experiences related to insurance to build a connection with your audience.

Engage with your audience by asking questions and encouraging feedback. Respond to their queries and concerns, and provide solutions to their problems. This will help build trust and establish your credibility.

Search Engine Optimization (SEO):

Implement SEO strategies to improve your website's visibility on search engines. Use keywords and phrases that your target audience is likely to search for when looking for insurance-related information. This will help your website rank higher in search results, making it easier for potential customers to find you.

Email Marketing:

Build an email list and send regular newsletters or emails with valuable information. Include risk management strategies, industry updates, and helpful tips. This will keep your audience engaged and increase the chances of converting leads into customers.

Online Reviews:

Encourage your customers to leave reviews on your website and social media pages. Positive reviews and testimonials can significantly impact potential customers' purchasing decisions and help build trust in your brand.

Partnerships and Collaborations:

Collaborate with influencers or industry experts to cross-promote each other. This can include guest blogging, social media takeovers, or joint webinars. By partnering with respected figures in the industry, you can expand your reach and enhance your credibility.

Remember, your online presence should be engaging, informative, and customer-centric. Focus on building relationships and providing value, rather than solely promoting your products. By implementing these strategies, you'll be able to attract and retain a wider audience, ultimately increasing your insurance sales.

The Mystery of IDD Insurance Charges on Your Bill: Unraveling the Acronym

You may want to see also

Provide learning and development opportunities

Providing learning and development opportunities is a powerful way to attract talent to the insurance industry, especially millennials who are poised to become the majority in the workforce. Here are some ways to create an enticing learning and development program:

Evaluate Needs and Personalize Training:

Start by assessing the skills gap within your organization and the interests of your employees. Create a personalized training program that meets the unique needs of your workforce. Sam's Club, for instance, offers a Manager in Training program to prepare high-potential team leads for managerial roles. They also have a Career Futuring program for associates interested in career exploration and lifelong learning.

Offer Management and Leadership Training:

According to a PayScale survey, 32% of respondents prioritized management and leadership training. This can include online courses, webinars, or internal workshops facilitated by high-level managers. Developing confident leaders can have a positive impact on employee engagement and retention across your organization.

Provide Professional Certifications:

Certifications are a great middle ground, requiring less commitment than degrees while still enhancing employees' skills and knowledge. Industries like accounting and finance value these certifications, and they can be appealing to employees taking on new roles or additional responsibilities.

Focus on Technical Skills Training:

Employees in various sectors, including media, publishing, architecture, engineering, IT, and maintenance, are interested in advancing their proficiency in technical areas. Providing technical training can help retain talent in-house instead of outsourcing tasks.

Develop Teamwork and Interpersonal Skills:

Don't underestimate the importance of soft skills like emotional intelligence, communication, and collaboration. These competencies are essential for thriving departments and can be developed through informal exercises and training.

Offer Employer-Subsidized Degrees:

Tuition assistance is a valuable benefit that can lead to higher retention and engagement. A health insurance company, for instance, experienced a 129% ROI through its education reimbursement program due to reduced turnover rates and lower recruitment costs.

By investing in learning and development opportunities, you create an environment that values growth and encourages employees to reach their full potential. This approach will not only attract talent but also enhance retention and the overall success of your organization.

Unraveling the Intricacies of Survival Benefits in Term Insurance: A Comprehensive Guide

You may want to see also

Target millennials

Millennials are the largest living generation today, controlling around $200 billion in annual American spending power. However, only 4% of millennials are interested in a career in insurance. This makes it crucial for insurance companies to employ strategies to attract and retain this demographic. Here are some ways to do that:

Demonstrate a Greater Social Purpose

Millennials value purpose and want to leave a legacy. Insurance companies should use social media to share stories about the crucial work they do worldwide, such as their efforts in addressing cyber-terrorism, hostage-taking, hurricanes, and climate change. This helps showcase how they are making the world a better place and allows millennials to see beyond the day-to-day work of insurance companies.

Build a Strong Employer Brand

Millennials are considered consumers of the workforce, constantly "shopping" for better jobs and researching everything online. Insurance companies need to understand and drive their employer brands to attract and retain the best talent. They should highlight their commitment to diversity and inclusion, as this is a key issue for millennials.

Provide a Flexible Work Environment

Millennials seek work-life balance and flexibility in their work schedules. Insurance companies should consider adopting flexible work hours, reducing mandated work hours, and offering telecommuting opportunities to create a flexible work environment that appeals to millennials.

Embrace Digital Transformation

As digital natives, millennials want to work with companies that have embraced technology to improve efficiencies. Insurance companies should implement digital tools such as social media, video conferencing, and instant messaging, which millennials are comfortable with and feel encourage productivity.

Provide Professional Development Opportunities

Millennials want to see their career path within a company. Insurance companies should highlight potential career paths and provide professional development opportunities, such as conferences or classes, to demonstrate their commitment to employee growth.

Utilize Online Presence and Social Media

Millennials are digital natives, and today's insurance shoppers are using Google, Facebook, Instagram, and YouTube to buy insurance. Insurance companies should establish an online presence through a well-designed website and social media profiles. They should focus on providing valuable content that educates their target audience about insurance issues and topics without being too salesy. This helps establish themselves as authorities in the industry, gain trust, and ultimately increase sales.

Offer Digital Communication

Millennials juggle multiple commitments and expect timely and direct responses. Insurance companies should adapt to their communication preferences by primarily using texting and email. Additionally, make it easy to sign up for insurance by providing interactive digital materials and ensuring a paperless option.

Target Older Millennials

When offering life insurance products, it is important to note that older millennials (aged 25-35) are more likely to be a better target market as they are moving into the "married-mortgage-kids" stage of life. However, younger millennials (aged 17-24) should not be ignored but may be more receptive to educational information and roadmaps.

Focus on Quality of Life

Millennials prioritize quality of life and experiences over material goods. When discussing life insurance products, frame the conversation around how these products can impact their ability to have the experiences and quality of life they desire. Provide clear roadmaps and relevant stories to illustrate how insurance can help them achieve their goals.

MRI Billing: Unraveling the Post-Insurance Costs

You may want to see also

Frequently asked questions

To attract top talent, insurance companies should offer competitive compensation and benefits, provide learning and development opportunities, create a positive culture, leverage technology and data, embrace social responsibility, and challenge and inspire their employees.

Insurance agents should build an online presence, such as a website and social media profiles. They should also focus on providing valuable and informative content rather than being overly promotional. Additionally, networking in the community and prospecting daily are essential for bringing in new clients.

Millennials prioritize ease of accessibility and saving time when shopping for insurance. They also value discounts and loyalty programs. Insurance agents should highlight discount offers and provide a human touch by understanding their needs and speaking their language. Building a strong online presence and targeting their interests through social media are also effective strategies for attracting millennial customers.