Billing insurance can be a complex process, but Aetna provides a range of tools and resources to help healthcare professionals manage claims, payments, and reimbursements. Healthcare professionals in the Aetna network should file claims for their patients, but out-of-network providers may also submit claims. Patients can submit medical claims through Availity, a vendor (which may include fees), or electronic coordination of benefits (COB) claims. Additionally, Aetna provides forms for claims, payments, billing, Medicare, pharmacy, and more.

| Characteristics | Values |

|---|---|

| Claim Submission | Electronically, through Availity, or through a vendor |

| Payment Methods | One-time payment, recurring monthly payments, automatic payments |

| Payment Receipt | Directly to your account |

| Claim Status | Online |

| Precertification | Required for some services |

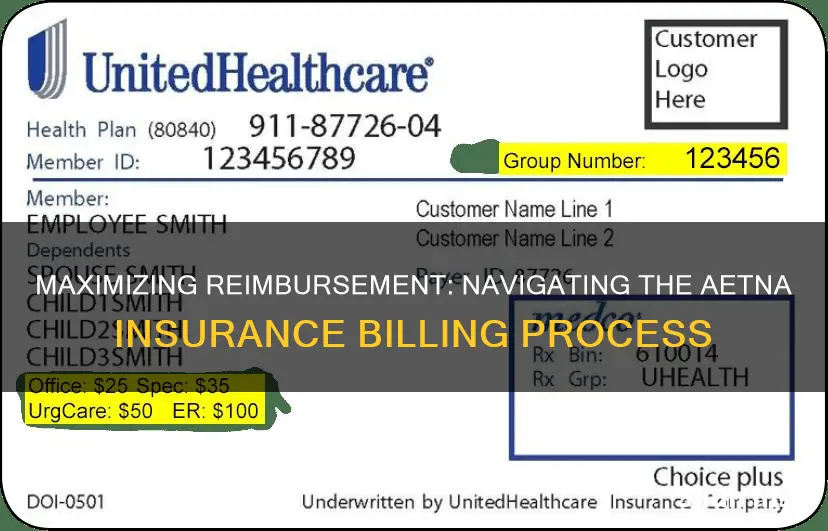

| ID Cards | Digital or physical |

| Overpayments | Simple steps to refunding |

| Coordination of Benefits | Electronic coordination of benefits (COB) when a patient is covered under more than one insurance plan |

| Payment Estimation | Estimate how much patients will owe for an office visit or look up how much Aetna reimburses for services |

| Clinical Policy Bulletins | Available |

| Formulary | Available |

| National Provider Identifier (NPI) | Replaces many numbers you may have previously supplied to payers on electronic claims, certifications, and authorization transactions |

What You'll Learn

Submitting claims electronically

- Submit claims through Availity.

- Submit claims through a vendor (fees may apply).

- Submit electronic coordination of benefits (COB) claims.

The National Provider Identifier (NPI) improves the efficiency and effectiveness of the electronic transmission of health information. It replaces many numbers you may have previously supplied to payers on electronic claims, certifications, and authorization transactions. This includes Medicare and Medicaid numbers and other payer numbers.

Aetna may ask you to submit clinical records before paying a claim if the claim includes:

- A code appended with Modifier 22 (unusual procedural service). For example, Aetna may request an operative report for surgical procedures or office notes for non-surgical procedures.

- An "unlisted code" as defined in the Index of CPT Codes under "unlisted services and procedures."

- A code from the list of non-specific codes.

Aetna also offers live webinars on topics such as how to sign up and use the provider portal on Availity, claims management, and onboarding for new healthcare professionals.

The Hidden Costs of Treatment: Unraveling the PML in Insurance Terminology

You may want to see also

National Provider Identifier (NPI)

The National Provider Identifier (NPI) is a Health Insurance Portability and Accountability Act (HIPAA) Administrative Simplification Standard. It is a unique 10-digit identification number for health care providers. All health care providers, health plans, and health care clearinghouses must use the NPIs in the administrative and financial transactions adopted under HIPAA. The NPI is not assigned based on the provider's specialty or location but is instead assigned to the individual provider.

The NPI improves the efficiency and effectiveness of the electronic transmission of health information. It replaces many numbers that providers may have previously supplied to payers on electronic claims, certifications, and authorization transactions. This includes Medicare and Medicaid numbers, and other payer numbers.

To obtain an NPI, you may apply online at https://NPPES.cms.hhs.gov. Individual providers can only have one NPI, however, organizations can have multiple NPIs.

Policybazaar's Term Insurance: A Safe Bet for Long-Term Financial Security?

You may want to see also

Payment options

Aetna offers a range of payment options for its members. You can choose to make a one-time payment or set up recurring monthly payments. Here are some of the ways you can pay your premiums:

- Online: You can set up your monthly payment or make a one-time payment online using your plan invoice.

- Phone: Call the number on your Member ID card or look up your plan's phone number to make a payment.

- Mail: Include your payment and invoice in a stamped envelope and send it to the address listed on your invoice.

- In-person: Pay by cash, credit, or debit card at a CVS® retail store with your invoice. (Please note that this option is not available at CVS Pharmacy® locations at Target or Schnucks.)

- Automatic payments: Set up automatic monthly payments by calling 1-855-651-4856 ${tty}. You can also set up automatic payments by logging into your account on the Aetna website.

- Social Security Administration Premium Withhold (SSA PWH) and Railroad Retirement Board Premium Withhold (RRB PWH): Set up your automatic monthly payment by calling the phone number on your Member ID card.

If you have any questions about your payment options, you can refer to the information provided to you by your employer or group health plan. Additionally, you can always reach out to Aetna's customer support for further assistance.

Unraveling the Mystery of Retroactive Dates in Insurance Policies

You may want to see also

Aetna External Review Program

The Aetna External Review Program is an opportunity for members to have certain coverage denials reviewed by independent physician reviewers. This program is for members who have exhausted the applicable plan appeal process and have a coverage denial for which they would be financially responsible, involving more than $500, and is based on a lack of medical necessity or on the experimental or investigational nature of the service or supply at issue.

How to Determine Eligibility for External Review

If, upon the final level of review, the plan upholds the coverage denial and it is determined that the member may be eligible for external review, they will be informed in writing of the steps necessary to request an external review, and a Request for External Review form will be included with the letter.

If coverage has been denied and the member is informed that they are not eligible to request external review of the coverage denial, they should check the following criteria to determine if the coverage denial meets eligibility criteria to participate in this program:

- The cost of the service or supply at issue for which the member would be financially responsible exceeds $500.

- The applicable plan appeal process has been exhausted.

How to Request an External Review

If the above eligibility criteria have been met, the member should print and submit the Request for External Review form, following the instructions provided on the form, to Aetna's External Review Unit at the address listed on the form for processing.

A second form, the Request for Expedited External Review form, is for use by the treating physician if they certify that a delay in service would jeopardize the member's health.

The Review Process

The Aetna External Review Unit will refer the request to an independent review organization (IRO) contracted with Aetna, and the IRO will choose an independent physician reviewer to examine the case. The reviewer must be board certified in the area of medical specialty at issue in the case, take an evidence-based approach to reviewing the coverage determination, and follow the plan sponsor's plan documents and applicable criteria governing the member's benefits.

Timeline

After all necessary information is submitted, external reviews are generally decided within 30 calendar days of the request. Expedited reviews are available when a member's physician certifies that a delay in service would jeopardize the member's health. Once the review is complete, the decision of the independent external reviewer will be binding on Aetna, the plan sponsor, and the health plan. Members are not charged a professional fee for the review.

Understanding Solvency Ratios: The Key to Evaluating Term Insurance Stability

You may want to see also

Out-of-network benefits

Out-of-network doctors and hospitals are more expensive than in-network providers. In-network providers have a contract with Aetna and provide services to members at a certain rate, which is usually much lower than what they would charge otherwise. Out-of-network providers, on the other hand, set their own rates, which are usually higher than the amount Aetna recognises or allows.

Some Aetna plans do not offer any out-of-network benefits, meaning out-of-network care is only covered in an emergency. For plans that do cover out-of-network care, you will usually pay more than if you stayed in-network.

Aetna pays for out-of-network care based on "recognised charges". These are calculated using data from Ingenix, which is owned by United HealthCare. Ingenix combines information from health plans into databases that show how much providers charge for a service in a particular zip code. For most health plans, Aetna uses the 80th percentile to calculate how much to pay for out-of-network services. This means that 80% of charges in the database are the same or less for that service in a particular zip code.

If there is not enough data in the database for a particular service in a zip code, Aetna may use "derived charge data" instead. This is based on the charges for comparable procedures, multiplied by a factor that takes into account the relative complexity of the procedure.

If you receive care from an out-of-network provider, you will need to submit a claim. You can do this by completing and mailing a medical claim form to the address on your ID card.

Understanding Pre-Existing Conditions: A Comprehensive List for Short-Term Insurance Applicants

You may want to see also

Frequently asked questions

You can submit a claim in one of three ways: through Availity, through a vendor (fees may apply), or by submitting an electronic coordination of benefits (COB) claim.

The NPI improves the efficiency and effectiveness of the electronic transmission of health information. It replaces many numbers you may have previously supplied to payers on electronic claims, certifications, and authorization transactions.

You can make a one-time payment or set up recurring monthly payments. You can pay online, by phone, by mail, or in-store at a CVS® retail store.

If you receive a bill or get care from a health care professional who is not in the Aetna network, you will need to submit a claim. Please complete and mail one of the forms below to the address on your ID card:

- Medical Claim Form (English or Spanish)

- Dental Claim Form (English or Spanish)

- Vision Claim Form for vision benefits within a medical plan or through the Aetna Vision Preferred plan (English or Spanish)

Not all forms may apply to your coverage and benefits. To find forms customized for your benefits, log in to your member account. If you have questions about which forms are meant for your use, call the toll-free number on the back of your member ID card.