CPT (Current Procedural Terminology) codes are used by healthcare providers to describe the services they provide. CPT codes are developed and updated by the American Medical Association (AMA). When billing codes 92133 and 92083 to insurance, it is important to note that these codes are related to eye care and cannot be billed together on the same date of service. Code 92133 refers to optical coherence tomography (OCT) scans, which are often used to diagnose and monitor eye conditions such as glaucoma. On the other hand, code 92083 refers to threshold visual field tests, which are also used to evaluate eye health and function.

| Characteristics | Values |

|---|---|

| CPT codes | 92133 and 92083 |

| CPT code meaning | 92133 - OCT optic nerve; 92083 - threshold visual field |

| CPT code billing | 92133 and 92250 cannot be billed on the same date of service |

| CPT code combinations | 92083 and 92133 cannot be billed together with 99214 |

What You'll Learn

The codes are for billing medically necessary follow-ups

The codes 92133 and 92083 are Current Procedural Terminology (CPT) codes used in medical billing and coding. CPT codes are used by healthcare providers to describe and bill for the services they provide. These specific codes are related to eye care and are often used by optometrists and ophthalmologists.

Code 92133 represents "OCT optic nerve", which stands for Optical Coherence Tomography, a type of imaging technique used to evaluate the optic nerve and other structures in the eye. Code 92083, on the other hand, represents "Threshold Visual Field-Extended", which is a test used to assess a patient's visual field, or peripheral vision.

When billing for medically necessary follow-ups, it is important to ensure that the correct codes are used and that they are billed appropriately to the patient's insurance company. In the context of codes 92133 and 92083, there are a few important considerations to keep in mind:

- Medically Necessary Follow-ups: These codes are typically used for follow-up visits related to specific eye conditions or issues. For example, code 92133 may be used for glaucoma management or monitoring of ocular pathology. It is important to establish the medical necessity of the follow-up visit and ensure that it is not considered a "routine" eye exam, which may not be covered by medical insurance.

- Correct Usage of Modifiers: Modifiers are used to provide additional information about the services provided. In the case of codes 92133 and 92083, the use of modifiers like -25 and -59 has been mentioned in billing forums. The -25 modifier indicates a "separately identifiable evaluation and management (E/M) service", while the -59 modifier indicates a "distinct procedural service". The correct use of these modifiers can impact reimbursement and help avoid claim denials.

- Carrier Guidelines: It is important to refer to the guidelines of the patient's insurance carrier when billing for these codes. Different carriers may have specific requirements or limitations on the use of codes 92133 and 92083, including the frequency of testing and the diagnoses that warrant their use. Checking the carrier's Local Coverage Determination (LCD) can help ensure that the codes are billed appropriately.

- Multiple Procedure Rules: When performing multiple diagnostic tests on the same day, it is important to be aware of the Multiple Procedure Payment Reduction (MPPR) rules. Medicare and other carriers may reduce the reimbursement for the second test (usually by 50% or more) if two similar tests, such as 92133 and 92250 (fundus photography), are performed on the same date of service. Therefore, it may be advisable to space out the tests over multiple visits to maximize reimbursement.

- Billing Separately: Codes 92133 and 92083 typically represent separate and distinct procedures. However, as mentioned in a billing forum, some insurance carriers may require the use of a modifier -51 when performing multiple tests. This modifier indicates that multiple procedures were performed on the same day.

- Correct Diagnosis Coding: Accurate diagnosis coding is crucial when using CPT codes for billing. The diagnosis code should justify the medical necessity of the procedure. For example, when billing for glaucoma-related services, the diagnosis code should reflect the specific type of glaucoma, such as primary open-angle glaucoma or low-tension glaucoma.

In summary, when billing codes 92133 and 92083 to insurance for medically necessary follow-ups, it is important to ensure that the procedures are correctly coded, modifiers are used appropriately, carrier guidelines are followed, and diagnosis codes support the medical necessity of the procedures. Proper billing practices help ensure reimbursement and provide clear documentation of the services provided.

The Consequential Loss Conundrum: Unraveling the Complexities for a Safer Future

You may want to see also

92133 and 92250 cannot be billed on the same date

The Current Procedural Terminology (CPT) code 92133 is a medical procedural code under the range of ophthalmological examination and evaluation procedures. CPT code 92250, on the other hand, is for fundus photography with interpretation and report. These two codes cannot be billed on the same date for the same patient.

The 2017 CMS policy manual states that fundus photography (CPT code 92250) and scanning ophthalmic computerized diagnostic imaging (CPT codes 92132, 92133, 92134) are generally considered mutually exclusive. This means that a provider would typically use one technique or the other to evaluate fundal disease. However, there are rare exceptions to this rule. In limited clinical conditions, both techniques may be medically reasonable and necessary for the ipsilateral eye. In these cases, both CPT codes can be reported by appending modifier 59 to CPT code 92250.

The use of modifier 59 should be a last resort and requires careful consideration. It is important to establish proper medical necessity for each procedure before appending this modifier. The clinical conditions that warrant both techniques must meet the definition of medical necessity, meaning that patient harm could result if the two tests are not performed on the same date of service.

It is worth noting that the NCCI edits are not absolute, and there are circumstances where reimbursement for both services performed on the same day may be allowed. According to the NCCI edits, the modifier indicator is "1", which means that it is possible to unbundle certain codes using modifier 59, subject to certain limitations. However, the use of modifier 59 does not override the rule that the posterior segment of the eye is considered a contiguous structure. Therefore, billing for both fundus photography and OCT on the same day should be very rare.

Understanding Ultrasound Billing: Navigating Insurance Coverage for Diagnostic Imaging

You may want to see also

Medicare denies billing 99214, 92083, and 92133 together

Understanding Insurance Codes

Insurance codes are used by health plans to make decisions about prior authorization requests, claims, and how much to pay healthcare providers. These codes are typically found on Explanation of Benefits (EOB) forms or documents, medical bills, and insurance claim forms.

CPT Codes

The CPT (Current Procedural Terminology) codes are used by healthcare providers to describe the services they provide. CPT codes are developed and updated by the American Medical Association (AMA). CPT codes are required on claim forms for healthcare providers to receive payment from health plans.

HCPCS Codes

The Healthcare Common Procedure Coding System (HCPCS) is the coding system used by Medicare. Level I HCPCS codes are the same as CPT codes. Medicare also maintains HCPCS Level II codes, which cover products, supplies, and services not included in CPT codes, such as ambulance services, durable medical equipment, prosthetics, and orthotics.

ICD Codes

The third system of coding is the International Classification of Diseases (ICD) codes, developed by the World Health Organization (WHO). ICD codes identify a patient's health condition or diagnosis. ICD codes are often used with CPT codes to ensure that the services provided align with the patient's diagnosis.

Understanding Billing and Coding for Eye Care

Medical billing in optometry was introduced over 30 years ago when legislation was passed to include optometry under Medicare. Today, medical billing is commonly used in eye care, with over 36,000 optometrists participating in Medicare.

Optometry medical billing includes reimbursement for office visits and various procedure codes, such as fundus/anterior segment photography, optical coherence tomography (OCT), visual fields, and pachymetry. Common CPT codes used in eye care include 92250 ("Fundus Photography"), 92083 ("Threshold Visual Field-Extended"), and 92133 ("OCT Optic Nerve").

Challenges in Medical Billing

Implementing medical billing in optometry comes with certain challenges, including denied claims and audits from insurance companies. One reason for denied claims is submitting claims before being fully approved and credentialed with an insurance carrier. Another reason is the incorrect use of modifiers on procedure codes. Understanding billing and coding for medical optometry is crucial to optimize practice flow and ensure adequate compensation for services rendered.

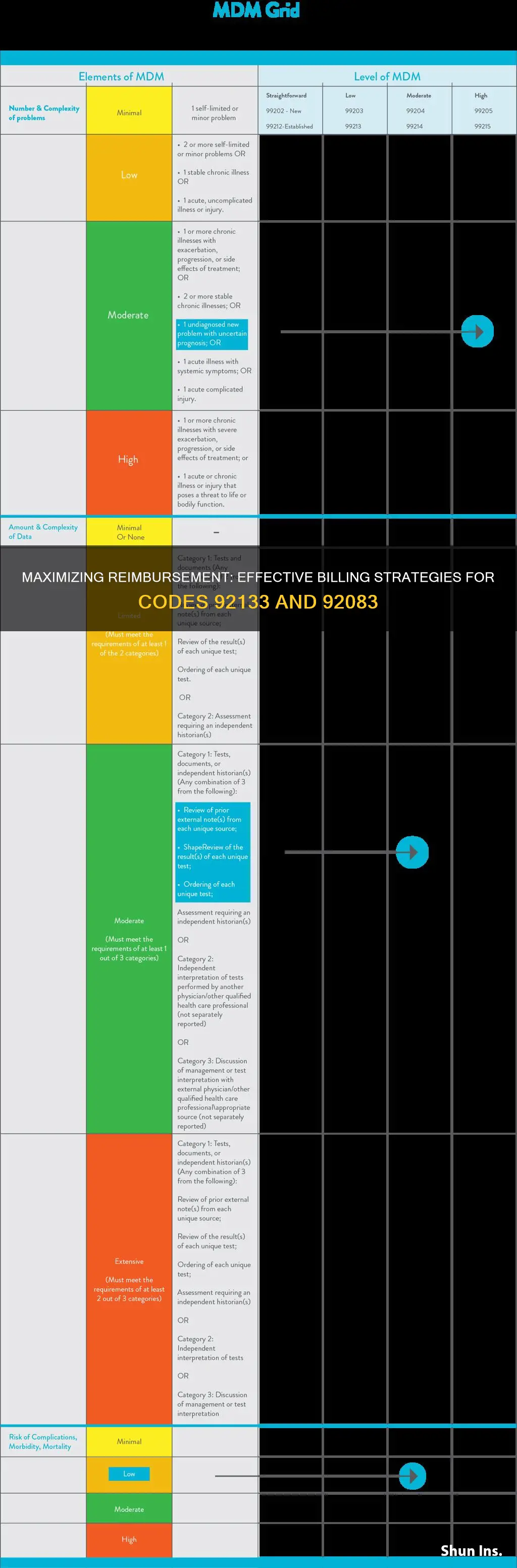

Billing CPT Codes 99214, 92083, and 92133 Together

When billing CPT codes 99214, 92083, and 92133 together, Medicare denies the claim. This denial may be due to specific criteria or frequency requirements not being met. It is important to check the carrier's LCD for diagnoses, frequency, and coverage criteria for these codes. Additionally, coding the severity of glaucoma for code 92133 may be necessary.

To bill these codes together, consider using modifiers. The -25 modifier indicates a separately identifiable visit and is typically used when a patient comes in for an office visit and glaucoma testing, followed by a procedure such as foreign body removal. However, the -25 modifier is generally not required when performing diagnostic testing on the same day of service.

It is also important to consider the Place of Service (POS) codes when billing Medicare. POS 02 refers to telehealth provided outside the patient's home, while POS 10 indicates telehealth provided in the patient's home.

In summary, when billing CPT codes 99214, 92083, and 92133 together, it is essential to understand the specific requirements and modifiers needed to ensure reimbursement from Medicare. Checking the carrier's LCD, coding the severity of glaucoma, and considering the use of modifiers and POS codes can help optimize billing and reimbursement for these services.

Selecting the Right Term Insurance: A Comprehensive Guide to Making the Best Choice

You may want to see also

CPT codes are used by healthcare providers to describe services

CPT (Current Procedural Terminology) codes are used by healthcare providers to describe the services they provide. They are a set of medical codes used by physicians, hospitals, and other healthcare professionals to streamline the reporting of procedures and services for consistent billing and reimbursement purposes. CPT codes are also used for administrative tasks such as claims processing and developing guidelines for medical care review.

The American Medical Association (AMA) developed the CPT system in 1966 to standardize the reporting of medical, surgical, and diagnostic services and procedures. CPT codes are updated annually to accommodate advancements in the healthcare industry, such as new services and the retirement of outdated procedures. The codes consist of five characters, typically numeric, but sometimes including an alpha character as the fifth character.

CPT codes are essential for accurate billing and reimbursement. Insurers use these codes to determine reimbursement amounts for providers. CPT codes are used by all providers and payers to ensure a consistent billing process and reduce errors. The same CPT code might have different reimbursement amounts depending on the contract between the provider and the insurer.

There are various categories of CPT codes, including:

- Category I: These codes describe distinct medical procedures or services and are identified by a five-digit numeric code.

- Category II: Supplemental tracking codes, also known as performance measurement codes, are alphanumeric and optional for correct coding.

- Category III: Temporary alphanumeric codes for emerging technologies, procedures, and services. They are used for data collection, assessment, and, in some cases, payment for new services that do not yet meet the criteria for a Category I code.

Healthcare providers use CPT codes to communicate the services provided to patients, while insurers use them to determine reimbursement amounts. CPT codes play a crucial role in the billing and reimbursement process, ensuring accurate and consistent documentation and payment for healthcare services.

Fire Department Billing Practices: Understanding the Intersection with Insurance

You may want to see also

Medical billing can increase practice revenue

Medical billing is the process of submitting health insurance claims to medical insurance companies on behalf of the patient. It is an indispensable aspect of any successful healthcare provider, ensuring the practice remains financially viable and can support the high costs of providing healthcare. Medical billing can increase practice revenue in several ways:

Establish a Clear Medical Bill Collection Process

Creating a clear and systematic collection strategy improves revenue cycles by ensuring patients are properly and thoroughly informed of their financial responsibilities. This includes informing patients of their co-pays and collecting this beforehand, sending letters to patients when bills are due, overdue, or sent to collections, and making clear what payment options are available.

Improve Claims Management

Approximately 80% of medical bills contain errors, often resulting in rejection or denial. To mitigate this, claims should be accurate and complete the first time. This involves inputting the correct patient, provider, and insurance information, avoiding duplicate billing, and providing clear documentation. Submitting clean claims directly relates to how quickly a provider receives payment and can be achieved by partnering with a Revenue Cycle Management (RCM) services vendor.

Minimize Coding Errors

Within a claim, medical coders use standardized codes to describe the performed procedures. While this provides a standard method of describing procedures, errors such as incorrect, missing, or mismatched codes can occur. To avoid this, medical practices need professional coding staff with a comprehensive understanding of medical billing coding guidelines. Outsourcing to medical billing companies can also help to ensure correct coding.

Promptly Handle Denied or Rejected Claims

Checking for errors in a claim can minimize the occurrence of rejections and denials. When they do occur, they should be handled as quickly as possible by keeping in touch with a representative of the payer to help expedite the claim editing process and minimize appeal and resubmission times.

Implement Specialty-Tailored Billing Software

Specialty-specific billing software can help providers increase their revenue and grow their bottom line. By implementing such software, providers can access tailored billing tools, like coding and claim-filing tools, that help optimize revenue and bypass unnecessary information.

Train Billing and Coding Staff

If an office employs an inexperienced coding staff, they might be missing out on valuable income due to incorrect CPT codes, diagnosis codes, or modifiers, giving insurance companies the right to deny a claim. To avoid this, offices should provide up-to-date training on the most recent Centers for Medicare and Medicaid Services (CMS) guidelines.

Unraveling the Intricacies of LIC Term Insurance: A Comprehensive Guide

You may want to see also

Frequently asked questions

CPT stands for Current Procedural Terminology. CPT codes are used by healthcare providers to describe the services they provide. CPT codes are developed and updated by the American Medical Association (AMA).

The CPT code for an OCT optic nerve scan is 92133.

No, CPT codes 92133 and 92083 cannot be billed together.