Billing electronically to insurance is a process that involves submitting claims electronically, rather than through traditional paper methods. This method of billing offers several advantages, including faster payment processing, reduced clerical work, and increased accuracy in billing and reimbursement. The shift towards electronic billing has been influenced by the Health Insurance Portability and Accountability Act (HIPAA), which mandates the use of standardized formats for electronic claim transmission. Additionally, Medicare payment policies require hospitals and clinics to submit all Medicare claims electronically. When billing electronically to insurance, it is important to select a method for receiving payments, such as Electronic Funds Transfer (EFT) or traditional paper checks. To get started with electronic billing, individuals can refer to resources that outline the basics of electronic claim submission and provide guidance on choosing the right electronic claim provider.

| Characteristics | Values |

|---|---|

| Benefits | Faster payment, fewer errors, fewer lost or incomplete claims, less paperwork, reduced clerical time and cost of processing, mailing, resubmitting and tracking the status of paper claims, environmentally friendly |

| Software | Therabill, Healthie |

| Requirements | Software that meets electronic filing requirements as established by the HIPAA claim standard, CMS requirements contained in the provider enrollment and certification category |

| Submission Process | Direct file submission, direct data entry |

| Submission Options | Full-service, self-service |

What You'll Learn

- Electronic Claims Submission saves time and money

- Electronic Fund Transfer (EFT) is a faster and more convenient method of payment

- The Health Insurance Portability and Accountability Act (HIPAA) has encouraged the use of electronic claims

- Full-service and self-service electronic claims are the two types of electronic claims

- Electronic Explanation of Benefits (eEOB) provides details about a claim and the payment

Electronic Claims Submission saves time and money

Electronic claims submission is a game-changer for healthcare providers, offering a streamlined, efficient, and cost-effective method for submitting medical claims to insurance companies. This process eliminates the need for manual, paper-based claims, reducing errors and speeding up payment processing.

Faster and More Efficient

The shift to electronic claims submission has been encouraged by the government, health plans, and the Health Insurance Portability and Accountability Act (HIPAA). This digital process is faster and more efficient than traditional paper claims. With electronic submissions, there is no need for printing or postage, and claims can be submitted instantly. This results in quicker reimbursement, improving cash flow for healthcare providers.

Reduced Errors and Improved Accuracy

Electronic submissions also improve accuracy and minimize errors. Digital software can automatically check for errors and inaccuracies, allowing for timely corrections before submission. This reduces the likelihood of claim rejections, further streamlining the process.

Enhanced Transparency and Tracking

Electronic claims submission provides enhanced transparency and tracking capabilities. Healthcare providers can easily track the status of their claims in real-time, staying informed throughout the entire process. This ensures a smoother and more efficient experience for all parties involved.

Cost Savings

Submitting claims electronically also results in significant cost savings. According to the American Medical Association, the processing cost for an electronic claim is $2.90 on average, while the cost for processing a paper claim is $6.63. By eliminating the need for paper, printing, and postage, electronic submissions reduce overhead costs and free up staff time for other important tasks.

Improved Cash Flow

With electronic claims submission, healthcare providers can expect improved cash flow. The faster payment processing and reduced payment delays ensure a steady cash flow, which is crucial for the financial health of healthcare organizations.

Secure and Compliant

Electronic Data Interchange (EDI) systems ensure that medical claims are transmitted securely and accurately between healthcare providers and insurance companies. This secure transmission of information protects sensitive patient data and helps maintain compliance with privacy regulations.

Misrepresentation: Understanding the Fine Line Between Inaccuracy and Fraud in Insurance

You may want to see also

Electronic Fund Transfer (EFT) is a faster and more convenient method of payment

Billing electronically to insurance is a great way to save time and money. Electronic Fund Transfer (EFT) is a faster and more convenient method of payment that allows you to move money across an online network between banks and people. It is a speedier alternative to physical payment methods like cash and checks.

During the insurance credentialing process, you will be required to select a method for receiving payments for insurance claims. With most insurance payers, you will have the option to set up EFT or choose a traditional paper check method. While receiving a paper check may be preferable to some healthcare providers, EFT has its advantages. With reimbursement funds deposited directly into your bank account, payments can be received more quickly and conveniently.

Setting up your business to file claims electronically and receive EFTs has many benefits over paper checks, including quicker claim and payment processing, easier record-keeping, and being more environmentally friendly. EFTs also benefit insurance payers, allowing them to streamline their claims processing and eliminate mailing costs. Some insurance payers, like CIGNA, no longer send paper checks and require providers to enroll in EFT.

To set up EFT, you will need to contact each insurance payer and choose your EFT option during the credentialing process. If you are already credentialed and have been receiving physical checks, you will need to contact each payer to switch your payment method. Some insurance payers allow this process to be done completely electronically through their website. In other cases, the insurance payer will provide you with an EFT enrollment form to complete and return, along with a voided check.

EFT payments are protected through the Electronic Fund Transfer Act (EFTA), which provides legal recourse if something is amiss with a transaction. Unauthorized transactions, lost or stolen debit cards, compensation for violations, and withdrawal limits are all covered under the EFTA.

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

The Health Insurance Portability and Accountability Act (HIPAA) has encouraged the use of electronic claims

The Health Insurance Portability and Accountability Act (HIPAA) has been instrumental in encouraging the use of electronic claims. HIPAA, enacted in 1996, has two primary objectives: to ensure continuous health insurance coverage for individuals who lose or change their jobs, and to reduce healthcare costs by standardising the electronic transmission of administrative and financial transactions.

HIPAA's Title II, also known as the Administrative Simplification (AS) provisions, mandates the establishment of national standards for electronic healthcare transactions and national identifiers for providers, health insurance plans, and employers. This section of the act has been instrumental in encouraging the use of electronic claims. The Administrative Simplification rules require the Department of Health and Human Services (HHS) to increase the efficiency of the healthcare system by creating standards for the use and dissemination of healthcare information.

The HHS has promulgated five rules regarding Administrative Simplification: the Privacy Rule, the Transactions and Code Sets Rule, the Security Rule, the Unique Identifiers Rule, and the Enforcement Rule. The Privacy Rule, which came into effect on April 14, 2003, establishes national regulations for the use and disclosure of Protected Health Information (PHI) in healthcare treatment, payment, and operations by "covered entities." Covered entities include healthcare clearinghouses, health insurers, employer-sponsored health plans, and medical service providers that engage in certain transactions. The Privacy Rule gives individuals the right to request that a covered entity correct any inaccurate PHI and take reasonable steps to ensure the confidentiality of communications with individuals.

The Transactions and Code Sets Rule simplifies healthcare transactions by requiring all health plans to engage in healthcare transactions in a standardised way. The EDI Health Care Claim Transaction Set (837), for example, is used to submit healthcare claim billing information, encounter information, or both, from providers of healthcare services to payers.

The Security Rule complements the Privacy Rule. While the Privacy Rule pertains to all PHI, the Security Rule is limited to Electronic Protected Health Information (EPHI). It lays out three types of security safeguards required for compliance: administrative, physical, and technical.

The Unique Identifiers Rule (National Provider Identifier, NPI) requires HIPAA-covered entities such as providers completing electronic transactions, healthcare clearinghouses, and large health plans to use only the National Provider Identifier (NPI) to identify covered healthcare providers in standard transactions.

The shift toward electronic claims has been further encouraged by the expectation that a growing number of insurers will require electronic claim submission to cut costs. Medicare payment policies have also played a role in this trend by mandating that hospitals and clinics submit all Medicare claims electronically.

The Dark Art of Balance Billing: Unraveling Insurance's Hidden Costs

You may want to see also

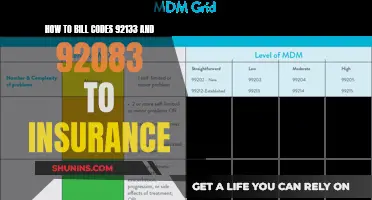

Full-service and self-service electronic claims are the two types of electronic claims

Full-service and self-service electronic claims are the two primary types of electronic claims. Each type has its own set of features and requirements that are important to understand when transitioning to electronic billing.

Full-service electronic claims are typically filed by a third-party billing service on behalf of the psychologist or practitioner. The psychologist is only required to provide basic patient and service information to the billing service. The billing service then develops and submits the claim directly to the appropriate insurer or healthcare claims clearinghouse. The billing service often charges a percentage of the total claim amount as payment, which can range from 4% to 15% depending on the types of services provided. This option is particularly useful for practitioners who submit claims to multiple third-party payers, as it simplifies the process by allowing the billing service to sort, format, check for accuracy, and transmit the claims to the appropriate payer.

On the other hand, self-service electronic claims are developed and submitted directly by the psychologist or a member of their staff to a third-party payer or healthcare claims clearinghouse. This option is often more economical for solo practitioners and small practices, as it gives them more control over the sensitive information contained in the claim. Pricing for self-service claims can be determined on a "per claim" basis, a flat fee, or a combination of both. Additionally, self-service claim submission options may offer additional features for an extra cost, such as checking insurance information, converting patient statements into electronic format, and receiving electronic remittance advice (ERA) and electronic Explanation of Benefit (EOB) statements.

Both full-service and self-service electronic claims offer benefits such as faster reimbursement, reduced disruptions to cash flow, increased accuracy, less paperwork, and decreased overhead costs when compared to traditional paper claims.

Understanding the Term Booster: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

Electronic Explanation of Benefits (eEOB) provides details about a claim and the payment

An Electronic Explanation of Benefits (eEOB) is a document that provides details about a claim and the payment. It is not a bill, but rather a summary of your care, coverage, and costs for medical and dental services. It includes information such as the date of service, the type of care received, and the provider's fee. The eEOB also shows the amount paid by the insurer and any outstanding payments to be made by the patient.

The eEOB is typically sent to the client and sometimes to the healthcare provider as well. It can be accessed and printed online, offering convenience and ease of record-keeping. This electronic format also contributes to quicker claim and payment processing, as well as being environmentally friendly.

The eEOB is particularly useful for ensuring accurate billing and payment. It allows individuals to verify the services they received and the providers listed, identify any inconsistencies when they receive the actual bill, and request payment plans or explore other payment options if needed. Additionally, the eEOB can be used as documentation when appealing an insurance decision or disputing a charge.

The shift towards electronic claims and payments is driven by several factors. These include the expectation that more insurers will require electronic claim submission to cut costs, the push for electronic exchange of healthcare payment information by the Health Insurance Portability and Accountability Act (HIPAA), and the trend towards electronic billing and payments in Medicare.

Frequently asked questions

Electronic billing can speed up the payment process, reduce errors, cut down on paperwork, and lower costs.

You can either use a "full-service" or "self-service" electronic claim. With full-service, a third party, often a billing service, submits the claim for you. With self-service, you or a member of your staff submits the claim directly to a third-party payer or healthcare claims clearinghouse.

The claim is transmitted electronically from the provider's computer to a Medicare Administrative Contractor (MAC). The MAC then checks for errors and sends the claim back for correction and resubmission if errors are found. Once the claim passes the initial edits, it is edited against the implementation guide requirements in the HIPAA claim standards. If errors are detected at this level, only the individual claims that included those errors would be rejected for correction and resubmission.

A Superbill is a detailed invoice that includes all the services provided by a healthcare provider in a single visit. It is used to bill insurance companies and patients for the services rendered.

An ERA is an electronic document that provides details on the claim payment. It is similar to an Explanation of Benefits (EOB) but is sent only to healthcare providers. An ERA includes information such as the status of claims payments, financial errors, and payer responses to claims.