How to Bill Formula to Insurance

There is no federal requirement for insurance companies to cover the cost of baby formula. However, some insurance companies do cover formula in certain circumstances. In this article, we will outline the steps to bill formula to insurance and discuss the different types of formula that may be covered. We will also provide information on other resources that may be available to help with the cost of formula.

| Characteristics | Values |

|---|---|

| Is baby formula covered by insurance? | In most situations, the answer is no. Insurance companies won't cover infant formula unless there is a medical need such as a gastrological condition or a food allergy. |

| How to get insurance to cover formula | One of the only ways to get your insurance to cover formula is to have your pediatrician give you a prescription. |

| Does insurance cover hypoallergenic formula? | Your insurance company may cover hypoallergenic formula, but in order to request coverage, you will still need documentation from a physician stating that it is medically necessary. |

| States that mandate formula coverage | There are currently 17 states that mandate insurance companies to cover formula for children with allergies or other related conditions. |

| Companies that cover formula | Blue Cross Blue Shield, Medicaid, United Healthcare, Cigna, Anthem |

What You'll Learn

Understanding the different types of formula and their insurance coverage

Baby formula is a breast milk substitute for children under 12 months of age. It comes in three main types: cow's milk formula, soy formula, and specialized formula. The U.S. Food and Drug Administration (FDA) regulates the contents and safe production of all infant formulas sold in the U.S., and all formulas have to contain sufficient nutrition, including iron.

Cow's milk formula

Cow's milk formula is the most common type, making up about 80% of all formulas sold. The milk is treated to make the protein more digestible, and milk sugar (lactose) is added to make it more similar to breast milk. Vegetable oil replaces the butterfat so that infants can more easily digest it.

Soy formula

Soy formulas use soy proteins and do not contain lactose. They may help babies allergic to lactose found in cow's milk. However, according to the American Academy of Pediatrics (AAP), up to 50% of babies allergic to milk protein may also be sensitive to soy protein.

Specialized formula

Specialized formulas are designed for babies with certain conditions and should not be used without a pediatrician's recommendation. They include premature baby formulas and hypoallergenic amino acid-based formulas. Hypoallergenic formulas are designed for babies with food intolerances and allergies to proteins found in cow's milk.

Insurance coverage for formula

There is no federal requirement for insurance companies to cover formula for any reason. However, some states mandate that insurance companies cover specialized elemental formulas that are prescribed to babies with certain allergies or other health conditions. In all covered cases, the formula must be deemed medically necessary.

If you are seeking assistance in paying for infant formula, it is important to check with your insurance provider to see if they offer coverage for your specific situation. Additionally, there are other avenues to explore, such as government programs like the WIC Program (Women, Infants, and Children), which is designed to help mothers and their children receive assistance with basic needs such as food and formula.

Terminal Illness: Understanding Its Coverage in Term Insurance Plans

You may want to see also

How to get a prescription for baby formula

Baby formula is usually readily available without a prescription, just like any other food. However, there are certain circumstances in which a doctor may prescribe formula to meet a specific medical need. This means that parents can then claim formula costs through insurance or a needs-based program.

A doctor may prescribe formula if a baby has a medical condition such as:

- Gastrointestinal disorders

- Severe food allergies (requiring an amino-acid elemental formula)

What to do if you think your baby needs a prescribed formula

If you know or suspect that your baby has any of these conditions, talk to your paediatrician or healthcare provider to get their recommendation. They will be able to advise on the best course of action and can prescribe a specialist formula if necessary.

Getting insurance coverage for prescribed formula

If your baby requires a specialist formula, you may be able to get coverage through your insurance company. Contact your insurance provider directly to see if reimbursement is available. You will need to provide documentation from your baby's doctor to establish a medical need for the formula.

Other sources of support

There are also other programs that can help with the costs of baby formula:

- The Supplemental Nutrition Assistance Program (SNAP) offers low-income nutrition assistance to eligible families. Qualifying participants can use their SNAP benefits to purchase any baby formula.

- The Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) is a government-sponsored program that assists qualifying families with nutritional needs. Certain specialty formulas and medical foods may be covered by WIC if the proper medical documentation is provided. Contact your community health department to find out which formulas are covered in your state.

- Enfamil offers a support program called Nutramigen Support, which provides tips and insurance support for families with infants who have a cow's milk allergy.

Understanding Insurance Policy Billing Cycles: A Guide to Navigating Payment Schedules

You may want to see also

How to qualify for formula coverage

Step 1: Determine your state's requirements

Firstly, it's important to understand that there is no federal requirement for health insurance providers to cover formula. Each plan differs and can be state-specific. Currently, 20 states have laws requiring some form of coverage, which varies widely. For example, Arizona requires coverage only for children with eosinophilic gastrointestinal disorder, while Maine also counts anaphylaxis, allergic gastroenteritis, gastroesophageal reflux disease, and severe vomiting or diarrhea as medically necessary diagnoses.

Step 2: Check your insurance plan

Contact your insurance company directly to see if reimbursement is available for formula. If you have a self-funded health plan, the employer pays the claims and is not subject to state law insurance mandates. However, if you have a fully insured plan, it is subject to state and federal law, and your insurance company administers and funds the claims.

Step 3: Consult your doctor

Specialized formula, whether available by prescription or over the counter, may be covered if a doctor indicates it as medically necessary. Most states specify which medical conditions make a child eligible for formula coverage. A letter of medical necessity from a doctor could help the family budget.

Step 4: Explore other avenues

If your insurance doesn't cover formula, there are still other options. Many hospitals and pediatricians have free samples provided by formula manufacturers. Similac and Enfamil offer rewards programs with coupons and samples. Nonprofits like the Children's Medical Nutrition Alliance provide formula for a year through an application process. Additionally, parents should look into whether they qualify for the USDA's Women, Infants, and Children program, which is based on income.

Step 5: Advocate for change

If your state doesn't require insurance to cover medically necessary specialized formula, consider joining an advocacy group to lobby for change. Families can also contact their representatives to push for legislation that mandates insurance coverage for formula.

The Green Oasis of Insurance: Understanding the Concept of Captives and Their Benefits

You may want to see also

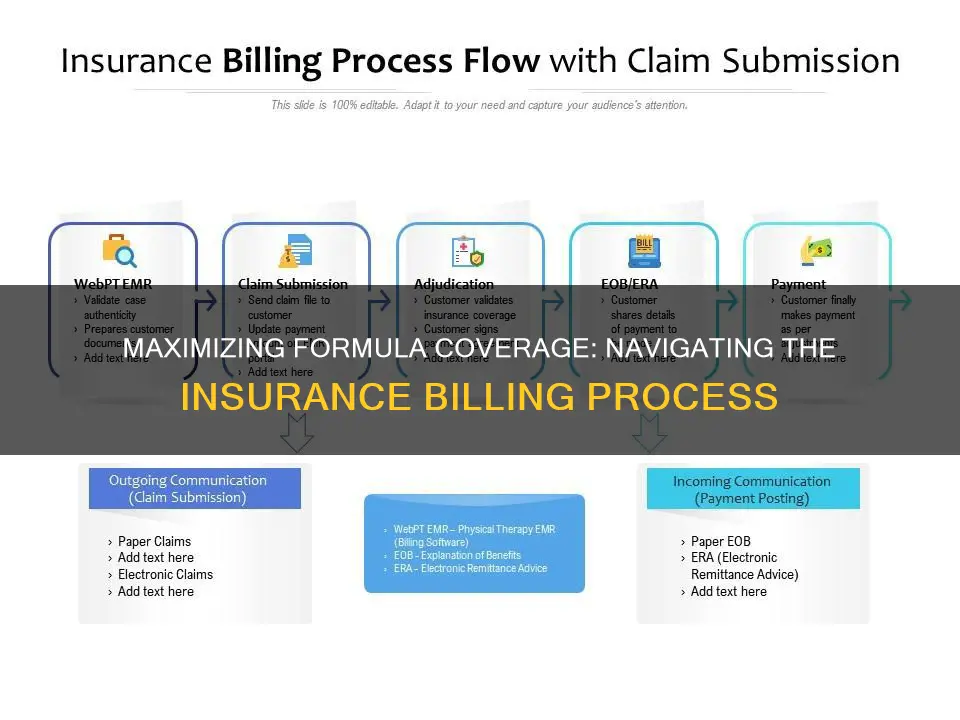

The role of insurance companies in the billing process

Once the patient arrives for their appointment, they will be asked to complete any necessary forms and provide identification and a valid insurance card. The provider will also collect any applicable copayments at this time. After the patient's visit, the provider creates a detailed record of the patient's diagnoses, procedures performed, and any prescribed medications. This information is then translated into standardized codes, such as ICD-10-CM or Current Procedural Terminology (CPT) codes, by a medical coder.

The coded record, known as a "superbill," is then sent to the medical biller, who prepares the insurance claim. The claim includes patient information, procedure codes, diagnosis codes, and the cost of the procedures. The biller must ensure that the claim meets compliance standards and then submits it to the insurance company, either directly or through a clearinghouse.

The insurance company reviews the claim to verify medical necessity and coverage eligibility based on the patient's insurance plan. If the claim is approved, the insurance company processes the payment, either directly to the healthcare provider or as a reimbursement to the patient. If the claim is denied or rejected, the provider may need to follow up and appeal the decision.

Throughout the process, accurate and timely reimbursement for healthcare services rendered is ensured by the medical biller, who must have knowledge of medical coding guidelines and familiarity with insurance policies. While certification is not required by law, it is encouraged and may improve employment prospects.

In summary, the insurance company plays a crucial role in the billing process by evaluating and processing claims, determining coverage eligibility, and issuing payments. The process involves coordination between the patient, healthcare provider, and insurance company, with the medical biller acting as the liaison between the provider and the insurer.

Understanding LabCorp's Billing Practices: Navigating Insurance Claims and Costs

You may want to see also

Dealing with billing errors

Billing errors are common and can be costly, so it's important to be vigilant about monitoring your bills and claims. Here are some steps to take if you suspect a billing error:

Know your health plan: Understanding your health plan coverage is crucial. Read your plan's summary of benefits and coverage, including deductibles, coverage limits, and in-network and out-of-network providers. This information is typically available on your insurer's or employer's website. Knowing your plan will help you identify any discrepancies or errors in your bill.

Estimate your costs in advance: Whenever possible, try to estimate the cost of a medical procedure or test before receiving care. Ask your doctor for the billing codes and contact your insurer to find out what they will cover. You can also use online tools, such as cost estimators, to get an idea of the expected charges.

Check your paperwork: After receiving care, carefully review the bills and Explanation of Benefits (EOB) from both your healthcare provider and your insurer. Compare these documents to the estimates you received beforehand and look for any discrepancies or errors. Pay attention to the services received, amounts paid by insurance, and the amount you owe to the provider.

Act quickly: If you suspect a billing error, it's important to act promptly. Contact your healthcare provider or insurer as soon as possible to discuss the issue. You may have a limited time frame to dispute a charge before it goes to collections, so don't delay.

Get help: If you're unable to resolve the issue directly with your provider or insurer, there are other support options available. You can seek assistance from your employer's benefits department, a medical billing advocate, or your local Area Agency on Aging. You can also submit a complaint to the Centers for Medicare and Medicaid Services or contact your state's Consumer Assistance Program.

Negotiate your bill: If you can't dispute a charge, consider negotiating with your provider. Check online resources to compare prices in your area and determine if you were charged more than the fair price. You may be able to ask for a reduced rate or set up a payment plan to make the bill more manageable.

Keep detailed records: Throughout the process, maintain detailed records of your communications with the healthcare provider and insurer. Keep copies of all bills, statements, and EOBs, as well as notes from phone conversations, including dates, times, names, and what was discussed. This documentation will be valuable if you need to escalate the issue or file an appeal.

By following these steps, you can effectively address billing errors and protect yourself from unnecessary costs and financial strain. Remember that billing mistakes can happen, and it's your responsibility to monitor your statements and take action to rectify any discrepancies.

Get in Touch: A Guide to Contacting Momentum Short-Term Insurance

You may want to see also

Frequently asked questions

There is no federal requirement for insurance companies to cover formula for any reason. However, some states mandate that insurance companies cover specialized elemental formula that is prescribed to babies with certain allergies or other health conditions. In all covered cases, the formula must be deemed medically necessary.

Standard formula is not mandated in any state. Specialized formula, on the other hand, is currently mandated in 17 states for children with allergies or other related conditions. Specialized formulas include hypoallergenic formulas, metabolic formulas, and premature infant formulas.

If you're unsure whether your child is eligible to receive a prescription, it's worth discussing with your doctor. The most common reason for a prescription is an allergy or the need for a special diet. The doctor must make it clear that the formula is medically necessary and prescribe a specific type of formula for the insurance company to approve the request.

Some examples of insurance companies that cover specialized formula under certain conditions include Blue Cross Blue Shield, Medicaid, United Healthcare, Cigna, and Anthem.

There are several alternative ways to receive coverage for baby formula. Hospitals and pediatricians often offer free formula samples. Formula companies may also have rewards programs and coupons. Additionally, government programs like the WIC Program (Women, Infants, and Children) provide assistance for mothers and their children in need of basic necessities such as food and formula.