The FIRE movement, which stands for Financial Independence, Retire Early, is a growing trend among millennials and Gen-Zers. One of the biggest challenges for people looking to retire early is securing affordable health insurance. In the US, health insurance is commonly offered as an employment benefit, with employers covering some or all of the costs. This means that early retirees need to find alternative ways to obtain health insurance. One option is to purchase health insurance through the Affordable Care Act (ACA) marketplaces, which allow individuals to buy qualified health insurance plans on their own. However, ACA plans can be expensive, with high premiums and deductibles. Another option is to get expat insurance if you plan to spend time outside of the US. Alternatively, some early retirees choose to work part-time or semi-retire to qualify for health insurance through an employer. Additionally, there are private company health insurance options and government-provided health insurance plans to consider. When planning for early retirement, it is crucial to include health insurance in your budget as it can be one of the most significant expenses.

| Characteristics | Values |

|---|---|

| How to get health insurance | Affordable Care Act (ACA) |

| Expat insurance | |

| Student health insurance | |

| Part-time work | |

| Spouse's employer's health plan | |

| Previous employer's retiree health insurance | |

| Part-time work with health insurance | |

| Consolidated Omnibus Budget Reconciliation Act (COBRA) | |

| Private company health insurance | |

| Healthcare sharing programs | |

| Government-provided health insurance |

What You'll Learn

Affordable Care Act (ACA) health insurance plans

The Affordable Care Act (ACA) was enacted in 2010 to expand health insurance coverage by increasing benefits and lowering health insurance costs, making coverage more affordable. ACA plans are major medical insurance plans certified by the ACA Health Insurance Marketplace to be offered on the marketplace.

Eligibility

To be eligible to enroll in health coverage through the ACA Marketplace, you must:

- Live in the United States

- Be a U.S. citizen or national, or be lawfully present

- Not be incarcerated in prison or jail

Benefits

ACA plans provide the following 10 Essential Health Benefits:

- Out-patient services

- Maternity and newborn care

- Mental health, behavioural health, and substance use disorder services

- Rehabilitative and habilitative services

- Pediatric services, including oral and vision care

- Preventative and wellness services and chronic disease management

- Follow established limits on cost-sharing (deductibles, copayments, and out-of-pocket maximum amounts)

- Provide coverage for pre-existing conditions

- Eliminate annual and lifetime dollar limits on health insurance coverage

- Provide 100% coverage for preventive care and cancer screening

ACA Plan Types

ACA plans are categorized into "metal tiers":

- Bronze plans typically have the lowest monthly premiums but higher out-of-pocket costs when you need care.

- Silver plans balance moderate premiums with lower costs when accessing healthcare services and may offer additional cost-sharing reductions based on income.

- Gold plans have higher monthly premiums but lower out-of-pocket costs for medical services.

- Platinum plans have the highest monthly premiums but the lowest out-of-pocket costs for medical services.

Enrollment

You can enroll in an ACA plan during the annual Open Enrollment Period, which usually runs from November 1 to December 15. If you miss the Open Enrollment Period, you may still be able to enroll during a Special Enrollment Period if you experience certain life events, such as getting married, relocating, having a child, or losing your health coverage.

Gap Insurance Tax Status in Connecticut

You may want to see also

Expat insurance

Health Insurance for Expats

International expat health insurance can give you and your family access to quality medical care wherever you are in the world. It is different from travel insurance, as it can help cover the cost of both routine and emergency medical care while you live outside your country of citizenship.

Different countries have different types of healthcare systems, including those financed by taxes, employment, or via an out-of-pocket system paid for by the consumer. Depending on which country you live in, it may even be a legal requirement for expats to have health insurance.

Expat health insurance works by limiting how much you would otherwise have to pay for expensive medical care abroad. You'll find and sign up for a health plan that fits your needs, then contact your insurer when you need treatment or health services. They will liaise with good-quality healthcare providers near you to arrange a guarantee of payment and check that the treatment is covered by your policy.

The cost of expat health insurance can range from as little as $50 per month for a basic plan with inpatient hospital benefits only, to more than $1,000 a month for a comprehensive medical policy covering most, if not all, of your medical expenses.

Life Insurance for Expats

International life insurance coverage provides additional peace of mind because it takes care of your family's financial needs should something happen to you while living overseas. The policy you have in your home country probably won't pay out if you pass away while living in another country, so an international life insurance plan fills that gap.

Travel Insurance for Expats

Expat travel insurance is typically for Americans living abroad for all or even part of the year. Expats may not need coverage for the same issues as people taking regular vacations, such as trip cancellations and interruptions, trip delays, and lost or delayed baggage. Instead, expats often primarily need health insurance or medical insurance for travel that works both at home and abroad, as well as coverage for emergency medical evacuation.

Engine Woes: Navigating the Grey Area of Auto Insurance for Engine Failure

You may want to see also

Health insurance through your employer

Requirements for Employers

The Affordable Care Act (ACA) requires employers with at least 50 full-time employees or "full-time equivalents" to provide health coverage to their workers. Applicable Large Employers (ALEs) that do not comply may be subject to penalties.

Small businesses with fewer than 50 full-time employees are not mandated to provide a healthcare plan, but they may qualify for the Tax Credit for Small Employer Health Insurance Premiums if they choose to do so.

Benefits for Employees

Employees with employer-sponsored health insurance can access affordable healthcare, including treatment for chronic diseases and mental health services, which may not be available through cheaper individual plans. Studies have shown that workers with access to healthcare have higher morale and improved productivity.

Benefits for Employers

Employers who provide health insurance can attract better talent, as prospective employees are more likely to choose an employer that will take care of their well-being. Additionally, employer health insurance premiums are tax-deductible, reducing tax bills by thousands of dollars each year.

Cost and Flexibility

Although employer-sponsored plans can be pricier, employees typically share the cost of premiums with their employers, resulting in lower costs for individuals. Furthermore, employees can make pre-tax contributions, reducing federal and state taxes.

While individual plans offer more flexibility in choosing preferred doctors and hospitals, employer-sponsored plans provide access to more perks and can ultimately be more affordable when considering tax advantages.

Digital Dilemmas: Proving Auto Insurance in Tennessee

You may want to see also

Private company health insurance

When considering private company health insurance, it is important to understand the different types of plans available. The most common types of plans are Bronze, Silver, Gold, and Platinum. Bronze plans typically have low monthly payments but higher deductibles, making them ideal for those who rarely visit the doctor. Silver plans have average monthly payments and lower deductibles, making them suitable for individuals and small families with average healthcare needs. Gold plans have higher monthly payments but cover most routine healthcare costs, while Platinum plans have the highest monthly payments but the lowest deductibles and are ideal for those with ongoing or specialized care needs.

In addition to the ACA, there are other options for private company health insurance. Some people may choose to get expat insurance if they plan to spend a significant amount of time outside of their home country. This type of insurance covers medical costs both inside and outside of the US and can be more affordable than domestic health insurance. Another option is to look into health care cooperatives or sharing programs, which are often faith-based and have affordable premiums and lower out-of-pocket caps. However, these programs may not cover pre-existing conditions or certain situations that do not align with the program's values.

When choosing a private company health insurance plan, it is important to consider your own healthcare needs and budget. Researching and comparing different plans and providers is essential to finding the best option for you. It is also important to remember that health insurance costs tend to increase over time, so planning for these increases in your budget is crucial. By understanding the different options available and carefully considering your needs, you can make an informed decision about your private company health insurance.

State Farm's Baby Boom: Does Parenthood Impact Auto Insurance Rates?

You may want to see also

Government-provided health insurance

In the United States, there are several government-provided health insurance programs that you may be eligible for. These include:

Medicare

This is a federal program that provides health insurance for people over 65, younger people with disabilities, and dialysis patients. You can find out more about Medicare and how to apply on Medicare.gov.

Medicaid

This is an assistance program that helps cover medical expenses for people with low incomes. You can learn more about the program and how to apply on Medicaid.gov.

The State Children's Health Insurance Program (SCHIP) or CHIP

CHIP provides low-cost health coverage for children in families that earn too much money to qualify for Medicaid. More information about CHIP can be found on Medicaid.gov.

The Affordable Care Act (ACA) Health Insurance Marketplace

The ACA provides more accessible and affordable health insurance options. There is no income limit to be eligible, and you can enroll regardless of any pre-existing conditions. You can find out more about the ACA and enroll at HealthCare.gov.

The Federal Employees Health Benefits (FEHB) Program

The FEHB program offers a wide range of health plans for federal employees, retirees, and their survivors. It includes options such as Consumer-Driven and High Deductible plans, as well as Fee-for-Service (FFS) plans. You can compare the costs, benefits, and features of different plans on the official website.

Other Programs

Depending on your circumstances, you may also be eligible for other government-provided health insurance programs, such as the Department of Defense TRICARE and TRICARE for Life programs, the Veterans Health Administration (VHA) program, or the Indian Health Service (IHS) program.

Mile Auto: Good Insurance Option?

You may want to see also

Frequently asked questions

One of the easiest ways to obtain health insurance after early retirement is through your spouse's employer's health plan. If your spouse is still working and is eligible for insurance, there is likely a family plan that you can join. You can also check with your previous employer to see if you are eligible for retiree health care insurance. If you are generally healthy, you should review your options through a private insurance company by shopping around and comparing prices for health insurance. Many people who retire early are also able to buy health insurance through the Affordable Care Act (ACA) health insurance marketplaces, which allow qualified people to have insurance on their own.

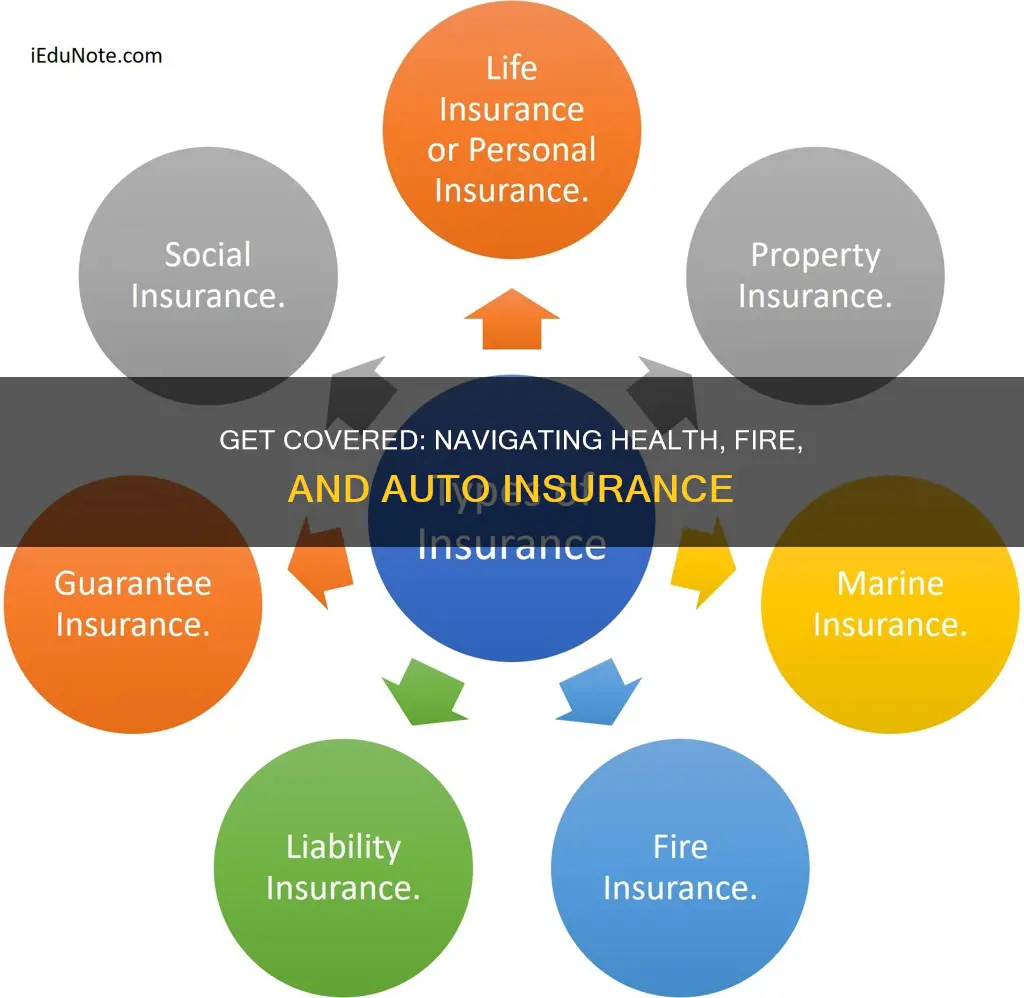

Fire insurance is one of the benefits commonly offered by employers in the United States. Getting fire insurance through your employer can help cover the cost of a fire insurance policy since your employer typically covers some of it. If you are looking for fire insurance for your business, you can consider a group plan. With a group plan, an employee can benefit from an insurance plan established or maintained by an employer or by an employee organization.

Auto insurance is another type of insurance that is commonly offered by employers as a benefit. You can get auto insurance through your employer, or you can purchase it directly from an insurance company. If you are looking for ways to save money on auto insurance, you can compare quotes from multiple companies to find the best price.