State Farm offers a range of insurance products, including auto insurance, and provides customers with physical and digital insurance cards as proof of insurance. This article will outline how to access and read your State Farm auto insurance card, as well as the importance of keeping it on hand. Whether you prefer a physical copy or the convenience of the State Farm Mobile App, understanding how to access and interpret your insurance card is essential for all policyholders.

| Characteristics | Values |

|---|---|

| How to obtain a State Farm auto insurance card | Download the State Farm Mobile App, access the My Accounts site, or request a copy by providing your phone number and date of birth |

| When to show your insurance card | When renewing your license plate, when stopped by the police, after an accident, or when purchasing a new or used car |

| Substitutes for the ID card | None; your declaration page and most recent insurance payment receipt are not valid substitutes |

| How to get your insurance ID card | Log in to your online account on statefarm.com, select the Auto policy, and click View/Print Documents |

What You'll Learn

Understanding the card's sections

State Farm auto insurance cards can now be accessed through the State Farm Mobile App, which is available on iOS and Android. This allows you to access your insurance card electronically, removing the need to keep a physical copy in your vehicle.

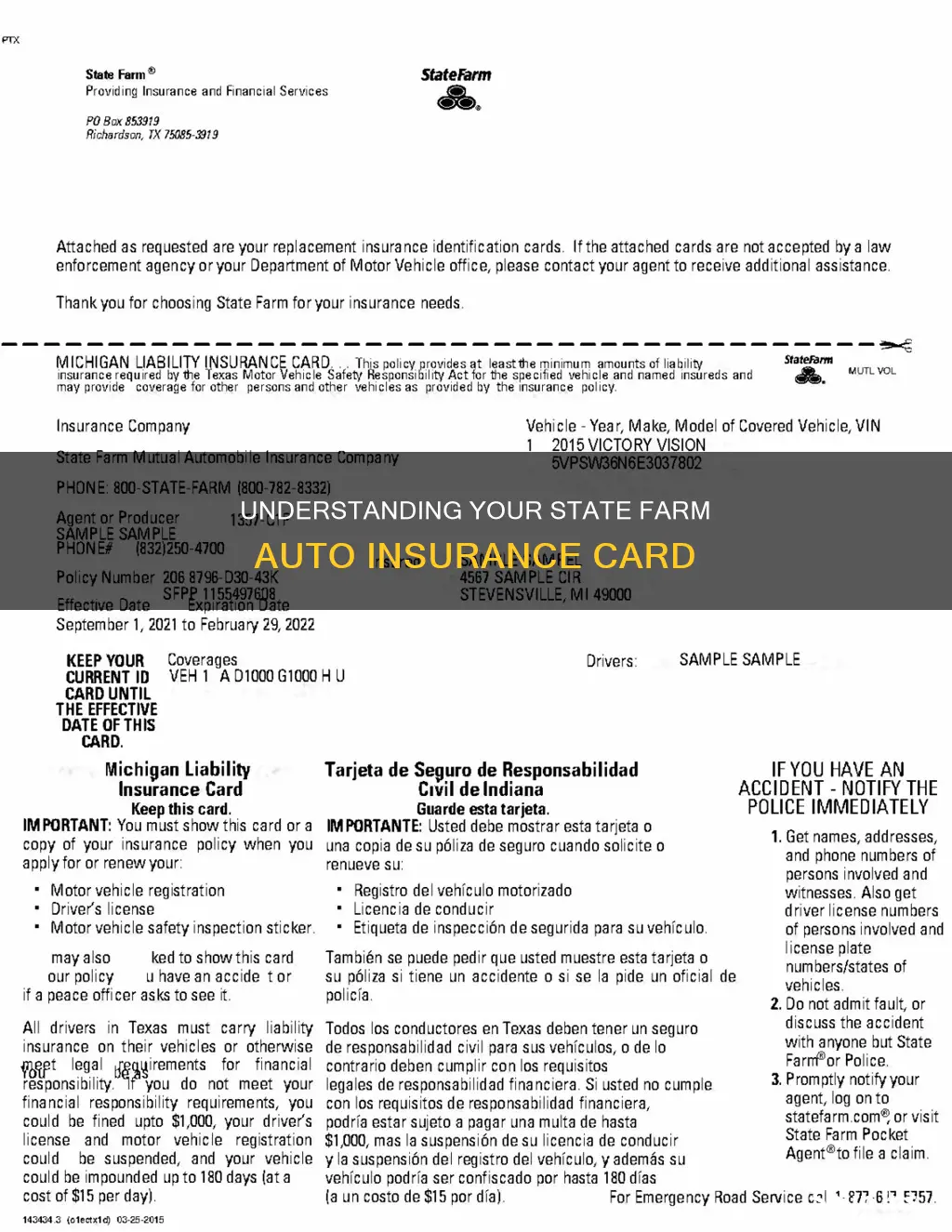

The insurance card will include the following information:

- Your name and address

- Your policy number, which is unique to each individual policy at State Farm

- Your vehicle description, including the make, model, and year of your car

- The effective date of your coverage, which is when you received valid proof of insurance

- The expiration date of your coverage

- The name and contact information of your State Farm agent

It's important to keep your insurance card up to date and easily accessible, as it is required by law to carry proof of insurance in your vehicle. You may need to present your insurance card when renewing your license plate, during a police stop, after an accident, or when purchasing a new or used car.

Dairyland Auto Insurance: Unraveling the SR-22 Insurance Conundrum

You may want to see also

Knowing what information to look for

Policyholder Information:

Start by locating the policyholder's name on the card. This section typically includes the full name of the primary policyholder, which is often the main driver or owner of the vehicle. This information is essential for identifying the insured individual.

Policy Number:

Your insurance card will display a unique policy number associated with your specific auto insurance policy. This number is crucial for referencing your coverage and policy details. It serves as a quick identifier when communicating with State Farm or filing a claim. Make sure to have this number handy whenever you need to discuss your policy.

Vehicle Information:

The insurance card will provide details about the insured vehicle, including the make, model, and vehicle identification number (VIN) of the car. This information specifies exactly which vehicle is covered under the policy. It is important to ensure that the vehicle information on your insurance card is accurate and up-to-date.

Effective and Expiration Dates:

Look for the effective date, which indicates when your policy coverage begins, and the expiration date, which shows when the policy period ends. These dates are critical for understanding the validity of your insurance coverage. It is important to keep your policy up to date to maintain continuous coverage.

Coverage Details:

Your State Farm auto insurance card will outline the different types of coverage included in your policy, such as liability, collision, and comprehensive coverage. It will also display the corresponding limits for each type of coverage, indicating the maximum amount your insurance will pay out in the event of a claim. Understanding your coverage details is essential for knowing what is covered and what your financial responsibilities may be in the event of an accident.

Additional Information:

Depending on your state and policy, your insurance card may include other important details, such as the number of insured drivers, the policy deductible, or any applicable endorsements or discounts. It may also list contact information for your local State Farm agent or provide instructions on how to file a claim.

Remember that your State Farm auto insurance card is a vital document that you should keep with you whenever you drive. It serves as proof of insurance, and you may be required to present it to law enforcement, the DMV, or other parties in the event of an accident or during routine checks. Knowing how to read and understand your insurance card is an important aspect of vehicle ownership and maintaining proper insurance coverage.

MedPay vs. Other Driver's Insurance: Who Pays First?

You may want to see also

How to access your card online

State Farm offers a variety of ways to access your auto insurance card online. You can download the State Farm Mobile App, which provides an electronic insurance card, on iOS and Android devices. The app also offers other helpful features such as the ability to add your electronic insurance card to your Apple Wallet.

Alternatively, you can access your insurance card through the State Farm website. To do this, you will need to create an online account by registering with your email address and at least one State Farm product. Once registered, you can log in to your account and view your insurance card.

If you are a new policyholder, you can download temporary insurance cards through the My Accounts page or via the confirmation email sent to you. These temporary cards are available for 30 days after purchasing the policy.

In addition, you can request to have a copy of your insurance card emailed to you by providing your phone number and date of birth. This option is available to State Farm customers who may not have an online account or prefer not to use the mobile app.

Auto Insurance: The Rising Cost Conundrum

You may want to see also

How to access your card via the State Farm Mobile App

State Farm has a mobile app available on iOS and Android that allows customers to access their insurance cards. To access your insurance card, you can follow these steps:

- Download the State Farm mobile app from the App Store or Google Play.

- Log in to your State Farm account.

- Navigate to the Auto Policy Information page.

- Click on "View/Print Documents".

- Open the ID Card electronic document.

- From here, you can choose to view, save, print, or email your State Farm ID card.

Please note that the digital insurance card provided by the State Farm Mobile App may not be accepted by law enforcement officials as an insurance ID card in your state. It is recommended that you check with your local Department of Motor Vehicles (DMV) to stay informed about the proof of insurance card requirements in your state.

Auto and Cycle: How Car Insurance Impacts Motorcycle Coverage

You may want to see also

How to request a physical card

To request a physical State Farm auto insurance card, you must first register for an online account on the State Farm website. Once registered, log in to your online account and follow these steps:

- Click on the Auto Policy above the vehicle description.

- Click on "Request Insurance Cards".

- Indicate how you would like to receive your insurance cards and if you need cards for additional vehicles.

- State Farm will then mail your physical insurance card to you.

You can also contact your State Farm agent for a new identification card if you do not wish to create an online account.

The Timeline of Auto Insurance Claims: Unraveling the Resolution Process

You may want to see also

Frequently asked questions

You can get your State Farm auto insurance card by logging into your online account on the State Farm website or by downloading the State Farm Mobile App. You can also contact your State Farm agent for a new identification card.

The State Farm auto insurance card contains information about your policy coverages and important documents. It is not a statement of contract but an estimate based on the information you provide.

Yes, it is important to carry your State Farm auto insurance card with you at all times. You will need to show it to the police if you are stopped for any reason, and to claimants and officers in the event of an accident.