Submitting a bill to insurance can be a complicated and jargon-filled process, but it doesn't have to be. There are two ways to submit a health insurance claim: the first and most convenient way is to have your medical services provider submit the claim directly to the insurance company on your behalf. This can be done electronically through the network. The second option is to complete the claim form yourself and send the paperwork to the insurance company. This is necessary if your health service provider is not part of your health plan network or cannot file the claim for you.

- Obtain itemized receipts and bills from your doctor or medical provider.

- Get a claim form from the insurance company's website or brochure section.

- Make copies of all documents.

- Review the claim form and ensure all necessary fields are filled out, then send the completed form and supporting documents to the insurance company.

| Characteristics | Values |

|---|---|

| First Step | Collect itemized receipts and bills from the doctor or medical provider. |

| Second Step | Complete a claim form. |

| Third Step | Make at least one copy of the claim form and receipts. |

| Fourth Step | Review the claim form, call the insurance company, and send the form and accompanying paperwork. |

| Fifth Step | Wait for the insurance company to process the claim. |

| Sixth Step | If the claim is denied, follow the insurance company's appeals process. |

What You'll Learn

Itemised receipts and bills

Understanding Itemised Receipts and Bills

Information to Include in an Itemised Receipt

When creating or requesting an itemised receipt, it is important to include the following key information:

- Name and contact information of the business or provider

- Price of each item or service purchased

- Taxes, fees, and discounts applied to the total cost

- Date of service or purchase

- Type of service or itemised list of products purchased

Obtaining Itemised Receipts for Medical Expenses

When dealing with medical expenses, it is common to need itemised receipts and bills for insurance reimbursement. You can obtain these by contacting your doctor, clinic, or hospital and requesting an itemised bill. This bill should list every service provided, along with the associated costs, including medications, lab tests, and medical equipment.

Using Itemised Receipts for Insurance Claims

When submitting an insurance claim, you will typically need to attach the original itemised receipts and bills to the claim form. This allows the insurance company to verify the charges and determine the amount of reimbursement. It is always a good idea to make copies of all itemised receipts and claim forms for your records before submitting them. This will help you keep track of expenses and protect yourself in case of disputes or lost paperwork.

Benefits of Itemised Receipts

Itemised receipts offer several advantages, including:

- Transparency: They provide a clear breakdown of charges, helping you understand the costs of your purchases or medical treatment.

- Accuracy: You can verify the accuracy of charges and identify any errors or discrepancies, ensuring you are not overcharged.

- Reimbursement: Insurance companies require itemised receipts to process claims accurately and determine the reimbursement amount.

- Tax Deductions: Itemised receipts are necessary for claiming tax deductions for medical or business expenses.

- Budgeting: They assist in budgeting and financial planning by allowing you to track your spending in detail.

Understanding the Face Value of Term Insurance: Unraveling the Mystery

You may want to see also

Claim forms

When it comes to claim forms, there are a few steps you can follow to ensure a smooth process. Firstly, obtain itemized receipts and bills from your doctor, clinic, or hospital. These will list the services provided and their associated costs. Secondly, obtain a health insurance claim form, either from your insurance company's website or from other sources like a brochure. This form will ask for details such as your insurance information, personal information, the reason for your visit, and more.

Once you have the necessary documents, make copies of everything. This is important in case there are any errors or if you need to refile your claim. Review your claim form to ensure all necessary fields are completed and that you've attached the required receipts and bills. Then, contact your insurance company to inform them that you'll be sending in a claim form. Ask them if there are any additional documents required and how long it will take to process your claim.

After ensuring you have everything in order, send the claim form and accompanying paperwork to your insurance company. The address for submission should be available on the claim form, and in some cases, you may be able to submit via email or fax. Finally, follow up with your insurance company after submitting your claim to ensure they have all the necessary documents and that they are filled out correctly.

The Intriguing Reason Behind Short-Term Insurance's 364-Day Duration

You may want to see also

Making copies

- Create both digital and hard copies of your documents. Store your hard copies in a climate-controlled space to prevent issues like mould and fading. Consider using a waterproof case or fire safe for added protection.

- For digital copies, use both cloud-based and drive-based storage methods to ensure you always have access to your records.

- When disposing of old insurance paperwork, be sure to shred the documents using a cross-cut shredder to protect your sensitive information.

- Keep copies of your insurance policies and records for as long as the policy is in effect or until any open claims are settled. If you have no open claims, you typically don't need to keep old, expired policies.

- For tax purposes, it is recommended to keep insurance records for a few years, especially if you are self-employed or the policies are related to a business. Consult with a tax advisor for specific guidance.

- If your claim involves a vehicle, keep registrations, titles, and other relevant documents for at least a year after you own the vehicle.

Understanding Insurance Billing for Procedure 92065: A Comprehensive Guide

You may want to see also

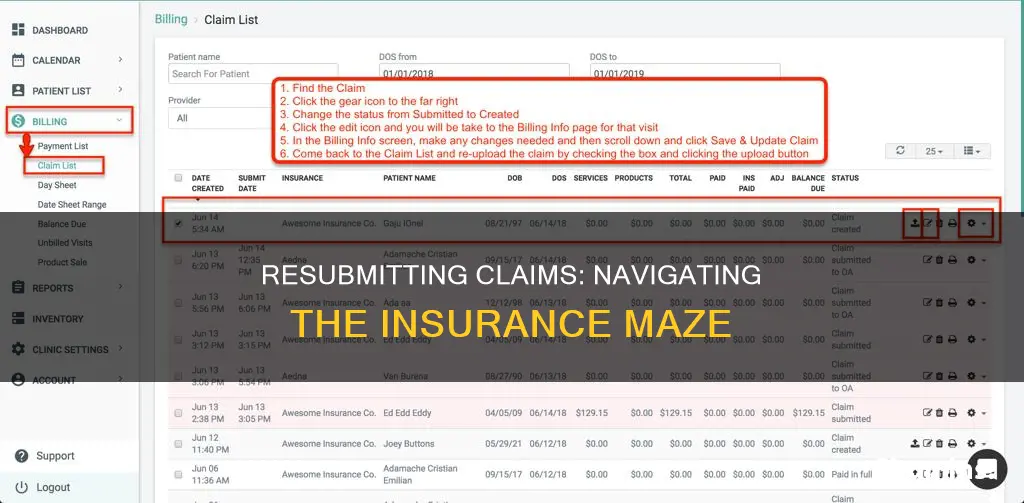

Online submission

To resubmit a bill to insurance online, you will need to follow a few important steps. Firstly, obtain itemized receipts and bills from your doctor, clinic, or hospital. An itemized bill lists every service provided and the cost of each service. You will need to attach these to your claim form.

Next, you will need to obtain a health insurance claim form. This can often be found on the insurance company's website, or you can download it from a site offering insurance services. The form will ask for information such as your insurance details, who will receive the payment, and the reason for your visit. The form will also provide instructions on any additional information that is required.

Once you have filled out the form, it is very important to make copies of the completed form and the itemized bill. This will help in case there are any issues with your claim, and will make it easier to refile if necessary.

Now, you are ready to submit your claim online. Sign in to your health plan account and navigate to the "Claims & Accounts" tab, then select "Submit a Claim". Here, you will be able to upload your completed Medical Claims Submission form.

After submitting your claim, you may want to follow up with your insurance company to ensure they have received all the necessary documents and that they are filled out correctly. Claims can take around 30 business days to process, and it is a good idea to contact the insurance company a week after submitting to make sure they have all the information they need.

Maximizing Insurance Reimbursement for Vivitrol Injection: A Guide for Medical Billing Professionals

You may want to see also

Claim rejection

- Missing documentation

- Incorrect coding

- Missing information, such as a blank field or an incomplete number

- The claim wasn't "scrubbed" (scanned for errors by a clearinghouse)

- The claim was submitted through the wrong portal or clearinghouse

- The client does not have benefits for the diagnosis or CPT code billed

- Prior authorization or referral was not obtained

Resubmitting a Rejected Claim

If your claim has been rejected, you will need to create a new claim and send it to the payer. This can be done by selecting "Resubmit" or "Send to insurance invoice area" when posting a payment. Make sure to include the following:

- A cover letter with "RESUBMISSION" written or typed on it (do not write on the claims)

- A copy of the remittance advice on which the claim was denied or incorrectly paid

- Any additional documentation required

- A claim reference number from the payer's response, so the insurer can connect your resubmission with the original submission

- A claim delay reason and a claim reference number from the payer (the Payer Claim Control Number)

Filing a Corrected Claim

If your claim has been denied, you will need to tell the payer that you have sent the claim to them before, but that you would like it to be re-adjudicated. This means that you are sending them information that was not provided previously or that you think they processed the original claim incorrectly. Make sure to include the following:

- A cover letter with "RECONSIDERATION" written or typed on it

- A copy of the original claim

- A copy of the remittance advice on which the claim was denied or incorrectly paid

- Any additional documentation required

- A brief note describing what correction is needed

The IUD Insurance Billing Conundrum: Unraveling the Complexities

You may want to see also

Frequently asked questions

First, check if the bill contains the words "insurance pending" or any other indication that the hospital/doctor has submitted the bill to the insurance company. If not, call the doctor or hospital and ask them to bill your insurance company. If they refuse or it is not possible, fill out the Blue Care Network Member Reimbursement Form and fax or mail it with an itemized statement.

You will need to provide your insurance policy number, group plan number, or member number, who received the services, whether there is coinsurance or dual coverage, and the reason for the visit.

Your insurance company will have an appeals process in place for you to request that they revisit your claim. This may have been denied in error, or more information may be needed.

First, obtain itemized receipts and bills from your doctor or medical provider. Next, complete a claim form, which you can obtain from your insurance company or their website. Make copies of all your documents and review them before sending them to your insurance company.