FHA-insured loans are not considered conventional. Conventional loans are offered by private lenders without direct government backing. In contrast, FHA loans are government-backed home loans insured by the Federal Housing Administration (FHA). This means that the FHA insures the borrower's mortgage payments, allowing more borrowers to access financing for their dream homes.

What You'll Learn

- FHA loans are insured by the Federal Housing Administration, conventional mortgages are not

- FHA loans are for lower credit scores, conventional loans require higher scores

- FHA loans are for lower down payments, conventional loans require higher down payments

- FHA loans are for higher debt-to-income ratios, conventional loans are for lower ratios

- FHA loans are for primary residences, conventional loans are for any residence

FHA loans are insured by the Federal Housing Administration, conventional mortgages are not

FHA loans are insured by the Federal Housing Administration (FHA), a government agency created to help home buyers qualify for a mortgage. The FHA provides backing on loans made by approved lenders to help provide loans to borrowers who need more lenient loan requirements. Conventional mortgages, on the other hand, are not insured by a federal agency. They are funded by private financial lenders and then often sold to government-sponsored enterprises like Fannie Mae and Freddie Mac on the secondary mortgage market.

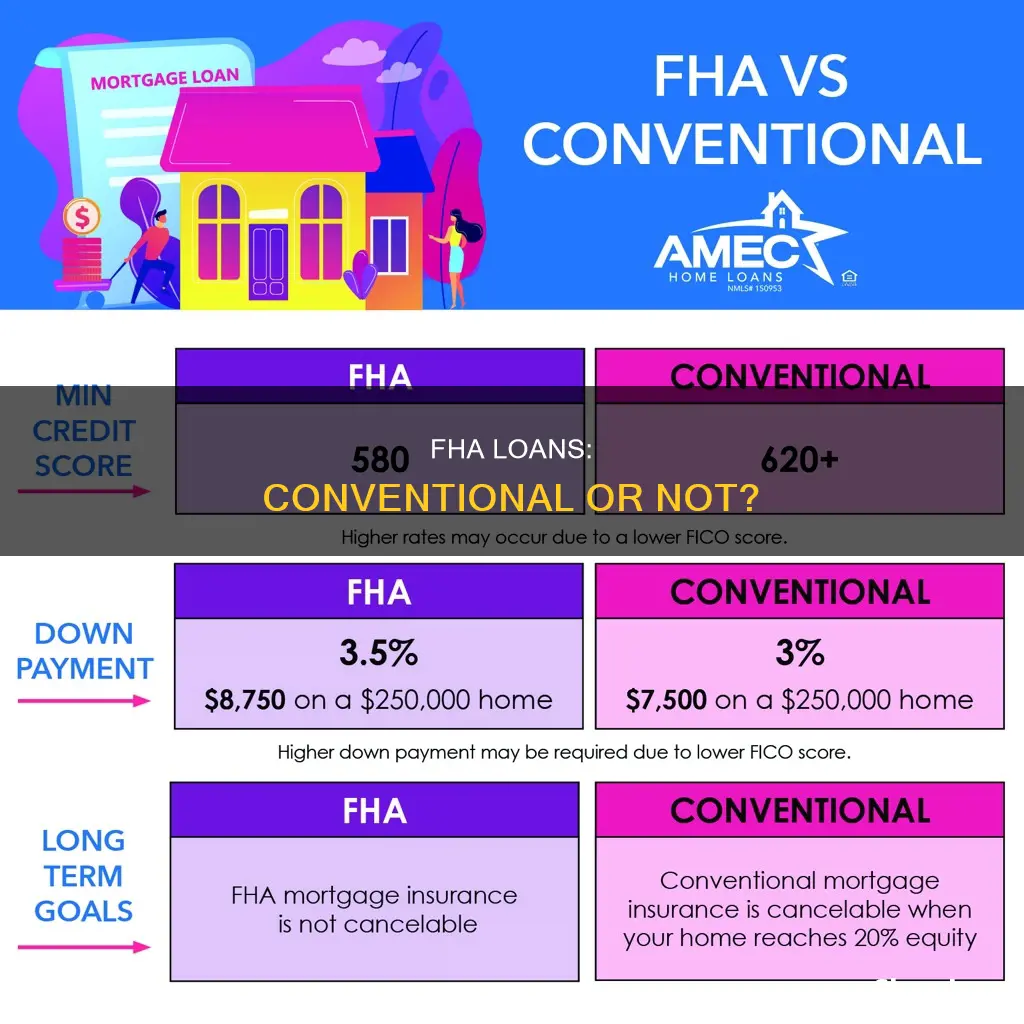

FHA loans are often a good choice for first-time home buyers or those with imperfect credit histories. They have more flexible standards for down payments and credit scores. For example, an FHA loan typically requires a minimum credit score of 580 to be eligible for a 3.5% down payment. If your credit score is between 500 and 579, you may still qualify for an FHA loan with a 10% down payment. Conventional loans, on the other hand, typically require a higher credit score of 620 or higher and a larger down payment of at least 3%.

Another key difference between FHA and conventional loans lies in the mortgage insurance requirements. FHA loans require two types of mortgage insurance payments: an upfront mortgage insurance premium (MIP) of 1.75% of the loan amount and a monthly MIP as part of your regular mortgage payments. Conventional loans may also require private mortgage insurance (PMI) if the down payment is less than 20% of the home's value. However, PMI can usually be removed once the borrower reaches 20% equity in their home.

In terms of loan limits, FHA loans have maximum lending limits based on the area where you want to live and the type of property you plan to purchase. Conventional loans also have loan limits, which vary depending on whether they are conforming or non-conforming loans. Conforming loans adhere to the maximum loan limits set by the Federal Housing Finance Agency, while non-conforming loans, or jumbo loans, exceed these limits and typically have higher interest rates.

When deciding between an FHA and a conventional loan, it's important to consider your financial situation and needs. FHA loans are generally easier to qualify for and offer competitive interest rates, but they may have stricter appraisal and inspection requirements. Conventional loans, on the other hand, may offer more flexible repayment terms and can be used for any type of residence, including secondary homes and investment properties. Ultimately, both loan types have their advantages and drawbacks, and the best choice will depend on your individual circumstances.

The Flexibility of Short-Term Insurance: Why It's Worth Considering for Your Yearly Plans

You may want to see also

FHA loans are for lower credit scores, conventional loans require higher scores

FHA loans are designed for borrowers with lower credit scores and are easier to qualify for. Conventional loans, on the other hand, require higher credit scores and are more challenging to obtain.

FHA loans are insured by the Federal Housing Administration (FHA), an agency under the US Department of Housing and Urban Development (HUD). They are designed to help borrowers with lower credit scores and limited savings to become homeowners. The minimum credit score for an FHA loan is typically 580, but some lenders may accept a score as low as 500. FHA loans also have more flexible standards for down payments, allowing borrowers to put down as little as 3.5% if their credit score is 580 or above.

Conventional loans, on the other hand, are not insured or guaranteed by the government. They are offered by private lenders and have stricter lending standards. To qualify for a conventional loan, borrowers typically need a credit score of 620 or higher. Conventional loans also usually require a larger down payment, typically ranging from 3% to 20%.

The higher credit score requirement for conventional loans reflects the greater risk assumed by the lender, as these loans are not insured by the government. As a result, conventional loans may offer lower interest rates and more flexible mortgage insurance options compared to FHA loans.

In summary, FHA loans are designed for borrowers with lower credit scores and offer more flexible down payment options. Conventional loans, on the other hand, require higher credit scores and typically demand a larger down payment. The choice between an FHA and a conventional loan depends on an individual's financial situation, with FHA loans being more suitable for those with lower credit scores and limited savings.

Thrivent Term Insurance: Understanding the Offerings and Benefits

You may want to see also

FHA loans are for lower down payments, conventional loans require higher down payments

FHA loans are insured by the Federal Housing Administration and are designed to be more accessible than conventional loans. They have more lenient qualifications and conditions, and are a good option for first-time homebuyers. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores.

The minimum down payment for an FHA loan is 3.5% for borrowers with a credit score of 580 or more. Borrowers with a credit score of 500 to 579 need to put 10% down to get an FHA loan.

Conventional loans are not insured by a federal agency. They have stricter lending standards and larger down payment requirements than FHA loans. Conventional loans require a higher credit score and a lower debt-to-income ratio.

The minimum down payment for a conventional loan is 3% for fixed-rate loans or 5% for adjustable-rate loans. However, a 20% down payment is standard, and lenders will often require private mortgage insurance if the down payment is less than 20%.

Understanding the Complexities of Term Insurance Calculations

You may want to see also

FHA loans are for higher debt-to-income ratios, conventional loans are for lower ratios

FHA loans are government-backed home loans insured by the Federal Housing Administration. They are designed to help low- to moderate-income families attain homeownership and are particularly popular with first-time homebuyers. FHA loans are available to individuals with credit scores as low as 500. That is within the "poor" range for a FICO score.

FHA loans have more lenient qualification requirements than other loans. They require a minimum credit score of 580 to be eligible to make a 3.5% down payment. If your credit score is 500 to 579, you may qualify for an FHA loan with a 10% down payment.

FHA loans have a maximum debt-to-income ratio of 50%. However, some lenders may set the limit closer to 40%. A debt-to-income ratio (DTI) is a percentage that tells lenders how much money you spend on monthly debt payments versus how much money you have coming into your household. The lower the DTI for a mortgage, the better. Most lenders see DTI ratios of 36% or less as ideal.

Conventional loans are home loans offered by private lenders without any direct government backing. They require a higher credit score, a lower debt-to-income ratio, and usually a slightly higher down payment to qualify. A conventional loan is a great option if you have a solid credit score and a low DTI. Conventional mortgages are also a popular choice for home buyers making a down payment of 20% or more.

The maximum debt-to-income ratio for a conventional loan is 45%. Exceptions can be made for DTIs as high as 49.9% with strong compensating factors like a high credit score and/or lots of cash reserves.

In summary, FHA loans are designed for borrowers with lower credit scores and higher debt-to-income ratios. On the other hand, conventional loans are better suited for borrowers with higher credit scores and lower debt-to-income ratios.

Understanding Income for Marketplace Insurance

You may want to see also

FHA loans are for primary residences, conventional loans are for any residence

FHA loans are typically used to finance primary residences, and borrowers are generally expected to occupy the home as their primary residence. This means that the FHA loan is not suitable for investment properties, vacation homes, or second homes. The FHA requires borrowers to occupy the property they are purchasing and use it as their primary residence for at least a year. This is to prevent investors from profiting off the government loan program's affordable rates and less stringent lending guidelines.

On the other hand, conventional loans are not subject to the same restrictions as FHA loans. Conventional loans are funded by private financial lenders and are not directly backed by a government agency. As a result, conventional loans can be used to finance any type of residence, including primary residences, secondary homes, vacation homes, and investment properties.

The main difference between FHA and conventional loans lies in their credit score and debt-to-income (DTI) requirements. FHA loans have more flexible qualifications, making them accessible to borrowers with lower credit scores and higher DTIs. In contrast, conventional loans typically require a higher credit score and a lower DTI.

Understanding Level Term Insurance: Unlocking the Benefits of Level Term V Policies

You may want to see also

Frequently asked questions

An FHA loan is a mortgage that is guaranteed by the United States government. They are under the governance of the Federal Housing Administration and were designed to be a more accessible alternative to the stricter credit requirements of a Conventional loan.

Conventional loans are the most common of home loans. Unlike FHA loans, a Conventional mortgage is not backed by the government. Instead, they follow guidelines set by Fannie Mae and Freddie Mac, two publicly traded corporations created to expand the mortgage market.

The minimum credit score for a Conventional loan is 620, whereas borrowers may be able to qualify for an FHA loan with a credit score as low as 500 depending on the circumstances. Conventional loans allow for down payments as low as 3%. FHA loans require a 3.5%-10% down payment depending on your credit score.

FHA loans are often a beneficial choice for first-time homebuyers. They are for and were created to help homebuyers with less than perfect credit. They have become one of the most popular loans in the mortgage industry. However, FHA loans usually feature higher interest rates than conventional mortgages and require borrowers to purchase mortgage insurance.

Conventional loans can be beneficial to borrowers who have a credit score of at least 620 and are able to afford a down payment of at least 3%, or 20% if they want to avoid PMI. The more you are able to put down for a down payment, the more beneficial the terms of your loan are likely to be.