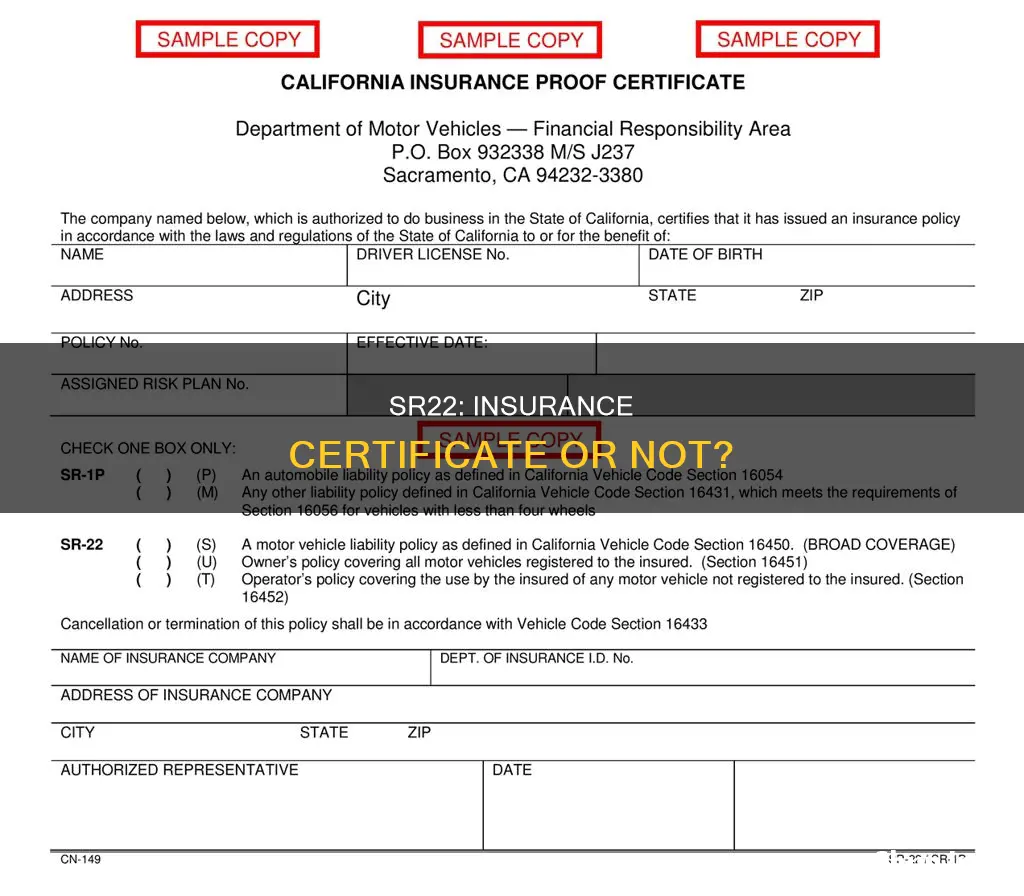

An SR-22 is not a type of insurance but a certificate of financial responsibility or a form filed with a driver's state that proves they have the minimum required auto insurance coverage mandated by the state. It is required for drivers who have been convicted of offences such as DUI, driving without insurance, or multiple traffic violations. An SR-22 is typically required for three years, but this timeframe can vary depending on the state and the reason for the SR-22 requirement.

| Characteristics | Values |

|---|---|

| What is an SR-22? | A certificate of financial responsibility or a form filed with your state to show that you are meeting your state's minimum auto liability insurance requirements. |

| Who needs an SR-22? | Drivers with too many traffic violations, such as DUI or DWI convictions, driving without insurance, or not paying court-ordered child support. |

| How do you get an SR-22? | Contact your insurance company and they will add the SR-22 endorsement to your existing policy and then file the SR-22 form with the state. |

| How much does an SR-22 cost? | The cost varies by state and insurance company, but it is typically around $25. |

| How long do you need an SR-22? | Typically, an SR-22 is required for three years, but it can vary depending on the state and the reason for the SR-22. |

| What happens if you don't comply with the terms of your SR-22? | Failure to comply with the terms of your SR-22 may result in the suspension or revocation of your driver's license. |

What You'll Learn

SR-22 is not a type of insurance

An SR-22 is not a type of insurance, but rather a certificate of financial responsibility or a form filed with your state to show that you are meeting your state's minimum auto liability insurance requirements. It is also known as an SR-22 Bond or SR-22 Form. An SR-22 is not insurance, but a document provided by your insurance company that proves you have liability coverage on your car insurance policy.

An SR-22 is typically required for drivers who have been convicted of certain driving offences, such as DUI, driving without insurance, or multiple traffic violations. It is also necessary for reinstating a revoked or suspended license. The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, usually about three years.

The SR-22 is not insurance itself, but it does typically affect your insurance rates. That's why you may sometimes hear insurance policies that take this form into account referred to as SR-22 insurance. An SR-22 requirement usually makes insurance prices go up, and how much it goes up depends on factors including your driving record, the severity of your offence, and where you live.

Understanding Pre-Existing Conditions: A Comprehensive List for Short-Term Insurance Applicants

You may want to see also

SR-22 is a certificate of financial responsibility

An SR-22 is a certificate of financial responsibility that some drivers are required to file with their state. It is not a type of insurance, but rather a document provided by your insurance company that proves you have liability coverage on your car insurance policy. It is often required for drivers with multiple serious traffic infractions, such as driving without insurance, driving under the influence (DUI), or driving while intoxicated (DWI). An SR-22 is typically ordered by a court or a state and serves as proof that the driver has purchased the minimum required auto coverage mandated by the state.

The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, usually about three years. Failure to comply with the terms of the SR-22 may result in the suspension of your license. The cost of filing an SR-22 form varies by state but is typically around $25.

In Virginia and Florida, a similar form called the FR-44 is used, which requires higher liability limits than the SR-22. The FR-44 is generally mandated for individuals convicted of more serious offenses, such as DUIs with higher blood alcohol concentrations or repeat offenses.

The Complexities of Abortion Coverage: Unraveling Privacy Concerns and Insurance Trails

You may want to see also

SR-22 is required for high-risk drivers

An SR-22 is a certificate of financial responsibility that is required for high-risk drivers. It is not a type of insurance but a form filed with the state to prove that the driver has the minimum amount of car insurance required by law. High-risk drivers are those who have been convicted of multiple traffic violations, received a DUI, or committed serious and/or repeat traffic offences. An SR-22 is typically required to reinstate a revoked or suspended license.

The SR-22 form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period, usually three years. The SR-22 period may begin on the date of the driving offence, the license suspension date, or the date of license reinstatement, depending on the state.

Drivers who need an SR-22 are typically considered high-risk and may face higher insurance rates as a result. The cost of filing an SR-22 varies by state but is typically between $15 and $25. Failure to maintain continuous insurance coverage during the SR-22 period can result in the suspension of the driver's license.

In addition to the SR-22 form, drivers in Florida and Virginia may be required to file an FR-44, which has higher minimum liability coverage amounts.

Understanding Churn in the Insurance Industry: Strategies for Retention and Growth

You may want to see also

SR-22 is needed for a hardship license

An SR-22 is a certificate of financial responsibility that is often required by a state or court order. It is not a type of insurance but rather a form filed with the state to prove that you have car insurance that meets the minimum coverages required by law. An SR-22 is typically required if you've been caught driving without insurance or a valid license, or if you've had a DUI or DWI conviction.

A hardship license is a restricted driving permit issued to a driver whose license has been suspended but who needs limited access to a car for specific reasons, such as commuting to work or taking children to school. In most states, you will need an SR-22 to obtain a hardship license, as it proves that you are carrying the minimum amount of car insurance required by law.

The process for obtaining a hardship license with an SR-22 will vary depending on your state, but here are some general steps to follow:

- Contact your state's Department of Motor Vehicles (DMV) to find out the specific requirements for obtaining a hardship license and SR-22 in your state.

- Shop around for insurance providers that offer SR-22 filings and choose one that meets your needs and budget. Be sure to let the insurance company know that you need an SR-22.

- Obtain a quote from the insurance company and purchase the policy. The insurance company will then add the SR-22 endorsement to your existing policy and file the SR-22 form with your state.

- Submit the SR-22 form and any other required documentation to your state's DMV to apply for your hardship license.

- Once your application is approved, you will be able to drive with your hardship license, but only for the specific purposes allowed under the terms of the license. Be sure to follow all the restrictions and conditions of your hardship license to avoid further penalties.

It's important to maintain your SR-22 and insurance policy for the required period, which is typically three years but can vary by state. If your policy lapses or is cancelled during this time, your insurance company is required to notify the DMV, and your license may be suspended again.

Short-Term Insurance Obligation: Understanding the Necessity

You may want to see also

SR-22 is necessary after a DUI

An SR-22 is a certificate of financial responsibility that is mandated by the state and provided by your auto insurance carrier. It is a form that your insurance company files with the state to prove that you have car insurance meeting the minimum coverages required by law. It is often required after a DUI arrest and/or conviction as a requirement to reinstate any driving privileges.

An SR-22 is not a type of insurance but rather an easy-to-get document from your state's department of motor vehicles. It is typically required if you've been caught driving without insurance or a valid license. An SR-22 is also necessary to reinstate a revoked or suspended license.

The SR-22 form verifies with the state that a driver has legally required auto insurance coverage. The form is filed by the driver's insurance company directly with the state's Department of Motor Vehicles (DMV) and serves as a guarantee that the driver will maintain the required insurance coverage for a specified period.

In most states, an SR-22 is required for three years, but this can vary depending on the number of DUIs on your record and state laws. Your specific requirements for filing an SR-22 will usually be dictated by the judge at your court hearing. You may also receive a letter from the state.

Understanding Term Insurance: A Guide to Unraveling This Crucial Aspect of Financial Planning

You may want to see also

Frequently asked questions

An SR-22 is a certificate of financial responsibility, or a form filed with your state to show that you are meeting your state's minimum auto liability insurance requirements. It is not a type of insurance but a document provided by your insurance company.

Not everyone needs an SR-22. It is typically required for high-risk drivers, such as those convicted of driving under the influence, driving without insurance, or multiple traffic violations.

If your insurance company offers SR-22 filings, you can call them and they will take care of it. They will add the SR-22 endorsement to your existing policy and then file the SR-22 insurance document with the relevant state authority.