When it comes to car insurance, understanding the coverage for additional drivers is crucial. Many insurance policies provide coverage for drivers other than the policyholder, but the extent of this coverage can vary. This paragraph will explore the different aspects of additional driver insurance, including the types of coverage available, the conditions under which it applies, and the potential benefits and limitations for both the policyholder and the additional driver.

What You'll Learn

- Coverage Limits: Determine the extent of insurance coverage for an additional driver

- Policy Exclusions: Identify situations where the additional driver's insurance may not apply

- Premium Impact: Understand how adding a driver affects insurance premiums

- Liability Concerns: Explore legal implications and liability for the additional driver

- Claims Process: Learn the steps for filing a claim with the insurance company

Coverage Limits: Determine the extent of insurance coverage for an additional driver

When considering the insurance coverage for an additional driver, it's crucial to understand the concept of coverage limits. These limits define the maximum amount an insurance policy will pay for a covered loss. In the context of additional drivers, coverage limits can significantly impact the financial protection available to them and the policyholder. Here's a detailed breakdown:

Understanding Coverage Limits:

Coverage limits are typically set for various aspects of an insurance policy, including bodily injury liability, property damage liability, and medical payments. For an additional driver, these limits determine how much financial protection they have in case of an accident. For instance, if an additional driver is involved in a minor collision, the coverage limits will dictate the maximum compensation they can receive for any injuries or vehicle damage.

Determining Relevant Limits:

- Bodily Injury Liability: This limit covers the costs associated with injuries sustained by other parties in an accident. When an additional driver is involved, their policy's bodily injury liability limit will determine how much they are protected against potential lawsuits or medical expenses of the other party.

- Property Damage Liability: This coverage applies to damage caused to another person's property. If an additional driver accidentally damages someone else's vehicle or property, their policy's property damage liability limit will cover the repairs or replacement costs.

- Medical Payments or Personal Injury Protection (PIP): These limits cover medical expenses for the additional driver and their passengers, regardless of fault. It ensures that any necessary medical treatments are covered, promoting a faster recovery and reducing out-of-pocket expenses.

Impact of Coverage Limits on Additional Drivers:

The coverage limits can vary widely depending on the insurance policy and the driver's preferences. Higher limits provide more comprehensive protection but may result in higher premiums. For instance, if an additional driver has a policy with low limits, they might be at risk of incurring significant out-of-pocket costs if they are involved in a serious accident. On the other hand, a policy with higher limits ensures better financial security.

Reviewing and Adjusting Limits:

It is essential for drivers, especially those frequently adding others to their policies, to regularly review their insurance coverage. Life events, such as marriage, divorce, or changes in income, may require adjustments to coverage limits to ensure adequate protection. Additionally, drivers should be aware of the insurance company's policies regarding additional drivers and any potential exclusions or limitations.

In summary, coverage limits play a critical role in determining the extent of insurance protection for additional drivers. Understanding these limits and regularly reviewing policies can help drivers make informed decisions to ensure they are adequately covered while managing their insurance costs effectively.

Triple-A's Auto Insurance: The Best Coverage for Your Needs?

You may want to see also

Policy Exclusions: Identify situations where the additional driver's insurance may not apply

When considering the insurance coverage for additional drivers, it's crucial to understand the policy exclusions that may impact your coverage. Here are some key situations where the insurance for extra drivers might not apply:

- Driving Under the Influence (DUI): One of the most critical exclusions is driving under the influence of alcohol or drugs. Insurance companies typically exclude coverage for any driver who operates a vehicle while impaired. This exclusion is in place to protect both the driver and the insurance provider. If an additional driver is caught driving under the influence, the insurance may not cover any resulting claims or damages.

- Vehicle Use: The specific use of the vehicle can also impact insurance coverage. For instance, if the policy explicitly states that it does not cover commercial or business use, and the additional driver is using the vehicle for work-related purposes, the insurance may not apply. Similarly, if the vehicle is used for racing, stunts, or any illegal activities, the insurance coverage for the additional driver could be void.

- Policy Limitations: Insurance policies often have limitations and restrictions. For example, some policies may exclude coverage for high-performance or luxury vehicles. If the primary driver's policy has these limitations, the additional driver's insurance might not cover certain types of vehicles. Additionally, policies may have age restrictions, excluding coverage for drivers below a certain age or above a specific age limit.

- Pre-existing Conditions: Certain pre-existing conditions or circumstances might void the insurance coverage. For instance, if the primary driver has a history of accidents or traffic violations, and the additional driver is aware of these issues, the insurance may not apply in certain situations. Furthermore, if the additional driver has a medical condition that could affect their driving ability, the insurance provider might exclude coverage for related incidents.

Understanding these policy exclusions is essential for both the primary driver and the additional driver. It ensures that everyone involved is aware of their responsibilities and the limitations of the insurance coverage. Always review the policy documents thoroughly to identify any specific exclusions that may impact your situation.

Auto Insurance Costs: How Much Do They Vary?

You may want to see also

Premium Impact: Understand how adding a driver affects insurance premiums

When you add an additional driver to your insurance policy, it can significantly impact your premiums. This is because insurance companies assess the risk associated with each driver and the overall risk of the policy. Here's a breakdown of how this process works and why it matters:

Risk Assessment: Insurance providers consider various factors to determine the risk of insuring a driver. These factors include age, driving experience, driving record, the type of vehicle driven, and the frequency of use. When you add a new driver, the insurer will evaluate their profile against these criteria. If the additional driver is a young, inexperienced male with a history of speeding tickets, for instance, they may be considered a higher-risk driver, leading to increased premiums.

Policy Impact: The inclusion of an additional driver can affect your insurance policy in several ways. Firstly, it may result in a higher premium for all drivers on the policy. This is because the insurer now has to account for the increased risk associated with the new driver. Secondly, if the additional driver has a poor driving record or is considered a high-risk individual, it could lead to a premium increase for all policyholders, not just the new driver. This is a common practice to ensure that the overall risk of the policy remains manageable.

Benefits of Additional Drivers: Despite the potential premium increase, there are benefits to adding an additional driver to your policy. For families with multiple drivers, it allows for better coverage and potentially lower rates overall. By adding all family members, the insurer can assess their individual risks and provide tailored coverage. This can lead to more accurate premium calculations and better risk management.

Customized Solutions: Insurance companies often offer customized solutions to address the specific needs of each policyholder. When you add an additional driver, the insurer may provide options to adjust the premium accordingly. This could include offering a discount for safe driving habits or providing a higher deductible to lower the premium. Understanding these options can help you make informed decisions and manage your insurance costs effectively.

In summary, adding an additional driver to your insurance policy can impact your premiums due to the increased risk assessment. However, it also provides an opportunity for better coverage and potentially lower rates when managed properly. By understanding the factors influencing premium calculations, you can make informed choices to optimize your insurance expenses.

U.S.A.A. Auto Insurance: Uncovering the Truth About Their Rates

You may want to see also

Liability Concerns: Explore legal implications and liability for the additional driver

When an additional driver is included in a vehicle, there are several legal and liability considerations that come into play. The primary concern is often the insurance coverage and the potential risks associated with having an extra person in the car. Here's an exploration of the legal implications and liability for the additional driver:

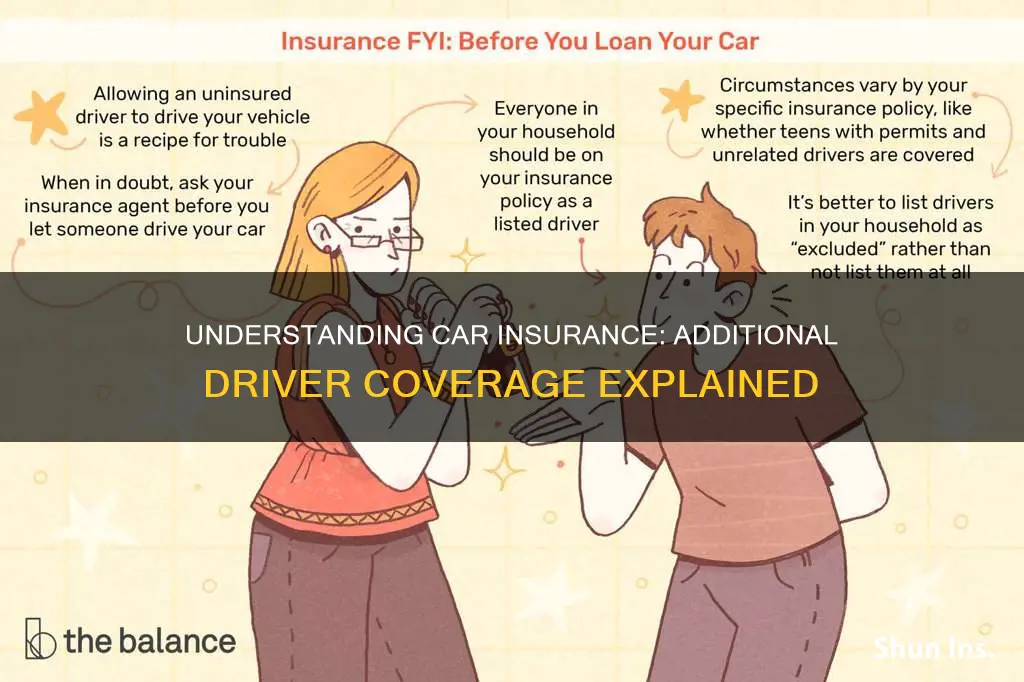

Insurance and Coverage: One of the most critical aspects is understanding the insurance policy and its coverage. In many jurisdictions, the primary driver's insurance policy typically covers a certain number of drivers. Adding an additional driver might require the primary driver to notify their insurance company and potentially obtain an endorsement or a new policy. Failure to do so could result in a lack of coverage for the additional driver in the event of an accident. It is essential to review the policy and ensure that the additional driver is included and protected under the insurance coverage.

Liability in an Accident: The presence of an additional driver can introduce complexities in liability determination. If an accident occurs, the insurance company will investigate the circumstances, including the number of drivers involved. In some cases, the insurance provider might argue that the additional driver's presence contributed to the accident, potentially reducing the compensation for all parties involved. The legal implications can vary, and it is crucial for all drivers to understand their rights and responsibilities. In certain situations, the additional driver might be considered a co-driver or a passenger, which can impact the liability and compensation process.

Permitted Use and Restrictions: Insurance policies often have specific clauses regarding the permitted use of the vehicle. Adding an additional driver might be restricted by the policy, especially if the primary driver's insurance does not cover it. For instance, some policies may only cover the primary driver and their immediate family members. Exceeding these restrictions can lead to a voidance of coverage, leaving the additional driver vulnerable in case of an accident. It is essential to review the policy terms and ensure compliance to maintain valid insurance coverage.

Financial and Legal Consequences: The legal implications can extend beyond insurance coverage. If an accident occurs, the additional driver might face financial and legal consequences, especially if they were at fault or contributed to the incident. This could include paying for damages, medical bills, and legal fees. Understanding the local traffic laws and regulations is vital, as they may impose penalties or liability on all drivers involved, regardless of their status.

In summary, when considering an additional driver, it is crucial to thoroughly review insurance policies, understand the legal implications, and ensure compliance with the permitted use clauses. Being well-informed about these aspects can help protect all drivers involved and prevent potential legal and financial complications.

Progressive Auto Insurance in Colorado: What You Need to Know

You may want to see also

Claims Process: Learn the steps for filing a claim with the insurance company

When you're involved in an accident, the process of filing a claim with your insurance company can be a bit daunting, especially if you're an additional driver. Understanding the steps involved can help ensure a smoother experience and a quicker resolution to your claim. Here's a breakdown of the typical claims process:

- Report the Incident: The first step is to report the accident to your insurance company as soon as possible. This is crucial for two main reasons. Firstly, it ensures that the insurance company is aware of the incident and can begin the claims process. Secondly, it helps prevent any potential issues with your policy, as some insurers may require immediate notification of accidents. You can typically report a claim by calling your insurance provider's customer service line or using their online portal. Have all the relevant details ready, including the date, time, and location of the accident, as well as the other driver's information (if available).

- Document Everything: After reporting the claim, it's essential to document the entire process. Take photos of the accident scene, including any damage to your vehicle and the other party's vehicle. Obtain a copy of the police report, if applicable, as it provides an official record of the incident. Also, gather any medical records or receipts related to injuries sustained in the accident. These documents will be crucial when it comes to filing a claim and proving the extent of your losses.

- Contact the Insurer: Your insurance company will guide you through the next steps. They may ask for additional information or request that you provide a detailed account of what happened. Be honest and provide all the necessary details. The insurer will then assess the claim and determine the coverage applicable to your policy. This is where the concept of 'additional driver' comes into play. If you were an additional driver, the insurance company will need to verify your status and the terms of your coverage.

- Claim Assessment and Settlement: Once the insurer has all the required information, they will assess the claim. This includes evaluating the damage, reviewing medical bills, and considering any other relevant factors. If the claim is approved, the insurance company will provide a settlement offer. This offer will outline the compensation you are entitled to, which may include vehicle repairs, medical expenses, and any other covered losses. Review the offer carefully and discuss any concerns with the insurer.

- Repair and Follow-up: If the claim involves vehicle repairs, the insurance company will often provide a rental car or reimburse you for temporary transportation. After the repairs are completed, you'll need to provide proof of the work done to the insurer. This ensures that the settlement amount is accurate and covers all necessary expenses. Finally, maintain open communication with the insurance company throughout the process to address any questions or concerns promptly.

Essential Guide to Washington's Auto Insurance Minimums

You may want to see also

Frequently asked questions

Adding an additional driver to your insurance policy ensures that any person who frequently operates your vehicle is covered under your insurance. This provides financial protection and peace of mind, as it covers potential accidents or claims involving the additional driver.

Insurance companies typically assess the risk associated with the additional driver by considering factors such as their driving record, age, and experience. They may require the additional driver to provide proof of a valid driver's license and possibly a driving history report to ensure they meet the insurer's criteria for coverage.

No, it is essential to inform your insurance provider about any additional drivers. Failing to do so could result in a void policy or denial of claims if an accident occurs. Insurance companies need to be aware of all drivers using the vehicle to accurately assess the risk and determine the appropriate coverage.

Yes, many insurance companies offer discounts or benefits for adding an additional driver. These can include multi-car discounts, family discounts, or safe driver discounts. By providing proof of the additional driver's safe driving record or other relevant information, you may be eligible for reduced premiums or special coverage options.