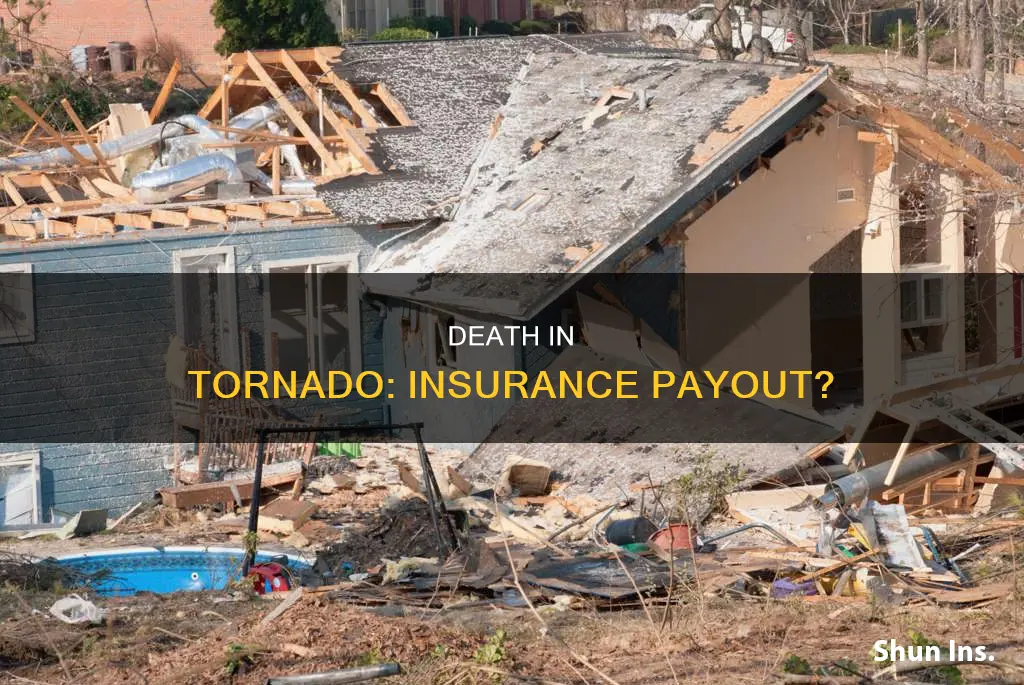

Whether or not dying in a tornado is considered accidental for insurance purposes depends on the type of insurance policy and the coverage it offers. In most cases, standard homeowners insurance policies cover tornado damage to the property and personal belongings. This includes damage caused by wind, rain, hail, and falling trees. However, it is important to carefully read the policy as some insurance companies have wind exclusions, and flood damage is generally not covered.

When it comes to life insurance, it is important to review the specific terms and conditions of the policy to determine if death caused by a tornado would be considered accidental. In general, accidental death insurance covers deaths resulting from unexpected or unintentional events, but the definition of an accident can vary across insurance providers.

What You'll Learn

- Home insurance policies typically cover tornado damage, but there are exceptions

- Home insurance usually won't cover damage caused by flooding from rain accompanying a tornado

- Separate wind and hail deductibles may apply, especially in high-risk areas

- If a fallen tree damages your home during a tornado, your insurance policy may cover the damage

- If your home is unsafe to live in after a tornado, your insurance may cover temporary living expenses

Home insurance policies typically cover tornado damage, but there are exceptions

The insurance industry classifies tornadoes as windstorms, and windstorms are covered by most insurance policies. However, some insurance policies may exclude wind damage, so it's important to read your policy carefully to understand whether it includes coverage for wind damage. If your policy excludes windstorm damage, it probably will not help cover the cost of repairs if your home is damaged by a tornado.

Even if your home policy doesn't exclude windstorm damage, don't assume that all tornado damage is covered by your homeowner's insurance. Almost all home policies contain exclusions for things like flooding and damage attributed to poor maintenance. So, if your home floods as a result of torrential rains that accompany a tornado, your home insurance policy is unlikely to cover the damage. You would need a separate flood insurance policy to recoup your losses.

Similarly, if a tree falls on your home during a tornado, your insurance company may refuse to pay for repairs if the tree was rotting and should have been removed prior to the storm.

Home insurance is broken down into three main coverage types: dwelling insurance, personal property coverage, and additional living expenses coverage.

Dwelling insurance covers the physical structure of a house and other structures such as a garage or deck. It pays to repair or rebuild your home if it's damaged or destroyed by a tornado.

Personal property coverage reimburses you if your personal belongings are destroyed. For example, if tornado winds sent debris crashing through your window, your dwelling coverage would typically pay to repair the window. But if that debris also shattered your TV, your personal property coverage would pay for the cost.

Additional living expenses coverage reimburses you for costs you incur if your residence becomes uninhabitable due to tornado damage. It covers expenses such as hotel stays and restaurant meals.

When it comes to replacing your belongings, your insurer will usually reimburse you for the item's actual cash value or replacement cost. Actual cash value coverage factors in depreciation, while replacement cost coverage reimburses you for the cost of replacing a damaged item with one of similar type and quality.

If you live in an area at high risk of tornadoes, you may need to buy a separate windstorm policy for financial protection against wind destruction. Separate wind and hail deductibles may also apply, particularly if you live in a high-risk area.

Transferring the Policy: Navigating Insurance Ownership Changes

You may want to see also

Home insurance usually won't cover damage caused by flooding from rain accompanying a tornado

Home insurance typically covers tornado damage, including damage to the home and personal belongings caused by wind, rain, and fallen trees. However, it's important to note that home insurance usually does not cover damage caused by flooding, including flooding from rain accompanying a tornado.

While tornadoes themselves do not require special coverage, flooding is a separate category that needs to be specifically included in your insurance policy. This distinction is crucial because tornadoes can be accompanied by heavy rainfall, which can result in flooding. Therefore, it is essential to have a separate flood insurance policy to protect against flood damage caused by a tornado or any other event.

To clarify, standard home insurance policies generally cover most internal and sudden water damage, such as wind-driven rain that leaks into your home through openings caused by a tornado. However, they do not cover flooding damage, which is defined as water entering your home and causing damage due to flooding events.

It is also worth noting that some insurance policies may have wind exclusions, which reduce or eliminate coverage for wind damage resulting from a tornado or other windstorm. Therefore, it is important to carefully review your policy to understand its covered perils and exclusions.

Additionally, home insurance policies typically include dwelling coverage, which pays to repair or rebuild your home if it is damaged or destroyed by a tornado. Personal property coverage may also be included to repair or replace damaged or destroyed belongings inside your home.

AWD: Performance Insurance or Not?

You may want to see also

Separate wind and hail deductibles may apply, especially in high-risk areas

Separate Wind and Hail Deductibles

When it comes to tornadoes, it's not just the wind that can cause damage—hail can also be a major factor. And if you live in an area that's prone to severe weather events, you may need to pay special attention to your insurance policy's wind and hail deductibles.

A wind and hail deductible is a specific type of deductible that applies to losses caused by wind and hail. It's important to note that this is separate from your standard home insurance deductible and is typically higher. In other words, it's an additional cost that you'll need to cover out of pocket before your insurance policy kicks in.

Wind and hailstorms can cause significant damage to your home, including damage to the roof, windows, and siding. The costs of repairing or replacing these damages can quickly add up. Having a separate wind and hail deductible means that you, as the homeowner, will be responsible for covering a larger portion of the repair costs.

Unlike standard deductibles, which are usually a fixed dollar amount, wind and hail deductibles are typically calculated as a percentage of your home's insured value. For example, if you have a $200,000 insurance policy on your home and a 5% wind and hail deductible, you would be responsible for paying $10,000 out of pocket before your insurance coverage begins.

High-Risk Areas

If you live in an area that is prone to severe weather events, such as tornadoes, hurricanes, or hailstorms, it's likely that your insurance policy will include a separate wind and hail deductible. These areas are often referred to as "high-risk" and include states like Texas, Oklahoma, Kansas, Nebraska, and other Midwestern states. Insurers implement these separate deductibles to reduce their costs associated with storm damage.

How to Prepare

If you live in a high-risk area, it's crucial to review your insurance policy carefully. Understand what your wind and hail deductibles are and how they will affect you financially in the event of a claim. Make sure you have the necessary funds set aside to cover these deductibles if needed. Additionally, consider adding additional coverage to your policy, such as windstorm insurance, to ensure you're protected in the event of a tornado or other severe weather event.

Supplemental Insurance: Understanding Its Role and Relationship with Short-Term Coverage

You may want to see also

If a fallen tree damages your home during a tornado, your insurance policy may cover the damage

Homeowners insurance typically covers damage caused by wind and hail, which are common during tornadoes. Most standard policies include dwelling coverage, which can help pay for repairs or rebuilding if wind from a tornado damages your home. Personal property coverage may also help pay for repairing or replacing damaged or destroyed belongings inside your home.

However, some insurance policies may exclude wind damage, so it's important to carefully review your policy to understand its covered perils and exclusions. Additionally, there may be situations where wind damage is covered but with a separate wind/hail deductible, which can be higher than your standard policy deductible.

If a fallen tree damages your home during a tornado, your insurance coverage will depend on whether windstorms are listed as a covered peril in your policy and whether your policy has any wind exclusions. In most cases, if wind caused the tree to fall onto your home and windstorms are covered, your insurance company will help pay for repairs. On the other hand, if the tree fell due to maintenance issues, such as neglect or rotting, your insurance policy may not cover the damage.

It's also important to note that homeowners insurance typically won't cover the cost of removing a fallen tree unless it damages your home or blocks a driveway or handicap access ramp.

The Intricacies of SQ: Unraveling the Insurance Industry's Unique Acronym

You may want to see also

If your home is unsafe to live in after a tornado, your insurance may cover temporary living expenses

To determine if your insurance covers temporary living expenses, review your policy to check if it includes coverage for tornadoes and windstorms. Some policies may have a wind exclusion, which could reduce or exclude coverage for wind-related damage. Additionally, understand the limits and deductibles associated with ALE coverage. The limit is often set as a percentage of your dwelling insurance, and there may be a separate windstorm deductible for tornado claims.

It is also important to keep receipts for all expenses incurred while your home is being repaired or replaced, as reimbursement for additional living expenses typically requires proper documentation.

The Importance of Term Insurance for Wives: Securing a Family's Future

You may want to see also

Frequently asked questions

Tornado damage is typically covered by a standard homeowners insurance policy, but there may be exceptions. Most standard homeowners insurance policies include dwelling coverage, which may help pay to repair or rebuild your home if wind from a tornado damages it. However, some insurance policies may exclude wind damage, so it's important to read your policy carefully.

Dwelling coverage is offered on an "open perils" basis, meaning your home insurance will generally cover damage to your home's structure, as long as it wasn't caused by a peril specifically excluded by the policy. Windstorm and hail damage are generally not among those exclusions.

Whether or not your insurer will help pay for damage caused by a fallen tree depends on your policy's coverages. For example, if wind caused the tree to fall and your policy includes wind as a covered peril, your insurance company will likely help pay for repairs. On the other hand, if the tree fell due to a maintenance issue, your homeowners insurance policy probably won't cover the repairs.