Prepaid insurance is an insurance premium paid in advance of the coverage period. It is considered a prepaid expense, where a business or individual pays for something before using it. Prepaid insurance is treated as an asset in accounting records, specifically a current asset, and is gradually charged to expense over the period covered by the insurance contract. It is considered a debit on the asset account because it is a resource that will diminish over time.

What You'll Learn

Prepaid insurance is a current asset

A current asset is a financial resource that can be easily liquidated, or converted to cash, in a year or less. In contrast, a non-current or fixed asset, like real estate, cannot be easily liquidated in a year or less. Prepaid insurance is usually classified as a current asset because the term of the related insurance contract that has been prepaid is usually for a period of one year or less.

When a business pays for an insurance contract in advance, the total amount is shown as a current asset and is carried as an asset until the coverage is used. When the coverage is applied for one month, that amount is expensed on the income statement, and it is no longer shown as an asset.

Prepaid insurance is also considered an asset because of its redeemable value. Any remaining prepaid portion of the premium could be refunded to the business if the policy is cancelled before the period covered by the premiums has expired. For example, if a business had purchased six months of insurance and decided to cancel the policy after two months, it could get a refund for the four remaining unused months of coverage. This is a source of future cash revenue for the business.

Prepaid insurance is important because a business should correctly record all of its transactions and resources to have accurate financial statements. Recording prepaid insurance as an asset and adjusting that asset as the policy is consumed on a monthly basis ensures that the business is accurately recording the true value of the policy over time.

The Green Oasis of Insurance: Understanding the Concept of Captives and Their Benefits

You may want to see also

Prepaid insurance is a prepaid expense

Prepaid insurance is a type of prepaid expense. A prepaid expense is an expenditure paid for in advance by a business or individual. Prepaid insurance is therefore an insurance contract that has been paid for in advance of the coverage period.

When an individual or business takes out an insurance policy, they usually pay a premium—a regular, recurring payment—to their insurer in exchange for insurance coverage. Typically, these premiums are paid monthly. However, some insurance providers allow customers to pay multiple monthly premiums in advance, in the form of a single lump sum. This is known as prepaid insurance. The payment may cover six or twelve months of premiums, and providers often offer discounts as an incentive.

Prepaid insurance is considered a prepaid expense because it is paid for in advance of the coverage period. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. For example, many auto insurance companies operate under prepaid schedules, so insured parties pay their full premiums for a 12-month period before the coverage actually starts. The same is true of many medical insurance companies.

Prepaid insurance is carried on an insurance company's balance sheet as a current asset until it is consumed. That's because most prepaid assets are consumed within a few months of being recorded. When the insurance coverage comes into effect, it is moved from an asset and charged to the expense side of the company's balance sheet.

Prepaid insurance is important because it allows businesses to correctly record all of their transactions and resources, ensuring they have accurate financial statements.

Adjusting Your Auto-Payments with Erie Insurance: A Step-by-Step Guide

You may want to see also

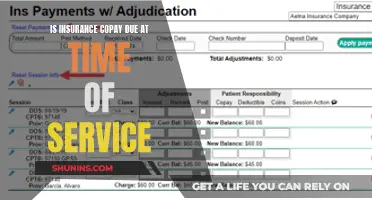

Prepaid insurance is recorded as a debit

Prepaid insurance is the fee associated with an insurance contract that has been paid in advance of the coverage period. Prepaid insurance is treated in the accounting records as an asset, which is gradually charged to expense over the period covered by the related insurance contract. Prepaid insurance is commonly recorded because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would be at risk of having its insurance coverage terminated.

Here's how an insurance company accounts for prepaid insurance. The premiums or payment are recorded in one accounting period, but the contract isn't in effect until a future period. A prepaid expense is carried on an insurance company's balance sheet as a current asset until it is consumed. That's because most prepaid assets are consumed within a few months of being recorded.

When the insurance coverage comes into effect, it is moved from an asset and charged to the expense side of the company's balance sheet. Insurance coverage, though, is often consumed over several periods. In this case, the company's balance sheet may show corresponding charges recorded as expenses.

Prepaid insurance is usually considered a current asset, as it becomes converted to cash or used within a fairly short time. But if a prepaid expense is not consumed within the year after payment, it becomes a long-term asset, which is not a very common occurrence. The payment of the insurance expense is similar to money in the bank—as that money is used up, it is withdrawn from the account in each month or accounting period.

Biopsy: Outpatient Surgery Insurance Coverage

You may want to see also

Prepaid insurance is charged to expense

Prepaid insurance is a fee associated with an insurance contract that has been paid in advance of the coverage period. It is considered a prepaid expense, which is an expenditure paid for before it is used. Prepaid insurance is typically paid a full year in advance, but it may also cover longer periods.

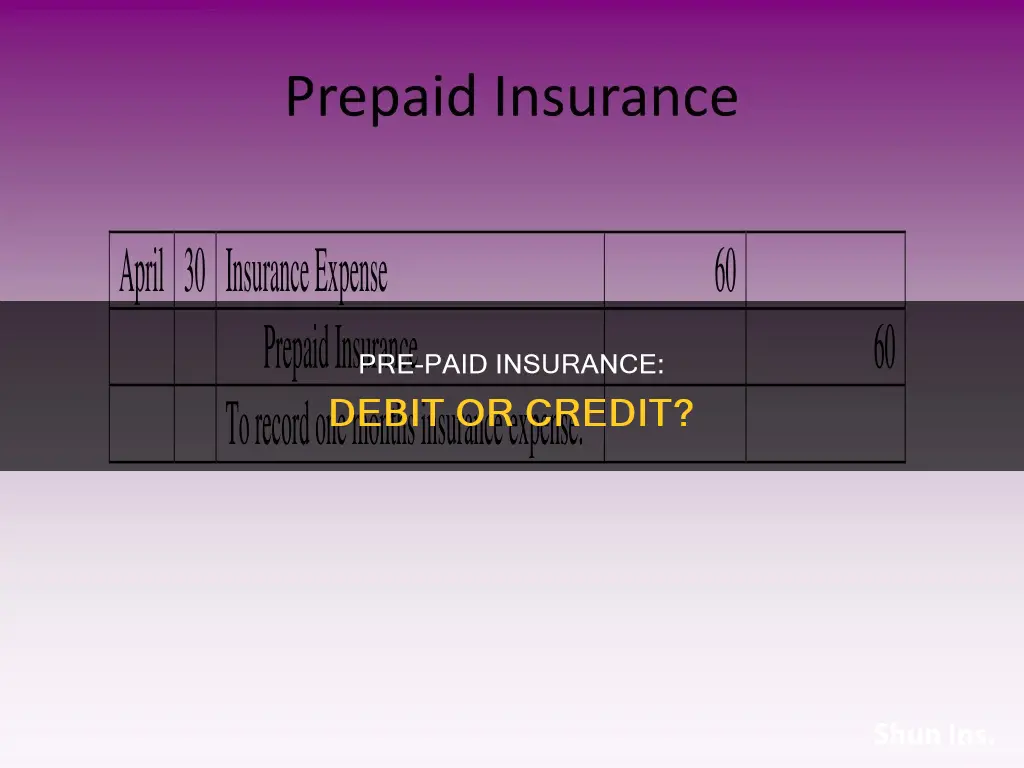

When prepaid insurance is initially purchased, the payment is recorded as a debit to prepaid insurance and a credit to cash. This is because the payment is made before the insurance contract comes into effect. Once the contract is in effect, the insurance company moves the payment from an asset to the expense side of its balance sheet. This is because the insurance coverage is being consumed.

For example, a business that buys one year of general liability insurance in advance for $12,000 would initially record a debit of $12,000 to the prepaid insurance (asset) account and a credit of $12,000 to the cash (asset) account. In each of the next twelve months, there would be a journal entry debiting the insurance expense account and crediting the prepaid expenses (asset) account. At the end of the twelve months, the asset account would show a balance of zero, and the total of the prepaid amount would appear in the insurance expense account.

The Heat is On: Climate Change's Impact on the Insurance Industry

You may want to see also

Prepaid insurance is an advance payment

When a business or individual purchases prepaid insurance, the contract generally covers a period of time in the future. For example, auto insurance companies often operate under prepaid schedules, with insured parties paying their full premiums for a 12-month period before coverage starts. Similarly, medical insurance companies often require upfront payment before coverage begins.

From an accounting perspective, prepaid insurance is treated as an asset on a balance sheet. It is considered a prepaid asset, which is a way to express the benefits of advance payments in accounting terms. An asset is any resource that has monetary value, and a prepaid asset has economic value to the business because of its future benefits. Prepaid insurance is considered a prepaid asset because it benefits future accounting periods, reducing monthly premium expenses and overall costs, while still providing coverage for the business.

Prepaid insurance is initially recorded as a debit to the asset account and as a credit to the cash account. As the insurance coverage is consumed over time, the asset value is reduced, and the expense value increases. At the end of the prepaid period, the asset account should show a balance of zero, while the expense account reflects the total prepaid amount.

The Evolution of Insurance: Navigating Management Changes

You may want to see also

Frequently asked questions

Prepaid insurance is the fee associated with an insurance contract that has been paid in advance of the coverage period. It is usually paid annually, but sometimes covers more than 12 months.

Prepaid insurance is recorded as an asset on a balance sheet, as it is a resource that will diminish over time. It is then gradually charged to expense over the period covered by the insurance contract.

Prepaid insurance is considered a debit because it is a resource that will diminish over time. As the policy is used, the policy's value for those months will be recorded as a credit, and the entries in the two columns will eventually cancel each other out.

Prepaid insurance is beneficial as it is considered a prepaid asset, which has economic value to the business because of its future benefit. It relieves them of the monthly premium expense, reducing their costs while still providing coverage. It also often comes with a discount on the premium price.