Variable life insurance is a type of permanent life insurance that offers a unique opportunity for policyholders to take control of their policy's growth potential. Unlike other life insurance policies, it combines lifelong insurance coverage with an investment element, allowing policyholders to direct their policy's cash value into various stock and bond accounts. While this offers the potential for significant growth when the market performs well, it also comes with higher risk and less stability. The cash value in a variable life policy can fluctuate daily, and market dips can affect the cash value, meaning policyholders shoulder both the rewards and the risks. This article will explore the topic of variable life insurance and answer the question: Is the cash value guaranteed?

| Characteristics | Values |

|---|---|

| Type of Insurance | Permanent life insurance |

| Investment Component | Yes |

| Death Benefit | Guaranteed minimum |

| Cash Value | Not guaranteed |

| Cash Value Account | Yes |

| Cash Value Investment Options | Mutual funds, stocks, bonds, fixed-rate accounts |

| Cash Value Sensitivity | Fluctuates daily |

| Accessing Funds | Loans against cash value |

| Policy Lapsing | Possible if cash value too low |

| Policy Termination | Possible if balance too low to cover fees |

| Premium | Fixed |

| Risk | High |

What You'll Learn

- Variable life insurance policies are permanent and have a higher cash-earning potential than traditional policies

- The cash value of a variable life insurance policy can be invested, but returns aren't guaranteed

- Variable life insurance policies are complex and require more hands-on attention

- The death benefit of a variable life insurance policy is typically structured in one of two ways: level death benefit or face amount plus cash value

- Variable life insurance policies are typically more expensive than other types of permanent life insurance policies

Variable life insurance policies are permanent and have a higher cash-earning potential than traditional policies

Variable life insurance is a permanent life insurance policy that offers lifelong coverage and includes an investment component. This means that it provides a guaranteed minimum death benefit for beneficiaries, while also allowing policyholders to grow the cash value of their policy by investing part of their premium in various funds, such as stocks or bonds.

Variable life insurance policies are designed to offer higher cash-earning potential than traditional policies. The cash value of these policies can grow significantly when the market performs well, as policyholders direct their cash value into various stock and bond accounts. However, it's important to note that there are no guarantees, and market downturns can lead to a decrease in the cash value and added benefits.

The investment component of variable life insurance shifts control to the policyholder, allowing them to make investment choices. This flexibility means that the cash value of the policy can fluctuate daily, and policyholders need to be comfortable with this level of risk. While it offers the potential for higher returns, there is also the possibility of losing money if investments perform poorly.

Variable life insurance policies are long-term commitments that may not be suitable for everyone, especially those who prefer more stability in their investments. Policyholders need to actively monitor their investments to ensure that a downturn in cash value doesn't lead to higher costs or policy termination.

In summary, variable life insurance policies offer permanent coverage and provide policyholders with the opportunity to grow their cash value through investments. While these policies have the potential for higher returns, they also carry more risk compared to traditional policies due to the fluctuating nature of the market.

Preparing for a Life Insurance Interview: What to Expect

You may want to see also

The cash value of a variable life insurance policy can be invested, but returns aren't guaranteed

Variable life insurance is a permanent life insurance policy that combines lifelong insurance coverage with an investment element. This means that, unlike other life insurance policies, variable life insurance policyholders can take charge of their policy's growth potential by investing the cash value of their policy.

The cash value of a variable life insurance policy can be invested in securities (often called subaccounts), which resemble mutual funds. These include:

- An index fund, such as the S&P 500.

- A portfolio of equities, such as an emerging markets fund.

However, returns on these investments are not guaranteed. The value of the cash account will rise or fall depending on market performance. If the market is doing well, the cash value of the policy will increase. If the market is doing poorly, the cash value of the policy will decrease. Therefore, there is a level of risk involved in investing the cash value of a variable life insurance policy.

Some policies may offer a fixed-rate investment option, which has less risk but also a lower potential reward. This option guarantees a rate of return to reduce the overall risk.

It is important to note that the investment of the cash value of a variable life insurance policy is not a guaranteed process. The potential for greater returns comes with the possibility of losses. Policyholders should carefully consider their financial goals and risk tolerance before choosing to invest the cash value of their variable life insurance policy.

Life Insurance for 20-Year-Olds: Necessary or Not?

You may want to see also

Variable life insurance policies are complex and require more hands-on attention

The complexity of variable life insurance policies stems from their dual nature as insurance policies and investment vehicles. On the one hand, they function like traditional life insurance policies, with beneficiaries receiving a death benefit upon the policyholder's death. On the other hand, they also serve as investment tools, allowing policyholders to invest the cash value of their policies in various funds, such as stocks, bonds, or mutual funds. This investment component introduces a level of risk and volatility not typically associated with traditional life insurance policies.

The hands-on attention required for variable life insurance policies is due to the active role policyholders play in managing their investments. Policyholders choose how to allocate their cash value across different investment options, and the performance of these investments directly impacts the value of the policy. As a result, policyholders need to actively monitor and manage their investments to ensure they are meeting their financial goals and minimizing risk.

The prospectus, provided by the insurance company, outlines the details of the policy, including fees, expenses, investment options, and other features. It is crucial for policyholders to thoroughly understand the prospectus to make informed decisions about their investments.

Variable life insurance policies also tend to have higher fees and charges associated with the policy's investment component. These fees, such as mortality and expense risk charges, sales and administrative fees, and investment management fees, can impact the overall returns of the policy. Therefore, policyholders need to carefully consider these costs when evaluating the potential risks and rewards of the policy.

In summary, variable life insurance policies are complex financial products that require a hands-on approach due to their dual nature as insurance policies and investment vehicles. Policyholders need to actively manage their investments, understand the associated fees and risks, and monitor the performance of their investments to ensure their policy aligns with their financial goals.

How Much Coverage: Understanding 15 Units of Life Insurance

You may want to see also

The death benefit of a variable life insurance policy is typically structured in one of two ways: level death benefit or face amount plus cash value

Variable life insurance is a permanent life insurance policy that combines lifelong insurance coverage with an investment element. The death benefit of a variable life insurance policy is typically structured in one of two ways: level death benefit or face amount plus cash value.

In the level death benefit structure, the death benefit remains constant and is equal to the face value of the policy when it is purchased. This means that the beneficiary will receive a payout that is equal to the face value of the policy, regardless of the performance of the investments within the policy.

On the other hand, the face amount plus cash value structure provides a higher payout to the beneficiary, as they will receive the cash value in addition to the policy's face value. This type of policy is typically more expensive due to the higher payout.

It is important to note that the death benefit in a variable life insurance policy is not always guaranteed to remain constant or increase. The performance of the investments within the policy can affect the death benefit, especially if the cash value significantly underperforms. Therefore, it is crucial to carefully review the policy's terms and conditions to understand the specific structure of the death benefit.

Variable life insurance policies offer policyholders the opportunity to invest their cash values into separate investment accounts, such as portfolios of stocks, bonds, and other investments. These accounts are similar to mutual funds and may be subject to market risks, which can impact the overall value of the policy. Policyholders should be comfortable with risk and actively monitor their investments to ensure the policy remains in force.

In summary, the death benefit of a variable life insurance policy can be structured in one of two ways: level death benefit or face amount plus cash value. The level death benefit provides a constant payout, while the face amount plus cash value structure offers a higher payout to the beneficiary. However, the performance of investments within the policy can impact the death benefit, and policyholders should carefully review the terms and conditions to understand the specific structure of their chosen policy.

Life Insurance Beneficiary: Does Location Matter?

You may want to see also

Variable life insurance policies are typically more expensive than other types of permanent life insurance policies

Variable life insurance is a type of permanent life insurance that combines lifelong insurance coverage with an investment element. It is typically more expensive than other types of permanent life insurance policies due to several factors. Firstly, variable life insurance policies have higher premiums because they offer the potential for higher returns. Policyholders can invest their cash value in various investment options, such as stocks, bonds, and mutual funds, which can lead to significant growth in the cash value. However, it's important to note that the cash value can also decrease if the market underperforms.

Another factor contributing to the higher cost of variable life insurance is the investment management fees associated with these policies. These fees, which average around 1% of assets managed annually, are included in the premiums and make variable life insurance one of the most expensive insurance options. Additionally, variable life insurance policies tend to have higher fees in general, including mortality and expense risk charges, sales and administrative fees, and policy loan interest. These fees further increase the overall cost of the policy.

Furthermore, variable life insurance policies require a more hands-on approach due to their complexity and investment risk. Policyholders need to actively monitor their investments and be comfortable with market risks. The cash value of a variable life insurance policy can fluctuate daily, and insufficient funds could lead to policy termination if not carefully managed. This level of involvement and potential risk may be off-putting to some individuals, especially those who prefer more stability and guaranteed returns.

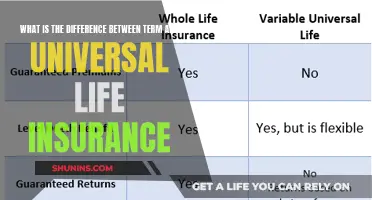

While variable life insurance offers the potential for higher returns, it's important to weigh the benefits against the higher costs and increased risk. For individuals seeking a more stable and low-maintenance option, other types of permanent life insurance policies, such as whole life insurance or universal life insurance, may be more suitable and cost-effective choices. These policies offer guaranteed returns, level premiums, and a fixed death benefit, providing peace of mind and long-term financial security.

Life Insurance and Taxes: What You Need to Know

You may want to see also

Frequently asked questions

No, the cash value in a variable life insurance policy is not guaranteed. The cash value of a variable life insurance policy is dependent on market performance and can fluctuate.

Variable life insurance is a type of permanent life insurance policy that combines lifelong insurance coverage with an investment element. The policyholder can direct the policy's cash value into various investment options, typically mutual funds, and the cash value can grow significantly when the market performs well.

Variable life insurance offers the potential for higher returns than other permanent life insurance policies, and the cash value can be accessed while the policyholder is alive. However, it is more expensive than term life insurance, there is no guaranteed minimum cash value, and the policyholder takes on all the investment risk.