Life insurance is a way to ensure that your loved ones are financially provided for in the event of your death. It is a common misconception that single people do not need life insurance, but there are several reasons why a single male may want to consider it. Firstly, if you have people who depend on your income, such as ageing parents or siblings, life insurance can ensure they are taken care of. Secondly, life insurance can help cover any outstanding debts, such as private student loans or a mortgage, so that your co-signers are not left with the burden. Thirdly, life insurance can also cover funeral and burial expenses, which can easily cost upwards of $10,000. Finally, if you are young and healthy, getting life insurance now can lock in lower premiums, as rates tend to increase with age and declining health.

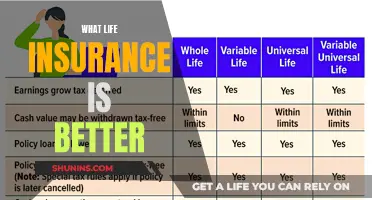

| Characteristics | Values |

|---|---|

| Purpose | Provide cash to family if the insured person passes away |

| Main consideration | Whether a spouse or children are depending on the insured person's earnings |

| Common reasons for single people to get life insurance | To pay off debt, cover final expenses, grow wealth, lock in coverage while young and healthy, leave a legacy |

| Common reasons for people with dependents to get life insurance | To pay off debt, cover final expenses, ensure children have funds for education, replace income |

| Factors that influence the cost of life insurance | Age, sex, health, tobacco use, hobbies, criminal history, occupation, financial history, coverage amount |

What You'll Learn

- Should a single male get life insurance to cover funeral costs

- What are the benefits of life insurance for a single male with a family history of health issues?

- Should a single male with a mortgage get life insurance

- What are the pros and cons of life insurance for a single male business owner?

- How does life insurance help a single male leave a legacy?

Should a single male get life insurance to cover funeral costs?

Life insurance is a way to provide financial support to your loved ones after your death. It can be used to cover funeral costs, pay off debts, or provide an income replacement for your family. Burial insurance, also known as funeral or final expense insurance, is a specific type of life insurance policy designed to cover funeral, burial, and other end-of-life expenses. It is typically a whole life insurance policy with a smaller death benefit, ranging from $5,000 to $25,000, meant to cover final expenses and funeral costs.

Cost of Funerals

Funerals can be expensive, with the average cost of a funeral and burial in the United States ranging from $7,000 to $10,000. This includes funeral home services, burial or cremation, a casket or urn, and the purchase of a headstone. By purchasing burial insurance, you can help ease the financial burden on your loved ones by ensuring that the funeral costs are covered.

Health and Age Considerations

Burial insurance is often marketed to older individuals with tight budgets and poor health. It is important to note that most burial insurance policies are available for individuals between the ages of 50 and 85. The cost of burial insurance is determined by age, gender, and health. The younger and healthier you are when you purchase the policy, the lower the premiums will be. If you are a young, healthy adult, you may be better off with a term life insurance policy, which is typically more affordable.

Existing Life Insurance Coverage

If you already have a life insurance policy that is large enough to cover your final expenses, you may not need a separate burial insurance policy. However, it is important to review your existing policy to ensure that it will provide sufficient coverage for your funeral costs. Term life insurance policies may expire if you outlive the policy term, while burial insurance is typically a whole life policy that lasts until your death.

Other Options for Funeral Costs

There are alternative options to burial insurance for covering funeral costs. You can set up a payable-on-death (POD) account, which allows you to put money aside specifically for funeral expenses. You can also consider pre-need insurance, which involves contracting with a funeral service provider and making specific arrangements for your funeral services. The policy's payout then goes directly to the funeral home rather than individual beneficiaries.

In conclusion, a single male should consider getting burial insurance to cover funeral costs if he wants to ensure that his final expenses are covered and ease the financial burden on his loved ones. However, it is important to weigh the pros and cons based on individual circumstances, such as age, health, and existing life insurance coverage.

Life Insurance from an IRA: A Smart Financial Move?

You may want to see also

What are the benefits of life insurance for a single male with a family history of health issues?

Life insurance is a contract that ensures your loved ones are financially protected after your death. While it is a common misconception that single people do not need life insurance, there are several benefits to investing in life insurance early, especially for a single male with a family history of health issues.

Firstly, life insurance can protect your loved ones from financial burdens, such as funeral and burial expenses, which can easily cost over $10,000. It can also help pay off any remaining debts, including student loans, credit card debt, and mortgages. This is especially important if you have a family history of health issues, as you may be at a higher risk of developing serious health conditions, leading to costly medical bills. Life insurance can provide peace of mind that your loved ones will not be left with these financial burdens.

Secondly, if you are a young, single male, investing in life insurance now can help you secure lower premiums. The younger and healthier you are, the less you will pay for life insurance. Additionally, if there is a possibility that you could develop health issues later in life, getting insured while you are young and healthy can help you qualify for a more affordable policy.

Thirdly, life insurance can provide financial protection for those who depend on you, such as aging parents or disabled siblings. If anyone relies on your income, life insurance can ensure they are taken care of financially if something happens to you.

Lastly, life insurance can also benefit you while you are living. Permanent life insurance, for example, accumulates cash value on a tax-deferred basis, which you can use to increase your personal wealth, supplement your retirement income, or cover emergency expenses.

In conclusion, while life insurance is not a one-size-fits-all solution, it can provide several benefits for a single male with a family history of health issues, including financial protection for yourself and your loved ones, lower premiums if purchased early, and peace of mind knowing that your loved ones will be taken care of.

Selling Fixed Annuities: Does a Life Insurance License Suffice?

You may want to see also

Should a single male with a mortgage get life insurance?

Life insurance is a way to ensure that your loved ones are financially provided for in the event of your death. While many people associate life insurance with married people or those with children, there are several reasons why a single male with a mortgage would benefit from having life insurance.

Protecting Others from Financial Burden

Even if you are single, life insurance can protect your loved ones from financial burdens that may arise from your passing. For example, if your next of kin would struggle to cover your funeral expenses, a life insurance policy could provide the funds they need to pay for your funeral service, burial, and other costs. This is especially important if you have a mortgage, as your loved ones may be left to deal with the financial burden of paying it off.

Peace of Mind

If you have a family history of health issues, getting life insurance while you are still young and single can give you peace of mind. It can also ensure that your loved ones have the ability to pay for any medical costs that may arise, especially if you get a critical or chronic illness rider or a long-term care rider.

Leaving a Legacy

Life insurance can also be a way for you to leave a legacy when you pass away. You can name an organization you care about as your life insurance beneficiary, allowing you to make a large donation to a cause close to your heart.

Affordability

If you are young and single, you may pay less for life insurance coverage since rates tend to be lower for younger people. Getting life insurance at a younger age can also give you access to lower rates and longer terms, which may be beneficial if you think you may need life insurance further down the line.

In conclusion, while the decision to purchase life insurance is a personal one, there are several compelling reasons why a single male with a mortgage may want to consider getting life insurance. It can provide financial protection for your loved ones, give you peace of mind, and allow you to leave a lasting legacy.

Life Insurance: Offset Taxes and Secure Your Future

You may want to see also

What are the pros and cons of life insurance for a single male business owner?

Life insurance is a recommended precaution for almost everyone who supports a family, but business owners usually have a greater need for protection. As a single male business owner, you may be wondering if you need life insurance. Here are some pros and cons to help you decide:

Pros of Life Insurance for a Single Male Business Owner:

- Protect your family: Life insurance can provide financial protection for your family in the event of your death. It can replace your income, pay off debts, and maintain their standard of living.

- Keep your business running: Life insurance can be used to pay off business debts, supplement cash flow, and cover expenses needed to find your replacement if you die. This can help keep your business afloat and protect your company.

- Fund partnership agreements: If you have business partners, life insurance can help fund a buyout if one partner dies or becomes incapacitated. This ensures the surviving partners can buy out the deceased partner's share of the business.

- Equalize your estate: Life insurance can be used to ensure that your heirs, including those who won't inherit ownership of your business, receive an equal amount of money or asset value.

- Grow your wealth: Permanent life insurance can provide a death benefit while also accumulating cash value on a tax-deferred basis. This cash value can be used to increase your personal wealth, buy a home, supplement your retirement income, or cover unexpected expenses.

- Lock in coverage while you're young and healthy: It's generally easier and more affordable to get life insurance when you're young and in good health. If you wait until you develop a health condition, it may be difficult or impossible to get coverage.

Cons of Life Insurance for a Single Male Business Owner:

- Cost: Life insurance premiums can be expensive, especially for whole life or permanent life policies that guarantee a payout. As a business owner, you may have other financial priorities and expenses.

- Complexity: Depending on the structure of your business and your personal situation, choosing the right life insurance policy can be complex. You may need to consult with a financial advisor or insurance agent to determine the best type and amount of coverage for your needs.

- Tax implications: In most cases, life insurance premiums for business owners are not tax-deductible. While there are some exceptions, such as offering life insurance as an employee benefit, the tax benefits of life insurance are generally limited.

Leaving Life Insurance to Animal Rescues: Is It Possible?

You may want to see also

How does life insurance help a single male leave a legacy?

Life insurance can help a single male leave a legacy in several ways. Firstly, it can provide financial protection for loved ones, such as parents, grandparents, or other dependents, ensuring they can meet their financial needs. Secondly, it can cover funeral and burial expenses, which can easily exceed $10,000, ensuring the individual's friends and family don't bear this burden. Thirdly, it can be used to pay off any outstanding debts, such as private student loans or mortgages, preventing these financial burdens from falling to co-signers or fellow borrowers.

Additionally, life insurance can enable a single male to leave a legacy by donating to a beloved charity or organization, funding a scholarship, or contributing to a community project, such as building a park or playground. This can be achieved by naming a trust as the beneficiary of the life insurance policy and providing specific instructions for allocating funds.

Furthermore, life insurance can help a single male leave a legacy by providing an inheritance to their family, which can be maximized through a single premium whole life insurance policy. This type of policy allows the individual to make a lump-sum payment and let the cash value grow over time, resulting in a larger legacy for their beneficiaries.

Overall, life insurance offers a simple solution for a single male to leave a lasting legacy, whether it's through financial support for loved ones, donating to charitable causes, or creating a lasting impact in their community.

Contacting American Amicable Life Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

If you're a single male with no dependents, life insurance can still be useful for covering debts (especially if you have a co-signer), final expenses, or business costs. It can also help you build a financial legacy for loved ones or donate to charities.

A good rule of thumb is to select a benefit that is 10 to 15 times your annual income. However, you should also consider your financial obligations, such as mortgage payments or college fees, and subtract your assets to determine the coverage gap that life insurance needs to fill.

The cost of life insurance depends on various factors, including age, gender, health, hobbies, occupation, and the coverage amount. Generally, younger people pay less than older people, and males tend to pay more than females.

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not expire and include a cash value component, while term life insurance only covers a set number of years and does not accumulate cash value.