Auto insurance limits, also known as your coverage amount, refer to the maximum amount your insurer may pay out for a claim. In the context of auto insurance, these limits are typically broken down into three categories: bodily injury per person, total bodily injury per accident, and property damage per accident. For example, if your auto insurance policy has liability coverage limits of $50,000/$100,000/$30,000, this means that your insurer will pay out a maximum of $50,000 for bodily injuries per person, $100,000 in total for bodily injuries per accident, and $30,000 for property damage per accident. It's important to note that these limits only apply to covered claims, and you may be responsible for any expenses that exceed your coverage limit.

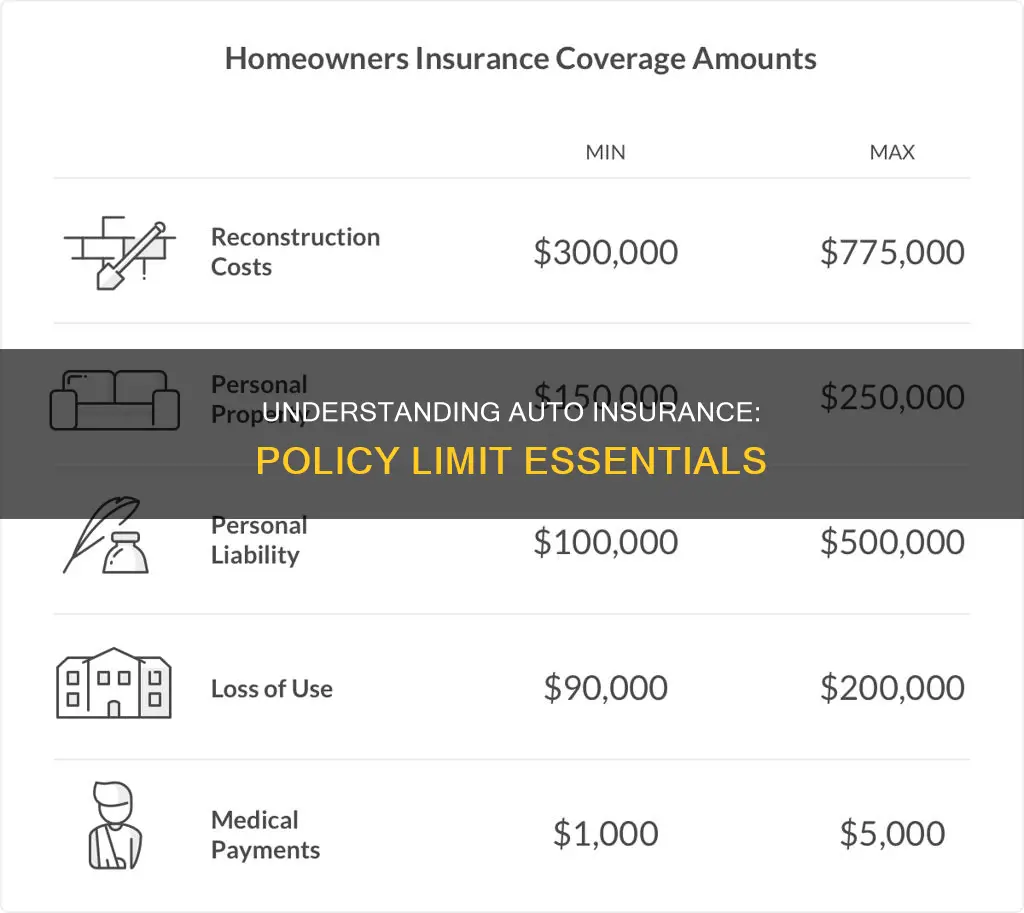

| Characteristics | Values |

|---|---|

| Bodily injury per person | $15,000 - $100,000 |

| Bodily injury per accident | $30,000 - $300,000 |

| Property damage per accident | $5,000 - $100,000 |

| Medical payments | $2,000 - $5,000 |

| Uninsured/underinsured motorist bodily injury per person | $15,000 |

| Uninsured/underinsured motorist bodily injury per accident | $30,000 - $60,000 |

| Uninsured motorist property damage | $3,500 - $250 |

What You'll Learn

Bodily injury liability coverage

The amount of bodily injury liability coverage you need depends on your state's requirements and your personal situation. The coverage limits are typically shown as two separate numbers, such as "$100,000/$300,000". The first number represents the maximum amount your insurer will pay per person, while the second number represents the total amount they will pay per accident. For example, if you have a policy with a limit of $100,000/$300,000 and you are at fault for an accident that injures four people, your insurance will pay up to $100,000 for each person's medical expenses, with a total payout of $300,000 for all four people's combined medical expenses.

In addition to medical expenses, bodily injury liability coverage can also cover lost income if the injured person is unable to work due to their injuries. It can also help pay for funeral costs in the unfortunate event of a fatality. In some cases, it may also provide compensation for emotional stress or prolonged pain resulting from the accident.

It is important to note that bodily injury liability coverage does not cover your own medical expenses or property damage. If you want coverage for your own expenses, you may need to consider additional insurance options, such as collision insurance or personal injury protection.

To determine the appropriate amount of bodily injury liability coverage, it is recommended to assess your state's minimum requirements and your personal financial situation. Some experts suggest having coverage limits of at least $100,000/$300,000, but you may want to consider higher limits to protect your assets in the event of a lawsuit.

Progressive Auto Insurance: Uncovering Chiropractic Coverage

You may want to see also

Property damage liability coverage

Most states require a minimum limit for property damage liability coverage, but the specific amount varies. For instance, in Georgia, the minimum required property damage liability coverage is $25,000 per incident, while in Iowa, the minimum is $15,000. It's important to note that these minimums may not be sufficient for your needs, especially if you live in an area with a lot of expensive vehicles or frequently drive in high-traffic areas.

When choosing your property damage liability coverage limit, consider your specific situation and the value of your assets. You can select a higher limit for this coverage to ensure you're adequately protected in the event of an accident. However, keep in mind that a higher coverage limit typically results in a higher insurance rate.

In the event that the cost of damages exceeds your coverage limit, you will be responsible for the remaining cost. Therefore, it's crucial to carefully consider your coverage needs and select a limit that provides sufficient protection.

Understanding Out-of-State Auto Insurance: A Guide

You may want to see also

Uninsured/underinsured motorist coverage

Understanding Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage comes into play when you are hit by a driver who does not have any auto insurance. This type of coverage ensures that you can receive compensation for your injuries, property damage, and other losses, even if the at-fault driver is uninsured.

Underinsured motorist coverage, on the other hand, protects you when you are involved in an accident with a driver whose insurance coverage is insufficient to pay for the damages they have caused. This includes situations where their liability limits are too low to cover your medical bills, vehicle repairs, or other expenses related to the accident.

Benefits of Uninsured/Underinsured Motorist Coverage

This type of coverage offers several advantages to drivers:

- Protection against uninsured drivers: According to the Insurance Research Council, about one in eight motorists is uninsured. Uninsured motorist coverage ensures that you can still receive compensation for your injuries and damages, even if the at-fault driver has no insurance.

- Coverage for hit-and-run accidents: In many states, uninsured motorist coverage also includes protection in the event of a hit-and-run accident, where the driver flees the scene and cannot be identified.

- Compensation for a range of expenses: Uninsured/underinsured motorist coverage can pay for medical expenses, lost wages, vehicle repairs, and even pain and suffering. It ensures that you are not left financially burdened by an accident caused by an uninsured or underinsured driver.

- Protection for you and your passengers: This type of coverage can provide compensation not only for your own injuries but also for those of your passengers. This can include medical expenses, lost wages, and other damages they may incur due to the accident.

- No-fault coverage: Uninsured/underinsured motorist coverage is a no-fault coverage, which means that it does not matter who was at fault for the accident. You can still receive compensation even if you were partially or fully at fault, as long as the other driver is uninsured or underinsured.

Considerations when purchasing Uninsured/Underinsured Motorist Coverage

While uninsured/underinsured motorist coverage offers valuable protection, there are a few things to keep in mind:

- State requirements: The requirements for this type of coverage vary by state. In some states, it is mandatory to have uninsured/underinsured motorist coverage, while in others, it is optional. Be sure to check the laws and requirements in your state.

- Policy limits: When purchasing uninsured/underinsured motorist coverage, you will need to choose the limits of your policy. Consider your potential risks and the amount of coverage that would adequately protect you in the event of an accident.

- Deductibles: In some cases, there may be deductibles associated with this type of coverage, especially for property damage claims. Be sure to understand the deductibles that may apply and how they could affect your out-of-pocket costs in the event of a claim.

- Exclusions: It is important to carefully review the exclusions in your policy. There may be certain situations or types of damages that are not covered by your uninsured/underinsured motorist coverage. Understanding these exclusions will help you make an informed decision about your coverage needs.

In conclusion, uninsured/underinsured motorist coverage is a crucial aspect of auto insurance that can provide financial protection and peace of mind in the event of an accident with an uninsured or underinsured driver. By understanding the benefits, considerations, and state requirements, you can make an informed decision about the level of coverage that is right for you.

Florida's Digital Car Insurance and Registration

You may want to see also

Collision insurance coverage

If you own your vehicle outright and choose not to carry collision coverage, you will have to pay for any repairs or replacements out of pocket if you're involved in a single-vehicle accident or are found at fault in an accident. However, if the other driver is found at fault, their liability coverage will typically pay for the damage.

When deciding whether to purchase collision insurance, consider the following factors:

- The value of your vehicle: If your vehicle is new or still worth a considerable amount, collision insurance can help cover expensive repairs or a replacement if it's damaged.

- Ability to pay out of pocket: If you couldn't afford to pay for repairs or a replacement vehicle without insurance, collision coverage may be worth considering for peace of mind.

- Whether your vehicle is in storage: If your vehicle won't be driven for a long period, such as a boat or RV in storage, collision insurance may not be necessary during that time.

In addition to collision insurance, comprehensive insurance can cover damage to your vehicle caused by events outside of your control, such as a tree falling on it or collisions with animals.

Kemper Auto Insurance: Legit or a Scam?

You may want to see also

Comprehensive insurance coverage

When it comes to comprehensive insurance coverage, there is no specific limit that can be chosen, as there is with other types of insurance. Instead, the maximum payout is based on the actual cash value of the vehicle. This means that if the costs of repairs or replacements exceed the value of the vehicle, the policyholder may be responsible for any remaining expenses.

Comprehensive coverage is a great way to ensure peace of mind, knowing that you're covered in the event of unexpected situations. It is important to note that comprehensive coverage does not include normal wear and tear on the vehicle.

In addition to comprehensive coverage, there are other types of auto insurance coverages to consider, such as liability coverage, uninsured motorist coverage, medical payments coverage, and collision coverage. These coverages work together to provide financial protection in the event of an accident, damage to the vehicle, or injuries to the driver or passengers.

When deciding on the right comprehensive coverage, it is essential to consider factors such as the value of the vehicle, personal preferences, and financial circumstances. By evaluating these aspects, individuals can determine if comprehensive coverage is worth the additional cost and how it can complement their overall auto insurance plan.

Social Security Number Privacy: South Dakota's Auto Insurance Conundrum

You may want to see also

Frequently asked questions

Auto insurance limits, also known as your coverage amount, refer to the maximum amount your insurer will pay out for a claim.

The most common minimum limits for liability are $25,000 per person and $50,000 per accident for bodily injury and $25,000 for physical damage. However, state requirements vary.

It's important to consider your state's requirements, your net worth, and your ability to pay for damages out of pocket when deciding on auto insurance limits.

Auto insurance limits are typically shown as three separate numbers for bodily injury per person, bodily injury per accident, and property damage per accident. For example, insurance limits of $50,000/$100,000/$30,000 mean that the insurer will pay out a maximum of $50,000 for bodily injury per person, $100,000 total for bodily injury per accident, and $30,000 for property damage per accident.

If the costs of a claim exceed your coverage limit, you may be responsible for any remaining expenses that aren't covered by your insurance. Therefore, it's essential to choose appropriate insurance limits to ensure adequate protection.