Before the Affordable Care Act (ACA) was passed, insurance companies could deny coverage to people with pre-existing conditions, charge them higher premiums, or reject their applications. This posed a significant barrier to people seeking affordable healthcare, especially those with chronic illnesses or ongoing health needs. However, the ACA has changed this by prohibiting insurers from denying coverage, charging higher premiums, or imposing waiting periods based solely on pre-existing conditions. This has dramatically increased access to health insurance for those with pre-existing conditions, ensuring they are not discriminated against when seeking healthcare coverage.

| Characteristics | Values |

|---|---|

| Can insurance companies deny coverage for pre-existing conditions? | No, insurance companies cannot deny coverage for pre-existing conditions. |

| Can insurance companies charge more for pre-existing conditions? | No, insurance companies cannot charge more for pre-existing conditions. |

| Can insurance companies deny coverage for pregnancy? | No, pregnancy is covered from the day the plan starts. |

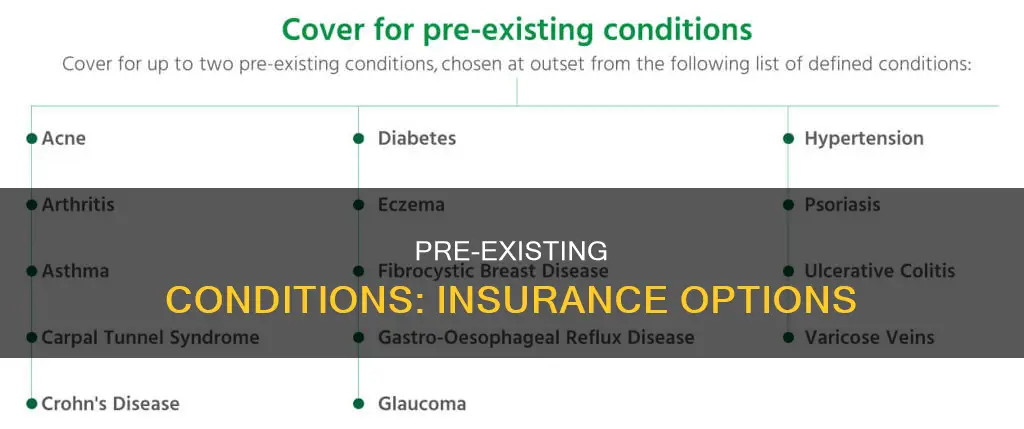

| What are some examples of pre-existing conditions? | Cancer, asthma, diabetes, high blood pressure, depression, mental health disorders, dementia, Alzheimer's, heart disease, etc. |

| What are some options for people with pre-existing conditions? | Marketplace plans, Medicaid, CHIP, short-term health plans, catastrophic health plans, community health centers, etc. |

What You'll Learn

- People with pre-existing conditions cannot be denied coverage or charged more

- People with pre-existing conditions can get insurance through the Affordable Care Act (ACA)

- Grandfathered health plans don't have to cover pre-existing conditions

- People with pre-existing conditions can get insurance through Medicaid and CHIP

- People with pre-existing conditions can get insurance through their employer

People with pre-existing conditions cannot be denied coverage or charged more

People with pre-existing conditions used to face significant challenges in obtaining health insurance. Insurance companies would often deny coverage or charge higher premiums to individuals with pre-existing health issues, as they were deemed a high-risk pool of members. This made it extremely difficult for people with chronic illnesses or ongoing health needs to access affordable healthcare.

However, recent changes in healthcare laws, specifically the implementation of the Affordable Care Act (ACA), have transformed this situation. The ACA, also known as Obamacare, prohibits insurance companies from denying coverage or charging higher rates based solely on pre-existing conditions. This legislation ensures that individuals with pre-existing conditions have the same access to insurance as those without such conditions. It is now illegal for insurers to reject applicants, charge more, or refuse to cover essential health benefits due to any pre-existing health condition.

The ACA's protections apply to a wide range of health conditions, including cancer, asthma, diabetes, pregnancy, mental health disorders, dementia, heart disease, and more. These protections are not limited to specific types of insurance plans and cover both individual and family health insurance. Additionally, the ACA requires all health insurance plans to cover a set of 10 essential health benefits, such as maternity and newborn care, mental health services, rehabilitative services, and preventive care.

It is important to note that there are still some exceptions to these protections. "Grandfathered" health plans, which were purchased before March 23, 2010, are not subject to the ACA's rules and may not cover pre-existing conditions. Additionally, short-term health insurance plans are also exempt from ACA regulations and may not provide coverage for pre-existing conditions. However, individuals with pre-existing conditions can switch to an ACA-compliant plan during open enrollment periods to ensure they have adequate coverage.

In summary, people with pre-existing conditions can no longer be denied coverage or charged more for health insurance. The ACA has significantly improved access to healthcare for individuals with pre-existing conditions, providing them with the same opportunities for insurance coverage as everyone else.

Halifax Phone Insurance: Navigating Policy Changes

You may want to see also

People with pre-existing conditions can get insurance through the Affordable Care Act (ACA)

The ACA's rules apply to plans that began on or after January 1, 2014. Before this date, insurance companies could reject people based on pre-existing conditions, and individuals had to enrol in a Pre-Existing Condition Insurance Plan (PCIP). However, since the ACA protections came into effect, all Marketplace plans must cover treatment for pre-existing conditions. This includes Medicaid and the Children's Health Insurance Program (CHIP).

It is important to note that "grandfathered" health plans, or individual plans purchased before March 23, 2010, are exempt from the ACA's rules. These plans were sold by insurance companies directly and are not subject to the same rights and protections. If an individual has a grandfathered plan and wants pre-existing conditions covered, they can switch to a Marketplace plan during Open Enrollment or buy a Marketplace plan outside of Open Enrollment and qualify for a Special Enrollment Period.

The ACA guarantees that individuals with pre-existing conditions have access to health insurance and are not discriminated against or charged higher prices due to their medical history. This ensures that everyone can obtain the necessary coverage and treatment for their health needs, regardless of their pre-existing conditions.

Resolving Insurance Billing Issues: Contacting Florida Hospital Celebration

You may want to see also

Grandfathered health plans don't have to cover pre-existing conditions

In the US, health insurance companies cannot refuse coverage or charge more based on a person's health before the start date of their insurance coverage. This includes conditions like asthma, diabetes, cancer, and pregnancy. However, "grandfathered" health plans—those that were purchased on or before March 23, 2010—are exempt from this rule and do not have to cover pre-existing conditions. These plans were sold by insurance companies, agents, or brokers, and may not include the rights and protections provided under the Affordable Care Act (Obamacare).

If you have a "grandfathered" plan and want pre-existing conditions covered, you have two options: switch to a Marketplace plan during Open Enrollment, or buy a Marketplace plan outside of Open Enrollment when your current plan year ends, which qualifies you for a Special Enrollment Period. A Marketplace plan will cover pre-existing conditions and offer rights and protections that your current plan may not, such as covering adult children up to age 26, providing a Summary of Benefits and Coverage, and guaranteeing your right to appeal a coverage decision.

It's important to note that "grandfathered" plans can lose their status if they make significant changes that reduce benefits or increase costs to consumers. For example, if a plan chooses to no longer cover care for people with diabetes, cystic fibrosis, or HIV/AIDS, it would lose its "grandfathered" status. In this case, consumers in these plans would gain additional benefits, such as coverage of recommended prevention services with no cost-sharing and patient protections like guaranteed access to OB-GYNs and pediatricians.

If you're unsure whether your plan is "grandfathered," check your plan's materials or contact your employer or health plan's benefits administrator. Your insurer is required to notify you if you have a "grandfathered" plan.

Non-Owner Insurance: When to Get It

You may want to see also

People with pre-existing conditions can get insurance through Medicaid and CHIP

Medicaid and CHIP are government-sponsored programs that provide health insurance to those who qualify. The Children's Health Insurance Program (CHIP) offers coverage for children from low-income families, while Medicaid provides health insurance to low-income adults, pregnant women, children, and people with disabilities.

The implementation of the ACA has significantly improved access to health insurance for individuals with pre-existing conditions. Before the ACA, insurance companies could deny coverage, charge higher premiums, or reject applications from people with pre-existing conditions. Now, insurance companies cannot refuse to cover or charge more for pre-existing conditions, and they cannot limit benefits for those conditions either.

It is important to note that each state has its own regulations regarding Medicaid and CHIP, and not all states have expanded Medicaid under the ACA. Therefore, the specific coverage options and eligibility criteria may vary depending on your state of residence.

In addition to Medicaid and CHIP, individuals with pre-existing conditions can also explore other options, such as subsidized plans through ACA Marketplaces, catastrophic health plans, and community health centers that offer services on a sliding fee scale based on income.

Understanding Counsyl's Billing Practices: Navigating Insurance Coverage for Genetic Testing

You may want to see also

People with pre-existing conditions can get insurance through their employer

Before the Affordable Care Act, insurance companies could reject people with pre-existing conditions, and people had to enrol in a pre-existing condition insurance plan (PCIP) instead. However, since the Affordable Care Act protections came into effect in 2014, insurance companies can no longer deny coverage based on a person's medical history.

It is worth noting that "grandfathered" health plans, which are individual health insurance plans purchased before March 23, 2010, are exempt from these rules. These plans were bought directly from insurance companies rather than through an employer, and they are not required to cover pre-existing conditions. If you have a "grandfathered" plan and need coverage for a pre-existing condition, you can switch to a Marketplace plan during Open Enrollment.

In addition to the protections offered by the Affordable Care Act, the Health Insurance Portability and Accountability Act (HIPAA) provides further safeguards for people with pre-existing conditions. HIPAA was enacted in 1996 and offers significant protections for those enrolling in employer-sponsored health plans. These protections include limiting the use of pre-existing condition exclusions, preventing plans from charging higher premiums based on pre-existing conditions, and guaranteeing the ability to renew coverage regardless of health conditions.

Overall, while people with pre-existing conditions may face challenges in obtaining insurance, there are legal protections in place to ensure they can access coverage, including through employer-provided insurance plans.

American Family Insurance: Understanding Their Billing Practices and What Lies Ahead

You may want to see also

Frequently asked questions

No, health insurance companies cannot refuse coverage or charge more for pre-existing conditions. This includes conditions like asthma, diabetes, cancer, and pregnancy.

A pre-existing condition is a medical illness or injury that you have before you start a new health care plan. It is typically determined by a diagnosis or treatment received before enrolling in the new plan.

If you enrolled in a plan after 2010, your insurer cannot legally deny you coverage or charge higher premiums because of a pre-existing condition. The Affordable Care Act made this practice illegal.

Pre-existing conditions can include chronic illnesses and medical conditions such as cancer, diabetes, lupus, epilepsy, depression, asthma, anxiety, and sleep apnea. Pregnancy before enrollment is also considered a pre-existing condition.

Yes, "grandfathered" health plans purchased before March 23, 2010, are not required to cover pre-existing conditions. These plans may have other restrictions and may not include all the rights and protections provided under the Affordable Care Act.