A vehicle is considered a total loss by insurance companies when the cost of repairing it exceeds its market value. This is also known as the total loss threshold, and the threshold varies by state. For example, in Arkansas, the total loss threshold is 70%, so a $6,000 car that sustains more than $4,200 in damages would be considered a total loss. Other states use the total loss formula, which deems a car a total loss if the repair costs plus the salvage value of the car exceed its market value.

| Characteristics | Values |

|---|---|

| Cost of repairs | Exceeds the actual cash value of the car |

| Damage amount | Meets the state's total loss threshold |

| Damages | Exceed the pre-accident value according to the state's total loss formula |

| Repairability | Cannot be repaired due to extensive damage |

| State laws | Vary across states |

| Total loss threshold | Varies between 50% and 100% |

| Total loss formula | Repair costs + salvage value ≥ car's actual cash value |

| Settlement | Actual cash value of the car |

What You'll Learn

Repair costs exceed the car's value

When it comes to insurance determining whether a car is a total loss, one of the primary factors they consider is when the repair costs exceed the vehicle's value. This situation can occur when a car has sustained significant damage, and the estimated cost to repair it is higher than its actual cash value (ACV). Insurance companies use this calculation to decide if it is more economical to repair the car or declare it a total loss. This threshold varies by state and insurance company but is typically between 51% and 80% of the car's ACV. If the repair costs surpass this threshold, the insurance company will likely consider the vehicle a total loss.

In simple terms, if the cost to fix the car is more than what the car is worth, insurance companies will often opt to pay the owner the car's current value instead of covering the repair expenses. They take into account the extent of the damage, the cost of parts and labor, and the pre-accident condition and value of the vehicle. Older cars with higher mileage and extensive damage are more likely to fall into this category, as the cost of repairing them can quickly exceed their diminished value. For example, if a car is worth $5,000 and the estimated repair cost is $6,000, the insurance company may deem it a total loss because the repair costs are higher than the car's pre-accident value.

Insurance carriers use specialized software and labor rates to calculate repair costs. They consider the time it takes to fix the damage, the cost of replacement parts, and the labor rate in the area. If the vehicle has sustained structural damage, such as a bent frame, the repair costs can quickly escalate. In some cases, the insurance company may use salvage parts to keep repair costs down, but if the damage is extensive, even this may not prevent a total loss declaration. Additionally, hidden damage may be discovered during the repair process, which can further increase the overall repair cost.

Once an insurance company has determined that the repair costs exceed the vehicle's value, they will initiate the total loss claim process. This typically involves paying the insured the ACV of the vehicle, minus any applicable deductibles and payments made for additional coverages, such as rental car reimbursement. The insurance company may also factor in sales tax, registration fees, and title transfer fees, depending on state regulations and the terms of the policy. The owner then surrenders the vehicle, and the insurance company takes ownership of it, often selling it at auction or to a salvage yard.

Insurable Hours: What Counts?

You may want to see also

The car cannot be safely repaired

When it comes to insurance and total loss, one of the key factors that insurance companies consider is whether a car can be safely repaired or not. If the cost of repairing the vehicle exceeds a certain threshold, often expressed as a percentage of the car's actual cash value (ACV), the insurance company may declare it a total loss. This threshold varies by state and insurance provider, but it typically ranges from 50% to 100% of the ACV. When a car is deemed too damaged to repair, it is because the structural integrity of the vehicle has been compromised to the point where it poses a safety risk.

There are several scenarios where a car may be considered beyond repair. One common example is when a vehicle has sustained extensive damage during a collision. If the frame or unibody of the car is severely bent or twisted, it may not be possible to straighten it or return it to its original specifications. In such cases, the insurance company will take into account the cost of labour and parts required to attempt a repair and compare it to the value of the vehicle before the damage occurred. If the cost of repair exceeds a certain point, it is more economical and safer to write off the car as a total loss.

Another situation is when a vehicle has been damaged by natural disasters such as floods or fires. Water damage can affect a car's electrical system, engine, and interior, while fire damage can compromise the structural integrity of the frame and body. In these cases, the insurance company will assess the extent of the damage and determine if it is feasible to restore the vehicle to a safe, pre-loss condition. If the cost of refurbishment would exceed the car's ACV, or if there are health and safety concerns, the insurer will likely declare it a total loss.

Sometimes, a car may be deemed irreparable due to a combination of factors, including its age, mileage, and pre-existing conditions. Older vehicles with high mileage may have already undergone multiple repairs, and their overall condition may be poorer than that of a newer car. In such cases, even moderate damage could result in a total loss declaration because the cost of repairing an older vehicle with hard-to-find parts may quickly add up. Additionally, pre-existing damage or prior repairs done to a vehicle can also factor into the insurance company's decision.

It is important to note that insurance companies have teams of experts, including adjusters and vehicle damage appraisers, who assess and evaluate each case individually. They consider various factors and use specialized tools and databases to determine the cost of repairs and the vehicle's value accurately. While the decision to total a car is primarily based on repair costs and vehicle value, insurance companies also take into account the safety and well-being of their customers. By declaring a severely damaged vehicle a total loss, they help prevent unsafe cars from returning to the roads.

VA Healthcare: In-Network Insurance?

You may want to see also

The car meets state total loss guidelines

When a car is damaged, insurance companies will consider it a total loss if the cost of repairing it exceeds its actual cash value (ACV). However, this is not always the case, as different states have different laws and guidelines for determining when a car should be considered a total loss. This is known as the "total loss threshold" (TLT). Some states use a simple percentage threshold, which can range from 50% to 100% of the car's ACV. For example, in Arkansas, the total loss threshold is 70%, while in Texas, it is 100%. This means that if the cost of repairing a car exceeds this percentage of its ACV, the car will be considered a total loss.

Other states use a "total loss formula" (TLF), which takes into account the repair costs, the salvage value of the car, and the car's ACV. In these states, a car is considered a total loss if the sum of the repair costs and the salvage value exceeds the car's ACV. For example, in California, a car is considered a total loss if the cost of repairs plus the salvage value is greater than or equal to the car's ACV.

It's important to note that insurance companies may also consider a car a total loss if it cannot be repaired at all, even if the repair costs are less than the ACV. Additionally, the total loss threshold is not just based on monetary value but also on safety. A car may be considered a total loss if it is deemed unsafe to drive, even after repairs are completed. This is especially true for vehicles that have been caught in floods, as they often sustain extensive damage.

When a car is considered a total loss, the insurance company will reimburse the owner for the ACV, which is the amount the car was worth right before the incident. However, this may not be enough to cover the remaining balance on a car loan or lease, in which case gap insurance can help cover the difference. It's also important to note that the ACV is not the same as the original purchase price of the car, as depreciation over time reduces the value.

If a car is declared a total loss, the owner has the option to either accept a settlement from the insurance company or keep the car and repair it themselves, depending on the state's laws. Keeping a total loss car may not be the best option, as it will likely require major repairs, which can be costly. Additionally, finding insurance for a total loss car can be challenging.

The Intricacies of Insurance Terms: Understanding the Requesting Process

You may want to see also

The car's salvage value is considered

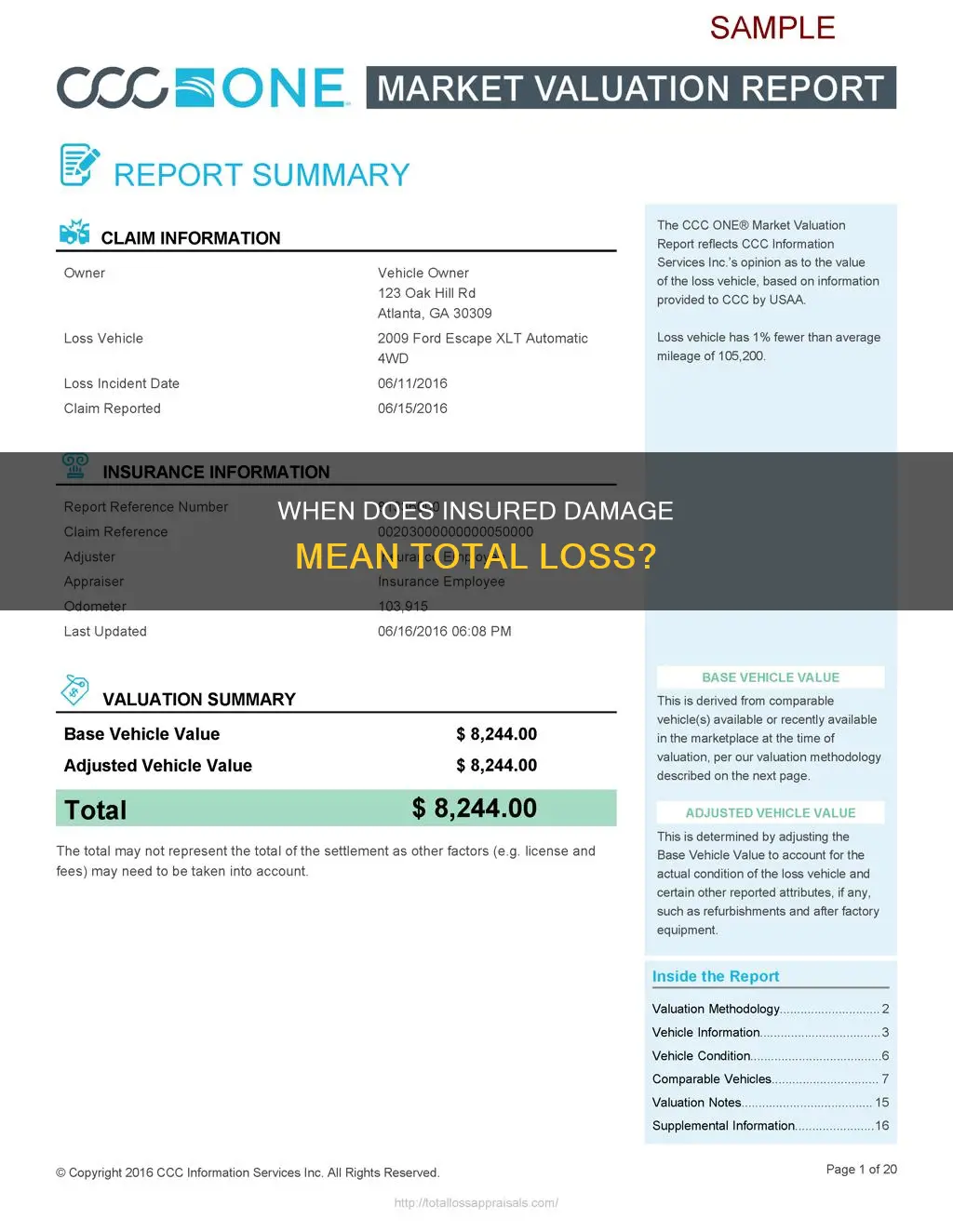

The salvage value of a car is the amount of money it would fetch at a scrapyard or from a buyer who specialises in salvaging vehicles.

When a car is declared a "total loss" by an insurance company, it is usually because the cost of repairing the damage would exceed the car's actual cash value (ACV). However, the exact definition of a "total loss" varies from state to state. Some states use a "total loss threshold" (TLT), where damage only needs to exceed a certain percentage of the car's value for it to be declared a total loss. For example, in Arkansas, the total loss threshold is 70%, so a car valued at $6,000 would be declared a total loss if it sustained more than $4,200 in damages.

About half of the states in the US use the "total loss formula" (TLF) to determine whether a car is a total loss. In these states, the car is considered a total loss if the sum of the repair costs plus the salvage value of the car exceeds the car's ACV.

For example, if your vehicle’s fair market value is $15,000, and the insurance company values the salvage at $4,000, then $11,000 in estimated repairs would result in the car being declared a total loss.

If you want to keep your totalled car, your insurance company may allow it, but you will be paid less. Your payment will be the actual cash value, minus the value of the car as salvage. Even totalled, a salvaged car will still have some value in its parts and the potential to be restored. However, some states prevent drivers from keeping total loss vehicles, while others will require you to obtain a certificate that states the car is salvaged.

Understanding Insurance Billing: Timing and Procedures

You may want to see also

The car's market value is calculated

The market value of a car is determined by several factors, including the car's make, model, age, mileage, condition, and features. The make and model of a car are important factors in valuing it. Popular and reputable brands, such as Toyota and Mazda, tend to hold their value due to their affordability, reliability, and high demand. Age also plays a role, as older cars generally have a lower residual value unless they are classic or vintage. Mileage is another critical factor, as a vehicle's value typically decreases with higher kilometres. The condition of the car, including any body or paint damage, as well as the functionality of its parts, such as upholstery, electronics, tyres, and mechanical components, can also impact its market value.

Additionally, special features and upgrades can increase the resale value. For example, non-standard features like leather seats, automatic headlights, navigation systems, or reversing cameras can boost the car's worth. On the other hand, modifications and custom extras, such as oversized wheels or stereo speakers, may not add monetary value and could even lower it.

Market demand, influenced by location, time, weather, and the popularity of the car, also plays a role in determining a car's market value. For instance, the rise in popularity of SUVs over the past decade has made them more desirable to a broader range of buyers.

When a car is involved in an accident, the insurance company will consider it a total loss if the cost of repairing the vehicle exceeds its actual cash value (ACV) or if it cannot be repaired at all. The ACV is determined by the car's pre-loss market value, minus depreciation from when it was new. This calculation takes into account factors such as wear and tear, age, and other relevant considerations deemed by the insurer.

To summarise, the market value of a car is calculated by considering its make, model, age, mileage, condition, features, and market demand. This value is essential in determining whether a car is considered a total loss by insurance companies, which occurs when the repair costs surpass the car's actual cash value.

Air Conditioner: House Insurance Coverage?

You may want to see also

Frequently asked questions

A vehicle is a total loss when the cost to return it to its pre-loss condition is greater than the value of the vehicle. In some states, a vehicle may be a total loss if the repair costs would exceed a certain percentage (e.g. 60%-80%) of the vehicle's value.

The total loss formula (TLF) is a calculation that insurers use to determine whether the cost of repairing a damaged vehicle is more than they are willing to take on. The formula is the vehicle's fair market value less its salvage value.

If you don't want to dispute the decision, you will need to remove license plates, remove personal belongings, hand over the keys to your claims adjuster, and complete the required paperwork.

You can dispute a total loss if you believe your vehicle was undervalued and is actually worth more. You will need to assemble documents and vehicle information, assess current market information on your vehicle, notify the insurer of your stance and submit your evidence, request an appraisal, and consider legal action if necessary.

Yes, you can keep a car that's a total loss, but it will be difficult to insure. The insurance company will notify the Department of Motor Vehicles (DMV) to issue a salvage title, and you may need to take steps to get a rebuilt title if you plan to repair and resell the vehicle.