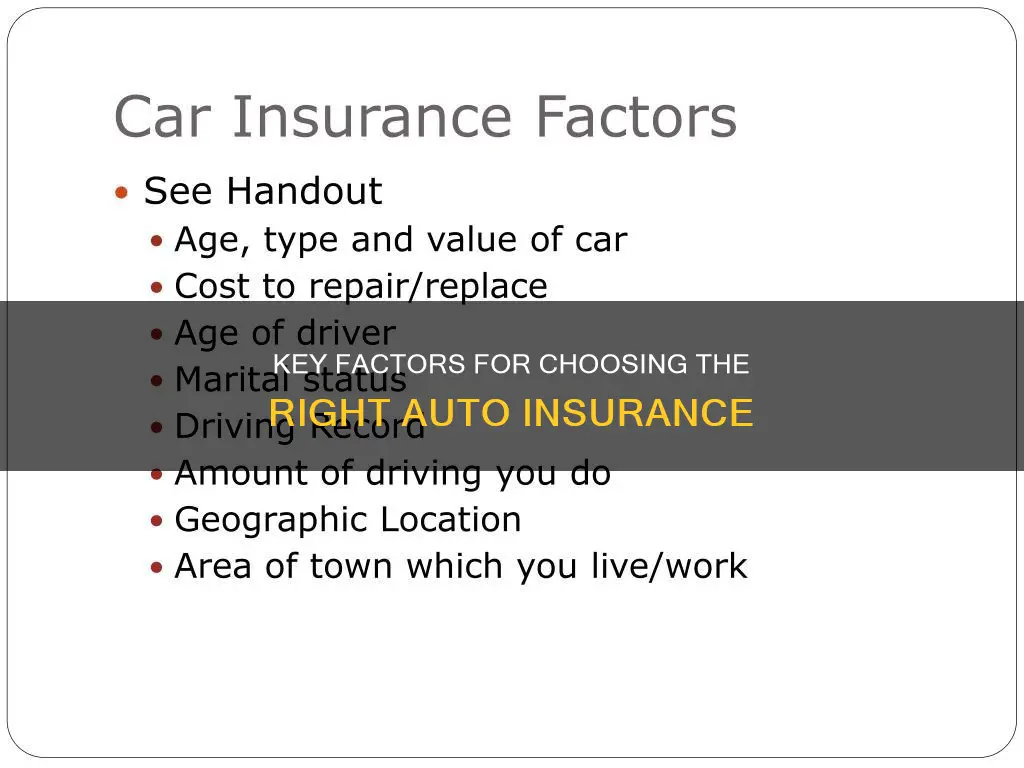

When choosing auto insurance, it's important to consider various factors to ensure you get the best coverage for your needs. The type of car you drive, your age, driving history, and location are all key elements that influence the cost of insurance. Additionally, the level of coverage you require, your budget, and the reputation of the insurance company are essential factors to keep in mind. Understanding these factors will help you make an informed decision about the types and levels of auto insurance coverage that suit your circumstances.

| Characteristics | Values |

|---|---|

| Age | Younger drivers are more likely to be involved in accidents and therefore pay higher premiums. Insurance costs decrease until the age of 55, then begin to rise again. |

| Gender | Women are statistically less likely to be involved in car accidents, and pay less for insurance in states that allow gender to be considered. |

| Marital Status | Married people are less likely to file auto insurance claims, and therefore pay lower premiums. |

| Driving History | A history of moving violations, such as speeding or reckless driving, will increase insurance costs. |

| Type of Car | The cost of insurance depends on the cost of repairs, the likelihood of theft, the safety record, and the size of the engine. |

| Annual Mileage | High-mileage drivers are more likely to be involved in accidents, and therefore pay higher premiums. |

| Credit Score | A higher credit score generally results in lower insurance premiums. |

| Location | Urban areas have higher insurance rates due to a greater risk of accidents, theft, and vandalism. |

| Insurance History | A lack of continuous coverage is seen as an indicator of higher risk. |

| Insurance Company | Rates vary substantially between companies. |

Age and driving experience

The number of years a person has been driving is also taken into account. Inexperienced drivers are more likely to make mistakes, leading to violations and claims. Therefore, insurance companies view them as riskier clients. On the other hand, drivers with many years of experience are often rewarded with lower insurance rates.

The impact of age on insurance rates is more pronounced in younger drivers, with a cost gap of over $5,500 between teen drivers and 50-year-olds. This gap narrows as drivers enter their 20s and becomes less significant after 25.

While age is a crucial factor, it is just one of many considerations insurance companies make when determining rates. Other factors include driving history, credit score, location, vehicle type, and more. By combining these factors, insurance companies assess an individual's risk profile and set insurance premiums accordingly.

AAA Auto Insurance: Understanding Replacement Value Coverage

You may want to see also

Type of car

The type of car you drive has a significant impact on your auto insurance rates. Here are some key factors related to your vehicle that influence your insurance premiums:

Make and Model

The make and model of your car play a crucial role in determining insurance costs. Each vehicle has specific crash statistics, repair costs, and safety features that insurers consider when setting rates. Some cars are riskier for insurance companies to cover due to expensive components or repairs, leading to higher premiums. On the other hand, cars with advanced safety features often have lower insurance costs as they are less susceptible to damage.

Vehicle Age

The age of your car is another factor in insurance rates. Generally, newer cars are more expensive to insure than older, base-model vehicles with more miles. Older or collectible cars may be an exception, with higher insurance costs due to their value.

Vehicle Size and Weight

The size and weight of your vehicle also affect insurance premiums. Larger and heavier vehicles tend to have higher insurance rates since they have a greater potential for damage and pose more risk to other road users.

Luxury Features

Luxurious features and customizations can increase the cost of insurance. Basic versions of cars without extensive customizations tend to keep insurance costs lower.

Safety Features

Safety features like anti-lock brakes, electronic stability control, and theft prevention systems can reduce insurance premiums. Insurers view these features positively as they lower the chances of accidents and reduce the severity of damage in collisions.

Repair and Replacement Costs

The cost of repairing or replacing your vehicle is a significant factor in insurance rates. If your car is expensive to repair or replace, your insurance company will charge a higher premium to cover these potential costs.

Vehicle Popularity with Thieves

If your vehicle is a popular target for car thieves, your insurance rates may be higher. Insurers factor in the risk of theft when calculating premiums.

Engine Size

The size of your car's engine can also influence insurance costs. Larger engines, particularly in sports cars, may lead to higher insurance rates as they are associated with higher speeds and performance.

Vehicle Safety Record

The safety record of your vehicle is essential for insurers. Cars with a history of safety issues or poor performance in crash tests may have higher insurance premiums.

Collision Damage Potential

Insurers also consider the potential damage your vehicle could cause in a collision. If your car is likely to inflict severe damage on other vehicles or property, your insurance rates may reflect that risk.

In summary, the type of car you drive has a significant impact on your auto insurance rates. Insurers consider various factors related to your vehicle, including its make, model, age, size, features, safety record, and repair costs. By understanding these factors, you can make informed choices when selecting a vehicle and managing your auto insurance costs.

Double Insuring Vehicles: Legal or Not?

You may want to see also

Location

When it comes to choosing auto insurance, location is a significant factor that can influence both the cost of your policy and the specific coverages you may need. Here are some key considerations regarding location:

Population Density

Weather Conditions

The weather patterns in your location can also impact your auto insurance rates. Areas prone to severe weather events such as snow, ice, hail storms, floods, or hurricanes may result in higher premiums. This is because these weather conditions can cause damage to vehicles and increase the number of claims filed. For example, states like Oklahoma, which experiences hail storms, or coastal states like Florida and Louisiana, which are susceptible to hurricanes and floods, may have higher insurance rates.

State Laws and Regulations

Different states have varying laws and regulations regarding auto insurance. Some states, like Michigan, require unlimited Personal Injury Protection (PIP) coverage, which increases insurance costs. On the other hand, no-fault states that mandate PIP coverage may have cheaper premiums since the coverage limits when you can sue, reducing legal costs. Additionally, each state has its own minimum requirements for liability coverage, and some states also mandate uninsured motorist coverage, which can affect your overall insurance costs.

Traffic and Road Conditions

The quality of roads and traffic conditions in your location can also impact your insurance rates. Poor road conditions, such as potholes and a lack of proper signage or traffic lights, can increase the risk of accidents. Similarly, congested areas with heavy traffic can lead to higher premiums. Insurers take these factors into account when calculating rates, as they contribute to the likelihood of filing a claim.

Local Crime Rates

Crime rates, particularly vehicle-related crimes like theft and vandalism, can significantly influence your auto insurance rates. If you live in an area with high car theft rates, your insurance costs are likely to be higher. Additionally, areas with higher claims due to break-ins and vandalism will also see increased premiums.

Legal Climate

The legal climate of your location can also be a factor. For example, in Louisiana, judges typically determine damages for accidents, and insurance companies tend to award higher amounts, resulting in increased insurance costs for residents.

In summary, location plays a crucial role in determining your auto insurance rates and the specific coverages you may require. By considering factors such as population density, weather conditions, state laws, traffic, road conditions, crime rates, and the legal climate, insurers can assess the level of risk associated with your location and set your premiums accordingly.

Gap Insurance: Partial Payment Explained

You may want to see also

Driving record

Your driving record is one of the most important factors that insurance companies consider when determining your auto insurance rates. A history of driving violations, accidents, and claims will result in higher insurance premiums. Conversely, a clean driving record can help you secure lower rates and even qualify for a "Good Driver Discount".

In the United States, each state maintains a record of an individual's driving history, known as a driving record or Motor Vehicle Record (MVR). This record includes personal identification information, license details, accidents, citations, violations, convictions, fines, license suspensions or revocations, and any driving courses taken.

Insurance companies review an individual's driving record when setting insurance premiums. A history of moving violations, such as speeding, reckless driving, or driving under the influence (DUI), is considered a red flag and will result in higher insurance rates. These violations are seen as indicators of risky driving behaviour, which increases the likelihood of accidents and insurance claims. For example, a serious offence such as a DUI or reckless driving charge can result in a premium increase of 30% to 300%. Even a single speeding ticket can bump up your insurance rates by 20%. Minor moving violations can also increase your insurance premiums by 10% to 15%.

Additionally, insurance companies may refuse to provide or renew a policy for individuals with major driving violations. This means that maintaining a clean driving record is crucial for obtaining and retaining auto insurance.

It's worth noting that insurance companies typically review your driving record when you apply for a new policy, but they rarely check when a policy is renewed. Therefore, if you already have insurance, minor violations may not significantly impact your rates unless you switch insurers or apply for a new policy.

To summarise, your driving record plays a crucial role in determining your auto insurance rates. A clean driving record indicates safe driving practices and can help secure lower insurance premiums. Conversely, a history of moving violations and accidents will result in higher insurance rates and may even lead to policy refusal or non-renewal.

Suing Auto Insurers: Your Rights Explored

You may want to see also

Insurance history

Insurers will look at your claims history, which is collected in a Comprehensive Loss Underwriting Exchange (CLUE) report, to determine your level of risk and set your insurance rates and premiums. This report includes details such as the date and type of claim, whether you were at fault, and any injuries claimed. Any claims in the past three years are considered highly important and can impact your rates. Surcharges may be applied to your policy for at-fault claims, traffic infractions, and tickets, but these typically only last for 36 months.

A continuous coverage history is also important. If you have had gaps in your insurance coverage, insurers may view this as a potential risk factor, assuming that you may have been driving without insurance during that time. Maintaining consistent coverage is crucial, and the longer you have had uninterrupted coverage, the more favourably it will be viewed by insurance companies.

Before applying for a new insurance policy, it is advisable to check your insurance history report to ensure that the insurer is assessing your risk level fairly. You can obtain your auto insurance history by contacting your previous insurance company or, if you cannot remember which company you used, your state's Department of Motor Vehicles.

When Accidents Happen: Understanding Total Loss Claims in Auto Insurance

You may want to see also