Life insurance is a vital part of the insurance sector, which is fundamentally rooted in risk management. Life insurance companies focus on legacy planning and replacing human capital value, with policies that pay a death benefit as a lump sum to beneficiaries upon the death of the insured. The basic concept of insurance is that the insurer guarantees payment for an uncertain future event, while the insured pays a smaller premium in exchange for that protection. Life insurance is a slow-growing but safe sector for investors, and it is highly regulated to guarantee consumer safety and ethical business practices.

What You'll Learn

- Life insurance companies focus on legacy planning and replacing human capital value

- Life insurance is regulated at the state level in the US

- Life insurance companies invest primarily in long-term products

- Life insurance companies can be structured as either traditional stock companies or mutual companies where policyholders are the owners

- Life insurance is regarded as a slow-growing, safe sector for investors

Life insurance companies focus on legacy planning and replacing human capital value

Life insurance companies operate within the insurance sector, which is fundamentally rooted in risk management. The basic concept of insurance is that the insurer guarantees payment for an uncertain future event, while the insured pays a smaller premium in exchange for that protection.

Legacy planning, also known as estate planning, involves deciding how an individual's assets will be bequeathed to their loved ones, and can also include imparting certain values or establishing a focus on charitable giving. It is a way to ensure that an individual's final wishes are carried out and that their affairs are handled according to their preferences, rather than dictated by the state.

Replacing human capital value refers to the process of calculating the amount of life insurance a family will need to replace the lost earnings of a family breadwinner who has passed away. This calculation takes into account various factors, such as the age, gender, planned retirement age, occupation, annual wage, employment benefits, and personal and financial information of the spouse and/or dependent children. The goal is to ensure that the family will not be left in financial distress and that all income lost due to the breadwinner's death is replaced.

Life insurance companies play a crucial role in helping individuals and families plan for the future and protect their financial well-being. By focusing on legacy planning and replacing human capital value, they provide essential services that offer peace of mind and financial security to their customers.

How Life Insurance Can Compel Fathers to Act

You may want to see also

Life insurance is regulated at the state level in the US

Life insurance is a crucial component of the financial sector, providing individuals and families with economic protection and peace of mind. In the United States, life insurance is predominantly regulated at the state level, ensuring consumer safety and financial stability. Here is an overview of how life insurance is regulated at the state level in the US:

Licensing and Oversight

Life insurance agents and brokers are required to be licensed to sell insurance within their respective states. The state insurance departments maintain strict oversight, verifying that insurance companies have the necessary financial resources to meet their obligations. This includes reviewing financial statements and conducting periodic on-site examinations.

Consumer Protection

State laws protect policyholders by ensuring that insurance companies comply with various regulations. State insurance departments play a crucial role in addressing consumer complaints and concerns. They set best practices and provide regulatory support to protect consumer interests. Additionally, state laws prohibit unfair practices such as deceptive advertising and unfair claims handling.

Product Regulation

State regulators closely monitor the products offered by life insurance companies, including term life, permanent life, and annuities. While premiums and rates may not be subject to regulatory approval, they are monitored to ensure that the benefits provided are commensurate with the charges. This helps protect consumers from unfair pricing and ensures they receive appropriate coverage for their payments.

Solvency and Guaranty Funds

The financial health of insurance companies is of utmost importance to state regulators. Through organizations like the National Association of Insurance Commissioners (NAIC), state regulators monitor the financial stability of insurance companies and intervene if they become financially unstable. In the event that an insurer faces liquidation or is unable to meet its financial obligations, each state has a guaranty mechanism in place to protect policyholders and ensure that covered insurance obligations are met.

Continuous Improvement

Regulations also focus on the continuous improvement of the insurance industry. Insurance agents and brokers are required to participate in continuing education programs to ensure they remain up-to-date with industry developments and maintain professional standards. This benefits consumers by providing them with well-informed and knowledgeable insurance professionals.

State-Specific Variations

It is important to note that regulations can vary from state to state, and some states may have additional requirements or protections in place. For example, certain states mandate that a spouse be named as the primary beneficiary on a life insurance policy. Therefore, it is essential to refer to the specific regulations within your state to understand the full scope of life insurance regulations.

Universal Life Insurance: Breaking Down Loan Benefits

You may want to see also

Life insurance companies invest primarily in long-term products

Life insurance companies have struggled with growth and profitability, but they remain a slow-growing, safe sector for investors. This perception is not as strong as it was in the 1970s and 1980s, but it is still generally true when compared to other financial sectors.

Life insurance companies focus on legacy planning and replacing human capital value. They are allowed to use their customers' money to invest for themselves, which is similar to banks but happens to an even greater extent. This is sometimes referred to as "the float."

Life insurance companies can be structured as either traditional stock companies with outside investors or as mutual companies where policyholders are the owners. Owing to the long-term nature of life insurance policies, life insurance companies invest in long-term, stable products.

Life insurance companies have historically invested in bonds and government-backed mortgages. However, with the rise of insurtech, they have also started investing in venture capital funds. Life insurance companies have also been investing in capital-markets products, specifically hybrids and unit-linked products, which are more capital efficient and perform well in a low-rate environment.

Brokers and Life Insurance Rates: Do They Vary?

You may want to see also

Life insurance companies can be structured as either traditional stock companies or mutual companies where policyholders are the owners

Life insurance companies can be structured as either traditional stock companies or mutual companies, where policyholders are the owners. This has implications for their business practices, products, and the level of risk their clients can expect.

A stock life insurance company is owned by investors and operators who have bought the company's stock. These companies operate similarly to most companies that people interact with daily. Dividends paid out from profits go to the shareholders, not the policyholders. Stock companies can raise money by issuing debt or by issuing more stock, giving them more flexibility. However, stock companies tend to focus on universal life products, which carry more risk and fewer guarantees.

On the other hand, mutual life insurance companies are owned by their customers who hold qualified policies issued by the company. Policyholders are both customers and owners, and dividends are paid out to them. Mutual companies tend to be more conservative and take less risk. They generally focus on whole life insurance, which offers guaranteed minimum yearly dividends and premiums that stay the same over time. Mutual insurers also tend to keep larger financial reserves and have more stable and reliable financial performance over time.

While mutual insurers are generally a better choice for those looking to minimize risk, stock insurers may be preferable for those willing to take on more risk in exchange for potentially higher returns or lower insurance costs.

Variable Life Insurance: Cash Value and Benefits Explained

You may want to see also

Life insurance is regarded as a slow-growing, safe sector for investors

The insurance industry is made up of different types of players operating in different spaces. Life insurance companies focus on legacy planning and replacing human capital value, while health insurers cover medical costs. Property, casualty, or accident insurance, on the other hand, is aimed at replacing the value of homes, cars, or other valuables.

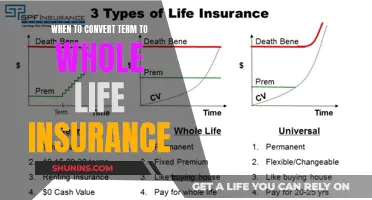

Life insurance companies offer policies that pay a death benefit as a lump sum upon the death of the insured to their beneficiaries. These policies may be sold as term life insurance, which is less expensive and expires at the end of the term, or permanent life insurance, which is more expensive but lasts a lifetime and carries a cash accumulation component.

The insurance sector is fundamentally rooted in risk management. All policies are written with various risks considered, and actuarial analysis is performed to understand the statistical likelihood of certain outcomes. Based on variances between statistical data and projections, policyholder premiums are adjusted, or benefits are re-evaluated. Generally, premium amounts paid within the insurance sector are a function of the risk associated with the related individual, property, or item being insured.

One of the interesting features of insurance companies is that they are allowed to use their customers' money to invest for themselves, similar to banks. This is sometimes referred to as "the float." Insurance companies have a positive cost of capital, which means they can offer lower-risk, stable returns to investors.

The insurance industry is highly regulated, which may protect investors while also creating compliance barriers that limit growth opportunities. Regulations ensure consumer safety, financial stability, ethical business practices, and adherence to solvency criteria.

Life insurance can also be a financial asset for the policyholder during their lifetime, just like an IRA or mutual fund. Permanent life insurance policies, such as whole life insurance and universal life insurance, enable policyholders to invest in conservative investments and accumulate cash value over time. Policyholders can borrow against this cash value, use it as collateral for a loan, or withdraw funds.

Variable Life Insurance: Annuity or Not?

You may want to see also

Frequently asked questions

The life insurance industry is a sector of the insurance industry, which is itself rooted in risk management. Life insurance companies focus on legacy planning and replacing human capital value.

The basic concept of insurance is that one party, the insurer, will guarantee payment for an uncertain future event, such as death. Another party, the insured or the policyholder, pays a smaller premium to the insurer in exchange for that protection.

Some of the largest life insurance companies in the United States by market capitalization include MetLife, American International Group (AIG), and Prudential Financial.

The life insurance industry has seen significant changes over the past decade. Developing economies, particularly emerging markets in Asia, have become global growth drivers and now account for more than half of global premium growth. The industry has also seen a shift from traditional life insurance to a greater emphasis on underwriting annuities.

Recent years have underscored the importance of financial preparedness for families, with events like the COVID-19 pandemic emphasizing the need for protection against unforeseen circumstances. This has sparked a significant increase in the demand for life insurance.