Service-connected veterans, who have been injured or disabled as a direct result of their military service, are eligible for a range of insurance benefits to support their well-being and financial security. These benefits are designed to address the unique challenges faced by veterans, including physical and mental health issues, as well as the impact of their service on their ability to work and maintain a stable income. The insurance options available to these veterans can vary, but they typically include healthcare coverage, disability compensation, and life insurance, tailored to meet the specific needs of those who have served their country. Understanding these benefits is crucial for veterans to ensure they receive the support they deserve and to navigate the complex process of accessing these essential services.

| Characteristics | Values |

|---|---|

| Type of Insurance | Health Insurance, Disability Insurance, Life Insurance, Long-Term Care Insurance, and Critical Illness Insurance |

| Health Insurance | VA Health Care, TRICARE, and private health insurance plans |

| Disability Insurance | VA Compensation and Pension (C&P) Benefits, Social Security Disability Insurance (SSDI), and private disability insurance |

| Life Insurance | VA's Service-Connected Disability Insurance (SCDI), private life insurance policies, and term life insurance |

| Long-Term Care Insurance | VA's Long-Term Care Insurance, private long-term care policies, and Medicaid |

| Critical Illness Insurance | Private critical illness insurance plans, and VA's Critical Illness Insurance (if available) |

| Eligibility Criteria | Service-connected disabilities, VA ratings, and specific medical conditions |

| Coverage | Medical expenses, disability benefits, income replacement, long-term care, and critical illness coverage |

| Administration | VA, Department of Defense (DoD), and private insurance providers |

| Application Process | VA claims, VA disability ratings, and private insurance enrollment |

| Benefits Duration | Long-term or permanent, depending on the disability and insurance type |

| Additional Support | VA's Vet Center, VA Regional Offices, and VA Community Resource Centers |

What You'll Learn

- Health Insurance: Veterans can access VA healthcare and receive coverage for medical services

- Disability Compensation: Financial aid for disabilities incurred or aggravated during military service

- Education Benefits: Veterans can utilize GI Bill programs for education and training

- Home Loans: VA offers mortgage benefits for purchasing, refinancing, or building a home

- Life Insurance: Veterans can secure financial protection for their families with VA life insurance

Health Insurance: Veterans can access VA healthcare and receive coverage for medical services

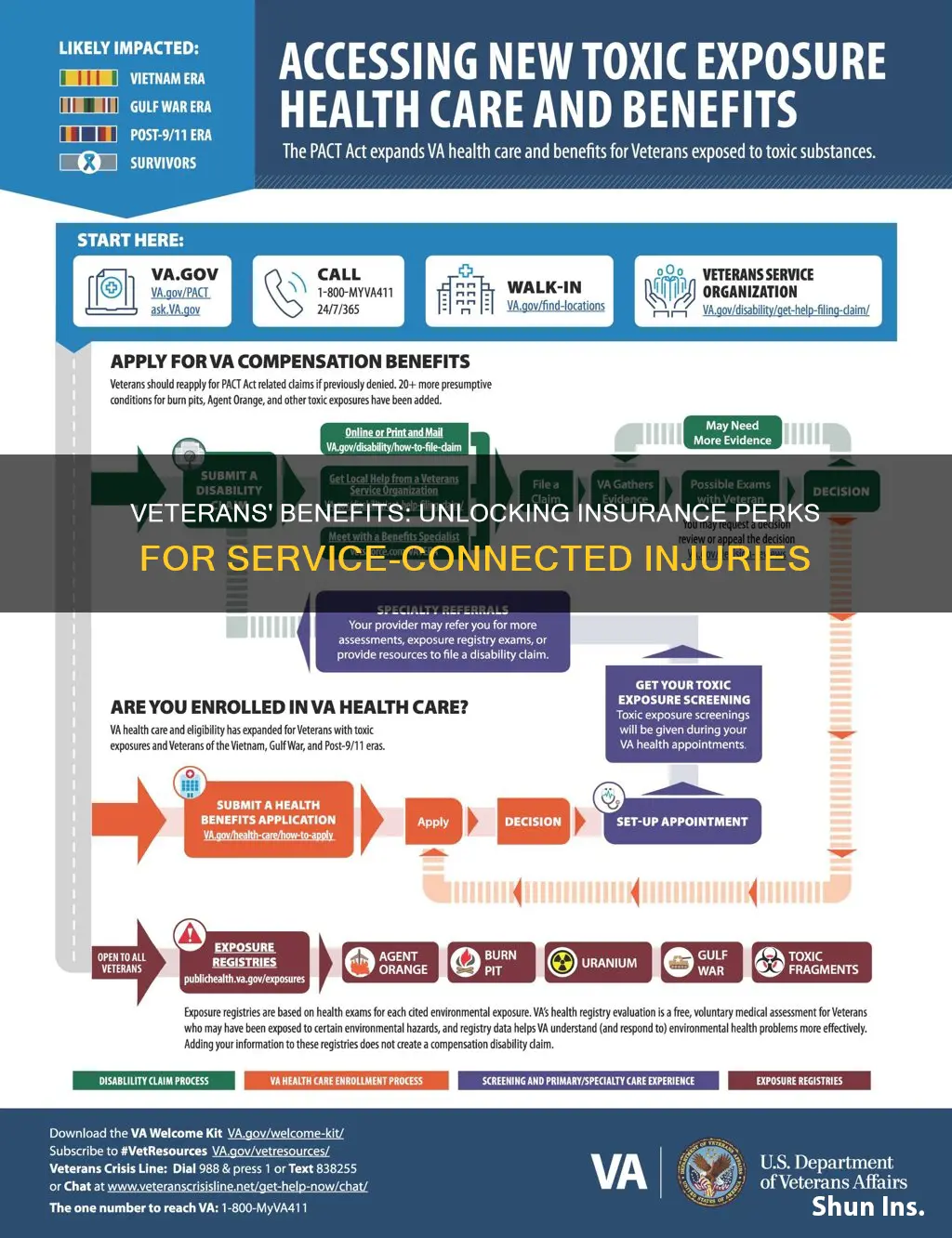

Service-connected veterans are eligible for a range of healthcare benefits and insurance coverage through the Department of Veterans Affairs (VA). The VA provides comprehensive healthcare services, ensuring that veterans who have served their country receive the necessary medical attention and support. Here's an overview of the health insurance and healthcare options available to these veterans:

Veterans who have been granted service connection for a disability can access the VA's healthcare system. This system offers a wide array of medical services, including primary care, specialty care, mental health services, and long-term care. The VA ensures that veterans receive the necessary treatment and support for their service-connected disabilities. This coverage is an essential benefit, as it provides access to specialized care that might not be readily available through private insurance providers. The VA's healthcare system is designed to cater to the unique needs of veterans, offering a holistic approach to their medical well-being.

One of the key advantages of VA healthcare is the absence of copayments, deductibles, or coinsurance for most services. This means that veterans can receive treatment without incurring additional costs, making healthcare more accessible and affordable. The VA also provides prescription drug coverage, ensuring that veterans have access to essential medications. This comprehensive approach to healthcare ensures that veterans can focus on their recovery and well-being without the added financial burden.

In addition to medical services, the VA offers mental health care, which is particularly important for veterans dealing with the challenges of service-connected disabilities. This includes access to counseling, therapy, and support groups to address various mental health concerns. The VA's commitment to providing holistic care means that veterans can receive the necessary support to manage their disabilities and improve their overall quality of life.

Furthermore, the VA's healthcare system provides long-term care services, ensuring that veterans receive the support they need as their medical conditions evolve. This includes assistance with activities of daily living, skilled nursing care, and rehabilitation services. The VA's long-term care program is designed to provide continuity of care and support for veterans with chronic or complex medical needs.

Service-connected veterans can also benefit from the VA's prosthetics and adaptive equipment services. This program provides veterans with the necessary devices and equipment to assist with mobility, daily living, and rehabilitation. The VA ensures that veterans have access to the latest advancements in assistive technology, promoting independence and improved quality of life.

In summary, the VA's healthcare system offers a comprehensive and supportive approach to health insurance for service-connected veterans. With a wide range of medical services, mental health care, long-term care, and specialized programs, veterans can access the necessary treatment and support. The VA's commitment to providing affordable and accessible healthcare ensures that veterans can focus on their well-being and continue serving their country with honor.

Insurance: Year Built vs Remodel

You may want to see also

Disability Compensation: Financial aid for disabilities incurred or aggravated during military service

Service-connected veterans who have incurred or aggravated disabilities during their military service are eligible for a range of financial benefits and support through the Department of Veterans Affairs (VA) in the United States. One of the primary forms of financial aid is Disability Compensation, a monthly tax-free payment designed to provide financial assistance to veterans with service-connected disabilities. This compensation is intended to cover the cost of living with a disability and is based on the degree of disability, ranging from 10% to 100% disability ratings. The VA assesses the severity of the veteran's condition using a comprehensive rating schedule, which takes into account the impact of the disability on the veteran's daily life and employment prospects.

To be eligible for Disability Compensation, veterans must have a service-connected disability, meaning the disability is directly related to their military service. This can include injuries sustained in combat, illnesses contracted during deployment, or disabilities that developed or worsened as a result of military training or service. The VA has a duty to assist veterans in establishing service connection, providing medical evidence and expert opinions to support their claims. Once a veteran's disability is service-connected, they can apply for compensation benefits.

The application process involves submitting detailed medical evidence, including treatment records, examination reports, and statements from healthcare professionals. Veterans should provide comprehensive documentation of their disability, including any medical treatments received and the impact on their daily functioning. The VA will then review the evidence and make a determination regarding the disability rating, which will determine the level of compensation. This process may involve multiple stages, including initial claims, appeals, and potential hearings.

Disability Compensation can significantly improve the quality of life for veterans with service-connected disabilities. The financial assistance can cover various expenses, such as medical bills, adaptive equipment, home modifications, and daily living aids. It also provides a sense of financial security, allowing veterans to focus on their well-being and reintegration into civilian life. Additionally, the VA offers other benefits, such as healthcare services, vocational rehabilitation, and educational assistance, to further support veterans with disabilities.

It is important for service-connected veterans to understand their rights and the benefits they are entitled to. The VA provides extensive resources and guidance to help veterans navigate the claims process and ensure they receive the appropriate compensation. Veterans can also seek assistance from VA-accredited representatives or veterans service organizations, who can provide support and advocacy throughout the application and appeal processes. By accessing these benefits, veterans can receive the financial and medical support they need to manage their disabilities and lead fulfilling lives.

Updating Your Address: A Nationwide Insurance Guide

You may want to see also

Education Benefits: Veterans can utilize GI Bill programs for education and training

Service-connected veterans are eligible for a range of educational benefits and programs through the GI Bill, which can significantly support their transition back into civilian life and provide opportunities for personal and professional growth. The GI Bill offers a comprehensive package of educational assistance, ensuring that veterans can access the resources they need to pursue their chosen paths.

One of the key benefits is the Post-9/11 GI Bill, which provides financial support for veterans who have served at least 90 days of active duty after September 10, 2001. This program offers a combination of housing stipend and educational assistance, allowing veterans to cover the costs of tuition, housing, and books. The amount of financial support varies based on the veteran's length of service and the chosen educational institution. For instance, a veteran with 36 months of active duty service is eligible for up to 36 months of educational benefits, which can be used for undergraduate, graduate, or even professional degree programs.

In addition to the financial aid, the GI Bill also provides access to other educational resources. Veterans can utilize the MyVA411 mobile app, which offers a wealth of information on educational benefits, including eligibility requirements, application processes, and available resources. This app serves as a valuable tool for veterans to navigate the complexities of educational assistance and make informed decisions about their future. Furthermore, the Department of Veterans Affairs (VA) offers a range of educational services, such as the VA Education Office, which provides guidance and support to veterans throughout their educational journey.

The GI Bill's educational programs are designed to cater to various needs and interests. Veterans can choose from a wide array of educational institutions, including public and private colleges, universities, and technical schools. They can also opt for distance learning or online programs, providing flexibility for those with unique circumstances or preferences. The program covers a broad spectrum of educational pursuits, from undergraduate degrees to specialized training and apprenticeships.

Moreover, the GI Bill's educational benefits extend beyond traditional academic pursuits. Veterans can utilize these programs for job training, vocational rehabilitation, and apprenticeship programs. These opportunities enable veterans to acquire new skills, gain industry experience, and enhance their employability in the civilian job market. By offering such diverse educational avenues, the GI Bill empowers service-connected veterans to pursue their desired careers and achieve personal and professional success.

Updating Your Lemonade Insurance Policy: Navigating Address Changes

You may want to see also

Home Loans: VA offers mortgage benefits for purchasing, refinancing, or building a home

The U.S. Department of Veterans Affairs (VA) provides a range of mortgage benefits specifically tailored to service-connected veterans, ensuring they have access to favorable home financing options. These benefits are designed to support veterans in their homeownership journey, whether they are purchasing a new home, refinancing an existing mortgage, or even building a custom home. Here's an overview of the VA's mortgage offerings:

Purchase Loans: Service-connected veterans are eligible for VA's Purchase Loans, which offer a unique advantage in the housing market. This loan type allows veterans to purchase a home with no down payment, eliminating the need for private mortgage insurance (PMI), which is typically required with conventional loans. The VA loan is backed by the government, providing lenders with a guarantee, and this assurance often results in more competitive interest rates and better terms for veterans. With this benefit, veterans can enter the housing market with greater financial flexibility and potentially save thousands of dollars in upfront costs.

Refinance Options: VA also offers refinancing opportunities to help veterans optimize their homeownership experience. The VA Cash-Out Refinance allows veterans to refinance their existing mortgage and access the equity in their home, providing funds for various purposes, such as home improvements, debt consolidation, or education. This option can be particularly beneficial for veterans who want to reduce their monthly mortgage payments or take advantage of lower interest rates. Additionally, the VA Interest Rate Reduction Refinance Loan (IRRRL) enables veterans to refinance their VA loan to a lower interest rate, potentially saving money over the life of the loan.

Building a Home: For those service-connected veterans with unique housing needs or preferences, the VA offers the VA Construction Loan. This loan program provides financing for the construction of a custom home or the renovation of an existing property. Veterans can secure funding for the entire construction process, ensuring they have the necessary financial support to build their dream home. The VA Construction Loan also offers the flexibility to choose the loan term that best suits the veteran's financial situation.

To take advantage of these mortgage benefits, veterans must meet specific eligibility criteria, including being honorably discharged from active military service and having a valid Certificate of Eligibility (COE). The COE is issued by the VA and confirms the veteran's entitlement to certain benefits. Veterans can apply for a COE online or through a VA Regional Office, which will streamline the process of accessing these valuable home loan options.

In summary, the VA's mortgage benefits for service-connected veterans are designed to support their housing needs and provide financial advantages. From purchase loans with no down payment to refinancing options for cash-out or rate reduction, these programs empower veterans to make informed decisions about homeownership. By leveraging these benefits, veterans can secure favorable financing terms, build equity, and ultimately achieve their homeownership goals with confidence.

Insurance Churning: Why Do People Do It?

You may want to see also

Life Insurance: Veterans can secure financial protection for their families with VA life insurance

Service-connected veterans are eligible for a range of insurance benefits provided by the U.S. Department of Veterans Affairs (VA), which can offer valuable financial security for veterans and their families. One of the most important benefits is life insurance, a crucial tool for ensuring financial stability and peace of mind. VA life insurance is specifically designed to provide financial protection for veterans and their beneficiaries in the event of the veteran's death.

The VA offers two types of life insurance policies: the Veterans' Life Insurance (VLI) and the Service-Disabled Veterans' Life Insurance (SDVLI). VLI is available to all honorably discharged veterans, while SDVLI is tailored for veterans with a service-connected disability rating of 20% or higher. This insurance is particularly beneficial for veterans who have served in active combat or have sustained injuries or illnesses related to their military service.

Enrolling in VA life insurance is a straightforward process. Veterans can apply online through the VA's eBenefits portal or by completing a paper application. The VA offers two levels of coverage: $50,000 and $100,000. The higher coverage amount is recommended for those with larger families or financial responsibilities. Premiums are determined by factors such as age, health, and the amount of coverage chosen. It's important to note that the younger and healthier the veteran, the lower the premium will be.

One of the key advantages of VA life insurance is its affordability compared to private life insurance policies. The VA sets premium rates based on the veteran's age and the chosen coverage amount, ensuring that the cost is reasonable and accessible. Additionally, veterans can choose to pay premiums annually, semiannually, or monthly, providing flexibility in budgeting.

By securing VA life insurance, veterans can provide a financial safety net for their families, covering expenses such as mortgage payments, education costs, or daily living expenses. This insurance ensures that the veteran's loved ones are financially protected, even in the event of the veteran's passing. It is a valuable benefit that should not be overlooked, as it offers long-term financial security and peace of mind for veterans and their families.

Billing Strategies for School Psychology Residents: Navigating Insurance Claims

You may want to see also

Frequently asked questions

Service-connected veterans are eligible for various insurance benefits, including health insurance, life insurance, and disability insurance. These programs are designed to support veterans who have incurred disabilities or health issues as a result of their military service.

The VA offers the Veterans Health Administration (VHA) health care system, which provides comprehensive medical services to eligible veterans. This includes access to primary care, specialty care, mental health services, and rehabilitation programs. Veterans with service-connected disabilities may receive priority for VHA treatment.

Yes, the VA offers the Veterans' Group Life Insurance (VGLI) program, which provides life insurance coverage to eligible veterans. VGLI offers both basic and additional coverage options, and it is available at a reduced cost compared to commercial life insurance policies.

Absolutely. Veterans who have been granted service connection for a disability by the VA are eligible for both disability compensation and disability insurance. The VA's disability compensation program provides monthly tax-free payments to veterans with service-connected disabilities, while disability insurance offers additional financial protection.

The application process varies depending on the specific insurance program. Veterans can start by filing a claim with the VA, providing necessary documentation, and completing the required forms. The VA will then review the application and determine eligibility. It is recommended to contact the VA or seek assistance from a VA representative to understand the application process in detail.