Term life insurance is a type of insurance that covers you for a set period, usually 10, 15, or 20 years. It is a cost-effective way to protect your family financially if you are no longer around to provide for them. A 15-year term life insurance policy is ideal for those with short-term insurance needs, such as covering a child's education or planning for retirement. It offers affordable coverage for a specific duration, after which beneficiaries receive a lump-sum death benefit. While term life insurance doesn't build cash value, it can be converted to permanent coverage, providing lifelong protection with additional features.

| Characteristics | Values |

|---|---|

| Term Length | 15 years |

| Renewal Options | Renew for another term, convert to permanent coverage, or allow the policy to lapse |

| Premium | Fixed for the duration of the policy |

| Death Benefit | Pays the policyholder's beneficiaries when the policy is in force |

| Conversion Options | Convert to a permanent life insurance policy, such as a whole or universal life insurance policy |

| Riders | Accelerated death benefit, waiver of premium, child coverage, etc. |

What You'll Learn

Who is it for?

15-year term life insurance is for people who want to provide replacement income to their beneficiaries via a death benefit should they pass away during the 15 years that the policy is in force. This type of insurance is usually chosen by people who want to protect their loved ones financially for a specific period.

- Parents: Raising kids is expensive. A 2022 study found that raising a child born in 2015 through the age of 17 would cost $310,605, excluding college expenses. If you plan to provide financial support to your kids until they are legally adults or through their college careers, then life insurance can help protect your ability to do so if you were to pass away too soon. A 15-year policy can be a great choice to get them off to a great start in life.

- People with a 15-year mortgage or less: Losing a partner is devastating, and one thing you can do to help ease the burden is to provide a financial safety net that could help pay your home mortgage in the event of your death. If you have a 15-year mortgage or less, a 15-year term life insurance policy in an amount that will cover the outstanding balance might make sense. The proceeds from your policy could be used by your partner to help pay the mortgage and other day-to-day expenses while they adjust to their new situation.

- People retiring within 10 to 15 years: For many, the goal of a life insurance policy is to replace the income that they contributed to their household if they pass away. As time goes on and your children leave the nest, your mortgage gets paid off, and you’re closing in on retirement, your financial needs may diminish, especially if you’ve set aside a sizable nest egg. If this sounds like you and retirement is a shining beacon 10-15 years down the road, a 15-year term life insurance policy could work well for you and your family.

- People planning to be financially independent within 15 years: Depending on where you are in life, a 15-year time horizon may end in financial independence for you and your partner. Maybe your plan is to pay off all of your debts and save a lot of cash during your prime earning years, leaving you free of financial burdens that you cannot cover. In that case, a 15-year term life insurance policy might be a good option to provide a safety net during your build-up period.

Credit Checks for Life Insurance: What You Need to Know

You may want to see also

How much does it cost?

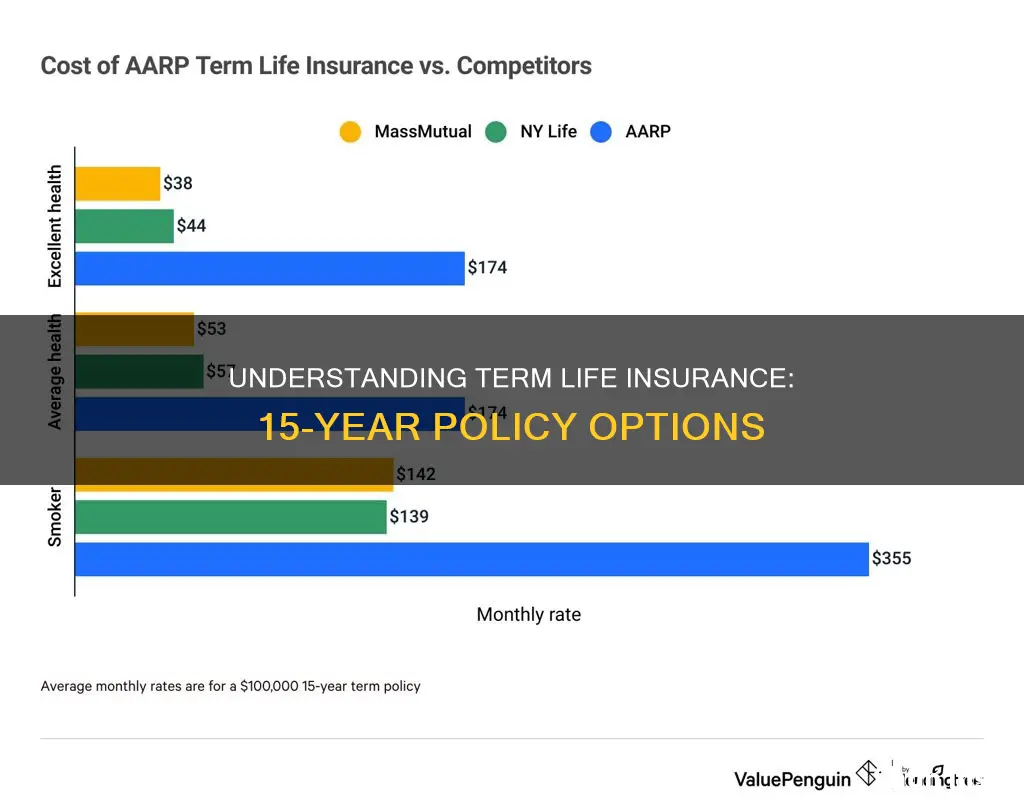

The cost of a 15-year term life insurance policy depends on several factors, such as age, gender, health status, lifestyle, and coverage amount. On average, a term life policy with $250,000 worth of coverage can cost between $17.85 and $44.37 per month, depending on your age. For smokers, the average cost of a 15-year term life policy is between $76.22 and $259.18 per month, while people in poor health pay between $35.40 and $106.92 per month on average. If you have a high BMI, the average cost of a term life policy is between $32.53 and $93.61 per month. The cost increases with age and the coverage amount.

When determining the cost of a 15-year term life insurance policy, insurance companies consider various factors to assess the risk and calculate premiums. These factors include:

- Age: Younger people generally get more affordable quotes because insurers consider them less risky. As age increases, life expectancy decreases, and the likelihood of insurers having to pay out the policy goes up, resulting in higher premiums.

- Gender: Since women have longer life expectancies than men, they usually pay less for term life insurance.

- Health: Insurance companies evaluate your height, weight, medical records, and family medical history to determine the likelihood of developing health conditions that can shorten your life.

- Lifestyle: Factors such as smoking habits and criminal record play a significant role in determining the cost of a term life insurance policy.

When shopping for a 15-year term life insurance policy, it is essential to compare quotes from multiple insurers, as rates can vary. Additionally, consider the financial strength and customer satisfaction ratings of the insurance company to ensure they have a good reputation and will be able to pay out claims in the future.

Life Insurance Maturity: Taxable in the US?

You may want to see also

What are the benefits?

A 15-year term life insurance policy is a good option for people who want to financially protect their loved ones after their death. Here are some of the benefits of a 15-year term life insurance policy:

Affordable Coverage

Since term life insurance policies offer coverage for a fixed period, they are much more affordable than permanent life insurance policies. A 15-year term life insurance policy provides comprehensive coverage at significantly lower premiums compared to longer-term insurance policies. This is especially beneficial for young people who are just starting and have less money to put towards financial protection.

Simple and Flexible

Term life insurance policies are simple to understand and offer flexibility in terms of coverage duration. You can choose a term length that suits your financial obligations and circumstances, typically ranging from 10 to 30 years. A 15-year term policy is also a good option for those who are not comfortable with long-term commitments.

Tax-Free Death Benefit

In the unfortunate event of the policyholder's death during the term, their beneficiaries will receive a tax-free death benefit. This payout can be used for various expenses, including end-of-life expenses, daily bills, mortgages, charity, debts, and dependent care.

Option to Convert to Whole Life Policy

A 15-year term life insurance policy often provides the option to convert it into a whole life insurance policy. This means that if your circumstances change and you want lifelong coverage, you can switch to a permanent policy without having to go through additional underwriting or medical exams.

Coverage for Dependents

A 15-year term life insurance policy is ideal for people with spouses, children, or other dependents who rely on their income. It ensures that your loved ones will have financial support to cover their expenses, such as education costs for children, in your absence.

Peace of Mind

By having a 15-year term life insurance policy, you gain peace of mind knowing that your family will be taken care of financially if something happens to you. This is especially important if you are the sole breadwinner of your family or have significant financial responsibilities, such as a mortgage or loans.

Life Insurance and UTMA: A Child's Future Security

You may want to see also

How does it compare to whole life insurance?

When comparing 15-year term life insurance to whole life insurance, there are several key differences to consider:

15-year term life insurance provides coverage for a specified period, which, in this case, is 15 years. During this time, the policyholder pays a predetermined premium, and the death benefit remains the same. If the insured person passes away within the 15-year term, the beneficiaries receive the death benefit. However, if the policyholder outlives the term, the policy simply terminates, and no death benefit is paid. This type of insurance is generally more affordable than whole life insurance, especially for younger individuals or those in good health, as it only provides coverage for a limited time.

On the other hand, whole life insurance, as the name suggests, provides coverage for the insured's entire life. This type of policy combines a death benefit with a savings component, known as cash value, which grows tax-deferred over time. Policyholders pay a fixed premium, and a portion of it goes towards the death benefit, while the rest is invested by the insurance company. The cash value accumulates over the years and can be borrowed against or withdrawn under certain circumstances. Whole life insurance is generally more expensive than term life insurance because it includes the investment component and guarantees a death benefit payout regardless of when the insured person passes away.

One of the main advantages of 15-year term life insurance is its affordability. The premiums are typically lower compared to whole life insurance, making it an attractive option for those on a budget or those who only require temporary coverage. It is ideal for individuals with dependents or financial obligations, such as a mortgage, who want to ensure their loved ones are protected during a specific period. Once the term ends, the coverage ends, and there is no refund or payout if the insured person survives the term.

Whole life insurance, on the other hand, offers permanent coverage and has a savings element. The cash value component can be a valuable feature, as it grows over time and can be accessed tax-free through loans or withdrawals. This makes whole life insurance a good choice for those seeking long-term financial security and a way to accumulate savings. The guaranteed death benefit also means that beneficiaries will receive a payout regardless of when the insured person passes away. However, the premiums for whole life insurance are generally higher, reflecting the lifelong coverage and investment component.

The decision between 15-year term life insurance and whole life insurance depends on individual needs and preferences. Those seeking affordable, temporary coverage may find 15-year term life insurance more suitable, while those looking for lifelong protection and a savings vehicle may prefer whole life insurance. It's important to consider factors such as budget, the desired length of coverage, and the need for a savings component when deciding between the two. Additionally, it's worth noting that term life insurance policies may offer the option to convert to a permanent policy, providing some flexibility if one's needs change over time.

In summary, 15-year term life insurance provides coverage for a specified period, making it ideal for temporary needs, while whole life insurance offers permanent coverage and includes a savings component. The choice between the two depends on factors such as budget, the desired duration of coverage, and the importance of having a guaranteed death benefit and accumulating savings. It's recommended to carefully assess one's financial situation, goals, and priorities before deciding which type of life insurance aligns best with those considerations. Consulting with a financial advisor or insurance professional can also provide valuable guidance in making an informed decision.

Colonial Penn Life Insurance: Legit or a Scam?

You may want to see also

How do I purchase it?

Purchasing a 15-year term life insurance policy can be done through various insurance companies, including New York Life, MassMutual, and State Farm. The process typically involves:

- Researching insurers and plans: Compare term life insurance rates, insurers, and plans to find the right coverage for your needs. Consider factors such as the policy type, coverage amount, and insurer reputation and financial strength.

- Connecting with an agent: Many insurance companies, like New York Life, suggest connecting with an agent to discuss your specific situation and explore your options.

- Considering additional riders: You can often customize your term policy with riders, which provide extra coverage. For example, a waiver of premium rider pauses your premiums if you become disabled and unable to work. These riders usually come at an additional cost.

- Getting quotes: Contact different insurance companies to obtain quotes for the desired coverage amount and term length. This will help you compare prices and make an informed decision.

- Applying for the policy: Once you've chosen an insurer, you'll need to provide personal information, and possibly undergo a medical exam, to apply for the policy. The insurance company may inquire about your age, health, driving record, occupation, hobbies, and family history.

- Finalizing the purchase: After your application is approved, you'll need to finalize the purchase by agreeing to the terms and conditions and making the required premium payments.

It's important to carefully review the terms and conditions of the policy before purchasing and to ensure that the coverage meets your specific needs. Additionally, keep in mind that premiums for term life insurance tend to increase with age, so it's generally more cost-effective to purchase coverage when you're younger.

Life Insurance Death Benefits: Taxable or Not?

You may want to see also

Frequently asked questions

A 15-year term life insurance policy is a type of life insurance that covers you for 15 years. It is a temporary form of coverage that is more affordable than long-term protection.

During the 15-year term, you pay monthly or annual premiums to keep the coverage active. If you die while the policy is active, your beneficiaries will receive a lump sum of cash called a death benefit. Once the 15 years are up, you can choose to extend your insurance plan or let it expire.

The 15-year term length is relatively short, so you can get a higher death benefit than many longer-term plans for the same cost. If you only need coverage for a specific period, such as until your children graduate or you pay off a loan, a 15-year term life insurance policy could be a good option.

A 15-year term life insurance policy can be ideal if you have short-term insurance needs with a specific end date. However, if you anticipate having major financial obligations beyond 15 years, investing in a longer-term policy may be more suitable.