Life insurance is a contract under which an insurance company agrees to pay a specified amount after the death of an insured party, as long as the premiums are paid. The payout amount is called a death benefit. The younger and healthier you are, the less you’ll pay for premiums. However, older people can still get life insurance. The average cost of life insurance is $26 a month. This is based on data provided for a 40-year-old buying a 20-year, $500,000 term life policy. The amount of life insurance you need depends on factors such as your debts, income, number of dependents, and how long you want to be covered.

| Characteristics | Values |

|---|---|

| How to calculate how much life insurance you need | Add up your long-term financial obligations, such as mortgage payments or college fees, and then subtract your assets. The remainder is the gap that life insurance will have to fill. |

| Quick ways to estimate how much life insurance you need | 1. Multiply your income by 10 |

| 2. Multiply your income by 10, plus $100,000 per child for college expenses | |

| 3. Use the DIME formula (debt, income, mortgage, education) | |

| 4. Replace your income, plus add a cushion | |

| Factors that affect the cost of life insurance | Your age, gender, smoking status, health, family medical history, driving record, occupation, lifestyle |

| Factors that don't affect the cost of life insurance | Your ethnicity, race, sexual orientation, credit score, marital status, number of life insurance policies, number of beneficiaries |

What You'll Learn

- Life insurance is based on a contract between the policyholder and the insurance company

- The average cost of life insurance is $26 a month

- Life insurance rates can vary depending on age, gender, health, and more

- Permanent life insurance is more expensive than term life insurance

- Life insurance can help cover funeral expenses and pay off debts

Life insurance is based on a contract between the policyholder and the insurance company

Life insurance is a contract between the policyholder and the insurance company. The policyholder is the person who owns the policy and pays the premiums. They are usually the same person as the insured, whose life is covered by the policy. However, the policyholder and the insured can be different people. For example, a parent might take out a policy on their child.

The policyholder has several rights and responsibilities, including:

- Paying the premiums

- Choosing the length of coverage

- Deciding on the beneficiaries and how much of the benefit they will receive

- Making any changes to the policy, such as changing the beneficiaries or surrendering the policy

- Using the cash value, if it is a permanent life insurance policy

The insured is the person whose life is covered by the policy. The insurance company will pay out the death benefit when the insured dies. The insured doesn't have the right to adjust the policy, unless they are also the policyholder. Premiums are based on the insured's health, lifestyle, age, and other factors.

The third key party in a life insurance policy is the beneficiary, who receives the death benefit when the insured dies. The policyholder can be the beneficiary, but this isn't always the case. It's important to regularly review the policy to ensure the named beneficiaries are up to date.

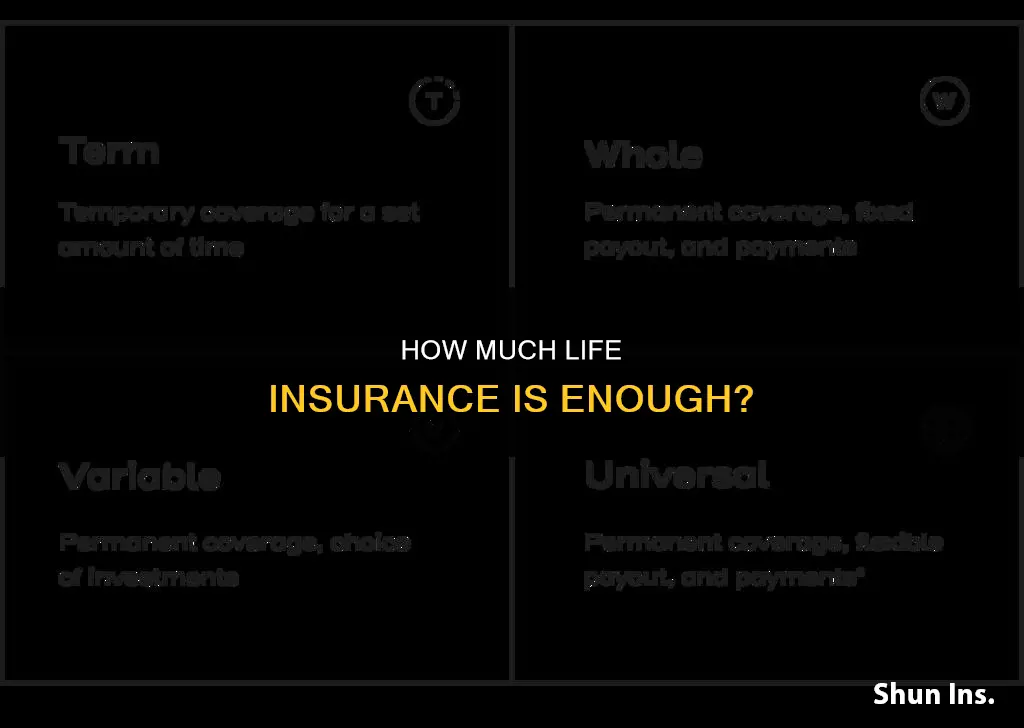

There are two main types of life insurance: permanent and term. Permanent life insurance policies do not have an expiration date, meaning you are covered for life as long as the premiums are paid. Many permanent life insurance policies allow you to build cash value by investing a portion of the premiums. Term life insurance only covers you for a set number of years and does not accumulate cash value.

Exide Life Insurance: IRDA-Accredited and Reliable

You may want to see also

The average cost of life insurance is $26 a month

Life insurance premiums are primarily based on life expectancy. Generally, the younger and healthier you are, the cheaper your premiums. Insurers typically classify applicants as super preferred, preferred, or standard, with super preferred being the healthiest category. They then calculate premiums based on your risk class.

Each insurer has its own evaluation process, known as life insurance underwriting, and weighs factors differently. Therefore, it's a good idea to compare quotes from multiple insurers.

- Your age: Younger people tend to pay less for life insurance because their life expectancy is higher.

- Your gender: Women usually pay less than men of the same age and health because they have longer life expectancies.

- Your smoking status: Smokers are at a higher risk of developing health issues and therefore pay more for life insurance.

- Your health: This includes any pre-existing conditions, as well as your blood pressure and cholesterol levels.

- Your family medical history: Insurers may ask about a history of serious health conditions in your family.

- Your driving record: A history of DUIs, DWIs, or major traffic violations may result in higher rates.

- Your occupation and lifestyle: High-risk jobs or dangerous hobbies may lead to higher premiums.

The type of life insurance you choose also affects the cost. Term life insurance is generally the least expensive, while permanent life insurance, which lasts a lifetime and includes a cash value component, is significantly more expensive. Adding riders to your policy, such as a child rider, can also increase your premium.

On the other hand, certain factors do not impact your life insurance premium. These include your ethnicity, race, sexual orientation, credit score, marital status, the number of policies you have, and the number of beneficiaries you name.

In summary, while the average cost of life insurance is around $26 per month, this figure can vary widely depending on individual circumstances and the specific policy chosen. It's important to carefully consider your needs and compare quotes from multiple insurers to find the most suitable coverage for your situation.

Life Insurance: Cheap, But Why?

You may want to see also

Life insurance rates can vary depending on age, gender, health, and more

Life insurance rates can vary significantly depending on several factors, including age, gender, health, and lifestyle choices. Here's how each of these factors influences the cost of life insurance:

Age

Age is a pivotal factor in determining life insurance premiums. As people age, the likelihood of passing away increases, which elevates the risk for insurers. Consequently, older individuals tend to pay higher premiums due to the heightened chance of a death benefit claim. The younger and healthier you are, the less you'll generally pay for life insurance premiums. It's advisable to purchase life insurance as early as possible to lock in lower rates, as age is a primary factor in premium calculations.

Gender

Actuarial data shows that women have a longer life expectancy than men, and insurance companies use this information to assess risk. Since women typically live longer, they often pay lower life insurance rates than men of the same age and health status. This disparity is reflected in the average life expectancy in the United States, which is 79.3 years for women and 73.5 years for men.

Health

Health is another critical factor influencing life insurance rates. People with pre-existing medical conditions or a family history of diseases may not live as long as those in good health. As a result, insurance companies often charge higher rates for individuals with health issues. During the underwriting process, insurers evaluate an applicant's health through medical exams, health questionnaires, and rating tiers to determine their risk class. The healthier an individual is, the lower their life insurance premiums are likely to be.

Lifestyle Choices

Lifestyle choices, such as smoking status, driving record, occupation, and hobbies, can also impact life insurance rates. Smokers are considered high-risk due to their increased likelihood of developing health issues, resulting in higher premiums. Additionally, hazardous jobs or high-risk activities like skydiving or racing can drive up insurance rates because they increase the probability of a claim.

In summary, life insurance rates are dynamic and depend on a multitude of factors that insurers use to assess risk. While age, gender, health, and lifestyle choices are significant considerations, other factors like policy type, coverage amount, and individual circumstances also play a role in determining the cost of life insurance.

HSA and Group Term Life Insurance: What's the Difference?

You may want to see also

Permanent life insurance is more expensive than term life insurance

Firstly, permanent life insurance policies do not have an expiration date, meaning they offer lifelong coverage as long as premium payments are made. In contrast, term life insurance covers a specified period, such as 10, 15, 20, or 30 years, and requires renewal or a new policy at the end of the term. This feature of permanent life insurance, where the insured is covered for their entire life, is a significant factor in the higher cost.

Secondly, permanent life insurance policies often include a cash value component. This means that the policyholder can build cash value by investing a portion of the premiums, which offers an investment opportunity. The cash value can be accessed and used during the lifetime of the insured and can also be inherited by survivors or other beneficiaries. Term life insurance, on the other hand, does not accumulate cash value and only offers coverage for a set number of years.

Thirdly, permanent life insurance premiums are typically higher because they cover the cost of the coverage, management fees for a more comprehensive policy, and contributions towards building the cash value. In contrast, term life insurance premiums only cover the cost of the death benefit.

Additionally, permanent life insurance policies may offer other benefits such as tax-deferred growth on the cash value and tax-free policy loans, which further contribute to their higher cost.

It's important to note that while permanent life insurance is more expensive, it also provides added benefits and flexibility that may be valuable to individuals with complex financial situations, higher incomes, or specific lifelong dependents.

AIG Life Insurance: AM Best Rating Explained

You may want to see also

Life insurance can help cover funeral expenses and pay off debts

Life insurance is an important financial tool that can help your loved ones cover funeral and burial expenses, pay off remaining debts, and manage day-to-day living expenses in the event of your passing. When determining how much life insurance you need, it's essential to consider your financial goals, family situation, and the specific needs of your dependents. Here are some key factors to keep in mind:

Funeral and Burial Expenses

Funeral costs can quickly add up to thousands of dollars, with the median cost of a funeral being around $8,300. Final expense insurance or burial insurance is a type of whole life insurance specifically designed to cover these end-of-life expenses. It typically has lower death benefits, ranging from $5,000 to $25,000, but also offers more affordable premiums. This type of insurance ensures your loved ones can cover funeral-related costs without financial strain.

Outstanding Debts

Life insurance can also help pay off any remaining debts, including mortgages, car loans, credit card debt, and student loans. It's important to ensure your policy includes enough coverage to pay off these debts in full, along with any additional interest or charges. This helps relieve your loved ones of the financial burden and provides them with greater financial security.

Income Replacement

Another crucial aspect to consider is income replacement, especially if you are the primary breadwinner for your family. Your policy's payout should ideally be large enough to replace your income for a certain number of years, accounting for inflation and unexpected costs. This ensures your dependents can maintain their standard of living even after your passing.

Education Costs

If you have children, it's essential to factor in their education costs, including college fees. Life insurance can help cover these expenses, ensuring your children can pursue their educational goals without financial hindrance.

Other Considerations

When determining the appropriate amount of life insurance, you can use various methods, such as the "10 times income" guideline or the DIME (debt, income, mortgage, education) formula. These methods provide a more comprehensive view of your financial obligations and help you estimate the necessary coverage. Additionally, consider seeking professional advice and comparing quotes from multiple insurers to find the best policy for your needs.

In conclusion, life insurance plays a vital role in financial planning, providing peace of mind and financial security for your loved ones. By considering funeral expenses, outstanding debts, income replacement, and education costs, you can ensure your dependents have the necessary support to navigate the challenges that may arise in your absence.

Group Life Insurance: Payout Frequency and What to Expect

You may want to see also

Frequently asked questions

The cost of life insurance is influenced by factors such as age, gender, health, family medical history, occupation, lifestyle choices, and driving record. Generally, younger people pay lower premiums than older people due to lower health risks. Additionally, women tend to have lower premiums than men because of their longer life expectancy.

The amount of life insurance needed depends on various factors, including income, debts, mortgage, education costs for children, and funeral expenses. A common guideline is to have coverage worth at least 10 times your annual income. Another approach is to calculate the sum of your long-term financial obligations, such as mortgage payments and education fees, and then subtract your assets to determine the coverage gap.

You can use a life insurance calculator or consult a licensed agent or financial planner to help determine the appropriate level of coverage. Consider your financial obligations, such as income replacement, mortgage balance, future expenses (e.g., education fees), and funeral costs. Subtract your liquid assets, such as savings and existing insurance policies, to estimate the necessary coverage amount.

Term life insurance covers a fixed period, such as 10, 20, or 30 years, and is generally more affordable. Whole life insurance, on the other hand, lasts a lifetime and includes a cash value component, making it more expensive. With whole life insurance, the beneficiary receives the death benefit regardless of when the insured person passes away.