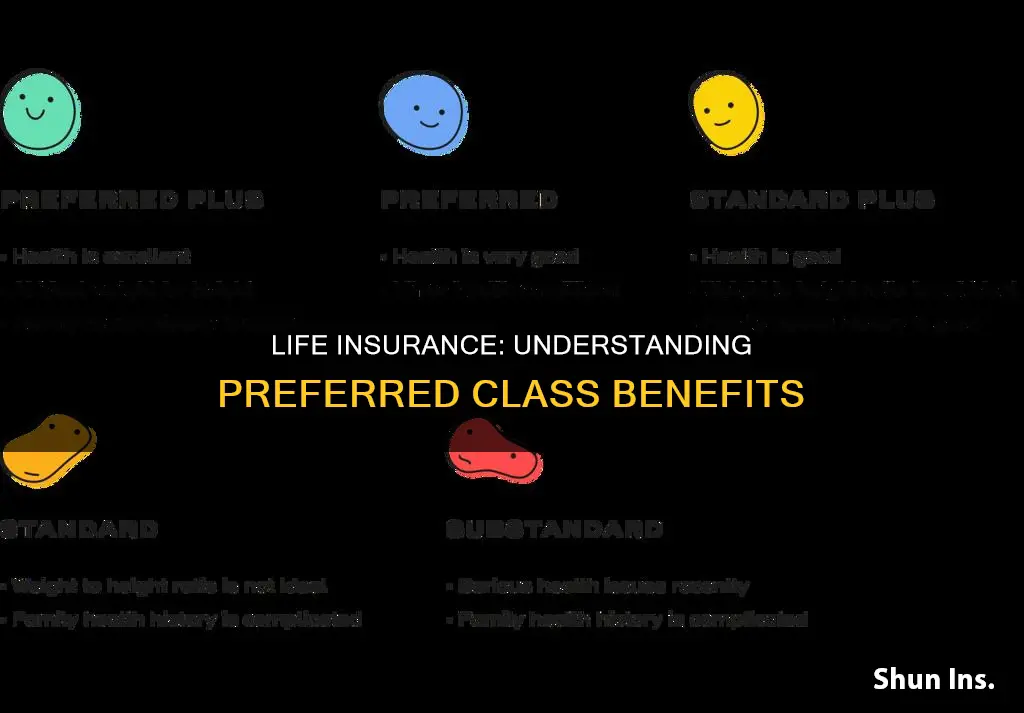

Life insurance companies use risk classes to determine how likely they are to have to pay out benefits on your behalf if you pass away. The risk class you're assigned to can directly impact what you pay for life insurance premiums. Generally, there are three risk classes: super preferred, preferred, and standard. However, some companies also have a substandard risk class. The criteria for each class are relatively similar, but specific requirements can vary. If applicants don’t meet the criteria for these classes, they might be classified as substandard.

| Characteristics | Values |

|---|---|

| Health | Excellent |

| Lifestyle | Safe |

| Age | Young |

| Tobacco use | No tobacco use in the past 3-5 years |

| Family history | No history of heart disease or cancer before age 60 |

| Driving record | Clean |

| Blood pressure | Normal |

| Cholesterol | Normal |

| Weight | Within height and weight guidelines |

| Occupation | Low-risk |

| Hobbies | Low-risk |

What You'll Learn

Preferred Plus Risk Class

The preferred plus risk class, also known as super preferred or preferred elite, is the lowest-risk category in life insurance. Individuals in this risk class are considered to be in excellent health, typically young, and have no immediate cause for concern. They can expect to pay the lowest premiums for life insurance.

To qualify for the preferred plus risk class, applicants must meet certain criteria. They should have no use of tobacco or nicotine-based products and should have no history of substance abuse. In addition, they should have no personal history of impairment or diseases that could affect mortality, such as diabetes, cancer, or heart disease.

The preferred plus risk class also takes into account family history. Applicants should have no immediate family members who have passed away from cardiovascular, cerebrovascular, or certain types of cancer before the age of 60. This ensures that the applicant's genetic risk factors are also favourable.

Other factors considered for the preferred plus risk class include driving history, with no more than two moving violations or DUI convictions in recent years, and no history of high-risk hobbies or professions, such as skydiving or mining.

Preferred plus applicants should also have ideal blood pressure and cholesterol levels, falling within specific ranges set by the insurance company. Their weight should be within the carrier's height and weight build chart, which varies for men and women.

Overall, the preferred plus risk class is reserved for individuals who exhibit superior health and pose the least risk to the insurer. Only a small percentage of applicants, around 5-10%, may be eligible for this group due to its stringent requirements.

By offering the preferred plus risk class, insurance companies can provide the lowest premiums to individuals who are least likely to file a claim, ensuring that the insurance policy is a mutually beneficial arrangement for both parties involved.

Checking Your Globe Life Insurance Application Status

You may want to see also

Preferred Risk Class

The preferred risk class is the second-best category for life insurance rates, after the super-preferred or preferred-plus class. Someone who qualifies for the preferred risk class is typically in good health, with a low-risk occupation and hobbies, and no history of risky behaviour such as smoking or drug use.

People in the preferred risk class are similar to those in the super-preferred category but may have slightly less-than-perfect health. For example, they may be taking medication to treat a condition such as high blood pressure, be slightly overweight, or have a family history that indicates a higher risk. People with diabetes or mental health conditions such as anxiety and depression, which are being managed through medication, can also qualify for the preferred risk class.

The preferred risk class is the most common category for life insurance applicants, with most people falling into this class. It is worth noting that the criteria for each class are relatively similar but can vary depending on the insurance company.

Canceling Your Fidelity Life Insurance: A Step-by-Step Guide

You may want to see also

Standard Plus Risk Class

A Standard Plus Risk Class in life insurance is for individuals who have an average health profile and a few minor health issues. They may have well-controlled conditions or a slightly higher risk factor but still meet the insurance company's underwriting guidelines for this class.

People in this risk class may have a history of more serious health challenges but are not currently at risk of premature death. They may be overweight and have minor health issues.

The standard plus risk class is above average health, but things like blood pressure or body mass index (BMI) may be outside the ideal range. The premiums are more favourable than the Standard risk class, but individuals in this class may pay more than those in the Preferred or Preferred Plus grouping.

The standard plus risk class is one of the four main rate classes that insurance companies use to categorise individuals. The other three are Preferred Plus, Preferred, and Standard. Some companies may also have a substandard risk class.

The specific risk classes may vary among insurance companies, but the general criteria for each class are similar. People in the Preferred Plus class are typically young and healthy, with no tobacco use or family history of heart disease or cancer before the age of 60. They have normal blood pressure and cholesterol and work in low-risk jobs.

The Preferred class is for individuals who are still in good health but may have conditions like high blood pressure or high cholesterol that are controlled with medication. They may also have a family history that indicates a higher risk.

The Standard class is for people with average health, who may be on multiple medications and often have higher BMIs than those in the other risk categories. They also typically have a family history of cancer and other serious diseases.

The Standard Plus class falls between the Preferred and Standard classes in terms of health and risk factors. Individuals in this class are generally in good health but may have some minor health issues or higher risk factors.

Black Americans and Life Insurance: Who Has Coverage?

You may want to see also

Standard Risk Class

The standard risk class is typically the starting point in life insurance underwriting. It represents an average risk compared to others within the same age and gender group. A life insurance underwriter then looks for risk factors that may cause an applicant to be more or less likely to die before reaching their natural life expectancy. If an applicant is more likely to die early, they are assigned to the substandard risk class. If they are less likely, they are assigned to the preferred risk class.

People in the standard risk class may have a weight that is a bit high for their height, or they may be managing conditions like high blood pressure or high cholesterol. They may also have a family history of early death due to heart disease or cancer, with a parent dying before the age of 60. Additionally, they may have a few minor infractions on their driving record or some setbacks in their financial history. However, like those in the preferred risk class, applicants eligible for the standard risk class typically do not participate in high-risk hobbies or work in dangerous jobs.

The standard risk class is the category that most applicants are assigned to. Some chronic illnesses, such as type 2 diabetes or being overweight, may be considered for coverage, provided there is adequate control over the ailment and no other complications are related to the disease.

Life Insurance Equity: What You Need to Know

You may want to see also

Substandard Risk Class

When applying for life insurance, the insurance company underwriters review your health and lifestyle factors. Based on their evaluation, they assign you to a risk class. If there are certain factors that place you outside the normal range of risk that the insurance company typically insures, you may be considered a substandard risk.

Each table rating is an extra 25% on top of the standard rate. For example, if you received a Table 4 rating, you would pay 100% more than the standard rate. The higher the table rating, the higher the premium.

Insurance companies use a table rating system of letters or numbers to classify policyholders who are considered substandard. Conditions that can trigger a table rating include past alcohol abuse or treatment, severe asthma, bipolar disorder, epilepsy, multiple sclerosis, and Type 1 diabetes.

In addition to table ratings, some life insurance companies use flat extras to balance out the risk of insuring substandard applicants. A flat extra is an extra payment added on top of the premiums to cushion the insurance company's risk. Flat extras are usually given instead of a table rating if the risk factor is constant, such as deafness, or if the risk factor is decreasing, such as the aftermath of surgery.

Flat extras are specific dollar amounts added per $1000 of insurance coverage. They can be permanent or temporary, depending on the likelihood of the risk factor changing over time. For example, a cancer survivor may be given a temporary flat extra for a few years, while a person with a criminal history may receive a temporary flat extra until a certain number of years have passed since the completion of parole.

It's important to note that even if you are considered substandard, you can still take steps to improve your risk class and lower your premiums. Making positive lifestyle changes, such as losing weight or quitting smoking, can help you qualify for a better risk class and lower your life insurance rates.

Managing Whole Life Insurance in Quicken

You may want to see also

Frequently asked questions

The preferred class in life insurance is for individuals who are generally healthy, have a good medical history, and engage in healthy lifestyle choices. While they may not meet all the criteria for the best category, they still qualify for lower premium rates compared to the standard risk class.

Individuals in the preferred class are considered to have above-average health and may qualify for lower insurance premiums as a result. This is because insurance companies view them as having a lower risk of premature death compared to those in the standard or substandard classes.

To qualify for the preferred class, you typically need to have excellent health with only minor issues that are well-controlled, such as high blood pressure or high cholesterol. You should also have a clean driving record and not engage in high-risk activities or occupations.