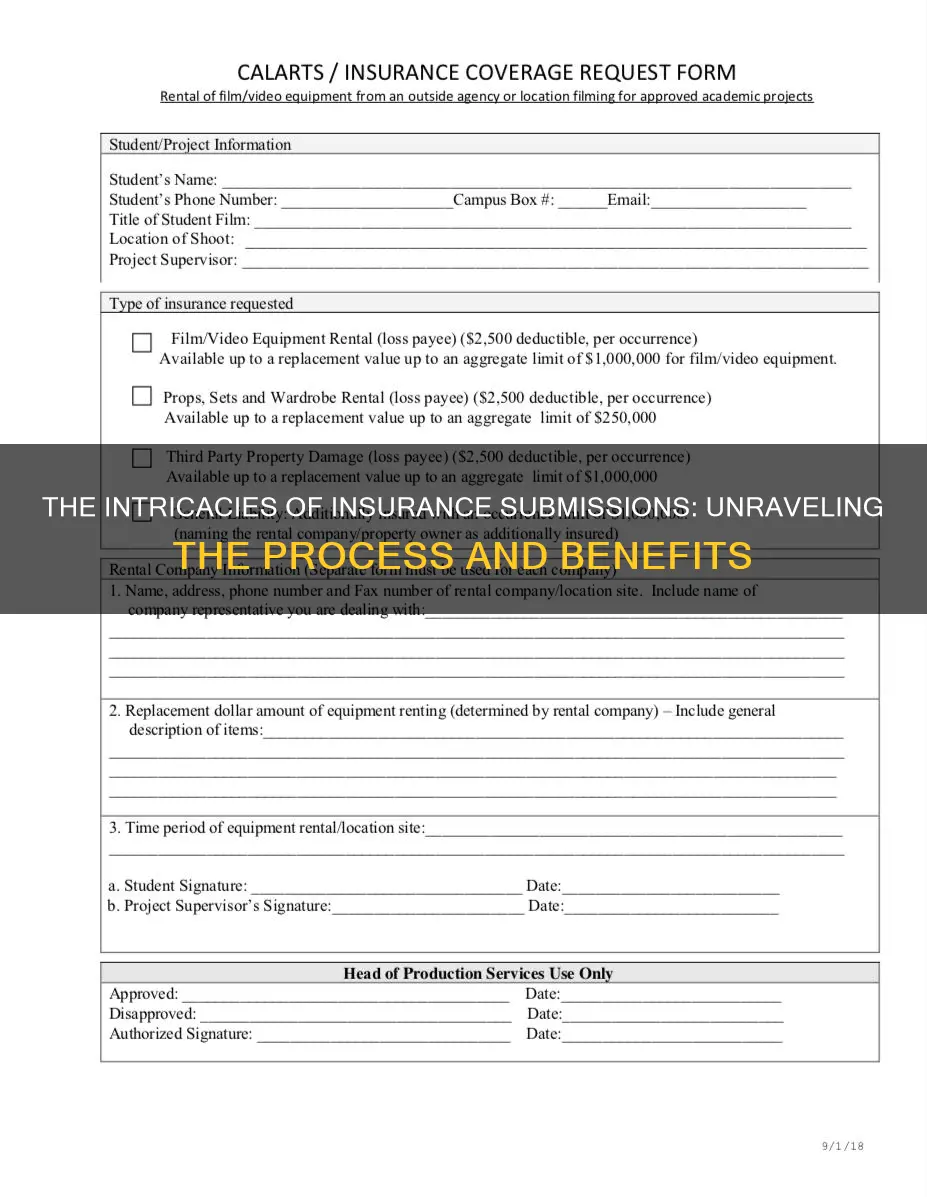

In insurance, a submission is a proposal for insurance submitted to an underwriter. It is more than a completed application form; it should contain all the information needed by the underwriter. A submission should include a clear objective, a general description of operations, the desired program structure, a clear list of exposures, coverage specifications, and how the company handles risks. It is important to avoid red flags in submissions, such as open losses and high reserves, which may cause the underwriter to require more information before deciding whether to quote.

| Characteristics | Values |

|---|---|

| Definition | A proposal for insurance submitted to an underwriter |

| More Information | The term implies more than a completed application unless the application contains all the information needed by the underwriter |

| Full Underwriting Submission Elements | Executive Summary, General Information, Physical Description, Certification, Coverage Specifications, Underwriting Information, Loss Information, Suit Status, Premium Expectations, Brochures and Annual Reports |

| Tips for Creating an Insurance Market Submission | Explain the submission's objective, provide a general description of operations, discuss the desired program structure, provide a clear list of exposures, provide coverage specifications, explain how your company handles risks, address bad claims |

What You'll Learn

A submission is a proposal for insurance

Submissions should be clear, concise, and well-defined, explaining the objective of the proposal. They should also include a general description of operations, defining the scope of work and any industry-specific jargon. It is important to remember that underwriters may not be experts in the industry, so it is helpful to provide an explanation in layman's terms.

A submission should also outline the desired program structure, including the type of program and the desired limits. A clear list of exposures should be provided, including the location of business operations, the number of employees, revenue, and payroll.

Additionally, it is important to address how the company handles risks, including safety culture, safety plans, and claims processes. This helps the underwriter understand the company's approach to risk management. Finally, it is crucial to address any bad claims, explaining what happened and the measures taken to prevent similar incidents in the future.

The Hidden Hazards of Moral Risk in Insurance: Unraveling the Complexities

You may want to see also

It is sent to an underwriter

A submission in insurance terms refers to a proposal for insurance submitted to an underwriter. It is more than a completed application form, unless the form contains all the information needed by the underwriter.

Underwriters are professionals who evaluate and analyse the risks involved in insuring people and assets. They establish pricing for accepted insurable risks. The term underwriting means receiving remuneration for the willingness to pay a potential risk.

When a submission is sent to an underwriter, they will first make an initial review of the insurance application and supporting documents to determine whether to accept the submission. If the submission is within the company's risk appetite, the underwriter will begin a deeper analysis to determine if the submission is acceptable as is or if modifications are needed.

The underwriter will then request any additional information required to assess the risk. Some submissions may contain detailed information, including loss runs, pictures, and narratives, allowing thorough underwriting to be done immediately. If the submission is incomplete, the underwriter will request the necessary external information from the agent.

Once the underwriter has all the necessary information, they will move on to the coverage determination step. If the submission meets the company's designated criteria, it will be approved, and the underwriter will move on to the rating process. If the submission is marginal, it may still be acceptable with coverage modifications. The underwriter may suggest deductible options, limits options, limitation endorsements, or other changes to make the risk acceptable.

Throughout the process, underwriters are looking for answers to all their questions in the submission. If the submission showcases the company as a good risk, it becomes challenging for underwriters to say no. Thus, it is essential to provide a comprehensive and well-prepared submission that addresses all the underwriter's concerns and showcases your company as a favourable risk.

The Mystery of HO-1733: Unraveling the Intricacies of Insurance Terminology

You may want to see also

Submissions should be clear and concise

In insurance terms, a submission is a proposal for insurance submitted to an underwriter. It is important to note that a submission implies more than a completed application form, unless the form contains all the information required by the underwriter.

- Explain the objective: Clearly state what you want and why.

- Provide a general description of operations: Define your operations, scope of work, and any industry-specific jargon. Avoid using technical vocabulary that underwriters may not understand.

- Be direct: Communicate clearly and directly. Avoid vague phrases like "all info forthcoming".

- Provide a clear list of exposures: Identify your exposures, including the location of business operations, the number of employees, revenue, and payroll.

- Give a concise loss history: Provide your loss history to help the underwriter determine their level of aggression with your company.

- Address bad claims: Explain any previous bad claims, what went wrong, and how you are preventing it from happening again.

- Use simple language: Write in layman's terms. Avoid industry jargon to ensure the underwriter understands your submission without needing to research further.

Supplemental Insurance: Understanding Its Role and Relationship with Short-Term Coverage

You may want to see also

They should include a general description of operations

A submission in insurance terms refers to a proposal for insurance submitted to an underwriter. It is more than a completed application form; it should contain all the information needed by the underwriter.

When creating an insurance market submission, it is important to include a general description of operations. This should define your operations, scope of work, and any trade-specific jargon. Underwriters are not expected to look up definitions or language they are unfamiliar with, so it is important to provide clear and concise explanations.

For example, if your company is in the business of manufacturing chemicals, it is important to explain the aspects of the chemical manufacturing process in layman's terms. This helps the underwriter understand the full extent of the underwriting and ensures they do not miss any important details.

In addition to the general description of operations, a market submission should also include a clear objective, the desired program structure, a list of exposures, coverage specifications, and information on how your company handles risks and addresses bad claims. By providing a comprehensive submission, you can demonstrate to the underwriters that your company is a good risk, increasing your chances of obtaining favourable insurance coverage and premiums.

Understanding VGIL Term Insurance: A Comprehensive Guide to its Benefits and Features

You may want to see also

Submissions should address how the company handles risks

A submission in insurance terms refers to a proposal for insurance submitted to an underwriter. It is more than a completed application and should contain all the information needed by the underwriter.

- Safety culture: Outline the company's commitment to safety, including any safety policies, procedures, and training.

- Safety plan: Detail the steps the company takes to identify and mitigate risks, such as risk assessments, safety inspections, and hazard controls.

- Claims process: Explain how the company handles insurance claims, including the steps for reporting, investigating, and resolving claims.

- Loss history: Provide details on any previous losses or insurance claims, including the cause, impact, and steps taken to prevent reoccurrence.

- Risk management strategies: Discuss the company's approach to managing risks, such as risk identification, analysis, and treatment.

- Risk tolerance: Explain the company's risk appetite and how it determines which risks to accept, mitigate, or avoid.

- Risk mitigation strategies: Outline the specific actions the company takes to reduce or eliminate risks, such as safety measures, insurance coverage, and emergency response plans.

- Emergency response and business continuity plans: Describe the company's plans for handling incidents that could disrupt business operations, including natural disasters, cybersecurity breaches, and other unforeseen events.

- Compliance with regulations: Address how the company ensures compliance with relevant laws, regulations, and industry standards related to risk management and insurance.

Term Insurance and ITR: Understanding the Mandatory Connection

You may want to see also

Frequently asked questions

A submission in insurance terms is a proposal for insurance submitted to an underwriter. It implies more than a completed application unless the application contains all the information needed by the underwriter.

A full underwriting submission should include an executive summary, general information, a physical description, certification, coverage specifications, underwriting information, loss information, suit status, and premium expectations.

Some tips for creating an insurance market submission include explaining the submission's objective clearly and concisely, providing a general description of operations, discussing the desired program structure, and providing a clear list of exposures.

Underwriters look for open losses and high reserves, a lack of communication or context, the use of technical vocabulary, and obvious red flags or warning signs.