Voluntary term life insurance is a type of life insurance that is offered by employers as an optional benefit for their employees. It is also known as supplemental life insurance, as it adds to the basic coverage provided by the employer. Employees can choose to purchase this insurance through payroll deductions, and the premium is often deducted directly from their paycheck. This type of insurance provides a death benefit to the beneficiary named on the policy if the insured passes away while the policy is active. The coverage amount is usually based on a multiple of the employee's salary, such as 1x, 2x, or 3x their annual income, and may include options for spouses and dependent children as well.

| Characteristics | Values |

|---|---|

| Type of insurance | Term or whole life insurance |

| Coverage | Multiples of the employee's salary, e.g. 1x, 2x, 3x, etc. |

| Cost | Less expensive than individual life insurance policies |

| Payment method | Premium deducted from employee's paycheck |

| Portability | May be portable, allowing employees to keep the policy after leaving the company |

| Riders or add-ons | Accidental death and dismemberment (AD&D), waiver of premium, accelerated death benefit, child or spouse riders |

| Eligibility | No mandatory health exams, but may require a minimum number of work hours |

| Enrollment | May be eligible to enroll upon hiring or during annual open enrollment |

| Death benefit | Paid to beneficiaries upon the death of the insured |

What You'll Learn

- Voluntary life insurance is a financial protection plan that provides a cash benefit to a beneficiary upon the policyholder's death

- It is an optional benefit offered by employers, with the employee paying a monthly premium

- It is usually less expensive than life insurance policies purchased in the retail market

- The benefit ceases upon the employee's termination or resignation

- It is also known as supplemental life insurance

Voluntary life insurance is a financial protection plan that provides a cash benefit to a beneficiary upon the policyholder's death

Voluntary life insurance is typically purchased through payroll deductions, with the employee paying a monthly or yearly premium. The main advantage is that it offers a death benefit, which is a guaranteed payment to the beneficiary when the insured person passes away. This benefit can be used to cover various expenses, such as day-to-day living costs, mortgage payments, education fees, and funeral expenses.

The amount of coverage provided by voluntary life insurance is often based on a multiple of the employee's salary, up to a certain maximum. For example, an employer may offer coverage of three times the employee's annual salary, up to $300,000. It is worth noting that voluntary life insurance policies usually have a specified term, such as 10, 20, or 30 years, and the policy must be active during the insured's death for the beneficiary to receive the payout.

One key feature of voluntary life insurance is its portability, which means that the policy can be continued even if the employee leaves the company. However, this may depend on the specific policy and the employer's guidelines, and the employee might have to bear the full premium cost.

Voluntary life insurance is generally more affordable than standard life insurance policies purchased individually. This is because employers can negotiate lower group rates based on the number of employees enrolled. Additionally, voluntary life insurance plans often do not require medical exams or lengthy health questionnaires, making them more accessible to individuals with health concerns.

Overall, voluntary life insurance can provide financial security and peace of mind for employees and their loved ones, especially in cases where the employee is the primary income earner. However, it is important to carefully review the policy details, including any limitations or add-ons, to ensure that it meets the individual's specific needs and circumstances.

Life Insurance: Americans and Their Coverage Choices

You may want to see also

It is an optional benefit offered by employers, with the employee paying a monthly premium

Voluntary life insurance is an optional benefit offered by employers, with the employee paying a monthly premium. It is a type of supplemental insurance that employees can choose to opt into, and it provides a death benefit to a beneficiary upon the employee's death. This benefit is typically paid to the beneficiary as a lump sum and can be used to cover expenses such as funeral costs, mortgage payments, or education fees.

The monthly premium for voluntary life insurance is often deducted directly from the employee's paycheck, making it convenient and ensuring timely payment of premiums. The cost of this insurance is generally lower than individual life insurance policies purchased on the retail market due to group rates. This makes it an affordable option for employees, especially those who may have health concerns or be on a budget.

Voluntary life insurance is usually available to employees immediately upon hiring or shortly thereafter. Employees can choose the amount of coverage they want, often based on a multiple of their salary, and this coverage can be in addition to any basic life insurance provided by the employer. It is important to note that voluntary life insurance may not always be portable, so employees should check the policy's terms to understand if they can keep the coverage if they change jobs.

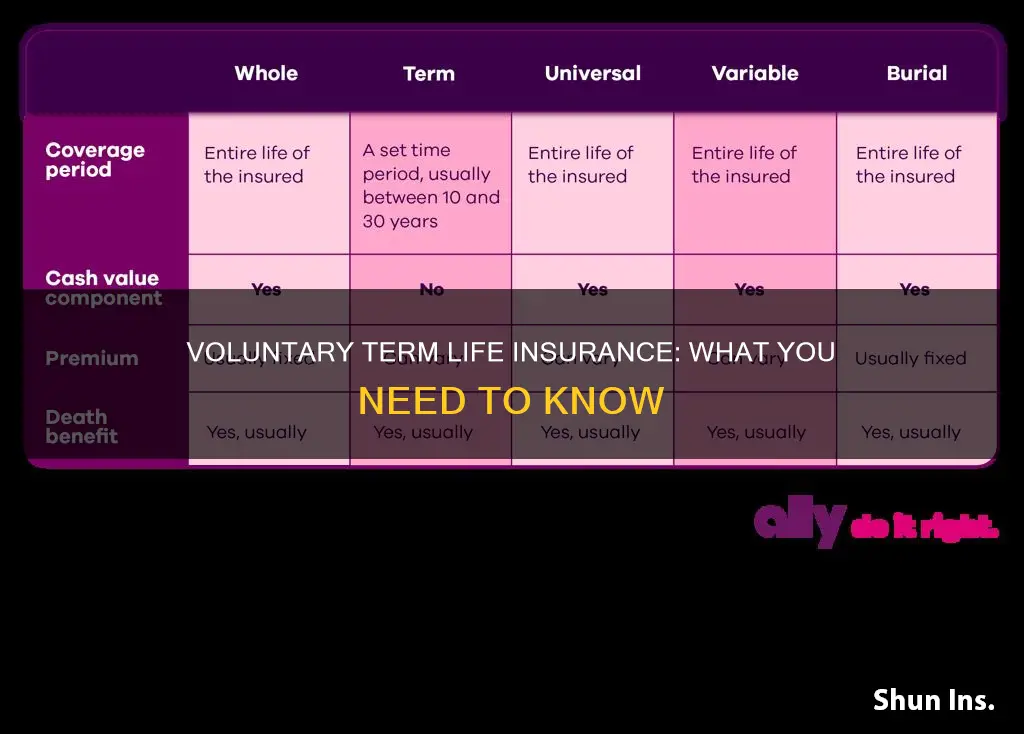

There are two primary types of voluntary life insurance: term and whole life insurance. Term life insurance covers a specific period, such as 10, 20, or 30 years, while whole life insurance provides coverage for the entire life of the employee. Term life insurance is generally more affordable, while whole life insurance includes a cash value component that can grow over time.

Overall, voluntary life insurance offered by employers with employee-paid premiums can be a valuable benefit, providing financial protection and peace of mind for employees and their loved ones.

Child Support and Life Insurance: Can They Place a Lien?

You may want to see also

It is usually less expensive than life insurance policies purchased in the retail market

Voluntary life insurance is often less expensive than life insurance policies purchased in the retail market. This is due to the group rates offered by employers, which can be supplemented by basic coverage. The larger the group, the lower the rates will be. This is because the risk is spread out among a larger group of people, so the rates are often less for the employer than they would be if an individual policy were purchased.

Voluntary life insurance is also known as supplemental life insurance, and it is an optional benefit offered by some employers in addition to their basic group life insurance benefit. Employees can purchase voluntary life insurance coverage through payroll deductions. The premiums are typically deducted from the employee's paycheck, making it a convenient and seamless payment process. The cost of voluntary life insurance is less than a standard life insurance policy but more than the free basic group life insurance offered by employers.

Voluntary life insurance is a good option for those who struggle to get approved for life insurance due to health issues or those who only need a small amount of coverage. It is also a good choice for those who want an easy way to pay for coverage, as the premiums are automatically deducted from their pay. However, it is important to note that voluntary life insurance may not be enough to meet all your needs, and it may not travel with you if you leave your job.

Voluntary life insurance typically offers two types of policies: term and whole life insurance. Term life insurance lasts for a specific period, such as 10, 20, or 30 years, while whole life insurance is a type of permanent insurance that does not expire as long as premiums are paid. Term life insurance is generally more affordable than whole life insurance, but the rates may increase over time. On the other hand, whole life insurance includes a cash value component that grows tax-deferred and can be used for loans or withdrawals.

Life Insurance Policyholders: Who Are They?

You may want to see also

The benefit ceases upon the employee's termination or resignation

Voluntary term life insurance is a financial protection plan that offers a cash benefit to a beneficiary upon the death of the insured. It is a type of employer-provided life insurance that employees can opt into, and they usually pay scheduled premiums to keep the policy active. The benefit ceases upon the employee's termination or resignation.

Voluntary term life insurance is often paid for by a monthly premium that is deducted directly from the employee's paycheck. This feature is attractive to employees because they don't have to worry about paying another bill. However, upon termination or resignation, the benefit ceases, and the employee will no longer have access to the policy.

It is important to note that some voluntary term life insurance policies may be "portable", which means that the employee can choose to continue paying for the same coverage even after leaving their job. This option typically needs to be exercised within 30-60 days of leaving employment and may result in higher premiums.

Additionally, employees may also have the option to convert their voluntary term life insurance coverage into a permanent individual life insurance policy upon termination or resignation. This conversion process can be complex and usually results in higher premiums.

To maintain life insurance coverage after leaving a job, individuals can also consider finding group coverage through a new employer or purchasing an individual life insurance policy.

Life Insurance Options for Colon Cancer Patients

You may want to see also

It is also known as supplemental life insurance

Voluntary term life insurance is a type of employer-provided life insurance that employees can opt into. It is also known as supplemental life insurance, which is an optional coverage that provides an extra layer of protection on top of the group policy provided by an employer.

Supplemental life insurance, also known as voluntary life insurance, is typically offered as an additional benefit by employers on top of the basic coverage they provide. It is called "supplemental" because it supplements or adds to the basic coverage provided by the employer. This type of insurance is usually less expensive than individual life insurance policies purchased in the retail market.

Supplemental life insurance can be purchased through work or through a private insurer to supplement an employer's basic plan. It is typically available in two forms: term and permanent. Term insurance covers a set period, such as 10, 20, or 30 years, while permanent insurance does not expire as long as the premiums are paid.

The cost of supplemental life insurance is often based on the age of the insured and sometimes includes subsidies from employers. This type of insurance can provide extra protection for accidents, funerals, and family support. It can also be purchased for spouses, domestic partners, and children.

Supplemental life insurance is a valuable option for those who want to ensure their loved ones have additional financial protection in the event of their death. It is also beneficial for those who want to increase their death benefit at a more affordable rate or ensure their children's needs are met for a certain period.

Variable Life Insurance: Security or Risk?

You may want to see also

Frequently asked questions

Voluntary term life insurance is a type of insurance that is offered by an employer as an optional benefit. It is a term life insurance policy, meaning it lasts for a specific period, such as 10, 20, or 30 years.

Voluntary term life insurance is offered as an employee benefit, with premiums often deducted directly from an employee's paycheck. It is also usually offered at a discounted group rate, making it more affordable than a standard term life insurance policy.

Employers may set eligibility criteria, such as requiring employees to work a minimum number of hours per week. There may also be limited times when employees can sign up, such as when they first join the company or during an annual enrollment period.

Voluntary term life insurance is often more affordable than standard life insurance and does not usually require a medical exam for enrollment. It also provides a death benefit to beneficiaries, which can be used to cover expenses such as mortgage payments, education costs, and living expenses.

Coverage may be limited and tied to employment, meaning you could lose the policy if you leave your job. It may also not provide enough coverage, especially if you are the primary earner in your family.