A negative adjustment refers to an alteration in the value of a vehicle, which is calculated based on damage beyond normal wear and tear. This typically applies when a vehicle is deemed a total loss, meaning the cost of repairs exceeds the vehicle's value. In such cases, an insurance adjuster assesses the vehicle's actual cash value (ACV), taking into account depreciation, condition, and modifications. The adjuster's evaluation may result in a lower payout than expected by the policyholder, as they can deduct several hundred to over $1,000 from the vehicle's value for serious defects. Policyholders can challenge the adjuster's assessment by hiring an independent appraiser to negotiate with the insurance company and potentially obtain a larger payout.

| Characteristics | Values |

|---|---|

| Definition | A condition adjustment alters the value of a vehicle based on damage beyond normal wear and tear. |

| Applicability | Applies when a vehicle is totaled, i.e., damaged so badly it will cost more to fix than it's worth. |

| Calculation | The insurance company determines the actual cash value (ACV) of the vehicle, which includes depreciation, condition, and modification. |

| Valuation Tools | Insurance companies may use comparable sales data, industry values (e.g., National Automobile Dealer's Association value), or a third-party valuation company to determine a fair price. |

| Subjectivity | Condition adjustments can feel subjective as they are based on rubrics for multiple parts of a car, and each company has its own system. |

| Impact | Serious defects can result in several hundred to over $1,000 being deducted from the vehicle's value. |

| Evaluation | Policyholders can use resources like the Kelley Blue Book Condition Quiz to evaluate their vehicle's condition and potentially challenge the insurance adjuster's ruling. |

| Protection | Maintaining the vehicle through regular maintenance, addressing mechanical issues, protecting paint, detailing the interior, and avoiding smoking can help protect the vehicle's value. |

What You'll Learn

- Insurance adjusters are not on the policyholder's side

- Loss adjustment expenses (LAEs) are costs incurred by insurance companies to investigate and settle claims

- There are two types of LAEs: allocated and unallocated

- Insurance companies can pay hospital charges at a discounted rate

- Condition adjustments can result in insurance companies paying less than expected after a covered loss

Insurance adjusters are not on the policyholder's side

Adjusters will engage in misleading tactics to convince you to accept a lower settlement amount than you deserve. They will try to pay out as little as possible and may even find ways to pay nothing at all. They will use anything you say against you and are trained to manipulate policyholders into admitting fault unintentionally. They will also use recorded conversations against you later, looking for inconsistencies in your story.

Adjusters are also trained to be friendly and accommodating to put you at ease and get you to open up, give sensitive information, and make statements that can be used against your claim. They want to close your case as early as possible before you realize how serious your injuries may be or how much money you may be owed.

To avoid being tricked by an insurance adjuster, it is recommended that you do not speak to them at all and instead consult an attorney who will deal with the insurance company for you.

Navigating the Claims Process: Dealing Directly or Through a Fire Insurance Adjuster

You may want to see also

Loss adjustment expenses (LAEs) are costs incurred by insurance companies to investigate and settle claims

LAEs can be divided into two types: allocated loss adjustment expenses (ALAEs) and unallocated loss adjustment expenses (ULAEs). ALAEs are direct, traceable costs tied to a specific claim, such as lawyer fees or adjuster salaries. ULAEs, on the other hand, are costs that cannot be directly attributed to a specific claim, such as salaries of employees not working on specific claims or other overhead expenses.

Accurate prediction and management of LAEs are important for insurance companies to estimate future costs, allocate resources effectively, set premiums, and determine profitability. By keeping a close eye on LAEs, insurance companies can identify areas for improvement, streamline their claims-handling processes, and ultimately, offer competitive insurance products to their customers.

LAEs are also essential for insurance companies to comply with contracts, limit the impact of fraudulent claims, and make a profit from the premiums they receive.

Overall, LAEs play a crucial role in the financial aspects of managing insurance claims and help insurance companies maintain profitability in the claims-handling process.

Becoming a FEMA Insurance Adjuster in Puerto Rico: Navigating the Claims Landscape

You may want to see also

There are two types of LAEs: allocated and unallocated

When it comes to insurance, a negative adjustment refers to the insurance company paying less than expected. This can occur due to various factors, such as the condition of your vehicle or property, or as a result of investigations into insurance claims.

Now, there are two types of Loss Adjustment Expenses (LAEs): allocated and unallocated. LAEs are costs incurred by insurance companies when investigating and settling insurance claims. Allocated LAEs, or Allocated Loss Adjustment Expenses (ALAEs), are expenses attributed to a specific claim. They occur when an insurance company pays for an investigator to survey claims made on a policy. For example, a driver with car insurance may be required to take their damaged vehicle to an authorised third-party mechanic for assessment. The cost of hiring this professional is an allocated LAE. Other allocated expenses include the costs of obtaining police reports and evaluating injuries.

On the other hand, unallocated LAEs, or Unallocated Loss Adjustment Expenses (ULAE), are expenses not attributed to a specific claim. These could include the salaries of in-house investigators, maintenance costs of their vehicles, and other general operational expenses. For instance, an insurance company that maintains a claims evaluation staff but has not received any claims will have salary and overhead costs as unallocated LAEs.

Becoming an Insurance Adjuster in Missouri: A Comprehensive Guide

You may want to see also

Insurance companies can pay hospital charges at a discounted rate

The discounted rate is specific to each insurance company and is not publicly available information. This means that insured patients often don't know how much of a discount they are getting. This can lead to surprise bills, where the patient owes more than they expected.

In addition, hospitals sometimes bring in out-of-network service providers without informing the patient. In these cases, the insurance company may pay less, or nothing at all, leaving the patient with a larger bill than anticipated.

Insurance companies are incentivized to negotiate good discounts for their customers because customers judge insurance plans based on the cost of healthcare services. However, insurance companies also benefit from higher healthcare prices because they earn more when more money is spent on care. This may reduce their incentive to negotiate the best possible rates.

In some cases, insurance companies may even be complicit in keeping prices high. Hospitals and insurers have been accused of intentionally keeping prices secret to take advantage of patients.

Understanding the Role of Insurance Adjusters in Houston: Claims, Assessments, and More

You may want to see also

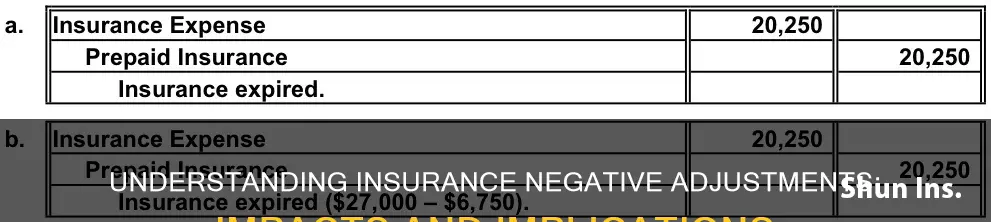

Condition adjustments can result in insurance companies paying less than expected after a covered loss

A condition adjustment changes the value of a vehicle based on damage beyond normal wear and tear, such as torn seats or dented body panels. This is relevant when a vehicle is deemed a total loss, meaning it is damaged beyond repair. In this case, an insurance adjuster will determine the value of the vehicle, taking into account its condition and any sustained damage.

The adjuster's ruling may result in the insurance company paying less than expected. This is because the adjuster's valuation of the vehicle's condition may be lower than the owner's, resulting in a smaller payout. For instance, serious defects can lead to a reduction of several hundred to over $1,000 in the vehicle's value.

There are several tools that insurance companies can use to determine the value of a vehicle, including comparable recent sales in the area, the National Automobile Dealer's Association value, or a third-party valuation company. While insurance companies cannot arbitrarily decide on a value, their handling of this process can seem subjective. This is because condition adjustments are based on specific rubrics for multiple parts of a car, and each company has its own system. For example, they may note and adjust the valuation based on the number of stains or tears on the interior upholstery.

If you feel that an insurance adjuster has unfairly downgraded the condition of your vehicle, you can take steps to challenge their evaluation. You can use resources like the Kelley Blue Book Condition Quiz to evaluate your vehicle objectively. You also have the right to hire an independent appraiser, who can assess your vehicle's value and negotiate with the insurance company on your behalf.

Unraveling the Path to Becoming an Insurance Adjuster in Arizona

You may want to see also

Frequently asked questions

A negative adjustment, also known as a condition adjustment, occurs when an insurance company pays less than the expected amount after a covered loss. This happens when the valuation process deems the vehicle to be in poor condition. Negative adjustments are based on rubrics for multiple parts of a car and can result in a significantly lower payout for the policyholder.

Condition adjustments are based on specific rubrics that vary across insurance companies. Generally, they involve assessing damage beyond normal wear and tear, such as torn seats or dented body panels. The number of stains, tears, or other serious defects in the vehicle's interior and exterior are taken into account, and the final adjustment amount can range from several hundred to over a thousand dollars.

To protect yourself from negative adjustments, it is essential to maintain your vehicle properly. While regular maintenance may not increase the value of your car, it can help prevent deductions by keeping it in good condition. This includes staying on top of oil changes, addressing mechanical issues promptly, protecting your paint with wax treatment, and using seat covers and floor mats, especially if you have pets or children. Additionally, avoiding smoking in your vehicle and maintaining proper tire inflation can also help.