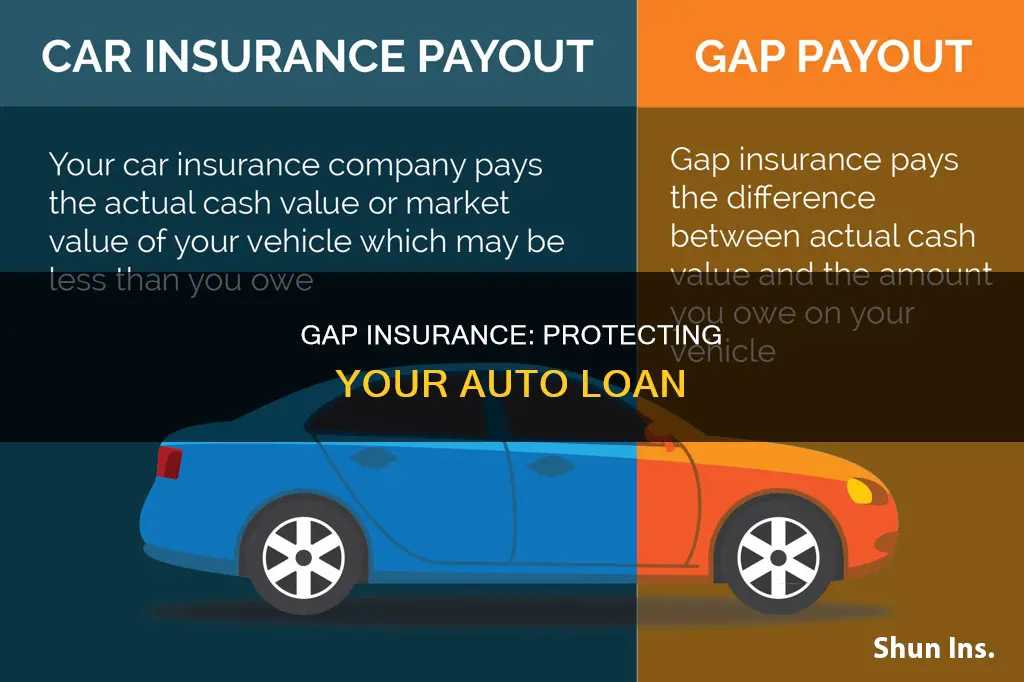

Guaranteed Asset Protection (GAP) insurance, also known as loan/lease gap coverage, is an optional product that covers the difference between the amount owed on an auto loan and the amount paid out by a standard insurance policy if a car is stolen or deemed a total loss. GAP insurance is intended for people who finance or lease their vehicles, and it can help them avoid a significant financial loss in the event of their car being stolen or written off.

| Characteristics | Values |

|---|---|

| Full Form | Guaranteed Asset Protection (GAP) |

| Type | Optional add-on product |

| Coverage | Covers the difference between the amount owed on the auto loan and the insurance company's payout if the car is stolen or totaled |

| Eligibility | Drivers who owe more on their car loan than the car is worth |

| Cost | Varies depending on factors like the car's actual cash value, state of residence, and previous car insurance claims |

| Purchase Options | Auto insurance company, lenders, dealerships, banks, or credit unions |

| Cancellation | Can be cancelled at any time if not specified in the lending or leasing agreement |

What You'll Learn

When is auto loan gap insurance necessary?

Auto loan gap insurance is necessary when the amount you owe on your car loan is more than the depreciated value of your car. This situation can occur if:

- You have a long loan term or high-interest rate.

- You put a lot of miles on the car, causing it to depreciate quickly.

- You have negative equity in a trade-in and end up borrowing more than the car is worth.

- You buy a vehicle with a down payment of less than 20%.

- You buy a vehicle that depreciates quickly, such as some luxury vehicles or sports cars.

- You plan to put a lot of miles on your vehicle, which can speed up depreciation.

- You want to roll the balance of your previous car loan into the new vehicle loan.

In these cases, gap insurance can protect you from financial loss if your vehicle is totaled or stolen. It covers the difference between the depreciated value of the car and the outstanding loan balance.

However, if you own your vehicle outright or have a large down payment, you may not need gap insurance. It's also important to note that gap insurance doesn't cover costs related to vehicle repairs, personal injuries, or other accident-related expenses.

Wells Fargo Auto Insurance: Understanding the Charges

You may want to see also

How does auto loan gap insurance work?

Auto loan gap insurance, or guaranteed asset protection (GAP) insurance, is an optional add-on product that covers the difference between the amount you owe on your auto loan and the amount your insurance company pays out if your car is stolen or deemed a total loss. This type of insurance bridges the gap between what you owe on your car loan and the car's actual worth, which can be significantly less due to depreciation.

Here's how auto loan gap insurance works:

When You Need It

If your car is stolen or deemed a total loss, your standard auto insurance will typically only pay up to the vehicle's actual cash value (ACV) at the time of the incident. This value is often much lower than what you originally paid for the car. If the amount you owe on your loan is higher than the car's ACV, you will be left with a financial gap. This is where auto loan gap insurance comes into play.

For example, let's say you owe $25,000 on your car loan, but due to depreciation, your car's ACV is only $20,000 at the time of the incident. Without gap insurance, you would be responsible for paying off the remaining $5,000 on your loan, in addition to dealing with the loss of your vehicle.

How It Helps

Auto loan gap insurance covers this $5,000 difference, ensuring that you don't suffer a financial loss on top of the loss of your vehicle. In this example, with gap insurance, you would receive a payout of $25,000 (the amount you owe on your loan) minus your deductible. This allows you to pay off your loan without incurring additional debt.

Eligibility and Requirements

To be eligible for auto loan gap insurance, there must be a "gap" between the value of your car and the amount you owe. This situation typically arises when you owe more on your loan than your car is currently worth. This can happen if you have a smaller down payment, a longer financing term, or your car depreciates quickly.

Additionally, to qualify for gap insurance, you usually need to have comprehensive and collision coverage on your auto insurance policy. Some lenders or leasing companies may also require you to purchase gap insurance as a condition of your loan or lease.

Cost and Availability

The cost of auto loan gap insurance varies and depends on factors such as the ACV of your car, the state you live in, and your previous insurance claims. You can purchase gap insurance from insurers, dealerships, lenders, or banks. However, buying it through your insurance company is often the most cost-effective option. You can add it to your existing policy, and it typically only increases your annual premium by a small amount.

When to Cancel

You should cancel your gap insurance when you no longer owe more than your vehicle is worth. This usually takes about two years. You can compare your loan amount with online car value guides to determine when to drop the coverage. Additionally, if you pay off your loan early or sell the vehicle, you should cancel the policy.

U.S.AA. Auto Insurance: Rated and Reviewed

You may want to see also

How much does auto loan gap insurance cost?

The cost of auto loan gap insurance varies depending on where you buy it. According to the Insurance Information Institute, auto insurers typically charge a few dollars a month or around $20 a year for gap insurance. However, if you buy gap insurance from a dealership, it can cost hundreds of dollars a year.

For example, if you add gap coverage to a car insurance policy that already includes collision and comprehensive insurance, it will typically increase your premium by around $40 to $60 per year. On the other hand, lenders charge a flat fee of around $500 to $700 for gap insurance, but if you add the coverage to your loan, you will also pay interest on it. That means you could end up paying much more for gap insurance from a dealer than from your auto insurer.

It is worth noting that gap insurance is not always available as a stand-alone product and may need to be added to an existing car insurance policy. Additionally, some lenders or leasing companies may require you to purchase gap insurance, while others may automatically include it. It is important to check with your insurance agent, lender, or leasing company to understand your options and find the best deal.

Auto Insurance: Elderly Premiums and Expensive Coverage

You may want to see also

Where can you buy auto loan gap insurance?

Auto loan gap insurance can be purchased from several sources. One option is to buy it directly from the dealership when you purchase your vehicle. Dealerships typically charge a flat rate for gap insurance, which can range from $400 to $700. While this may be convenient, it might not be the most cost-effective option. Some dealerships have been known to increase the price of gap insurance for a significant profit, so it is important to shop around and compare prices.

Another option is to purchase gap insurance through your auto insurance company. Adding gap insurance to your comprehensive and collision coverage will only increase your annual premium by a small amount, often around $20 on average. This makes it a much cheaper option than buying from a dealership. It is recommended to set up gap insurance with your insurance company in advance if you choose to go down this route, so you are covered from the moment you drive your new vehicle off the lot.

Some banks and credit unions also offer gap insurance. This can be a very affordable option, with some credit unions offering gap insurance for as little as $200. It is worth noting that if you arrange a car loan through your bank or credit union, they may include gap insurance as part of the financing agreement. However, this will increase your total loan amount and the overall interest you pay over time.

In summary, while gap insurance can be purchased from dealerships, auto insurance companies, banks, and credit unions, it is generally more cost-effective to buy it through an insurer or financial institution. Shopping around and comparing prices can help you find the best deal and ensure you are not overpaying for this optional coverage.

Claiming on Another's Auto Insurance

You may want to see also

Can you cancel auto loan gap insurance?

Yes, you can cancel auto loan gap insurance. Gap insurance is an optional, add-on product that covers the difference between the amount you owe on your auto loan and the amount your insurance company pays out if your car is stolen or totalled. It is designed to cover the loss you would suffer if your loan balance is higher than the value of the vehicle.

Gap insurance can be purchased from car insurance companies, banks, credit unions, and dealerships. It is usually required by lenders when you buy a new car, but you don't have to buy it from the dealership. If you've already bought coverage from a dealer, you can request a refund from that dealership, but make sure you have an active policy in place before cancelling your dealer's policy.

To cancel gap insurance, contact your insurer, who can provide you with a form to fill out to cancel your policy and refund any remaining money. You can also cancel by submitting a written request, including your name, address, and vehicle identification number (VIN). It's also possible to cancel online, but only if you received coverage through an insurance company, not a dealership.

There are a few things to consider before cancelling your gap insurance policy. Firstly, you may be charged a cancellation fee, even if you cancel within the first few days of purchasing the policy. Secondly, if you still owe money on your vehicle, cancelling your policy could leave a gap between the balance owed and what insurance would pay out if your car was totalled or stolen. Ensure you have a new policy in place before cancelling your existing gap policy to ensure there's no lapse in your vehicle's coverage.

Auto Insurance: Understanding the Basics of Vehicle Coverage

You may want to see also

Frequently asked questions

Guaranteed Asset Protection (GAP) insurance is an optional add-on product that covers the difference between the amount you owe on your auto loan and the amount your insurance company pays if your car is stolen or totalled.

If your car is stolen or deemed a total loss, gap insurance covers the difference between the amount you owe on your car loan and the actual cash value of the vehicle.

Auto loan gap insurance is designed for people who finance or lease their vehicles. It is a good option for drivers whose car loan requires gap insurance, and drivers who owe more on their car loan than the car is worth.