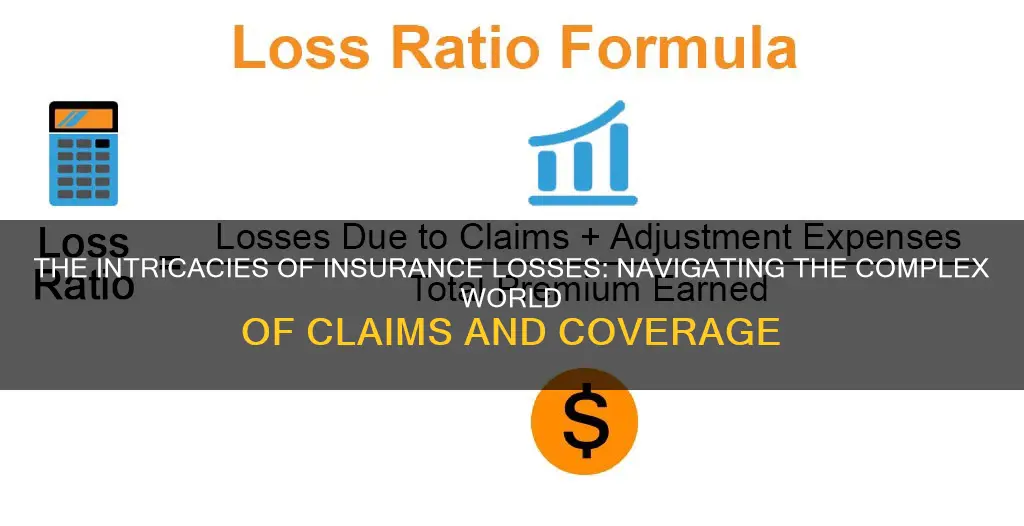

In insurance terms, a loss is the basis of a claim for damages under the terms of a policy. It can be considered a loss of assets resulting from a pure risk. Broadly speaking, the types of losses that concern risk managers include personnel loss, property loss, time element loss, and legal liability loss. A loss can refer to when something has been damaged, destroyed, or stolen. It generally refers to the direct physical loss or property damage caused by a particular event or peril. This type of loss is usually covered by an insurance policy that provides coverage for losses caused by specific circumstances, such as fire, theft, windstorms, or other natural disasters.

| Characteristics | Values |

|---|---|

| Definition of Loss | Basis of a claim for damages under the terms of a policy |

| Types of Loss | Personnel loss, property loss, time element loss, and legal liability loss |

| Causes of Loss | Damage, destruction, or theft |

| Claimant | Person who makes an insurance claim |

| Claim Process | Investigation, determination of cause and extent of damage, decision on whether the claim is covered under the policy terms |

| Loss Control | Analyzing hazards and determining a course of action to reduce the risk of loss |

What You'll Learn

Loss of assets resulting from a pure risk

Pure risk is a category of risk that is uncontrollable and can only result in two outcomes: complete loss or no loss at all. There is no opportunity for gain or profit when pure risk is involved. Pure risk is generally prevalent in situations such as natural disasters, fires, or death. These situations cannot be predicted and are beyond anyone's control. Pure risk is also referred to as absolute risk.

Pure risk can be divided into three categories: personal, property, and liability. Personal risk directly affects an individual and may involve the loss of earnings and assets or an increase in expenses. For example, unemployment may lead to financial burdens from the loss of income and employment benefits. Identity theft may result in damaged credit, and poor health may result in substantial medical bills, as well as the loss of earning power and the depletion of savings.

Property risk involves property damage caused by uncontrollable forces such as fire, lightning, hurricanes, tornadoes, or hail. It can also include the loss of property from theft, resulting in both direct and indirect losses.

Liability risk may involve litigation due to real or perceived injustice. For instance, a person injured after slipping on someone else's icy driveway may sue for medical expenses, lost income, and other associated damages. All liability risks are considered pure risks.

When it comes to insurance, pure risk is generally insurable, whereas speculative risk is not. Speculative risk, which involves the opportunity for gain, is a conscious choice and can be managed by the capital markets. On the other hand, pure risk is typically covered by commercial, personal, or liability insurance policies. Individuals can transfer part of the pure risk to an insurer by purchasing an insurance policy. For example, a homeowner may buy home insurance to protect against perils that can cause damage or loss. The insurer then shares the potential risk with the homeowner.

Pure risk is insurable due to the law of large numbers, which states that as a sample size increases, its mean gets closer to the average of the population. This law is more applicable to pure risk than speculative risk because insurers can more accurately predict loss figures in advance. As a result, they will not enter an unprofitable market.

In summary, pure risk involves situations with only two possible outcomes: zero change or complete loss, with no possibility of gain. It can be categorized into personal, property, and liability risks, all of which can lead to the loss of assets. While pure risk is generally insurable, it is important to carefully consider the specific circumstances and consult with insurance professionals to determine the most appropriate coverage.

The Policyholder's Shield: Unraveling the Provision that Safeguards Insured Terms

You may want to see also

Personnel loss

In insurance terms, a loss is the basis of a claim for damages under the terms of a policy. Losses can be broadly categorised into four types: personnel loss, property loss, time element loss, and legal liability loss.

To protect themselves from personnel loss, businesses can also consider disability insurance, which covers lost income and helps protect individuals and their families in the event of a disability due to an accident or illness. Additionally, life insurance can provide financial protection for loved ones in the event of an individual's death.

Entrepreneurs and small business owners should also consider daily allowance insurance and loss of earnings insurance to protect themselves and their employees in the event of illness or earning incapacity. These types of insurance can provide income replacement and help cover expenses during difficult times.

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

Property loss

Property insurance is a broad term for a series of policies that provide either property protection coverage or liability coverage for property owners. Property insurance provides financial reimbursement to the owner or renter of a structure and its contents in the case of damage, theft, or an injury that occurs on the property to someone other than the owner or renter.

Property insurance can include a number of policies, such as homeowners insurance, renters insurance, flood insurance, and earthquake insurance. Personal property is usually covered by a homeowners or renters policy. However, personal property that is very high in value and expensive is usually covered by purchasing an addition to the policy called a "rider."

Losses that are not covered, in addition to those caused by excluded perils, include damage caused by:

- Continuous or repeated water seepage

- Frozen pipes when the house is vacant unless the homeowner has taken reasonable steps to protect it

- Vandalism of a house empty for at least 30 days

- Exterior damage done by the freezing, thawing, pressure, or weight of snow or ice

- Hidden defects, mold, smog, rust, deterioration, and animals

The most common covered losses for homeowners' insurance are fire, lightning, windstorms, and hail.

Property insurance policies normally exclude damage that results from a variety of events, including tsunamis, floods, drain and sewer backups, seeping groundwater, standing water, and a number of other sources of water. Mold is usually not covered, nor is the damage from an earthquake. In addition, most policies will not cover extreme circumstances, such as nuclear events, acts of war, or terrorism.

Porting Term Insurance: Navigating the Transition for Continued Coverage

You may want to see also

Time element loss

Business interruption coverage provides indemnity against the loss of earnings due to damage to or destruction of the physical plant by any insured peril, to the extent that such earnings are not realized. Insurable values are based on past, current, and prospective earnings factors. This type of coverage is intended to reimburse the policyholder for the income lost or incremental increase in expenses experienced during the loss period. To trigger this coverage, there must be physical damage to the property as a result of a covered peril or another trigger defined in the property policy, such as civil authority, ingress/egress, or service interruption.

Extra expense coverage provides for the payment of expenses that are in excess of normal operating expenses and are reasonable and necessary to continue the business following physical loss or damage to the property. Typically, extra expense coverage is used when a business must continue its day-to-day operations, such as a law firm or a newspaper. Extra expense coverage is meant to provide funding to enable the business to continue operations during the period of time necessary to repair the physical damage.

Other types of time element coverage include contingent business interruption, rental income, and soft costs. Contingent business interruption provides coverage when the insured's suppliers or customers suffer physical damage, resulting in financial loss for the insured. Rental income coverage provides insurance for the insured's net rental income, fair rental value, and continuing operating expenses in connection with the premises. Soft costs refer to additional expenses incurred during a construction project due to delays caused by an insured peril, such as interest on construction loans, excess real estate taxes, and advertising and promotional costs.

In summary, time element loss is a critical aspect of insurance, particularly for businesses. It covers losses resulting from the inability to use property due to physical damage or other insured perils, with the amount of loss depending on the time needed for repairs or replacement.

Weighing the Benefits: Exploring Term Insurance for Your Children's Future

You may want to see also

Legal liability loss

Liability insurance is designed to protect individuals and businesses from these types of legal liability losses. It covers the legal costs and payouts for which the insured party is found liable. However, it is important to note that liability insurance policies typically do not cover intentional damage, contractual liabilities, or criminal prosecution.

The scope of legal liability loss covered by insurance can vary depending on the specific policy and industry. For example, general liability insurance may cover customer injuries and property damage, while professional liability insurance focuses on errors or omissions in the services provided.

Understanding the potential risks and choosing the appropriate insurance coverage is essential for businesses and individuals to mitigate the financial impact of legal liability losses.

The Transferability Myth: Understanding the Non-Negotiable Nature of Term Insurance Policies

You may want to see also

Frequently asked questions

A first-party claim is filed by an insured person against their own insurance policy. A third-party claim is filed against another person's insurance policy.

This is known as the "loss".

This is known as the "deductible".