In the context of insurance, consideration is the exchange of money for the guarantee of an act performed or another benefit provided. It is the premium or future premiums that the insured pays to the insurance company in exchange for coverage for losses. The consideration clause in an insurance policy outlines the cost of coverage, the payment schedule, and the benefits provided. This clause ensures that each party to the contract receives some value from the agreement. For example, a person who pays auto insurance premiums would receive consideration in the form of compensation for a covered loss to their vehicle.

Characteristics of Consideration in an Insurance Transaction

| Characteristics | Values |

|---|---|

| Something of value | Money, contractual rights, property, salary, shares, etc. |

| Mutually exchanged | Something of value is exchanged by both parties to bind a contract |

| Payment schedule | The amount due and when payments are made |

| Penalty clauses | Penalties for one party failing to meet their requirements |

What You'll Learn

- Consideration clauses define the cost of coverage and when payments are due

- Consideration is the benefit each party receives when entering a contract

- Consideration payments are exchanged for something of value

- Consideration clauses can include penalty clauses

- Consideration is required for a contract to be legally binding

Consideration clauses define the cost of coverage and when payments are due

A consideration clause is a stipulation in an insurance policy that outlines the cost of coverage and when payments are due. It is a critical component of any insurance contract, as it defines the financial obligations of both the insurer and the insured. The clause is typically included in the coverage details section of the insurance contract.

Consideration clauses are commonly used in insurance policies to outline the amount due for coverage and the payment schedule. In the context of insurance, the consideration clause defines the premium payments to be made by the insured and the corresponding coverage provided by the insurer. The clause ensures that both parties understand their financial responsibilities and rights under the contract.

The cost of coverage, as specified in the consideration clause, includes the premium amount, payment frequency, and any applicable penalties for missed payments. The clause may also outline the effective date of the policy, providing clarity on when the coverage begins. This information is crucial for the insured to understand their payment obligations and ensure they remain compliant with the terms of the policy.

In addition to defining the cost of coverage, the consideration clause also outlines when payments are due. This includes the timing of premium payments, such as monthly, quarterly, or annual payments. It may also include information on grace periods, late payment fees, and the consequences of non-payment, such as policy cancellation. The clause ensures that the insured is aware of their payment schedule and helps them avoid any disruptions in coverage due to missed payments.

Furthermore, the consideration clause may also include details on the payment methods accepted by the insurer and any applicable discounts or incentives for timely payments. It is designed to provide transparency and clarity on the financial aspects of the insurance contract, ensuring that both parties are aware of their obligations and benefits.

By defining the cost of coverage and when payments are due, the consideration clause plays a vital role in protecting the rights of both the insurer and the insured. It helps prevent disputes by clearly outlining the financial expectations of both parties. Therefore, it is essential for individuals to carefully review the consideration clause when purchasing an insurance policy to fully understand their financial commitments and ensure they receive the expected coverage.

Therapists: Insurance-Covered Specialists?

You may want to see also

Consideration is the benefit each party receives when entering a contract

In the context of insurance, consideration is the benefit each party receives when entering a contract. It is an exchange of money for the guarantee of an act performed or another benefit provided. In other words, it is the premium paid by the insured to the insurer in exchange for coverage in the event of a loss. This is a type of consideration clause, which outlines the cost of coverage and when payments should be made.

Consideration clauses are commonly used in insurance policies and define the amount due for coverage, as well as the payment schedule. They dictate that something of value will be exchanged for a bargain. For example, in the case of insurance, the insured pays premiums to the insurer in exchange for financial protection against certain risks. This is a form of mutual consideration, where both parties receive something of value from the contract.

Consideration can also take the form of a promise to perform a specific act or to refrain from doing something. In the context of insurance, this could mean the insured promising to make timely payments in exchange for the insurer's promise to provide coverage. Consideration is essential for a contract to be legally binding, ensuring that each party receives some type of benefit from the agreement.

In addition to monetary consideration, there are other aspects of an insurance contract that should be considered. These include the offer and acceptance, legal capacity, and legal purpose. When applying for insurance, the first step is to submit a proposal form to the insurance company, which they may accept or modify. It is also important to review the contract for any errors and to ensure that all relevant information is disclosed to the insurer.

Overall, consideration is a critical component of an insurance transaction, outlining the obligations and benefits of each party and ensuring a fair exchange of value.

Spinal Tap: Insurance Coverage?

You may want to see also

Consideration payments are exchanged for something of value

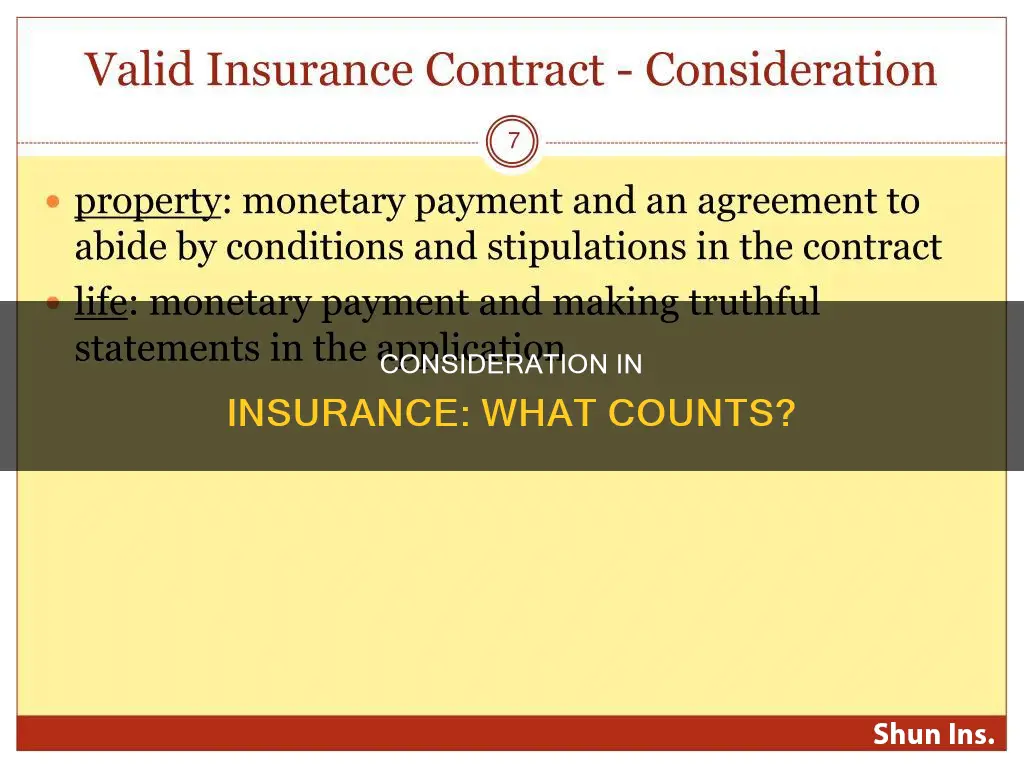

In the context of insurance, consideration is the exchange of money for the guarantee of an act performed or another benefit provided. It is the premium or future premiums that an individual pays to their insurance company. In return, the insurance company provides coverage for losses as long as premiums are paid. This is a type of contract where each party receives something of value, and each party must provide some value to the relationship for it to be legally binding.

The consideration clause in an insurance policy outlines the cost of coverage and when payments should be made. It defines the amount due for coverage and the payment schedule. For example, in the case of life insurance, the legal consideration consists of the application and payment of the initial premium, which may also include the effective date. The consideration clause is crucial as it helps to protect the rights of both parties and sets the tone for their relationship.

Consideration clauses are commonly used in insurance policies and real estate contracts. They are essential in defining the terms and conditions of the exchange, ensuring that both parties understand their obligations and benefits. In the case of insurance, the consideration clause helps to outline the specifics of the policy, including what is covered, when payments are due, and any penalties for missing payments.

It is important to note that the concept of consideration goes beyond just the exchange of money. It can also include the promise to perform a specific act or the promise to refrain from doing something. In the context of insurance, this could mean the insurance company's promise to provide coverage for a specified period or the policyholder's promise to make timely payments.

The Hidden Dangers of Critical Illness: Uncovering the Critical Illnesses Covered by Term Insurance

You may want to see also

Consideration clauses can include penalty clauses

A consideration clause is a stipulation in an insurance policy that outlines the cost of coverage and when payments should be made. Consideration clauses are most commonly used in insurance policies and define the amount due for coverage. These clauses also usually define a payment schedule.

Consideration clauses are generally used in real estate and insurance contracts. They set the terms around how one party pays another party for something valuable, like a house or insurance policy. They could also be used when selling shares to a buyer under a share purchase agreement. In this case, consideration clauses prove that mutual consideration existed.

Consideration clauses are used to define the total amount due for coverage. They are the terms and conditions that determine how payment is made in exchange for mutual consideration. Consideration clauses dictate that something of value will be exchanged for a bargain. Every party that enters into and benefits from a contract must be given consideration. The best way to understand a consideration is as an exchange. For example, if you provide a service for a business, you can receive a salary in return. In real estate, you would exchange property for regular payments.

Consideration is an exchange of money for the guarantee of an act performed or another benefit provided. In the context of insurance, the insurance company gives the consideration of coverage for losses as long as premiums are paid. If a person wants to continue to have the option of this consideration, then they can buy a policy and pay premiums.

Insurance Contracts: Adhesion or Not?

You may want to see also

Consideration is required for a contract to be legally binding

A contract is an agreement between two or more parties that is legally binding and enforceable by law. For a contract to be valid, it must include five elements: an offer, acceptance, consideration, intention, and capacity.

Consideration is a fundamental aspect of contract law and is required for a contract to be legally binding. It refers to the exchange of something valuable between the parties involved. This could be a promise to pay money, a promise to do something, a promise not to do something, or the provision of goods or services. The value exchanged does not have to be equal on both sides, but each party must give up something that matters to them.

In the context of insurance, consideration refers to the exchange of coverage for losses in return for the payment of premiums. For example, a person who pays auto insurance premiums would receive consideration in the form of insurance coverage if they experienced a covered loss to their vehicle.

Consideration clauses are commonly used in insurance policies to outline the cost of coverage and when payments should be made. These clauses define the amount due for coverage and the payment schedule. They are essential to ensure that all parties that enter into and benefit from a contract are given consideration.

When creating a contract, it is important to ensure that the consideration is specific to reduce the chance of disputes in the future. Additionally, the contract must be supported by mutual assent, expressed through a valid offer and acceptance. While the form of communication used to create a contract is generally irrelevant, certain types of contracts, such as transfers of land, must be in writing and signed by the parties involved to be enforceable.

Navigating the ICW Insurance Claims Process: Sending Bill Reconsiderations

You may want to see also

Frequently asked questions

A consideration in an insurance transaction is the exchange of money for the guarantee of an act performed or another benefit provided.

A consideration clause outlines the cost of coverage and when payments are due.

An example of a consideration in an insurance transaction is the payment of premiums in exchange for insurance coverage.

Consideration is important in an insurance transaction because it ensures that both parties are receiving something of value in exchange for their participation in the contract.

If there is no consideration in an insurance transaction, the contract may not be legally binding, and the insured may not be able to receive the benefits of the insurance policy.