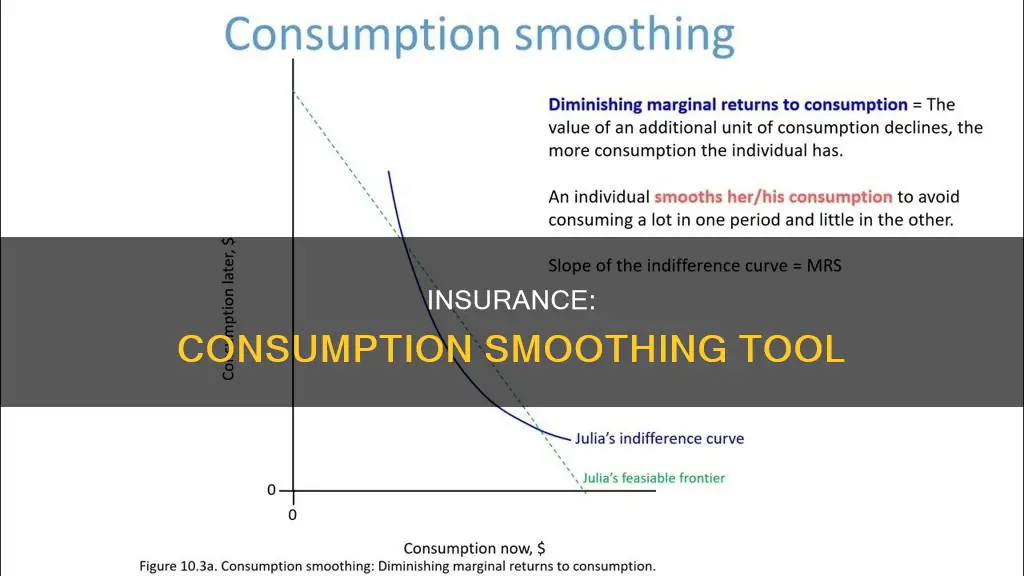

Consumption smoothing is an economic concept that refers to the process of optimising an individual's standard of living by balancing spending and saving throughout their life. It aims to minimise the impact of income fluctuations, unexpected expenses, and economic downturns, promoting financial stability and resilience. This involves making trade-offs between spending power in the short term and saving or purchasing insurance to mitigate future risks. Insurance is a vital tool in consumption smoothing, as it helps individuals manage the cost of potential events that could significantly impact their lifestyle and future consumption. By purchasing insurance, individuals can translate consumption from periods of high consumption and low marginal utility to periods of low consumption and high marginal utility, thus providing more certainty for the future.

What You'll Learn

- Insurance helps people spread out the cost of potential events that could impact their lifestyle

- Insurance is a tool to help people translate consumption from high to low periods

- Insurance is a risk-averse strategy to protect consumption levels

- Insurance is a safety net that may be valuable in low-income economies

- Insurance helps people reduce uncertainty and mitigate future risks

Insurance helps people spread out the cost of potential events that could impact their lifestyle

Consumption smoothing is the practice of optimising one's standard of living by balancing spending and saving across different life stages. Insurance is one method of consumption smoothing, as it allows people to spread out the cost of potential events that could impact their lifestyle and overall standard of living.

Insurance provides financial protection against unforeseen events, such as accidents, injuries, property damage, or unemployment. By purchasing insurance, individuals can translate consumption from periods of high income and low marginal utility to periods of low income and high marginal utility. This helps to reduce the financial burden associated with unexpected events and provides more certainty for the future.

For example, event insurance is a type of insurance that can protect individuals or businesses from financial losses due to event cancellations, injuries to guests, or property damage. The cost of event insurance varies depending on factors such as the type of event, the number of attendees, and the coverage options included. Similarly, health insurance can help spread the cost of medical expenses, while unemployment insurance provides financial support during periods of job loss.

Overall, insurance plays a crucial role in helping individuals and businesses manage their financial risks and maintain a more stable standard of living, regardless of the life stage or circumstances they find themselves in. By purchasing insurance, people can achieve consumption smoothing and protect their lifestyle from the impact of potential events.

Navigating Insurance Options with an FHA Loan: Understanding Your Choices

You may want to see also

Insurance is a tool to help people translate consumption from high to low periods

Consumption smoothing is a financial planning concept that aims to optimise a person's standard of living by balancing spending and saving during different life phases. It is a challenging yet crucial aspect of financial planning, helping people maintain a relatively stable and predictable standard of living throughout their lives.

Insurance is a vital tool in consumption smoothing, enabling individuals to translate consumption from periods of high spending to periods of low spending. By purchasing insurance, people can "smooth" between different states of consumption, providing more certainty for the future. For example, consider an individual who is healthy and working, earning a good income to spend on necessities and luxuries. However, an unexpected accident occurs, leaving them unable to work and resulting in a loss of income. In this scenario, insurance can help cover the loss of income, ensuring that the individual can still meet their basic needs.

Similarly, in developing economies, social safety nets and insurance play a significant role in consumption smoothing, especially for risk-averse households. While income shocks may not cause substantial consumption fluctuations, social insurance provides valuable support during low-income periods.

Overall, insurance is a powerful mechanism that helps individuals translate consumption from high to low periods, promoting financial stability and a more consistent standard of living. It is an essential component of consumption smoothing, helping people manage uncertainty and achieve a more balanced and secure financial future.

Switching Screens: Navigating a Career Shift from Insurance to Computers

You may want to see also

Insurance is a risk-averse strategy to protect consumption levels

Consumption smoothing is the practice of optimising one's standard of living by balancing spending and saving throughout life. This financial planning concept aims to achieve a stable and predictable standard of living despite fluctuations in income or other financial resources.

Insurance is a risk-averse strategy that helps protect consumption levels. It is a tool that enables individuals to translate consumption from periods of high consumption (low marginal utility) to periods of low consumption (high marginal utility). Insurance provides certainty for the future by reducing the number of uncertain outcomes. For example, in the event of an accident that renders someone unable to work, insurance can help cover the loss of income and ensure that basic needs are still met.

Risk-averse individuals may also choose to give up spending power in the short term and purchase insurance to protect against future risks and changes in income. This is particularly relevant for those in developing countries, where social safety nets may be valuable even when consumption is not very sensitive to shocks.

Insurance is one of the four main "financial levers" that enable consumption smoothing, along with work income, spending, and assets. It helps spread out the cost of a potential event that could significantly impact an individual's lifestyle and is therefore a crucial tool for stabilising consumption and optimising one's standard of living.

Chronic Kidney Disease: Insurance and Nephrolithiasis

You may want to see also

Insurance is a safety net that may be valuable in low-income economies

Consumption smoothing is the practice of optimising one's standard of living by balancing spending and saving across different life stages. This involves planning and budgeting to ensure that bills can be paid when they are due, even during periods of fluctuating or low income.

Insurance is one method of consumption smoothing, as it allows individuals to protect their consumption levels during periods of low income or uncertainty. By purchasing insurance, individuals can translate consumption from periods of high consumption (low marginal utility) to periods of low consumption (high marginal utility).

In low-income economies, insurance can serve as a valuable safety net, helping to protect individuals and families from the impact of economic shocks, natural disasters, and other crises. Social safety net programs, such as insurance, have been shown to lower inequality and reduce the poverty gap. They can also improve health, education, and career outcomes, especially for children in low-income families.

However, it is important to note that in low-income countries, a significant proportion of the world's poorest people still lack access to safety nets, including insurance. This highlights the need for stronger social safety net programs and policies to support these vulnerable populations.

Overall, insurance can be a valuable tool for consumption smoothing, especially in low-income economies, by providing a safety net that helps individuals manage risk and maintain their standard of living during difficult periods.

Navigating Cobra Insurance: A Guide to Submitting Doctor Bills

You may want to see also

Insurance helps people reduce uncertainty and mitigate future risks

Consumption smoothing is the practice of optimising one's standard of living by balancing spending and saving throughout life. It is a challenging aspect of financial planning, as it requires planning and budgeting to ensure bills are paid on time.

Insurance is a key tool in consumption smoothing, as it helps people reduce uncertainty and mitigate future risks. Basic insurance theory states that individuals will demand full insurance to smooth consumption across different states. For example, in the case of an accident that renders someone unable to work, insurance can provide financial support and certainty for the future.

Risk and uncertainty are central to the insurance industry. Uncertainty about the future is the primary reason people purchase insurance policies. While risk and uncertainty are distinct concepts, they are often used interchangeably. Risk refers to an unknown outcome with a known probability, while uncertainty involves an unknown outcome and an unknown probability.

Insurance helps people manage uncertainty by providing a level of certainty and protection against unforeseen events. It allows individuals to transfer their risk to the insurer and receive financial support in the event of a covered loss. This can help smooth consumption by providing resources to maintain a standard of living during difficult periods.

Additionally, insurance can provide peace of mind and reduce stress associated with uncertain future events. It empowers individuals to make decisions with greater confidence, knowing that they have financial protection in place. This can lead to better decision-making and a more stable financial path.

In summary, insurance plays a crucial role in helping people reduce uncertainty, manage risk, and achieve consumption smoothing. By purchasing insurance, individuals can translate consumption from periods of high spending to periods of low spending, creating a more balanced and stable financial outlook.

Exploring Short-Term Insurance Options with Horizon

You may want to see also

Frequently asked questions

Consumption smoothing is a financial planning concept that refers to the idea that people want to maintain a stable and predictable standard of living throughout their lives. It involves achieving a balance between spending and saving during different life phases to optimise one's overall standard of living.

Insurance helps people to "smooth" their consumption by providing certainty for the future. It allows individuals to spread out the cost of potential events that could significantly impact their lifestyle, such as accidents or injuries that affect their ability to work. Insurance enables people to translate consumption from periods of high consumption (low marginal utility) to periods of low consumption (high marginal utility).

Consumption smoothing is a major financial planning challenge, as it requires understanding an individual's spending and saving requirements. It also involves making trade-offs between spending power today and saving for the future. Achieving consumption smoothing over a lifetime is more complicated than monthly budgeting and requires long-term planning, complex calculations, and the ability to foresee potential future events.