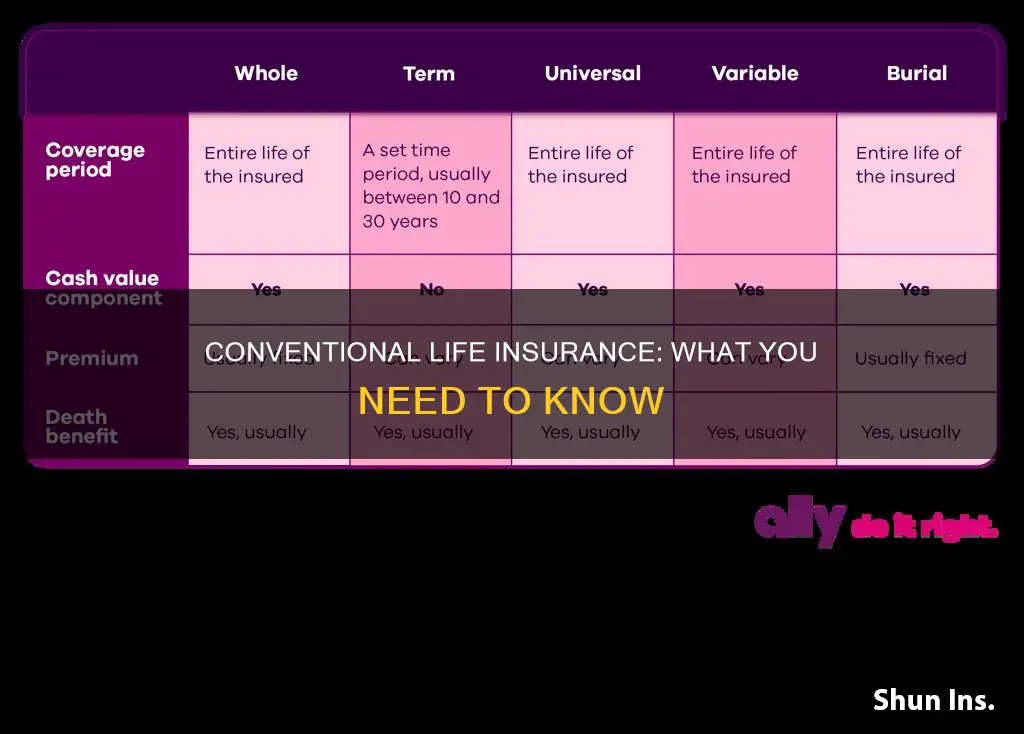

Conventional life insurance is a type of insurance that provides a death benefit in exchange for paying a premium. The risk is transferred from the individual to the insurance provider, and the insurance company owns all the premiums and is entitled to the balance after any deductions for compensation paid to the policyholder. Conventional life insurance is not a financial investment, and its main purpose is to provide death cover. However, some policies include an investment element that may pay bonuses to the investor. Bonuses accumulate on conventional life insurance policies during the term of the policy and are assessed as income when withdrawn.

What You'll Learn

- Conventional life insurance provides a death benefit in exchange for paying a premium

- Conventional life insurance is not a financial investment

- Conventional insurance companies own all the insurance premiums

- Conventional insurance is not based on Islamic Shariah law

- Conventional insurance is a co-operative policy where funds are contributed by donations from participants

Conventional life insurance provides a death benefit in exchange for paying a premium

Conventional life insurance is a contract between the insurance company and the policyholder. The insurance company undertakes to compensate the policyholder for the damages sustained from the risks covered under the insurance policy. In return, the policyholder pays a premium. Conventional life insurance is not a financial investment. Its main purpose is to provide a death benefit, but some policies also include an investment element.

Under a conventional life insurance policy, the risk is transferred from the individual to the insurance provider. The insurance company owns all the premiums and is entitled to the balance after any deductions for compensation paid to the policyholder. The premiums paid by the policyholder are used to pay for future claims.

Conventional life insurance policies can be distinguished from family takaful, which is a Shariah or Islamic law-compatible coverage. Family takaful is based on the principles of mutual assistance and risk-sharing. In contrast, conventional insurance operates based on the commercial factors of the organisation and abides by government laws.

While conventional life insurance is not an investment, some policies do include an investment element that may pay bonuses (profits) to the investor. Bonuses accumulate on conventional life insurance policies during the term of the policy and are assessed as income when the policy matures or is surrendered.

In summary, conventional life insurance provides a death benefit in exchange for paying a premium. The risk is transferred from the individual to the insurance provider, and the premiums paid are used to pay future claims. Conventional life insurance is not an investment, but some policies may include an investment element.

Reliance Life Insurance: Is It Worth the Investment?

You may want to see also

Conventional life insurance is not a financial investment

While the main purpose of conventional life insurance policies is to provide death cover, some policies include an investment element which may pay bonuses (profits) to the investor. A person who invests in such a life insurance policy is seen as deriving income from a profit-making transaction. However, these bonuses are not assessed as ongoing income during the life of the policy, but only upon withdrawal, surrender, or maturity of the policy.

In contrast to conventional life insurance, takaful, or Islamic insurance, is a form of investment where your money grows over time. Takaful is based on the principles of cooperation and sharing, with the idea of offering participants financial support in times of disaster based on mutual aid, brotherhood, and solidarity. In a takaful plan, participants contribute to a common pool, which is then used to pay for valid claims made by participants. Any surplus in the pool is shared among the participants, while any pay-outs are subject to the financial health of the pool.

Another key difference is that takaful is structured as an investment product, whereas traditional life insurance is not. This means that with takaful, you not only have protection against death or critical illness but can also grow your money over time. With traditional life insurance, the death benefit is typically the only pay-out you will receive.

Bankruptcy's Impact: Life Insurance and Your Future

You may want to see also

Conventional insurance companies own all the insurance premiums

Conventional life insurance is a co-operative policy where the risk is transferred from the individual to the insurance company. In exchange for paying a premium, the insurance company provides a death benefit. Conventional insurance companies own all the insurance premiums and are entitled to the balance after any compensation paid to the policyholders. This means that the insurer bears all the risks and rewards. If there are more claims than expected, the insurer must cover them from its own reserves.

In contrast, family takaful is a Shariah or Islamic law-compatible coverage based on the principles of mutual assistance and risk-sharing. The term "takaful" is derived from the Arabic word "kafalah", which means to guarantee or look out for one's needs. In the event of an unexpected event, financial aid is taken from the Takaful fund donated by the participants based on the concept of "Tabarru", which means donation.

Another key difference between conventional insurance and family takaful is that the latter is structured as an investment product, whereas traditional life insurance is not. This means that with family takaful, you have protection against death or critical illness, and you can also grow your money over time. With traditional life insurance, the death benefit is the only payout you will receive.

In terms of financial benefits, takaful offers more advantages than conventional insurance. Takaful is based on the principles of cooperation and sharing, with the idea of offering participants financial support in times of disaster based on mutual aid, brotherhood, and solidarity. This means that in takaful, participants help each other out in times of need. Additionally, takaful providers offer a no-claim cash-back policy, where a set amount of money is refunded if no claims are filed during the coverage term.

When it comes to investment, takaful is considered an investment, while conventional insurance is not. This means that in takaful, your money grows over time, whereas in conventional insurance, your money is used to pay for future claims. Insurance companies are free to invest in legal instruments like stocks, bonds, and other channels that may not be Shariah-compliant. In contrast, takaful contributions and shareholder capitals must be invested in Shariah-compliant instruments only, which are free from elements of interest, gambling, and uncertainty.

Arizona School Retirees: Life Insurance Benefits Explained

You may want to see also

Conventional insurance is not based on Islamic Shariah law

Conventional life insurance is a financial contract of exchange, not a donation or contract of benevolence. It revolves around the pooling of resources to protect against losses, with the risk transferred from the insured to the insurer for a premium.

However, conventional insurance is not based on Islamic Shariah law. This is because, from the perspective of Islamic Jurisprudence, the contract is considered speculative or contingent, as the risk being insured against is a matter that may or may not happen in the future. This uncertainty is considered 'ambiguous' and has implications on the ruling of a contract.

The contract is also viewed as a contract of adhesion, with the insurer being the stronger party that dictates its will to the counterparty, i.e., the insured. This dynamic is further emphasised in cases where insurance is compulsory, such as with car insurance in the UK.

Furthermore, conventional insurance is seen by some as a means of realising Riba (usury/interest) and is akin to gambling from an Islamic perspective, as one party's gain is contingent on the other's loss.

In contrast, Islamic insurance or Takaful is based on the principles of Shariah law, with an emphasis on mutual assistance, shared responsibility, and ethical investing. It operates on a cooperative model, where participants mutually guarantee each other against loss or damage. While Takaful is compliant with Islamic law, it is not a religious product, and anyone, regardless of religious belief, can participate.

Life Insurance Exam: How Many Questions for Kentucky?

You may want to see also

Conventional insurance is a co-operative policy where funds are contributed by donations from participants

Conventional life insurance is a type of insurance that provides a death benefit in exchange for paying a premium. It is a co-operative policy where funds are contributed by donations from participants. The pooled funds can be used to protect other participants from risk. In other words, conventional insurance is a commutative contract where the insurance company compensates policyholders for damages sustained from covered risks in exchange for insurance premiums.

The main purpose of conventional life insurance policies is to provide death cover, but some policies also include an investment element. For example, some policies may mature and provide a benefit if the insured becomes totally disabled. Bonuses may accumulate on conventional life insurance policies during the term of the policy and are assessed as income when withdrawn.

In contrast to family takaful, a Shariah or Islamic law-compatible coverage, conventional life insurance is not an investment. Instead, the money paid in premiums is used to pay for future claims. The risk is transferred from the individual to the insurance provider, and pay-outs are guaranteed as long as the premiums are paid.

When deciding between conventional insurance and family takaful, it is important to consider the needs and preferences of the individual. Conventional insurance may be a good option for those seeking guaranteed pay-outs, while family takaful may be preferable for those who want the potential to grow their money over time.

Group Life Insurance Basics: What You Need to Know

You may want to see also

Frequently asked questions

Conventional life insurance is a co-operative policy where the risk is transferred from the individual to the insurance provider. It provides a death benefit in exchange for paying a premium.

Conventional life insurance works by providing a death benefit in exchange for paying the premium. The risk is transferred from an individual to the conventional insurance provider.

The main purpose of conventional life insurance policies is to provide death cover. However, some policies also mature and provide a benefit if the insured becomes totally disabled, or include an investment element.

Before deciding to buy a policy, you must check and see whether or not there is availability of a guarantee of return, what the lock-in period is, details of the premium to be paid, what would be the implications of premium default, what the revival conditions are, what the policy terms are, what charges would be deducted, and whether a loan would be available.

Conventional life insurance and family takaful are both financial tools for protecting your loved ones in the event of an unexpected death. However, family takaful is based on the principles of Shariah or Islamic law, while conventional insurance is not. Conventional insurance is also not a financial investment, while family takaful is.