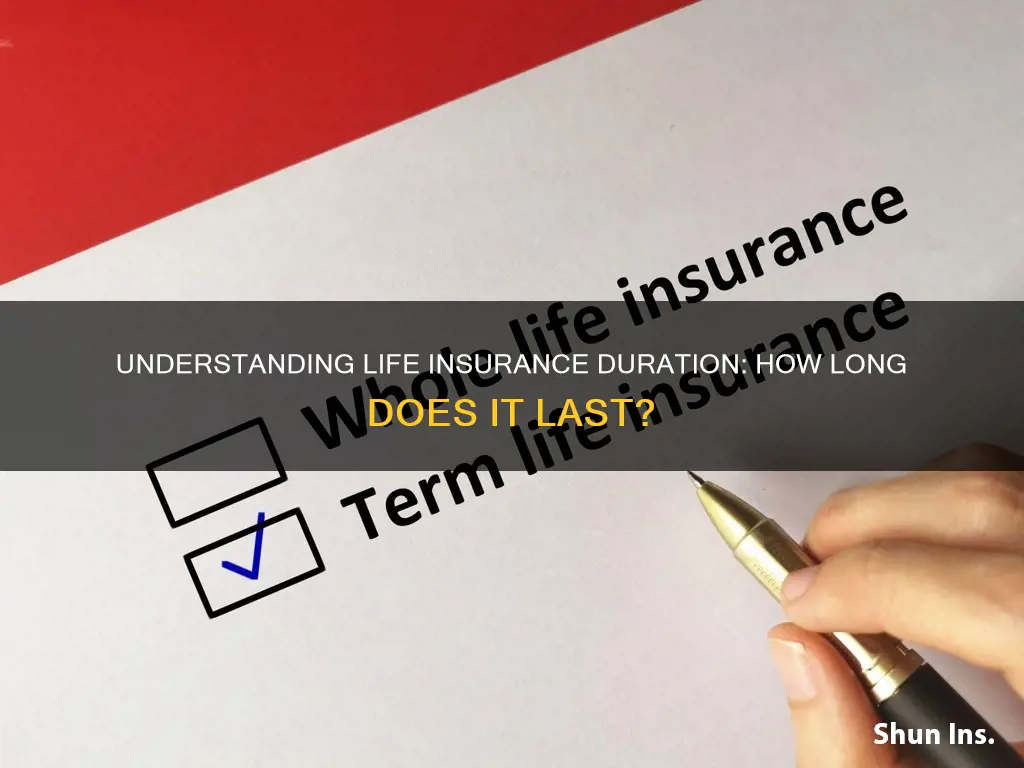

Life insurance is available in different durations, depending on your needs and budget. Term life insurance lets you select how long you'll be covered, usually 10, 15, 20, or 30 years, with some insurers offering coverage for up to 40 years. You can also get whole life insurance, which covers you for your entire life. Term life insurance is generally more affordable, but the cost increases with the length of the term and your age when you purchase the policy. When choosing the duration of your life insurance, consider your current financial obligations, any outstanding debt, and how long you'll need coverage.

| Characteristics | Values |

|---|---|

| Term life insurance | 10, 15, 20, 30 or 40 years |

| Whole life insurance | Permanent coverage |

| Short, medium or long term | Varies depending on the insurer |

What You'll Learn

Term life insurance

When determining the length of your term life insurance, it is important to carefully consider your current financial obligations and any outstanding debt. Having a plan that runs a little longer than you need can make more financial sense than having to purchase a new plan when the first expires. It is also important to consider the cost of the insurance. A 20-year term policy is more affordable than a 30-year term policy, and the price spread can be even more attractive when comparing a 20-year term versus a 30-year term because rates increase as you age. If cost is an issue, it is better to have a safety net with a shorter duration than no net at all.

How to Sell Term Life Insurance Successfully

You may want to see also

Whole life insurance

Life insurance can be purchased for a set duration, usually 10, 15, 20, or 30 years, with some insurers offering coverage for up to 40 years. The duration of the policy is usually referred to as the 'term'.

Another thing to keep in mind is that whole life insurance policies often come with additional benefits, such as the ability to build cash value over time. This means that, in addition to providing a death benefit, whole life insurance can also be used as a tool for long-term savings.

Term Life Insurance: What's the Difference?

You may want to see also

Short, medium, and long-term life insurance

Life insurance policies can be purchased for a specified term, usually 10, 15, 20, or 30 years, with some insurers offering coverage for up to 40 years. Term life insurance is categorised into three lengths: short, medium, and long-term.

Short-term life insurance is ideal for those who are cost-conscious. A 20-year term policy is more affordable than a 30-year term policy. If you are older when you purchase your policy, a shorter-term policy can be more attractive because rates increase as you age. It is better to have a safety net with a shorter duration than no net at all.

Medium-term life insurance is a good option for those who want coverage for a longer period but are still conscious of cost. A 20-year term policy might be a good choice for those who want a balance between coverage and affordability.

Long-term life insurance provides coverage for 30 or 40 years. This option is ideal for those who want comprehensive coverage for their entire lives. While it may be more expensive, long-term life insurance ensures that your beneficiaries will receive a guaranteed life benefit no matter when you pass away, as long as your premiums have been paid.

When determining the right life insurance duration, carefully consider your current financial obligations, any outstanding debt, and your specific needs. Having a plan that runs a little longer than you need can make more financial sense than having to purchase a new plan when the first expires.

Life Insurance: A Necessary Safety Net?

You may want to see also

Cost of life insurance

Life insurance is available for a specified term, usually 10, 15, 20, or 30 years, with some insurers offering coverage for up to 40 years. Term life insurance is also categorised into short, medium, or long-term lengths. The cost of life insurance depends on the length of the term. A 20-year term policy is more affordable than a 30-year term policy. The price spread can be more attractive when comparing a 20-year term with a 30-year term because rates increase as you age. If cost is an issue, it is better to have a safety net with a shorter duration than no net at all.

When determining the length of life insurance, you have the option of term life insurance or whole life insurance. Whole life insurance provides coverage for your entire life via a permanent policy that pays out no matter when you pass away, as long as your premiums have been paid. Term life insurance, on the other hand, allows you to select how long you will be covered.

To choose the appropriate term length, carefully consider your current financial obligations and any outstanding debt. Having a plan that runs a little longer than you need can be more financially prudent than having to purchase a new plan when the first one expires. It is essential to look for a policy term length that you feel you will be able to pay for over the years.

Life Insurance: Your DIY Guide to Peace of Mind

You may want to see also

How to determine the right life insurance length

When determining the right life insurance length, you first have the option of term life insurance or whole life insurance. Term life insurance lets you select how long you'll be covered, usually 10, 15, 20, or 30 years, with some insurers offering coverage for up to 40 years. Term life insurance is also categorised into short, medium or long-term.

If you are cost-conscious, a 20-year term policy might be the best option. Term life insurance is affordable, but you pay more for a 30-year term policy than you would for a 20-year term. If you are older when you purchase your policy, that price spread can be even more attractive when comparing a 20-year term versus a 30-year term because rates increase as you age. If cost is an issue, it’s better to have a safety net with a shorter duration than no net at all.

Whole life insurance provides coverage for your entire life. This permanent policy category contains several types of life insurance that pay out no matter when you pass (as long as your premiums have been paid).

To determine the right life insurance length, carefully consider your current financial obligations and any outstanding debt. Having a plan that runs a little longer than you need can make more financial sense than having to purchase a new plan when the first expires.

Does Your Job's Life Insurance Policy Require Drug Testing?

You may want to see also

Frequently asked questions

Term life insurance lets you select how long you'll be covered, usually 10, 15, 20, or 30 years, with some insurers offering coverage for up to 40 years. Whole life insurance, on the other hand, is a permanent policy that pays out no matter when you pass (as long as your premiums have been paid).

This depends on your current financial obligations and any outstanding debt. It's important to carefully consider your specific situation and needs. Having a plan that runs a little longer than you need can make more financial sense than having to purchase a new plan when the first expires.

A 20-year term policy is a good choice if you are cost-conscious as it is more affordable than a 30-year term policy. However, rates increase as you age, so if you are a bit older when you purchase your policy, the price spread between a 20-year and 30-year term may be even more attractive.

Term life insurance is categorized into three lengths: short, medium, and long term.

Term life insurance is a guaranteed life benefit paid to the insured's beneficiaries after death.