The loss ratio is a metric used in the insurance industry to assess an insurance company's financial health and profitability. It is calculated by dividing the total losses incurred (including claims paid and loss adjustment expenses) by the total premiums earned over a specific period. The result is expressed as a percentage, indicating the proportion of income spent on settling claims. A lower loss ratio generally indicates better profitability, as the company is paying out less in claims relative to the premiums collected. Conversely, a higher ratio may suggest the company is experiencing financial difficulties.

| Characteristics | Values |

|---|---|

| Definition | A fundamental financial metric used in the insurance industry to measure the profitability of an insurance company |

| Formula | (Insurance claims paid + Loss adjustment expense) / Total premiums earned x 100 |

| Purpose | To provide insurance companies with a high-level overview of their financial performance |

| Ideal Range | 40% to 60% |

| Interpretation | A lower loss ratio indicates better profitability, while a higher ratio suggests the company may be experiencing financial difficulties |

| Components | Incurred losses (claims paid, loss reserves, and loss adjustment expenses) and earned premiums |

| Use | Evaluating the financial health, underwriting practices, and overall business performance of an insurance company |

What You'll Learn

How to calculate loss ratio

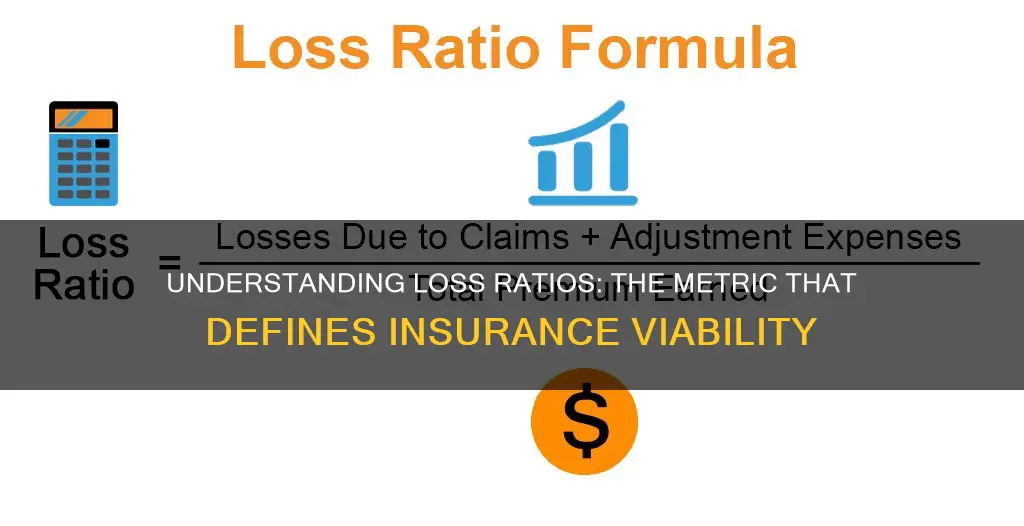

To calculate the loss ratio, you need to know the total amount of money paid by the insurance company in claims and the total amount of money earned by the company in premiums. The loss ratio formula is:

Loss ratio = ((insurance claims paid + loss adjustment expenses) / premium earned) x 100

Here's a breakdown of each component:

- Insurance claims paid: The total amount of money paid by the insurance company to settle claims. This includes money paid for replacement or repair of damaged property, cash settlements, or legal damages in liability claims.

- Loss adjustment expenses: The costs incurred by the insurance company to investigate and verify claims, including adjusters' pay, investigation costs, and other administrative expenses.

- Premium earned: The total sum of insurance premiums paid by customers during the specified period.

Let's look at an example to understand how to calculate the loss ratio. Suppose an insurance company earned $10 million in premiums from its customers in a year. During that same year, they paid $5 million in claim settlements and spent another $2 million on adjusting those claims.

To calculate the loss ratio for this insurance company, we use the formula:

Loss ratio = (($5,000,000 + $2,000,000) / $10,000,000) x 100

Loss ratio = 0.7 x 100

So, the loss ratio for this insurance company is 70% for that particular year. This means they used 70% of their premium earnings to pay for losses.

It's important to note that the loss ratio is just one metric used to evaluate the financial health of an insurance company. Other factors and ratios, such as the expense ratio and combined ratio, should also be considered for a comprehensive assessment.

Understanding Select Term Insurance: Tailored Coverage for Peace of Mind

You may want to see also

The importance of loss ratio in the insurance industry

The loss ratio is a fundamental metric in the insurance industry, used to evaluate the financial health and profitability of an insurance company. It is calculated as the ratio of incurred losses (including claims paid, loss reserves, and loss adjustment expenses) to earned premiums over a specified period. This ratio serves as a critical benchmark for assessing an insurer's financial stability, underwriting practices, and overall business performance.

The importance of the loss ratio in the insurance industry is significant for several key reasons:

- Financial Health Evaluation: The loss ratio provides a quick and effective way to assess an insurance company's financial health. It indicates whether the company is paying out more in claims than it is collecting in premiums, which can be a sign of financial distress. A high loss ratio may lead to solvency issues, especially for property or casualty insurance companies.

- Underwriting and Risk Management: The loss ratio helps insurance companies evaluate their underwriting practices and risk management strategies. By comparing incurred losses to earned premiums, insurers can identify trends, uncover potential issues in risk management, and make informed decisions to optimise their underwriting policies and pricing strategies.

- Regulatory and Investor Assessment: Regulators, investors, and rating agencies use loss ratios to assess the stability and profitability of insurance companies. This makes it a key performance indicator that can impact a company's reputation, market position, and access to capital.

- Consumer Protection: Consumer advocates compare loss ratios across insurers to evaluate performance. A high loss ratio indicates that the insurer is returning a larger portion of premiums to consumers in claim payouts, which is beneficial to customers.

- Business Decision-Making: Insurance companies use loss ratios when making management decisions, such as setting target premiums, comparing product lines, and assessing their performance against competitors.

- Long-term Sustainability: Maintaining an appropriate loss ratio is vital for insurance companies to ensure sustainable growth and long-term success in a competitive market. It helps them balance claims payouts with premium collection, ensuring profitability while managing risk effectively.

In summary, the loss ratio is a critical tool in the insurance industry, providing a financial snapshot of an insurance company's performance. It helps insurers, regulators, and consumers assess the financial health, stability, and profitability of insurance providers, ultimately contributing to informed decision-making and sustainable business practices.

Understanding Proof of Loss: A Crucial Component of the Insurance Claims Process

You may want to see also

Components of loss ratio

The loss ratio is composed of two main components: incurred losses and earned premiums. These components are used to assess an insurance company's financial performance in terms of claims management and premium collection.

Incurred Losses

Incurred losses represent the total cost of claims an insurance company is liable for during a specific period. They include the following sub-components:

- Claims Paid: The actual amount paid to policyholders for covered losses during the specified period.

- Loss Reserves: The estimated amount set aside by the insurer to cover future claim payments for losses that have occurred but have not yet been settled or paid.

- Loss Adjustment Expenses: The costs associated with investigating, processing, and settling claims, including legal fees, personnel costs, and other related expenses.

Earned Premiums

Earned premiums are the portion of the insurance premiums that correspond to the coverage provided during a specific period. They are derived by adjusting the total premiums collected during a period for unearned premiums, which are premiums that have been collected but not yet earned because they correspond to future coverage periods.

Understanding Convertible Term Insurance: Flexibility for Changing Needs

You may want to see also

Interpreting loss ratio values

The loss ratio is a fundamental financial metric used in the insurance industry to assess an insurance company's financial health and profitability. It is calculated as the ratio of incurred losses (including claims paid and loss adjustment expenses) to earned premiums over a specified period. A lower loss ratio generally indicates better profitability, as the company is paying out less in claims relative to the premiums collected. Conversely, a higher loss ratio suggests that the company may be experiencing financial difficulties by paying out more in claims.

An ideal loss ratio typically falls within the range of 40% to 60%. This range indicates that the insurance company is maintaining a balance between claims payouts and premium collection, ensuring profitability and sustainable growth. A loss ratio below the ideal range could indicate that the insurer is underwriting too conservatively, potentially missing out on business opportunities, or charging high premiums, leading to customer dissatisfaction and a potential loss of market share. On the other hand, a loss ratio above the ideal range may signal inadequate underwriting, pricing, or risk management practices, resulting in a higher frequency or severity of claims and threatening the company's long-term sustainability.

For example, if an insurance company pays out $60 in claims for every $100 in collected premiums, its loss ratio is 60%, with a profit ratio/gross margin of 40% or $40. In this case, the company is making a profit, as the claims paid are less than the premiums collected. However, if the loss ratio exceeds 100%, it indicates an unfavourable position, as the company is losing money on its policies. When the loss ratio is equal to 100%, it means that the company is neither making profits nor losses, as the total amount of premiums collected equals the total amount of claims and expenses.

It is important to note that the interpretation of a good or bad loss ratio value depends on the context and the type of insurance being considered. Loss ratios vary depending on the type of insurance. For instance, the loss ratio for health insurance tends to be higher than that of property and casualty insurance. Additionally, each insurance company formulates its own target loss ratio, which depends on its expense ratio.

The Fine Print: Understanding Riders in Term Insurance Policies

You may want to see also

Strategies for managing loss ratio

Strategies for managing the loss ratio:

- Risk Selection and Underwriting: Insurance companies can balance their risk exposure and premium collection by accurately assessing the risk profiles of potential policyholders. This enables them to either screen out high-risk clients or price policies accordingly to account for increased risk exposure.

- Pricing Optimization: Insurance companies can set premiums at an optimal level by leveraging advanced data analytics, predictive modelling, and market insights to accurately assess individual risk profiles. This helps maintain a competitive edge while ensuring sufficient revenue to cover claims and expenses.

- Claims Management Improvement: Streamlining the claims handling process, reducing claim costs, and enhancing customer satisfaction can help control incurred losses and maintain a healthy loss ratio. Advanced technology solutions can be implemented for automation, data analysis, and fraud detection, improving the accuracy and consistency of claims handling.

- Fraud Prevention and Mitigation: Advanced fraud detection technologies, such as data analytics, artificial intelligence, and machine learning, can help identify patterns, anomalies, and suspicious activities that indicate potential fraudulent claims. This reduces the financial burden of paying out fraudulent claims and promotes transparency and accountability within the industry.

- Reinsurance Strategies: Reinsurance allows insurance companies to transfer a portion of their risk to other insurers, mitigating the impact of large claims and catastrophic events on their financial performance. By ceding a share of the risk, companies can stabilize their loss ratios, better manage their capital, and maintain competitive pricing for policyholders.

The Dark Side of Short-Term Insurance: Uncovering the Hidden Pitfalls

You may want to see also

Frequently asked questions

A loss ratio is a metric used to evaluate the financial health and profitability of an insurance company. It is calculated by dividing the total losses incurred (claims paid plus adjustment expenses) by the total premiums earned.

The loss ratio indicates how financially stable an insurance company is. A loss ratio below 100% means the company is earning more in premiums than it is paying out in losses. A ratio above 100% means the company is paying out more in claims than it is earning, which could lead to financial difficulties.

A good loss ratio typically falls within the range of 40% to 60%, indicating that the insurance company is balancing claims payouts and premium collection effectively. However, what is considered a good loss ratio can vary depending on the type of insurance and the company's business model.

The loss ratio is used by insurance companies to make management decisions, such as setting target premiums and assessing their performance against competitors. It is also used by external parties like regulators, investors, and consumer advocates to assess the financial stability and profitability of insurance companies.

The formula for calculating the loss ratio is:

Loss Ratio = ((Insurance claims paid + Loss adjustment expenses) / Total premiums earned) x 100