Term life insurance is a type of coverage that provides financial protection for a specific period, known as the term. During this term, the policyholder pays a premium to the insurance company, and in return, the insurer promises to pay a predetermined death benefit to the policy's beneficiaries if the insured individual passes away within the specified period. The commission on term life insurance refers to the fees or charges that the insurance company earns from selling this policy. This commission is typically a percentage of the premium paid by the policyholder and is a significant factor in determining the overall cost of the insurance. Understanding the commission structure is essential for consumers to make informed decisions when choosing a term life insurance policy, as it can impact the policy's affordability and long-term value.

What You'll Learn

- Definition: Term life insurance is a temporary policy with a set duration and fixed premium

- Cost Factors: Premiums depend on age, health, lifestyle, and desired coverage amount

- Benefits: Provides financial security for beneficiaries during the policy term

- Comparison: Term insurance is often cheaper than permanent life insurance

- Term Lengths: Policies can be for 10, 20, or 30 years, or even longer

Definition: Term life insurance is a temporary policy with a set duration and fixed premium

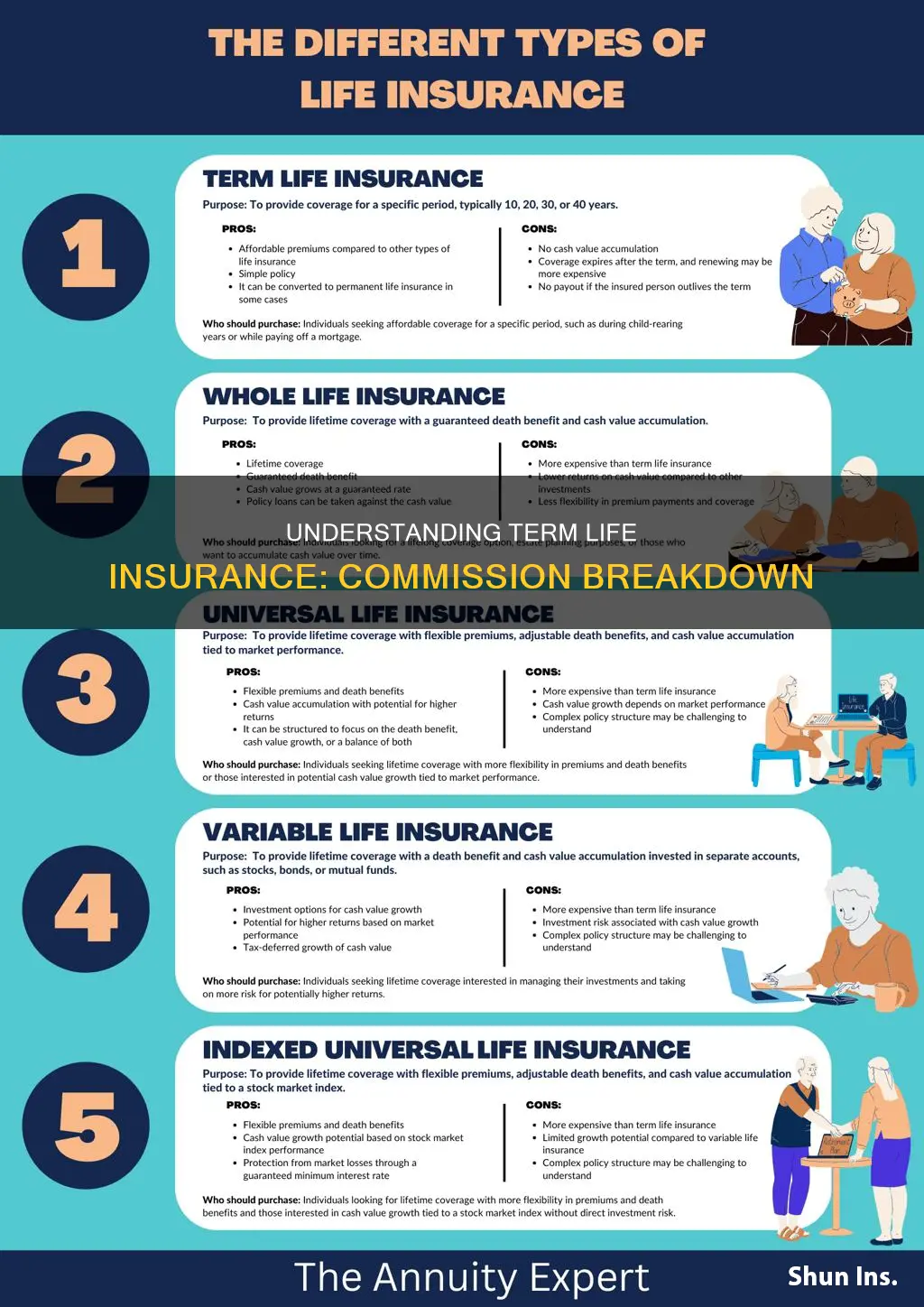

Term life insurance is a type of life insurance policy that provides coverage for a specific period, known as the "term." This term can vary, ranging from a few years to several decades, depending on the policyholder's needs and preferences. One of the key advantages of term life insurance is its affordability; it offers a cost-effective way to secure financial protection for a defined period. During this term, the policyholder pays a fixed premium, which remains constant throughout the duration of the policy. This predictability in premium payments is a significant benefit, allowing individuals to plan and budget effectively.

The temporary nature of term life insurance means that it is designed to provide coverage for a specific time frame, often aligning with financial obligations or goals that may change over time. For instance, a young professional might opt for a 20-year term policy to cover mortgage payments or provide financial security for their family during their working years. As the individual's circumstances evolve, they can adjust their insurance coverage accordingly, either by renewing the policy or transitioning to a different type of life insurance.

In contrast to permanent life insurance, which provides lifelong coverage, term life insurance is not intended to be a long-term financial commitment. It is a strategic choice for individuals who want to protect their loved ones or secure financial goals within a defined period. The fixed premium structure ensures that policyholders know exactly how much they will pay each year, making it easier to manage personal finances.

When considering term life insurance, it is essential to understand the duration of the policy. This duration can vary widely, and the choice should be based on individual circumstances. For example, a 10-year term policy might be suitable for someone who needs coverage to secure a business venture or a specific financial goal. In contrast, a 30-year term could be more appropriate for long-term financial planning, such as providing for children's education or retirement savings.

In summary, term life insurance is a flexible and affordable option for individuals seeking temporary financial protection. Its fixed premiums and defined term make it a straightforward and cost-effective choice, allowing policyholders to manage their finances effectively while ensuring their loved ones are protected during specific life stages. Understanding the duration and flexibility of term life insurance is crucial in making informed decisions about personal insurance needs.

Understanding Guaranteed Issue Life Insurance: A Comprehensive Guide

You may want to see also

Cost Factors: Premiums depend on age, health, lifestyle, and desired coverage amount

When considering term life insurance, understanding the cost factors is crucial, as they significantly impact the overall price you'll pay. One of the primary determinants of the premium is your age. Younger individuals typically pay lower rates because they are statistically less likely to require insurance payouts during the policy term. As you age, the risk of developing health issues increases, leading to higher premiums. This is why term life insurance often becomes more expensive as you get older.

Health status plays a pivotal role in setting the price of your policy. Insurers assess your medical history and current health to determine the likelihood of future claims. Individuals with pre-existing conditions or chronic illnesses may face higher premiums or even be deemed uninsurable. Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and avoiding harmful habits like smoking, can help lower your insurance costs.

Lifestyle choices also influence the cost of term life insurance. Insurers consider factors such as occupation, hobbies, and daily routines. For instance, high-risk occupations like construction or emergency services may result in higher premiums due to the increased likelihood of accidents or injuries. Similarly, extreme sports enthusiasts might pay more due to the perceived higher risk. On the other hand, leading a sedentary lifestyle or engaging in less risky hobbies can contribute to lower insurance rates.

The desired coverage amount is another critical factor affecting the premium. Term life insurance provides a death benefit to beneficiaries if the insured individual passes away during the policy term. The higher the coverage amount, the more the insurance company will charge. This is because a larger payout means a more significant financial risk for the insurer, which is typically reflected in the premium. It's essential to strike a balance between the desired coverage and your financial capabilities to ensure the policy remains affordable.

In summary, term life insurance premiums are influenced by age, health, lifestyle, and the desired coverage amount. Younger, healthier individuals with lower-risk lifestyles and smaller coverage needs often pay lower premiums. Conversely, older individuals with health issues, high-risk occupations, or substantial coverage requirements may face higher costs. Understanding these cost factors can help you make informed decisions when selecting a term life insurance policy that aligns with your needs and budget.

Global Life Insurance: Is It a Smart Choice?

You may want to see also

Benefits: Provides financial security for beneficiaries during the policy term

Term life insurance is a straightforward and cost-effective way to provide financial security for your loved ones during a specific period. When you purchase a term life insurance policy, you agree to pay a premium for a set duration, known as the "term." During this term, the insurance company promises to pay out a predetermined death benefit to your designated beneficiaries if you were to pass away. This financial security is a critical aspect of life insurance, offering peace of mind and a safety net for your family.

The primary benefit of term life insurance is its ability to offer a substantial financial cushion to your beneficiaries when you are no longer around. This benefit is especially valuable for families with financial obligations, such as mortgage payments, children's education costs, or other long-term commitments. By ensuring a steady income stream for your beneficiaries, term life insurance helps them maintain their standard of living and cover essential expenses, even in the event of your untimely death.

One of the advantages of term life insurance is its affordability. Since the coverage is limited to a specific term, the premiums are generally lower compared to permanent life insurance policies. This makes it an attractive option for individuals who want to provide financial protection for a particular period, such as until their children finish school or a mortgage is paid off. With term life insurance, you can secure a substantial benefit without the long-term financial commitment associated with other insurance types.

When choosing a term life insurance policy, it's essential to consider the length of the term that best suits your needs. Common term lengths include 10, 20, and 30 years, each offering different levels of coverage and premium costs. Longer terms provide more extended financial security but come with higher premiums. It's a good practice to review and adjust your policy periodically to ensure it aligns with your changing circumstances and financial goals.

In summary, term life insurance is a powerful tool for providing financial security to your beneficiaries during a defined period. Its affordability and flexibility make it an excellent choice for individuals seeking to protect their loved ones from financial hardship. By understanding the benefits and features of term life insurance, you can make an informed decision to safeguard your family's future.

Life Insurance Claims: Time Limits and Your Rights

You may want to see also

Comparison: Term insurance is often cheaper than permanent life insurance

Term life insurance is a popular and cost-effective option for individuals seeking temporary coverage for a specific period. One of the key advantages of term insurance is its affordability compared to permanent life insurance. This cost difference is primarily due to the nature of the coverage and the underlying factors that influence pricing.

When comparing term and permanent life insurance, the primary distinction lies in the duration of coverage. Term insurance provides protection for a defined period, typically 10, 15, 20, or 30 years. During this term, the policyholder pays a fixed premium, and if a covered event occurs (such as death), the beneficiary receives a death benefit. After the term ends, the policy expires, and further coverage may require a new policy or a conversion to permanent insurance. This flexibility and shorter-term nature make term insurance more affordable.

In contrast, permanent life insurance, also known as whole life or universal life, offers lifelong coverage. It provides a death benefit and a cash value component that grows over time. The primary difference in cost arises from the additional benefits and guarantees associated with permanent insurance. Permanent policies typically have higher premiums because they ensure coverage for the entire life of the insured, often with a guaranteed death benefit and the potential for cash value accumulation.

The pricing of term insurance is influenced by various factors, including the insured's age, health, and the chosen term length. Younger individuals generally pay lower premiums as they are considered less risky. Additionally, the longer the term, the higher the premium, as the insurance company assumes a higher risk of paying out a death benefit over an extended period. In contrast, permanent insurance premiums are often higher due to the lifelong commitment and the additional features it offers.

The affordability of term insurance is particularly appealing to those who need coverage for a specific period, such as to secure a mortgage, provide for children's education, or cover business expenses. It allows individuals to obtain substantial coverage at a lower cost, making it an excellent choice for short-term financial planning. On the other hand, permanent insurance is suitable for those seeking lifelong financial protection and the potential for long-term savings.

In summary, term insurance is often cheaper than permanent life insurance due to its temporary nature, fixed premiums, and the absence of additional guarantees. This cost-effectiveness makes term insurance an attractive option for individuals who require coverage for a specific period without the long-term commitment and higher costs associated with permanent life insurance. Understanding these differences can help individuals make informed decisions when choosing the right insurance coverage for their needs.

Borrowing from Fegli Life Insurance: Is It Possible?

You may want to see also

Term Lengths: Policies can be for 10, 20, or 30 years, or even longer

When considering term life insurance, one of the key decisions you'll make is the duration of the policy, or the "term length." This term refers to the period during which the insurance coverage is in effect. Term life insurance offers a straightforward and cost-effective way to protect your loved ones financially for a specified period. The term length can vary, providing flexibility to suit different needs and circumstances.

The most common term lengths for term life insurance policies are 10, 20, and 30 years. These options are widely available and cater to various stages of life. For instance, a 10-year term might be suitable for covering expenses related to a mortgage or a child's education, providing a safety net for a relatively short period. In contrast, a 30-year term could be more appropriate for long-term financial goals, such as providing for children's education or replacing a primary earner's income over an extended period.

Longer term lengths are also available, offering extended coverage for those who require it. Policies can be tailored to last for 40, 50, or even 100 years, providing a comprehensive solution for long-term financial security. Longer terms are often chosen by individuals or families with substantial financial obligations or those who want to ensure coverage throughout their working years and into retirement.

The choice of term length is crucial as it directly impacts the cost of the policy. Longer term lengths typically result in higher premiums, as the insurance company assumes a greater risk of paying out a claim over an extended period. Conversely, shorter term lengths may offer lower premiums, making it more affordable for those with immediate financial obligations.

It's essential to evaluate your financial situation, future goals, and the potential risks to determine the most suitable term length. Consulting with an insurance advisor can provide valuable guidance in making this decision, ensuring that your term life insurance policy aligns with your specific needs and provides the necessary protection for your loved ones.

Graded Death Benefit: Life Insurance's Lesser-Known Clause

You may want to see also

Frequently asked questions

The commission on term life insurance can vary depending on the insurance company, the policy type, and the distribution channel. Typically, commissions are paid to insurance agents or brokers over a specific period, often the first few years of the policy. These commissions are usually a percentage of the policy's premium, and they can be structured as a combination of a front-end commission (paid upfront) and a trailing commission (paid over time).

The commission rate for term life insurance can range from 5% to 15% or more of the annual premium, depending on the factors mentioned earlier. For example, a 10-year term life insurance policy with an annual premium of $1,000 might result in a commission of $50 to $150 for the agent, paid upfront, for the first year.

Yes, in addition to the commission, insurance companies may charge other fees, such as underwriting fees, administrative fees, or policy administration fees. These fees are typically disclosed in the policy documents and can vary depending on the insurance provider and the specific policy features.

Yes, the commission structure can be negotiated between the insurance company and the agent or broker. Factors like the agent's experience, the policy's complexity, and the insurance company's policies can influence the commission rate. Some insurance providers offer different commission structures, including flat fees or performance-based commissions, to incentivize agents.

The commission is a component of the policy's premium, so a higher commission can result in a slightly higher overall cost for the policyholder. However, it's essential to consider that commissions are typically a one-time payment, and the long-term benefits of having life insurance coverage should also be evaluated. Additionally, shopping around and comparing quotes from different insurers can help policyholders find competitive rates and potentially lower overall costs.